Why Queensland’s rare earths could give Brazil’s a run for their money

Queensland's REE projects could be racing Brazilian plays to the finish. Pic: Getty Images

- Queensland’s rare earths projects have the potential to be competitive with Brazilian ionic clay rare earths projects

- AHK’s Sandy Mitchell and RDM’s Sybella projects have unique characteristics that could filter through to lower operating costs

- State is an attractive mining destination, while Australia has positive tax incentives for critical minerals

Brazil’s rare earths sector has drawn plenty of attention due to the advantages granted by their grades and expected ease of mining and processing. But Australian operators believe rare earth projects in Queensland have the potential to be just as competitive.

While Brazil is known for its ionic adsorption clay deposits, which are known for their potential to deliver low-cost, high-margin operations thanks to their shallow, free digging nature and relative ease of processing, Queensland’s major deposits fall into two yet more distinct categories.

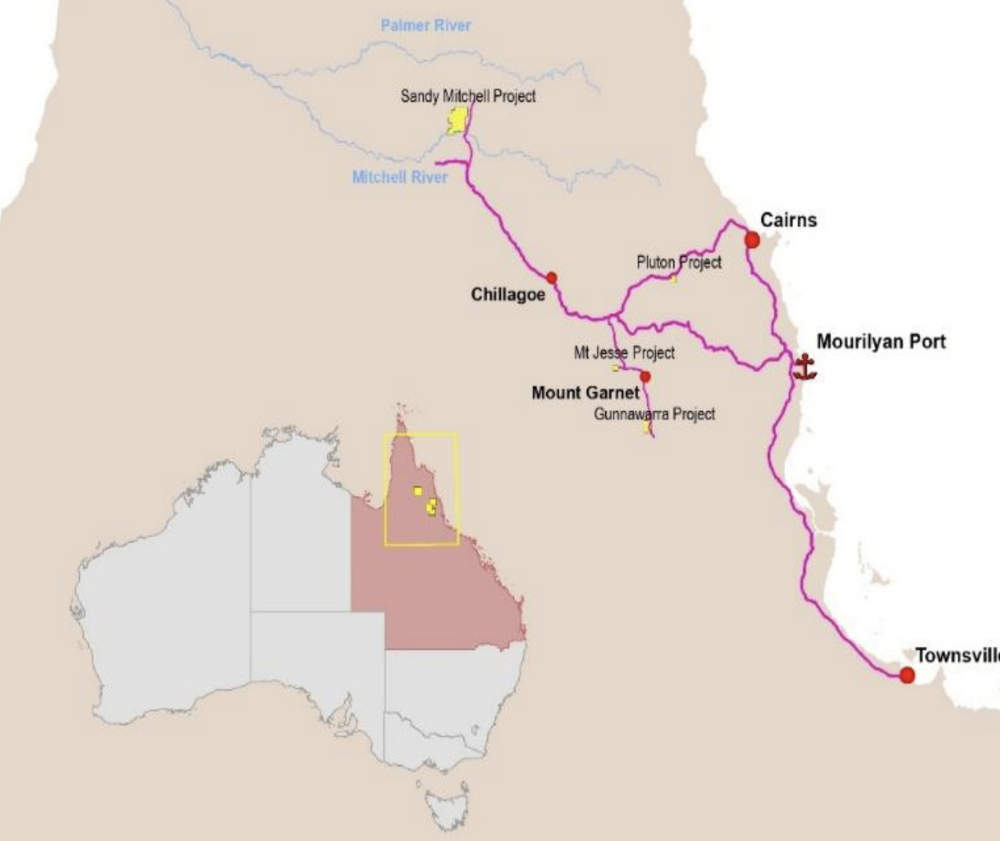

First up is the terrestrial placer-style deposit found at Ark Mines’ (ASX:AHK) Sandy Mitchell project in northern Queensland.

REE mineralisation found at this project is hosted in fine sands where grains of valuable minerals are mixed with sand deposited by ancient rivers or glaciers.

These tend to require simpler processing methods because they are easy to handle and don’t require large amounts of energy or clean water to liberate the minerals of value from the mullock (worthless rock).

Beneficiation test work using simple gravity has already succeeded in producing concentrates with grades of up to 51.9% total rare earth oxides, which is expected to be readily accepted for refining by standard sulphuric acid baking refiners.

Sandy Mitchell already has an indicated resource of 21.7Mt at 1419ppm monazite equivalent with valuable magnet REEs – neodymium, praseodymium, dysprosium and terbium – making up 24% of the TREO basket.

Oxidised granites

The other features REEs found in weakly-oxidised granites, present at Red Metal’s (ASX:RDM) Sybella project near Mt Isa, north-west Queensland.

Speaking to Stockhead, RDM managing director Rob Rutherford noted that like the Brazilian IAC projects, Sybella mineralisation is also amenable to processing through the use of ambient temperature leach conditions.

This compares with processing hard rock deposits in WA like Lynas and Iluka where acids have to be heated up to 800 degrees Celsius to liberate the rare earths from monazite.

“Our room temperature leach conditions make processing very simple and low cost,” Rutherford said.

“Reagent cost is low, capital cost is low. Both have that advantage. But we have the added advantage of not being clay, because clay requires a lot more filtration and water balance issues which come from handling a lot of clay and water.

“We on the other hand don’t have that, we have got granite rock that we can just crush to 10-15mm and then put weak acid over the top of it and extract the rare earths.”

Rutherford added that while IAC projects would always be limited by the size of the plant due to the use of vat leaching, Sybella ore can be processed using heap leach, which he considered to be the lowest capex and opex mining process in the industry.

“Our project is quite scalable, we can make it at 5Mtpa and if the prices are good, ramp it up to 10 or 20Mtpa,” he noted.

“We just have to crush more rock and put more rock on the heap. So we are not limited by the size of the build, which a lot of these clay projects will be.”

Sybella also benefits from the expected low use of reagents as well as MREOs making up 39% of the TREO basket after purification, a process that recently produced a saleable mixed rare earth concentrate with 48.7% TREO.

“Having a high proportion of magnet (rare earths) in your final product makes for better payability if you are just selling mixed rare earth concentrates directly,” Rutherford said.

“It also has heavy REE content comparable to a lot of IAC deposits and certainly a lot higher than typical monazite sand deposits.”

Queensland calling

But it is not just the quality of Red Metal’s or Ark Mines’ projects that makes them attractive.

Queensland also stands out as an attractive mining destination, ranking 13th in the 2024 global investment attractiveness ranking from the Fraser Institute Annual Survey of Mining Companies.

Rutherford added Australia and Brazil had differing royalty regimes and tax systems with the latter having a 7% private royalty on revenue and a 34% tax rate on companies.

“That starts to add up when you compare that to what is going on in Australia,” he said.

“However, the real advantage Australia has is some really wonderful tax incentives to develop critical minerals.”

The proposed Critical Minerals Production Tax Incentive, for example, will give companies who refine critical minerals a 10% refundable tax offset for expenditure associated with downstream processing.

Australia also recently provided $1.4bn in direct financial support to companies developing critical minerals projects across Australia and it’s not a stretch to think more assistance will be forthcoming.

The Queensland Government itself provides incentives such as the Queensland Resources Industry Development Plan, which has $17.5m available (as of end March) until June 2027 to support explorers.

Right environment

At a more local level, RDM’s project is located in a semi-arid, savannah-type terrain rather than in a tropical environment with high rainfall, which Rutherford said meant Sybella did not have the water issues that came with operating in a high rainfall environment.

Being just 20km south-west of Mt Isa also allows the project to benefit from available infrastructure and a ready pool of skilled labour given the likelihood the copper smelter and mine will close after well over 50 years of operations.

“I think if you going to find a REE deposit anywhere in Australia, you couldn’t have picked a better spot right now than at Mt Isa in Queensland,” Rutherford said.

“Infrastructure, workforce, those are boxes one certainly has to tick, it is flat terrain from the environmental point of view, it is sort of a very benign environment, it is not a high rainfall environment.

“You have options for the workforce and you don’t have to build your own camp, which drops the capital cost further.

“Same for water, power – there’s a gas pipeline that traverses the project, 20km from a big power station that powers the whole town and the mine.

“There are a lot of advantages and when you’re a bulk tonnage, low-grade operation like Sybella, every advantage you have makes a huge difference.”

Other rare earths projects

Besides RDM and AHK, other companies with REE projects in Queensland include Australian Rare Earths (ASX:AR3) and DevEx Resources (ASX:DEV) .

DevEx holds the Kennedy ionic clay project in northern Queensland that already hosts an inferred resource of 150Mt at 1000ppm TREO within unconsolidated clay-rich gravels from surface with no overburden.

This has the potential to be expanded through infill and extensional drilling to the west.

Preliminary leach tests have already demonstrated rapid recoveries by desorption of REE in the first 30 minutes using ammonium sulfate solution in weak acidic (pH4) conditions along with low acid consumption and very low dissolution of gangue (waste) elements.

AR3 holds the Dalrymple project and exploration tenements in the Kennedy Province.

Dalrymple consists of four granted exploration permits and one exploration permit application that covers a total area of 933km2.

The company plans to carry out follow-up sampling and metallurgical testwork.

It has also been granted four exploration permits in the Kennedy Province close to DEV’s Kennedy REE project, which it intends to rapidly assess.

In the race for development

Much of the market’s focus has turned to Brazil’s growing project pipeline, and Rutherford said Australian explorers need to work fast to compete for the same space in emerging market, with costs key.

“Both Brazilians and Australians are in that race, and there’s a limited but growing market, they are talking about 7% per annum growth for Nd (neodymium) at least,” he said.

“There’s room for another 4-5 big new projects to come on line. There’s this race in the rest of the world to see who’s going to be the lowest cost producer, because the lowest cost producers are the guys that are going to get up.

“And once that market is full, there’s not going to much room for anyone else to get in, so we know there’s an urgency and we know we are in a race with the Brazilians.”

At Stockhead, we tell it like it is. While Ark Mines and Red Metal are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.