Why LFP is becoming ‘the chosen’ battery tech of choice, and the ASX stocks getting in early

Pic: Getty Images

The future of e-mobility and the world’s decarbonisation efforts used to revolve around the ‘battle of the battery chemistries’ but, as it turns out, the battle may have already been won by a plucky option that was once considered the poor man’s alternative to the better-known lithium-ion chemistries.

Before we touch on that, we should make clear that in the world of EV batteries, the term ‘lithium ion’ is a bit of a misnomer as it is used to refer to a family of different rechargeable battery types, with those featuring nickel-manganese-cobalt-oxide (NMC) in the cathode taking the prime spot for some time.

But with global economies scrambling to meet net zero requirements, raw materials like cobalt, lithium, nickel, and copper are poised to become more valuable than oil as prices continue to break new records.

The most expensive of these commodities – cobalt – saw prices surge through the roof in 2021 and 2022, surpassing $80,000/mt back in March and comes with an assortment of issues, making it the highest material supply chain risk for EVs in the short to medium term.

Eight of the top 10 cobalt-producing operations were in the DRC back in 2020, a country commonly affected by political instability and child labour deaths.

For mass electrification to take place, experts say cobalt needs to be eliminated or reduced to an absolute bare minimum, despite the metal’s high density providing NMC battery chemistries with a higher-power rating due its strong lithium diffusion rate and electron mobility.

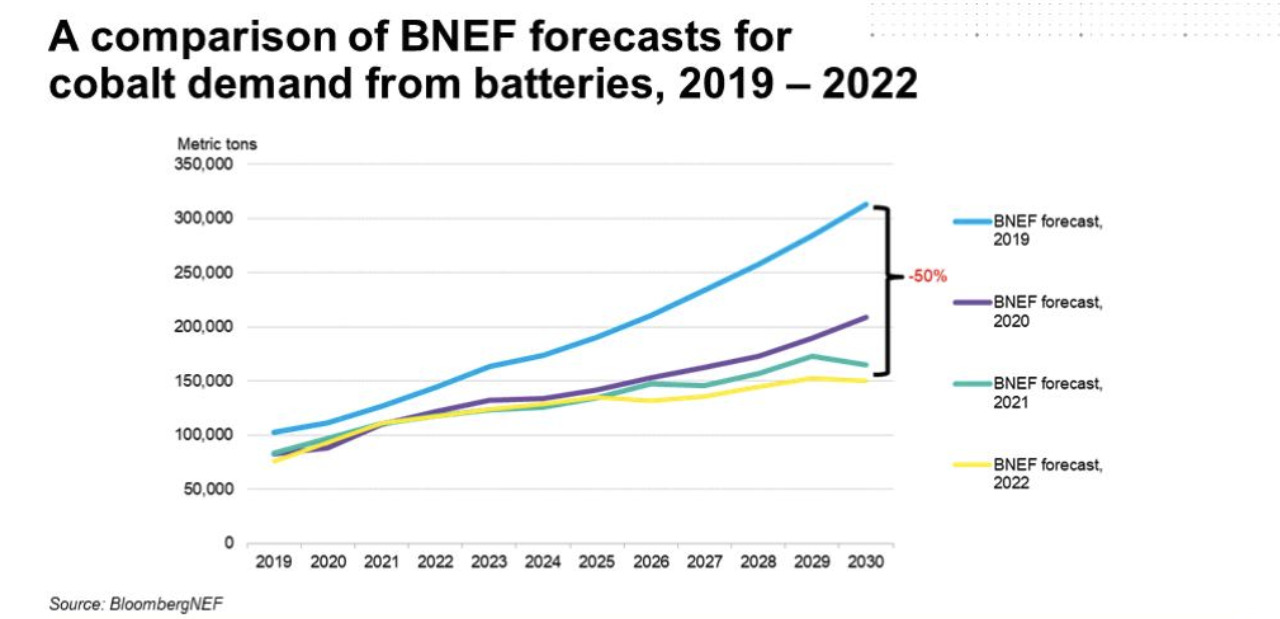

Thankfully, according to BloombergNEF’s battery metals outlook, historical cobalt demand has been on a steady decline year-on-year since 2019, in line with the industry demand switch to lithium-iron-phosphate (LFP) – the aforementioned plucky option – and other battery chemistries.

LFP vs NMCs – pros and cons

Unlike NMCs, LFP batteries have 100% charging capacity, meaning they can be fully charged without causing accelerated degradation.

The phosphorous-oxygen bond in the LFP cathode is stronger than the metal-oxygen bond in other cathode materials, making LFP batteries more stable and less likely to experience thermal runway or catch on fire.

Although discovered 26 years ago by researchers at the University at Texas, experts say one of the biggest factors holding LFP cells back is its lower energy density, which offers less range to a single charge for the same weight compared to the widely used NMC lithium-ion batteries.

That said, LFP batteries are used extensively throughout China in electric buses, which perform best during stop and start duty cycles where the benefits of regenerative braking are the highest.

But there is a huge, critical attraction that is proving too powerful to ignore when it comes to LFPS, and that is price.

LFP cells are roughly 30% cheaper than their nickel-cobalt rich counterparts and while intellectual property restrictions have traditionally kept the technology within China’s boundaries, the world’s most aggressive EV carmaker, Tesla, introduced the tech into its Chinese-made standard Model 3 and Model Y cars two years ago.

NOW READ: Battery storage: It’s not just about lithium anymore

LFP demand on the up and up

Since then, investor sentiment has taken off.

Benchmark Mineral Intelligence reckons China is set to extend its dominance in the battery material space, increasing its share of production from 78% in 2022 to 87% in 2030. Central to all of this is China’s LFP industry, which Benchmark forecasts will account for 69% of the country’s cathode output in 2030, up from 44% in 2022.

While China is investing in all areas of lithium-ion manufacture, Benchmark analyst Rob Burrell tells Stockhead the country is particularly focused on LFP as they know on-coming demand will be strong for the material in the years ahead.

“China are also in a good position to supply almost all global supply in theory,” he adds.

“If they continue to corner the LFP market, then it will become increasingly difficult for other countries to compete.”

One big issue China may face is the fact that it is not an FTA (free trade agreement) country for North America or the vast majority of European countries, which may hold it back with the US’s Inflation Reduction Act and the EU’s Rules of Origin policies, Burrell explains.

China’s dominance of the lithium ion battery supply chain, from mine to battery cell / EV. @benchmarkmin #Lithium #Graphite #Nickel #Cobalt #Manganese

Big topic for Benchmark Week 2022, 14-18 Nov > https://t.co/63jk7N8Imu pic.twitter.com/F3gFTSMZNU

— Simon Moores (@sdmoores) October 11, 2022

The big players in the LFP game

The global LFP market is largely dominated by the top four LFP producers who occupy around half the market, Burrell explains.

China’s Dynanonic and Yuneng New Energy are the two largest producers, with Dynanonic having a pretty hefty share overall with four major production bases totalling 260,000mt of capacity.

It plans to add 80,000mt of LFP capacity by the end of 2022 and is expected to reach 345,000mt by the end of 2025.

The US state of Michigan saw a huge pouring of investment into the LFP battery chain earlier this month after start-up Our Next Energy – a Michigan-born company – said it would inject US$1.6bn into a new battery cell and pack plant, and China’s Gotion announced it would also build battery cathodes and anodes in the state.

Both of the deals come as the Inflation Reduction Act paves the way for an improvement in economics of producing cells in the US with tax credits of up to $45 a kilowatt-hour to battery producers.

It also includes tax credits equal to 10% of the cost of producing electrode materials such as cathodes.

But while we are seeing investment in LFP projects in other regions, Burell says these countries cannot compete with the low-cost production of these batteries in China – especially given the fact many of these projects remain in their infancy.

ASX players in the LFP game

Avenira (ASX:AEV)

While there is currently no LFP production coming from within Australia itself this year, Burrell believes the recent partnership between Avenira, Taiwanese battery materials manufacturer Advanced Lithium Electrochemistry (Aleees) and the Northern Territory government will help build out capacity and propel it into the scene.

The three entities signed a non-binding MOU at the end of September for the development of a LFP battery cathode manufacturing facility, which is aiming for an initial 5,000 – 10,000tpa production capacity by 2023/2024.

It will eventually scale up to 200,000tpa by 2032.

Lithium Australia (ASX:LIT)

LIT is another stock making moves in the space with its ‘VSPC’ subsidiary focused on the design, manufacture and supply of cathode formulations for the lithium-ion batteries and other high-purity, high-performance metal oxides.

It recently appointed Lycopodium Minerals to provide engineering support services for a definitive feasibility study into a potential LFP cathode powder manufacturing facility.

The DFS program is progressing well with activities expanded to include early-stage LFP production, to support the final stages of product pre-qualification.

Customer offtake discussions are advancing in parallel with the DFS.

Calix (ASX:CXL) and Pilbara Minerals (ASX:PLS)

The two companies completed a scoping study into the viability of constructing a demonstration-scale chemicals facility producing value-added lithium phosphate salts at the Pilgangoora Operation back in March.

This scoping study is the first economic evaluation of the mid-stream project which has been prepared to an accuracy level of +/-40% (for capital costs) and +/-30% (for operating costs), PLS said in an announcement.

Any decision to proceed will be the subject of more definitive studies, as part of a proposed joint venture with Calix.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.