Worth the risk? Mali is a study of contrasts, with riches that make up for its challenges

Mali is almost two countries in one. Pic: grinvalds via Getty Images

- Mineral rich West African country of Mali can be a challenging operating environment for miners and explorers

- But to find 10- or 20-bagger stocks investors must be prepared to take risks: Rick Rule

- Besides its well-known gold prospectivity, Mali is increasingly becoming known for hard rock lithium discoveries

Operating in parts of Africa can be challenging for many reasons, be it unstable government, policies that are unfavourable towards foreign investment, or conflict.

It’s why there is such a thing as an ‘African discount’, commonly applied by analysts to projects on account of the risks of operating in parts of Africa.

Ultimately though, it’s about investment risk vs reward.

“You are going to have to go to jurisdictions where you are less comfortable, where the industry is less comfortable and where fewer people have gone before,” Rule says.

“If you are looking for a 5Moz deposit in the Victorian goldfields you are assuming you are smarter than hundreds of years of geologists that went before you, which is a lousy assumption.

“Can it happen? Of course. It is a wonderful place to look for a deposit – just look at the Swan Zone at Fosterville. But is it likely? No.”

At first glance Mali appears to fall into the “What the heck were you thinking” category.

Australia’s Smart Traveller website advises against travelling to landlocked Mali, while our very own Guy Le Page lumps the country together with Burkina Faso and Niger as the highest risk jurisdictions in the continent this year.

News from the country is after all predominantly about the ongoing conflict between the military, rebels and jihadists with the military celebrating a recent victory after seizing control of a key rebel stronghold in the north.

On the business front, Leo Lithium (ASX:LLL) was forced to suspend production of direct shipping ore (DSO) from its Goulamina lithium spodumene project, leading to no shortage of angst and concern.

Except things – as they often are in real life – aren’t quite as straightforward as they seem.

For starters, Mali has a mining friendly jurisdiction with established industry and a transparent system of mineral and surface titles.

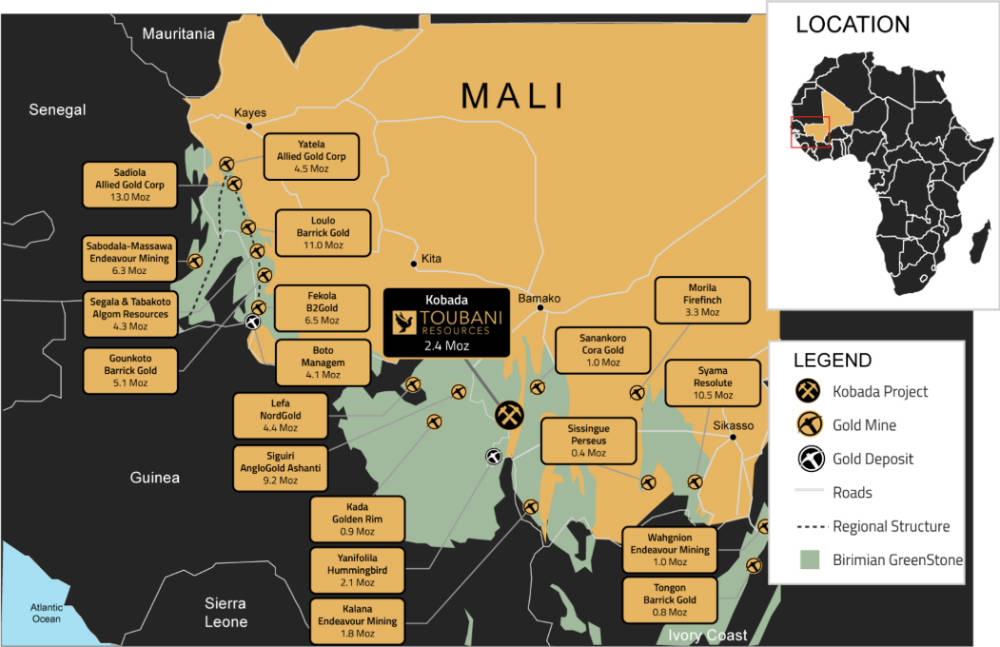

This is enough for Mali to be ranked as Africa’s fourth largest gold producer, attracting companies such as Barrick Gold, Resolute Mining, B2Gold, Allied Gold and Hummingbird Resources to establish gold operations or plan further development and expansion in the country.

Operating on the right side of the tracks

Speaking to Stockhead, Toubani Resources (ASX:TRE) chief executive officer Phil Russo touched on the issues faced by LLL, saying it appears to be a distinctly different and unique set of circumstances beyond the gold miners.

“The broader mining industry has been under a moratorium in terms of the renewing and issuing of any new exploration or mining permits but in our case, since we are already permitted, we’ve been able to continue to move the project forward,” he said.

“The moratorium is expected to be lifted soon as it was put in place for the country to revisit its mining code and now that has happened, we believe the industry will pick up again.

“Its worth noting that operating mines in country for the likes of Barrick, Resolute and B2Gold have continued to operate unaffected through this backdrop.”

Russo also pointed out that it is easy to paint the entire country with the same brush.

“Mali could be described as two countries within one. The southwest of Mali is where the majority of the population live and where its economic industries are located. The headlines you read in the news pertain mostly to the north-eastern part of the country where there is a long history of tribal infighting and instability,” he said.

“It’s important to give this context as we are located in the southwest of Mali where our experience in operating within this part of the country have been uninterrupted over a long period of time now and we engage consistently with all levels of government on the advancement of our Kobada project.”

He added that while there were challenges that came from operating in Africa, West Africa still had appeal as it was still possible to find deposits that would have been mined out long ago in Australia.

Russo has intimate familiarity with this.

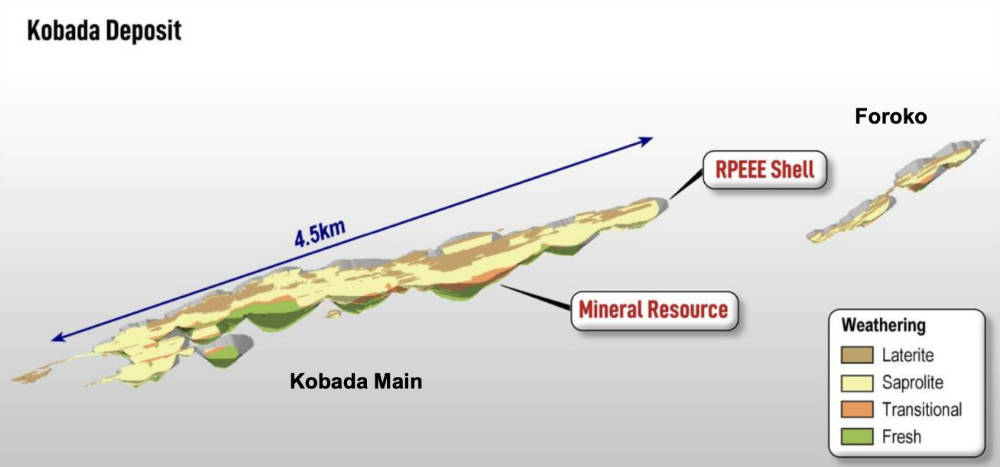

TRE’s advanced 2.4Moz Kobada project benefits from being open-pittable – with 77% of the resource found at depths of just 150m below surface, and from most of it – ~1.5Moz – being free-digging oxide ore.

This combination enables mining to be carry out quickly and at bulk tonnage rates, which underpins increased production and lower cost.

A diamond in the rough

Russo says this amount of near-surface, free-digging oxide gold resource is an absolute rarity in the sector.

“What makes us compelling is we already have a large resource base, the gold has already been found. For us, it’s about positioning the project to become a mine now of which we are confident that will become evident for the market in the near-term,” he added.

“We are readying to begin a targeted drill plan to upgrade components of the inferred resource to the higher confidence indicated category.

“This will underpin the updated DFS (definitive feasibility study) where we are looking to demonstrate the potential to produce at scale, at a low cost and over an extended mine life.

“The technical simplicity of our deposit is another advantage that will shine through. We believe this will drive a surfacing of value in Kobada, particularly in an M&A market where the likes of Tietto are attracting bids of +$600m – advanced gold projects are few in West Africa.”

The company’s original 2021 DFS outlined a +100,000oz per annum operation at an all-in-sustaining cost of US$972/oz over the first 10 years.

Mali and the trail to forward facing minerals

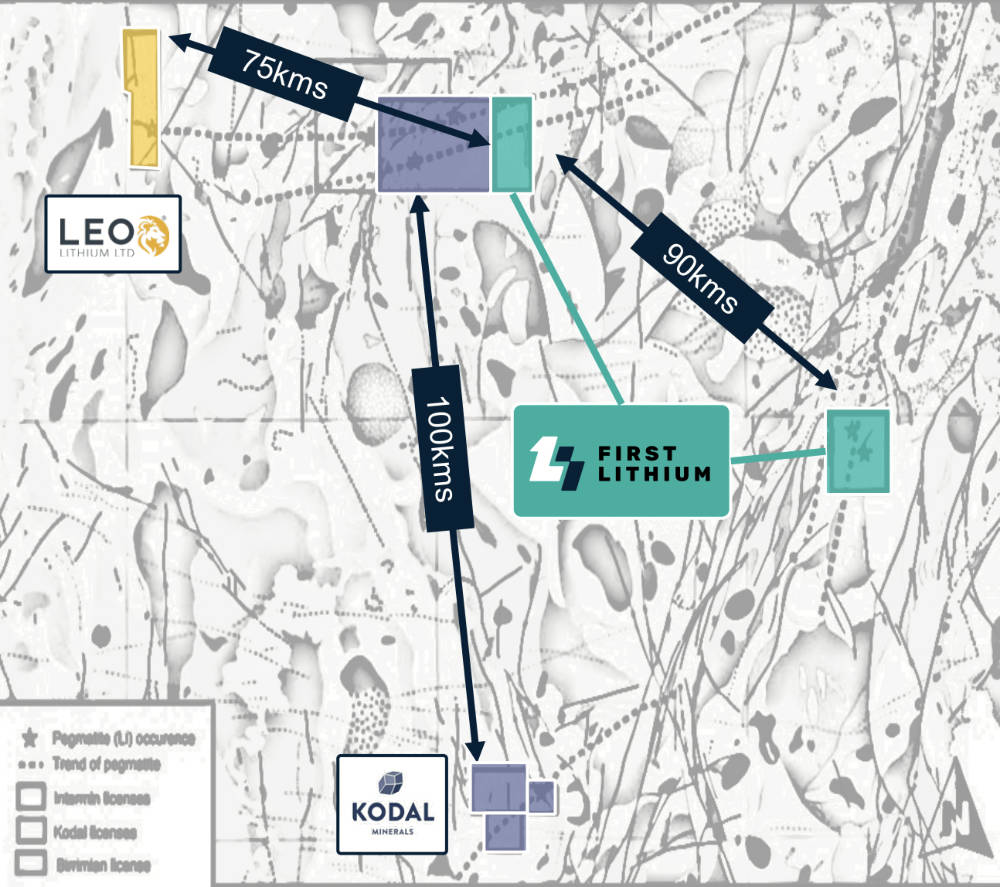

While Mali has long being known for its gold prospectivity, it is increasingly gaining attention for its potential to host significant quantities of lithium.

Highlighting this potential, Australian play Leo Lithium (ASX:LLL) had defined the world’s fifth largest hard rock spodumene project at Goulamina, with a resource of 211Mt that remains open in many regions at depth and along strike.

It subsequently embarked on its development plans and for a short, shining moment, became the country’s first producer of direct shipping ore (DSO) lithium.

This came to a screeching halt after the Malian Ministry of Mines ordered a halt to all DSO activities though the company claimed that it is on track to start spodumene concentrate production in Q2 2024.

While development took off some of the shine from LLL, which saw its shares plummet from $1.245 on 11 July to 50.5c prior to its entering a trading half and being subsequently slapped with a suspension from the ASX, it has not deterred fellow Australian First Lithium (ASX:FL1) from progressing its exploration efforts.

FL1 has good reason to push hard on the Blakala prospect within its Gouna permit.

Blakala was first identified as having lithium bearing spodumene in the 1960s by Russian geologists though precious little was done to follow-up on the find.

However, its rise to prominence came in 2008 when CSA Global ranked two Tier 1 priority lithium targets in Mali that appeared to be geological mirrors of each other.

One of the two is now LLL’s giant Goulamina deposit and the other is Blakala.

Despite this, Blakala was left largely alone until FL1 came along and kicked off a 6,000m drill program to delineate the extent of known spodumene bearing pegmatites with substantive surface expression.

This has yielded some very intriguing results with all eight diamond holes drilled to date having intersected what the company describes as “significant spodumene mineralisation” from surface.

Assays are pending before the company can declare that it has really made a significant lithium discovery but the signs are certainly promising and just serve to reinforce the attractiveness of Mali as an exploration destination.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.