Why Smackover’s history of oil production could translate to cheap lithium brine for Pantera Minerals

Pantera Minerals' plans to re-enter existing oil wells to reduce the cost of lithium brines exploration at the Smackover. Pic via Getty Images

Lithium might be experiencing a downturn at the moment but there’s little doubt that demand for the battery metal will return stronger than ever as more lithium-ion batteries are required to electrify transport.

It also helps that countries such as the US are keen to secure domestic supplies of lithium in the interests of ESG and supply security.

This is particularly true given the wave of planned battery plants that will increase North American annual battery manufacturing capacity from 55 gigawatt hours (GWh) in 2021 to nearly 1,000GWh before 2030.

Reaching this level of battery manufacturing capacity will be needed to meet the demands of automotive manufacturers with GM, Ford and Stellantis having committed >US$50bn collectively to electrify their offerings.

Any North American-focused lithium company capable of holding the course despite the current challenges and timing their entry into production just as this surge in demand is realised will be perfectly positioned to enjoy the rewards.

But doing so will require having the financial resources to continue operations and/or ensuring maximised impact from operations for the lowest possible cost.

Pantera building commanding position in the Smackover Brine play

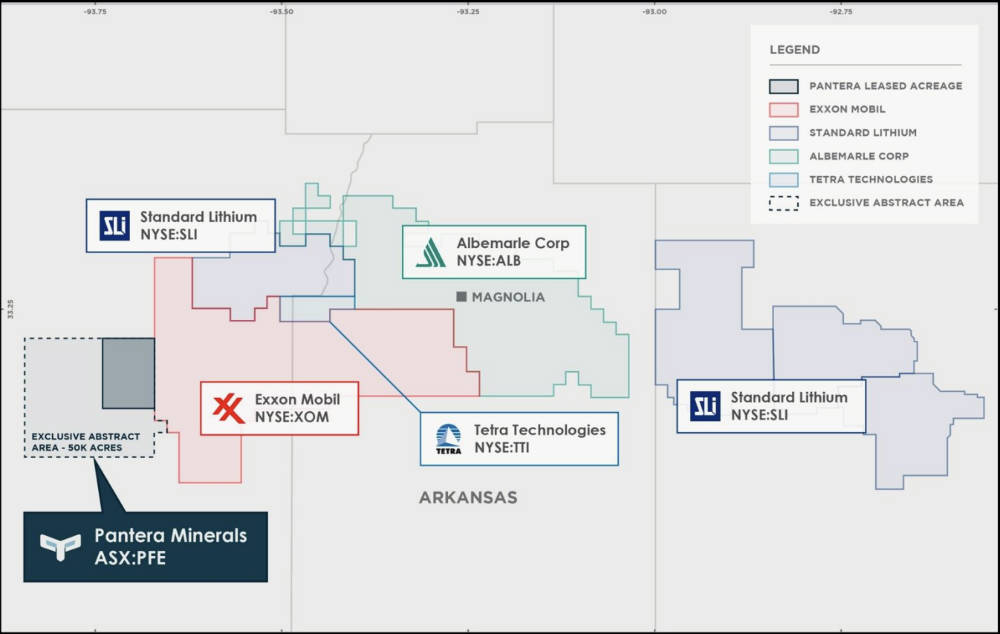

Pantera Minerals (ASX:PFE) is amongst the ASX companies seeking to progress lithium exploration projects in North America and has been carefully building up its acreage in the highly intriguing Smackover Brine play in Arkansas.

The company has locked up some 50,000 acres of ground in the Smackover through an exclusive abstract agreement and has leased 13,457 acres of this with another 8,600 acres under negotiation for its Superbird lithium project.

Securing the extra ground will take PFE towards the initial 20,000 acre target that non-executive chairman Barnaby Egerton-Warburton told Stockhead the company was aiming for to quantify a real commercial project.

With major players such as ExxonMobil holding large tracts of ground – 120,000 acres in the oil and gas giant’s case – Egerton-Warburton said the exclusivity agreement means that PFE has essentially shut out other publicly-listed juniors from building acreage position of any significance on this prime location.

Other companies that have significant leases in the region are Standard Lithium and Albemarle, the latter of which already produces bromine from the formation.

And just to highlight why the Smackover is in such high demand, ExxonMobil, which recently drilled multiple lithium brine wells on their acreage, has flagged that it could be producing lithium for more than 1 million EVs a year from 2030.

This confidence stems from the Smackover Formation having brines with +400ppm concentrations, amongst the highest lithium concentrations anywhere in the world.

Having ExxonMobil stand up and say that the Smackover is the place to be for lithium brines out of all the other great opportunities available globally also helps with PFE’s marketing of its own project to stakeholders.

However, while building a position in a red hot lithium brine play is undoubtedly important, it is the Smackover’s extensive oil exploration and production history that makes it every bit as exciting for PFE – especially at this early stage of operations.

Leveraging existing oil wells

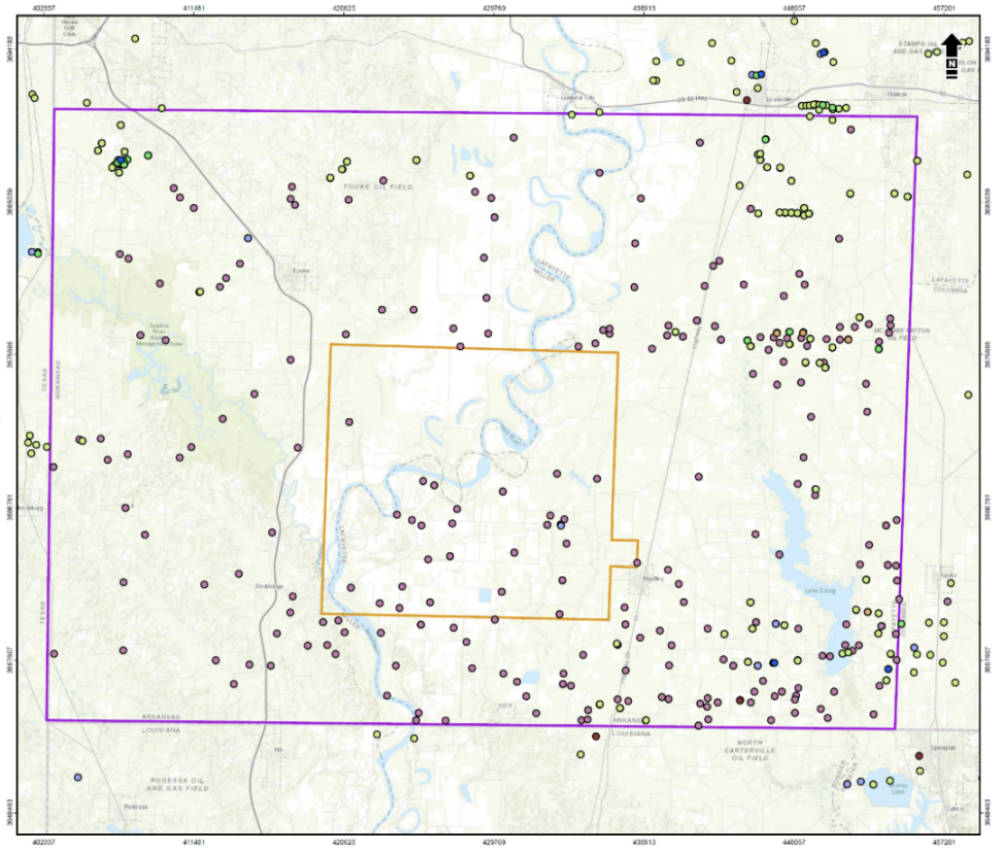

The long history of oil exploration and production from the Smackover means that the region hosts many historically producing oil wells that have been plugged and abandoned after the reservoir or part of the reservoir they serviced became depleted.

For Pantera (and potentially some of the big players), these wells present a massive opportunity to carry out exploration at a much lower cost compared to other lithium brine areas.

Egerton-Warburton said re-entering an existing well can be done quickly and cheaply as it involves drilling through the concrete plugs set by the previous operator and running the logging and sampling tools.

“Most of these wells will allow you to get down to test the formation, brine, permeability and porosity,” he noted.

“Cost is US$150,000-200,000 (per well) and this is just to define your resource vs drilling a fresh well, which might cost you US$2m.”

“Realistically, we only need three wells, though it may well be that we have to drill one fresh well and have two re-entry wells.”

This is backed by Arkansas having what he described as an “amazing” services sector.

Egerton-Warburton says the company is currently analysing all the wells on its acreage and will move to re-enter wells in the next four to four months.

“Once we have samples, we will send them for grade and also run those samples through a DLE pilot plant and get some resources.”

PFE has already defined an exploration target of between 436,000t and 2.97Mt LCE at Superbird that underscores its potential scale and promising grade.

Direct lithium extraction (DLE) is of course the preferred method of lithium production in the Smackover Brine area as evaporation ponds are unsuitable due to environmental reasons, taking up large amounts of land, and the weather ensuring that evaporation won’t work in the first place.

Arkansas also has plenty of nuclear power, allowing any DLE plants in the region to benefit from lower power costs that are nearly 25% below the national average.

The road ahead

Besides re-entering historical oil wells and potentially drilling a new well to determine an initial JORC resource, the company will also continue to increase its leased acreage and might bring a pilot plant to site.

Egerton-Warburton added that a pilot plant will enable the company to produce a lithium chloride that can be sent to various providers to produce lithium carbonate.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.