Guy on Rocks: An actual high-grade resource with scale? Fill my cup!

Now that's what we call a Holy Grail. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

The US dollar rose to its highest levels since March with the DXY finishing the week at 105.07 while gold lost US$21 to close at US$1,919/ounce, falling to US$1,909 by the middle of this week.

In an interview with the AFR last weekend, BetaShares’ David Bassanese highlighted the recent gold purchases by China which snapped up 23 tonnes of gold (equivalent to 4% of the world’s reserves) in July with global banks buying a net 55 tonnes. July represented the ninth consecutive month of Chinese gold purchases.

Interest rate cuts and a pause in the bond market could drive gold higher according to Bassanese.

Silver lost 6% to finish the week at US$22.69/ounce while platinum was sold down heavily losing US$70 or 7% to close at US$890/ounce. Palladium also continued its downtrend and was off 2% last Friday to US$1,170/ounce and recovering later in the week to just over US$1,234/ounce.

Volatility remains subdued at 14 (median of 18-19 over 33 years).

US 10-year treasuries closed at 4.26% up 7 basis points for the week and were off slightly mid-week to 4.23%. The 2-10 year inversion of around 70 basis points continues.

Recent economic news out of the US showed the US economy was more resilient than expected with the ISM Services Index increasing to 54.5 from 52.7 (consensus was around 53) and the employment index up 4.0 points to 54.7 from 50.7.

The business activity index also saw a slight improvement to 57.3 from 57.1 last month.

Despite the better-than-expected economic news coming out of the US, the CME Fedwatch are estimating a 90% chance of interest rates remaining unchanged in a couple of weeks (figure 2).

Copper was off 10 cents or 2.6% closing at US$3.73/lb and remains in backwardation (figure 3), however spot prices recovered to US$3.79/lb by mid-week.

Kitco reported (13 September 2023) that the Biden administration in their infinite wisdom was proposing an overhaul of its 151-year old law governing gold, copper and other minerals on Federal lands. Under current US laws the Federal Government does not collect any royalties from mining however the government is considering a variable 4-8% net royalty on hard rock mines.

Given royalty regimes – as far as minerals are concerned – are common and represent a significant source of income for the Australian government, it is strange that the US Government is looking at implementing this regime while it is trying to boost domestic production of minerals needed for electric vehicles, solar panels and other clean energy technologies.

On the energy front WTI continues to move higher (figure 4) on the back of further OPEC cuts with the Saudis indicating they intend to maintain their 1 MBOPD cut until December of this year. At the same time Russia also decided to reduce oil exports by 300,000 BOPD as US inventories declined by over 6 MBOE last week.

The only thing stopping oil charging through US$90BBL is the tepid economy in China. It appears the Biden administration is doing its best impersonation of a wrecking ball by cancelling Alaskan oil leases while at the same time trying to buy low-grade oil from Venezuela and increasing purchases from Saudi Arabia.

Uranium continues its winning streak with equities 60-70% of the value compared to April 2022 despite strong prices. Production problems at Cameco’s Cigar Lake mine may have contributed to upward moves in the spot price last week.

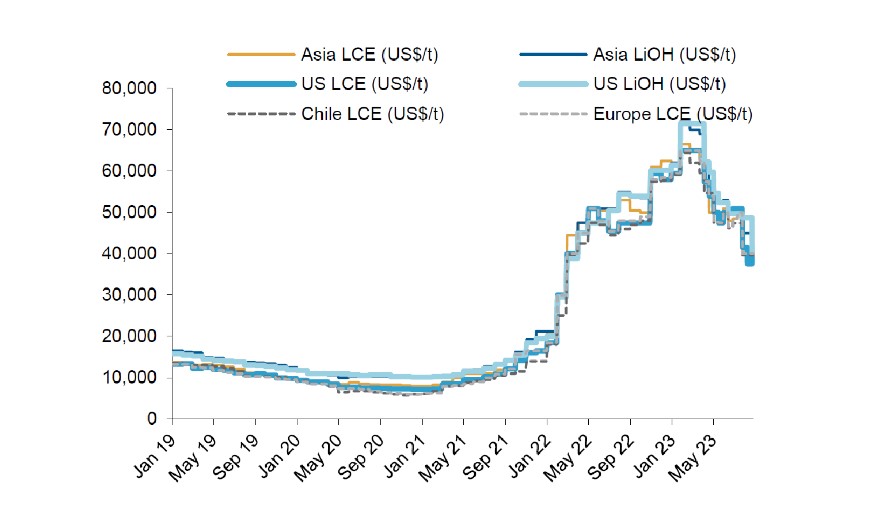

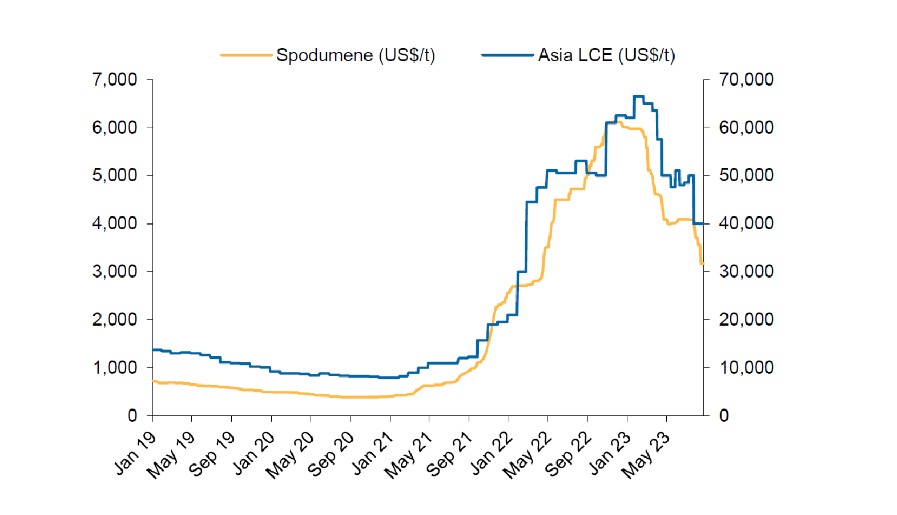

Both lithium and spodumene prices (figures 5 and 6) appear to have stabilised while inventory levels at major Chinese refiners and cathode markers, according to Morgan Stanley (August 2023), peaked in April 2023, and have since normalised.

Lithium Refineries continued to have a larger proportion of LCE inventory of 39kt in July, while cathode makers reported an inventory level of 13kt in the same period.

Many downstream processors in China slowed stock purchase given the recent price decline.

EV and battery makers production plans for late 2023 and early 2024 would be key to watch in the near term, in our view.

The lithium space can only be described as “white hot” after Albemarle’s $3.0/share or $6.6 billion bid for Liontown Resources (ASX: LTR) only to be followed by Gina Rhinehart’s Hancock Prospecting lifting her stake from 4.9% to 7.72% late last week.

Liontown is targeting first production in mid-2024.

European central bank rate decision, CPI and the wholesale arm PPI end of the week – as well as retail sales.

New Ideas: Africa Down Under

A good turnout last week at Africa Down Under which was held over 6-8 September 2023 at the Pan Pacific Hotel in Perth. The conference was put on by Paydirt Media with Bill Repard giving the opening address.

Just some feedback from me, Bill – the coffee was crap and there were no cakes or chocolates during the interval. A cigar smoking section would have also been appreciated. Maybe next time you could set up a separate section to cater for me?

While it would have been good to see more brokers and investors attending there was solid representation from African governments, as well as a broad spectrum of developers and explorers from First Quantum Minerals, one of the power houses in copper production, to unlisted rare earth developers such as Harena Resources which is looking to breath life back into the Ampasindava Rare Earths project in Madagascar.

Special mention to Hon Minister Oladele Alake and his team from Nigeria for making trip to Perth.

While there have been some headwinds in Africa generally, more specifically in Mali, Burkina Faso and Niger where security concerns and some political instability have seen investors leaving in droves, it was good to see an increase in the level of activity in countries such as Zimbabwe which have had their own well publicised struggles over the last 30 years or so.

Tanzania is also well and truly back on the map after an overhaul of its mining legislation.

The junior gold sector and West African explorers in particular are a little unloved by the market at the moment. There is probably good reason for this if any of the Stockhead faithful have time to read the Sarama Resources (ASX: SRR, TSX-V, SWA) ASX announcement on 6 September 2023 advising the market that the Burkina Faso Ministry of Mines and Energy had advised the company that it had withdrawn SRR’s rights to its 100% owned Tankoro 2 Exploration Permit which hosts the Tankoro Deposit (Mineral Resource of 0.6Moz Au Indicated and 1.9Moz Au Inferred).

I think Mali, Burkina Faso and Niger are looking to finish on the podium this calendar year as the highest risk jurisdictions in Africa with investor confidence now at rock bottom. With Russia tightening its group on Niger, seemingly supported by Mali and Burkina Faso, expect more bad news to follow.

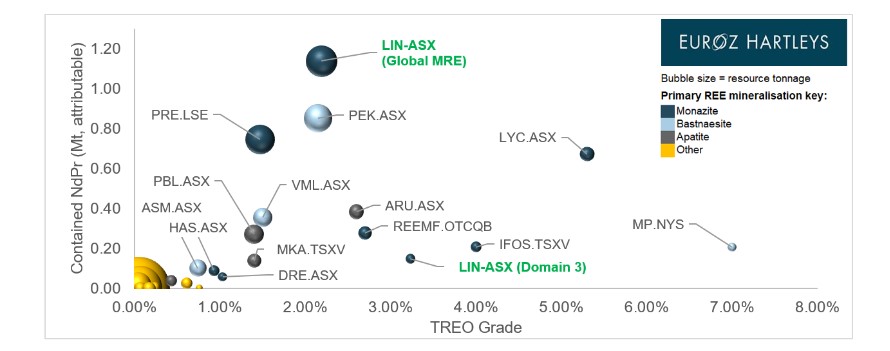

A stand-out for me was Lindian Resources (ASX:LIN) which is developing the Kangandkunde REE project in Malawi. One thing I have learnt about rare earths over the last couple of years is that rare earths are not rare and have complexities at every level.

The company has one of the largest REE resources as far as contained NdPr is concerned with JORC Resources of 253Mt @ 2.23% TREO including a higher-grade core of 23Mt @ 3.23% TREO. As figure 8 demonstrates (and unlike my featured company from last week which I won’t mention, Chalice), this is a high-grade resource with scale.

The project, which has a projected 27-year mine life, has a number of favourable attributes including low stripping ratios, high-grades (Nd/PR) and very low “water based” processing. Capital costs are likely to start at a modest US$20 million or thereabouts.

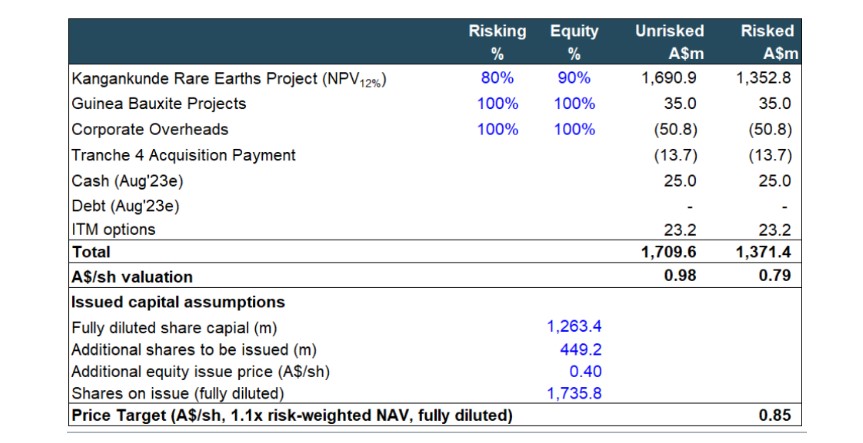

For those who want to know more, go on to the LIN website and read the Euroz-Hartley’s report whose sum of parts valuation puts them around 85 cents based on a risked sum-of-parts valuation.

While REE prices have been under pressure over the last two years, Meteoric Resources (ASX: MEI) and LIN are shaping up as the standouts of the near-term developers. LIN shares are sitting around 25 cents off from 37 cents when the Euroz-Hartley’s report was published, however I think the conclusions in this report are reasonable.

I am not expecting an immediate rebound, but I think as REE prices stabilise and start to trend back up, LIN should see a strong recovery in its share price.

I’ll have to cut things off here as I am due at the Cigar Social Climate Change Sceptic Committee meeting where we are debating over which are the world’s easiest jobs.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.