High Voltage: China may dominate 90% of the world’s cathode production by 2030, but the devil’s in the detail

Pic: Man_Half-tube, DigitalVision Vectors/ Vioa Getty Images

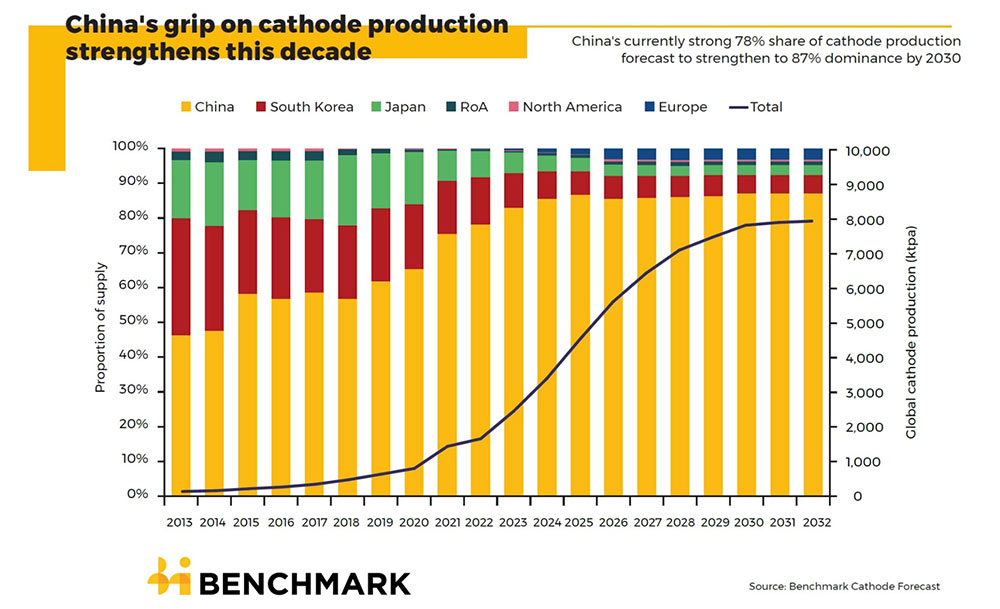

- China will extend its dominance in cathode production, increasing market share from 78% in 2022 to 87% in 2030: Benchmark

- And yet this will mostly be from Tier 3 producers, which currently do not supply EV market

- Tier 1 production — those which can supply non-Chinese car makers — will actually shrink from 66% in 2022 to 43% in 2030

- This week’s biggest movers: QXR Resources, Winsome Resources, Eastern Resources, Alchemy Resources and Prospect Resources

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

Europe and the US appear determined to secure their own battery supply chains and drastically reduce their reliance on China.

While demand is ostensibly growing for battery material which bypasses China, data from Benchmark’s Cathode Forecast shows that China is set to extend its dominance, increasing its share of production from 78% in 2022 to 87% in 2030.

The cathode is a crucial part of the battery which contains high value metals like cobalt, nickel, manganese and lithium.

The data highlights how China’s total output is set to increase by a further 5.3 times from now until 2030, despite efforts to develop cathode capacity in the rest of the world which is only forecast to increase 2.8 times in the same period.

“China has a stronghold grip on the market,” Robert Burrell, an analyst at Benchmark, said.

“China will produce far more [cathode active material] than it needs domestically.”

But maybe that 90% figure ain’t as dominant as it sounds

Firstly, many of the cathode facilities in planning or under construction are from Tier 3 producers, who currently do not supply the EV market.

“This tier currently makes up just under a quarter of China’s cathode production in 2022, but will grow to nearly half by 2030,” Benchmark says.

“Tier One producers, those which can supply ex-China automotive markets, will see the lowest growth in the country of all the tiers, and will shrink from 66% of production in 2022 to just 43% in 2030.”

Looks like the ex-China world may need more of its own cathode production after all.

In fact, China’s share of NCM cathode production will fall

There are different types of cathode chemistries.

Central to China’s growth is its LFP (lithium iron phosphate) cathode industry, which Benchmark forecasts will account for 69% of the country’s cathode output in 2030, up from 44% in 2022.

The popularity of LFPs has exploded over the past year or so.

They are ostensibly cheaper than the incumbent NCA or NCM (nickel manganese cobalt) cells mainly because they don’t require scarce and price-volatile metals such as nickel or cobalt.

This is offset by their lower energy densities, which makes them not-so-good for gruntier, long range vehicles.

Benchmark forecasts that in 2030 China will produce 98% of the world’s LFP.

However, between 2022 and 2030, China’s share of NCM production will drop from 39% to 22%.

“China’s EV demand is less driven by range anxiety as in North America and Europe, leading to a lower demand for high energy cathodes such as NCM,” Benchmark says.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected].

| CODE | COMPANY | % WEEK | % MONTH | % 6 MONTH | % YEAR | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| QXR | Qx Resources Limited | 53% | 79% | -28% | 206% | 0.052 | $42,108,754 |

| EFE | Eastern Resources | 41% | 37% | -21% | 17% | 0.041 | $30,274,901 |

| ALY | Alchemy Resource Ltd | 40% | 33% | 87% | 104% | 0.028 | $27,639,203 |

| WR1 | Winsome Resources | 37% | 40% | -24% | 0% | 0.37 | $47,289,898 |

| PSC | Prospect Res Ltd | 36% | 11% | 144% | 411% | 0.11 | $46,225,946 |

| GAL | Galileo Mining Ltd | 30% | 39% | 586% | 492% | 1.51 | $278,345,647 |

| RBX | Resource B | 26% | -8% | -44% | -45% | 0.11 | $4,507,415 |

| SRZ | Stellar Resources | 25% | 0% | -44% | -52% | 0.015 | $15,069,464 |

| AS2 | Askarimetalslimited | 24% | 6% | -40% | 55% | 0.34 | $13,377,379 |

| VR8 | Vanadium Resources | 21% | 31% | 0% | 64% | 0.105 | $44,983,676 |

| IMI | Infinitymining | 20% | 20% | 45% | 0% | 0.24 | $13,512,500 |

| VRC | Volt Resources Ltd | 18% | 8% | 37% | -19% | 0.026 | $79,695,931 |

| BEM | Blackearth Minerals | 18% | 8% | -22% | -25% | 0.098 | $23,825,668 |

| TMT | Technology Metals | 17% | 14% | -29% | 6% | 0.41 | $87,077,191 |

| CZN | Corazon Ltd | 17% | -8% | -49% | -45% | 0.0175 | $10,070,454 |

| AKN | Auking Mining Ltd | 16% | 9% | -50% | -54% | 0.095 | $8,871,040 |

| RLC | Reedy Lagoon Corp. | 15% | -6% | -57% | -35% | 0.015 | $8,361,404 |

| NKL | Nickelxltd | 15% | 15% | -9% | -12% | 0.15 | $7,762,500 |

| GRE | Greentechmetals | 15% | -39% | -31% | 0% | 0.155 | $4,379,200 |

| WC1 | Westcobarmetals | 15% | 41% | 96% | 22% | 0.275 | $8,456,271 |

| CNJ | Conico Ltd | 14% | -9% | 196% | -17% | 0.041 | $55,288,788 |

| SYA | Sayona Mining Ltd | 14% | -2% | 0% | 43% | 0.25 | $1,869,559,978 |

| LRV | Larvottoresources | 13% | -4% | -4% | 0% | 0.215 | $7,060,525 |

| TLG | Talga Group Ltd | 13% | -1% | -20% | -7% | 1.335 | $390,367,384 |

| PLS | Pilbara Min Ltd | 12% | 40% | 45% | 156% | 4.96 | $13,580,544,828 |

| HRE | Heavy Rare Earths | 12% | -16% | 0% | 0% | 0.185 | $10,112,948 |

| MLX | Metals X Limited | 12% | 9% | -57% | -19% | 0.29 | $244,961,838 |

| AQD | Ausquest Limited | 11% | 18% | -9% | 18% | 0.02 | $15,677,835 |

| THR | Thor Mining PLC | 11% | 0% | -41% | -47% | 0.01 | $10,991,633 |

| MIN | Mineral Resources. | 11% | 18% | 27% | 66% | 69.09 | $12,540,578,548 |

| ADD | Adavale Resource Ltd | 11% | -11% | -18% | -51% | 0.031 | $14,396,445 |

| ILU | Iluka Resources | 11% | -1% | -13% | 14% | 9.76 | $3,960,367,647 |

| BHP | BHP Group Limited | 10% | 9% | -15% | 22% | 39.87 | $195,540,673,462 |

| PLL | Piedmont Lithium Inc | 10% | 5% | -13% | 21% | 0.875 | $435,245,910 |

| GSR | Greenstone Resources | 10% | -1% | 74% | 144% | 0.066 | $63,207,221 |

| MRD | Mount Ridley Mines | 10% | 10% | -39% | -21% | 0.0055 | $29,726,363 |

| TON | Triton Min Ltd | 10% | -21% | -24% | -37% | 0.022 | $30,421,252 |

| MRD | Mount Ridley Mines | 10% | 10% | -39% | -21% | 0.0055 | $29,726,363 |

| GBR | Greatbould Resources | 10% | 3% | -23% | -38% | 0.1 | $42,287,217 |

| CHN | Chalice Mining Ltd | 10% | -11% | -45% | -33% | 3.91 | $1,399,825,562 |

| JRV | Jervois Global Ltd | 9% | 9% | -35% | 8% | 0.535 | $767,474,235 |

| OCN | Oceanalithiumlimited | 9% | -10% | 0% | 0% | 0.55 | $17,433,000 |

| INR | Ioneer Ltd | 9% | -1% | -15% | -5% | 0.615 | $1,269,371,116 |

| INF | Infinity Lithium | 9% | 6% | 6% | 54% | 0.185 | $79,042,483 |

| SUM | Summitminerals | 9% | -5% | 0% | 0% | 0.185 | $4,203,684 |

| DVP | Develop Global Ltd | 8% | 16% | -16% | 1% | 2.64 | $400,275,648 |

| NTU | Northern Min Ltd | 8% | 0% | -20% | -2% | 0.043 | $204,140,635 |

| GED | Golden Deeps | 7% | -6% | 15% | 50% | 0.015 | $16,173,174 |

| KOR | Korab Resources | 7% | 7% | -25% | 43% | 0.03 | $11,378,550 |

| CAI | Calidus Resources | 7% | -3% | -44% | 0% | 0.545 | $223,268,670 |

| IGO | IGO Limited | 7% | 15% | 1% | 69% | 14.5 | $10,465,441,176 |

| LRS | Latin Resources Ltd | 6% | -9% | -31% | 127% | 0.1 | $181,010,776 |

| HXG | Hexagon Energy | 6% | 6% | -62% | -77% | 0.017 | $8,719,570 |

| LKE | Lake Resources | 6% | -9% | -58% | 63% | 0.96 | $1,244,026,470 |

| GRL | Godolphin Resources | 6% | -1% | -41% | -41% | 0.088 | $9,824,664 |

| AZS | Azure Minerals | 6% | -5% | -49% | -42% | 0.18 | $54,378,751 |

| AVL | Aust Vanadium Ltd | 6% | -18% | -60% | 64% | 0.036 | $135,262,871 |

| WCN | White Cliff Min Ltd | 6% | -10% | -37% | 46% | 0.019 | $15,699,671 |

| EUR | European Lithium Ltd | 5% | -8% | -50% | -26% | 0.078 | $109,218,656 |

| LYC | Lynas Rare Earths | 5% | -6% | -30% | 20% | 7.785 | $6,760,893,891 |

| LPI | Lithium Pwr Int Ltd | 5% | -6% | -40% | 70% | 0.5425 | $197,556,569 |

| SYR | Syrah Resources | 5% | 0% | -5% | 61% | 1.6425 | $1,059,501,722 |

| MQR | Marquee Resource Ltd | 5% | -17% | -48% | -13% | 0.06 | $18,937,055 |

| SCN | Scorpion Minerals | 5% | 1% | 18% | 45% | 0.08 | $26,214,664 |

| CAE | Cannindah Resources | 5% | -9% | -39% | 45% | 0.21 | $114,932,941 |

| COB | Cobalt Blue Ltd | 5% | -5% | -23% | 126% | 0.735 | $233,076,763 |

| IXR | Ionic Rare Earths | 5% | -4% | -51% | 23% | 0.043 | $158,776,802 |

| MCR | Mincor Resources NL | 5% | -12% | -20% | 46% | 1.855 | $893,420,724 |

| MLS | Metals Australia | 5% | -14% | -69% | 120% | 0.044 | $24,888,484 |

| QEM | QEM Limited | 5% | -4% | -13% | 50% | 0.225 | $28,146,055 |

| NMT | Neometals Ltd | 4% | -11% | -40% | 37% | 1.175 | $626,913,287 |

| WMG | Western Mines | 4% | -4% | -47% | -43% | 0.13 | $4,395,900 |

| OZL | OZ Minerals | 4% | 4% | -2% | 21% | 26.42 | $8,636,422,006 |

| AZI | Altamin Limited | 4% | -13% | -10% | 4% | 0.083 | $32,512,490 |

| KGD | Kula Gold Limited | 4% | 40% | -39% | -42% | 0.028 | $9,750,146 |

| AAJ | Aruma Resources Ltd | 4% | -17% | -57% | -35% | 0.058 | $8,475,921 |

| AGY | Argosy Minerals Ltd | 4% | 42% | 4% | 170% | 0.5125 | $664,081,094 |

| ESS | Essential Metals Ltd | 3% | 5% | -23% | 178% | 0.445 | $104,174,191 |

| S32 | South32 Limited | 3% | -7% | -30% | 6% | 3.715 | $16,477,216,439 |

| PGD | Peregrine Gold | 3% | -17% | 21% | 51% | 0.605 | $23,813,757 |

| LOT | Lotus Resources Ltd | 3% | -7% | -39% | -7% | 0.2275 | $285,089,849 |

| LTR | Liontown Resources | 3% | -5% | -21% | 14% | 1.54 | $3,195,813,434 |

| TMB | Tambourahmetals | 3% | 11% | -40% | -24% | 0.155 | $6,384,853 |

| ABX | ABX Group Limited | 3% | 24% | -16% | 48% | 0.155 | $35,774,530 |

| PVW | PVW Res Ltd | 3% | -35% | -67% | -20% | 0.16 | $14,418,391 |

| KTA | Krakatoa Resources | 3% | 3% | 12% | -9% | 0.064 | $21,372,015 |

| PVW | PVW Res Ltd | 3% | -35% | -67% | -20% | 0.16 | $14,418,391 |

| KTA | Krakatoa Resources | 3% | 3% | 12% | -9% | 0.064 | $21,372,015 |

| M2R | Miramar | 3% | -11% | -47% | -51% | 0.098 | $5,840,986 |

| TEM | Tempest Minerals | 3% | -15% | -82% | 50% | 0.033 | $16,404,901 |

| VML | Vital Metals Limited | 3% | -13% | -42% | -40% | 0.035 | $156,713,116 |

| PAN | Panoramic Resources | 3% | -14% | -38% | -10% | 0.185 | $379,419,091 |

| RNU | Renascor Res Ltd | 3% | 3% | -40% | 42% | 0.185 | $379,709,155 |

| VUL | Vulcan Energy | 3% | 1% | -29% | -41% | 7.55 | $1,013,380,578 |

| ITM | Itech Minerals Ltd | 3% | 27% | -18% | 0% | 0.38 | $30,883,334 |

| PAM | Pan Asia Metals | 3% | -9% | -30% | -13% | 0.39 | $26,980,888 |

| AKE | Allkem Limited | 3% | 8% | 15% | 70% | 14.215 | $8,404,333,573 |

| BRB | Breaker Res NL | 2% | -5% | -16% | -28% | 0.21 | $68,426,595 |

| 1MC | Morella Corporation | 2% | -10% | -36% | -64% | 0.0225 | $116,031,116 |

| GLN | Galan Lithium Ltd | 2% | -1% | -42% | 24% | 1.21 | $338,072,568 |

| ASN | Anson Resources Ltd | 2% | -3% | 82% | 249% | 0.3 | $328,761,375 |

| LIN | Lindian Resources | 2% | 15% | 824% | 797% | 0.305 | $262,987,574 |

| LPM | Lithium Plus | 2% | 6% | 0% | 0% | 0.615 | $26,547,829 |

| EGR | Ecograf Limited | 2% | -13% | -43% | -52% | 0.325 | $139,603,372 |

| AZL | Arizona Lithium Ltd | 1% | -4% | -56% | 84% | 0.079 | $185,564,268 |

| ASO | Aston Minerals Ltd | 1% | -2% | -50% | -31% | 0.083 | $93,536,598 |

| IPX | Iperionx Limited | 1% | -6% | -35% | -22% | 0.845 | $150,721,938 |

| CHR | Charger Metals | 1% | 3% | -42% | -2% | 0.485 | $19,622,716 |

| ARL | Ardea Resources Ltd | 1% | 5% | -47% | 123% | 0.9 | $154,461,373 |

| NVX | Novonix Limited | 0% | -11% | -71% | -72% | 1.83 | $844,389,633 |

| VIA | Viagold Rare Earth | 0% | 0% | 0% | 317% | 2 | $166,624,808 |

| NWC | New World Resources | 0% | -6% | -32% | -47% | 0.032 | $59,100,890 |

| HNR | Hannans Ltd | 0% | 0% | -45% | -38% | 0.021 | $54,731,701 |

| DEV | Devex Resources Ltd | 0% | -19% | -31% | -2% | 0.31 | $113,258,759 |

| AVZ | AVZ Minerals Ltd | 0% | 0% | -40% | 129% | 0.78 | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0% | -18% | -40% | -37% | 0.036 | $18,707,497 |

| FRS | Forrestaniaresources | 0% | 20% | -45% | -42% | 0.18 | $7,063,865 |

| CLA | Celsius Resource Ltd | 0% | 15% | -44% | -38% | 0.015 | $21,039,607 |

| FGR | First Graphene Ltd | 0% | -12% | -35% | -39% | 0.11 | $60,481,409 |

| SBR | Sabre Resources | 0% | 0% | 0% | 20% | 0.006 | $16,739,136 |

| ADV | Ardiden Ltd | 0% | -13% | -53% | -42% | 0.007 | $18,678,347 |

| PGM | Platina Resources | 0% | -12% | -60% | -63% | 0.023 | $11,361,739 |

| TKL | Traka Resources | 0% | 0% | -42% | -46% | 0.007 | $4,821,422 |

| IPT | Impact Minerals | 0% | -13% | -40% | -52% | 0.007 | $17,369,594 |

| LIT | Lithium Australia | 0% | -27% | -50% | -52% | 0.055 | $67,080,377 |

| ARN | Aldoro Resources | 0% | -14% | -30% | -50% | 0.215 | $22,407,146 |

| BSX | Blackstone Ltd | 0% | -5% | -55% | -60% | 0.18 | $80,448,288 |

| AUZ | Australian Mines Ltd | 0% | -13% | -69% | -69% | 0.07 | $32,809,969 |

| FFX | Firefinch Ltd | 0% | 0% | -51% | -2% | 0.2 | $236,248,644 |

| ATM | Aneka Tambang | 0% | 0% | 1% | 15% | 1.15 | $1,499,196 |

| RMX | Red Mount Min Ltd | 0% | -14% | -37% | -33% | 0.006 | $8,211,819 |

| LML | Lincoln Minerals | 0% | 0% | 0% | 0% | 0.008 | $4,599,869 |

| QPM | Queensland Pacific | 0% | -4% | -29% | -49% | 0.135 | $204,322,707 |

| LEG | Legend Mining | 0% | 0% | -49% | -49% | 0.039 | $104,695,157 |

| AML | Aeon Metals Ltd. | 0% | 0% | -61% | -49% | 0.028 | $32,802,923 |

| WKT | Walkabout Resources | 0% | 0% | -10% | 8% | 0.173011 | $78,248,343 |

| S2R | S2 Resources | 0% | -7% | -23% | 52% | 0.135 | $48,110,605 |

| BNR | Bulletin Res Ltd | 0% | -15% | -57% | 69% | 0.115 | $32,185,021 |

| EMS | Eastern Metals | 0% | 12% | -28% | 0% | 0.14 | $5,218,594 |

| SHH | Shree Minerals Ltd | 0% | 13% | -44% | -10% | 0.009 | $9,907,895 |

| TSC | Twenty Seven Co. Ltd | 0% | 14% | -43% | -43% | 0.002 | $10,041,254 |

| WML | Woomera Mining Ltd | 0% | 0% | -25% | -28% | 0.015 | $10,302,496 |

| KZR | Kalamazoo Resources | 0% | -9% | -42% | -38% | 0.205 | $31,996,165 |

| CMX | Chemxmaterials | 0% | -3% | -18% | 0% | 0.18 | $8,435,903 |

| AOA | Ausmon Resorces | 0% | -11% | -11% | 14% | 0.008 | $6,858,315 |

| CML | Chase Mining Limited | 0% | -21% | 5% | -26% | 0.012 | $5,617,593 |

| ENV | Enova Mining Limited | 0% | 6% | -15% | -23% | 0.017 | $6,242,656 |

| RR1 | Reach Resources Ltd | 0% | -14% | -25% | -33% | 0.006 | $11,460,304 |

| AVW | Avira Resources Ltd | 0% | 0% | -33% | -33% | 0.004 | $8,475,160 |

| KAI | Kairos Minerals Ltd | 0% | 18% | 3% | 10% | 0.033 | $62,850,992 |

| RAS | Ragusa Minerals Ltd | 0% | 49% | 252% | 260% | 0.32 | $41,237,478 |

| IG6 | Internationalgraphit | 0% | -7% | 0% | 0% | 0.33 | $26,076,195 |

| CLZ | Classic Min Ltd | 0% | 4% | -89% | -89% | 0.016 | $7,163,591 |

| RMX | Red Mount Min Ltd | 0% | -14% | -37% | -33% | 0.006 | $8,211,819 |

| VMS | Venture Minerals | 0% | -11% | -63% | -50% | 0.025 | $38,581,525 |

| IDA | Indiana Resources | 0% | -4% | 10% | 10% | 0.064 | $30,963,508 |

| TAR | Taruga Minerals | 0% | 12% | 16% | -45% | 0.029 | $16,763,399 |

| RR1 | Reach Resources Ltd | 0% | -14% | -25% | -33% | 0.006 | $11,460,304 |

| AOA | Ausmon Resorces | 0% | -11% | -11% | 14% | 0.008 | $6,858,315 |

| CTM | Centaurus Metals Ltd | 0% | -8% | -32% | 2% | 1.005 | $418,564,148 |

| CWX | Carawine Resources | -1% | -5% | -55% | -54% | 0.095 | $13,094,263 |

| DM1 | Desert Metals | -1% | 15% | 28% | 77% | 0.46 | $22,796,114 |

| PRL | Province Resources | -1% | -27% | -23% | -50% | 0.077 | $88,611,986 |

| CNB | Carnaby Resource Ltd | -1% | -10% | -40% | 133% | 0.745 | $105,529,453 |

| AXE | Archer Materials | -1% | -5% | -23% | -58% | 0.735 | $187,592,741 |

| PTR | Petratherm Ltd | -1% | 4% | 43% | 19% | 0.07 | $15,507,829 |

| MEK | Meeka Metals Limited | -2% | -13% | 13% | 34% | 0.059 | $62,448,094 |

| A8G | Australasian Metals | -2% | 10% | -40% | -31% | 0.285 | $11,733,591 |

| RXL | Rox Resources | -2% | 4% | -36% | -33% | 0.255 | $41,390,532 |

| JRL | Jindalee Resources | -2% | -14% | -34% | 2% | 2.25 | $127,955,094 |

| SLZ | Sultan Resources Ltd | -2% | -16% | -45% | -55% | 0.088 | $7,329,026 |

| LNR | Lanthanein Resources | -3% | -35% | 15% | 129% | 0.039 | $34,661,721 |

| LNR | Lanthanein Resources | -3% | -35% | 15% | 129% | 0.039 | $34,661,721 |

| NIC | Nickel Industries | -3% | -14% | -39% | -15% | 0.775 | $2,048,455,123 |

| JMS | Jupiter Mines. | -3% | -3% | -27% | -14% | 0.19 | $382,003,251 |

| ODE | Odessa Minerals Ltd | -3% | 27% | 27% | 280% | 0.019 | $9,668,720 |

| FTL | Firetail Resources | -3% | -27% | 0% | 0% | 0.19 | $11,738,675 |

| ODE | Odessa Minerals Ltd | -3% | 27% | 27% | 280% | 0.019 | $9,668,720 |

| SGQ | St George Min Ltd | -3% | 35% | -30% | -49% | 0.035 | $24,500,623 |

| AX8 | Accelerate Resources | -3% | -8% | -50% | -15% | 0.035 | $9,466,061 |

| RGL | Riversgold | -3% | 3% | -59% | 43% | 0.035 | $26,356,458 |

| OD6 | Od6Metalsltd | -3% | 3% | 0% | 0% | 0.175 | $8,634,587 |

| ASM | Ausstratmaterials | -3% | -28% | -71% | -77% | 2.26 | $315,932,897 |

| REE | Rarex Limited | -3% | -3% | -38% | -40% | 0.059 | $34,183,808 |

| ZNC | Zenith Minerals Ltd | -3% | -7% | -28% | 37% | 0.28 | $98,257,250 |

| M24 | Mamba Exploration | -3% | 40% | -3% | -18% | 0.14 | $5,482,750 |

| EMN | Euromanganese | -4% | -21% | -35% | -46% | 0.265 | $67,317,820 |

| E25 | Element 25 Ltd | -4% | 18% | -19% | -59% | 0.76 | $112,242,121 |

| EVR | Ev Resources Ltd | -4% | -11% | -58% | -26% | 0.025 | $22,223,618 |

| SRI | Sipa Resources Ltd | -4% | 7% | -4% | -14% | 0.048 | $9,841,191 |

| EMH | European Metals Hldg | -4% | 1% | -49% | -46% | 0.72 | $82,619,547 |

| OMH | OM Holdings Limited | -4% | -11% | -33% | -38% | 0.6 | $443,174,002 |

| GT1 | Greentechnology | -4% | 7% | -25% | 0% | 0.715 | $135,424,259 |

| GGG | Greenland Minerals | -4% | -28% | -30% | -57% | 0.047 | $62,364,225 |

| GME | GME Resources Ltd | -4% | -12% | 17% | 85% | 0.115 | $69,046,117 |

| PNN | Power Minerals Ltd | -4% | -7% | -15% | 10% | 0.455 | $31,749,095 |

| MRR | Minrex Resources Ltd | -4% | -12% | -33% | 175% | 0.044 | $45,484,570 |

| GL1 | Globallith | -4% | 28% | -6% | 449% | 2.17 | $325,331,425 |

| PEK | Peak Rare Earths Ltd | -4% | -10% | -46% | -53% | 0.43 | $91,233,356 |

| ARU | Arafura Resource Ltd | -4% | 10% | -20% | 49% | 0.32 | $534,617,185 |

| MNS | Magnis Energy Tech | -4% | -22% | -29% | 15% | 0.3725 | $349,319,334 |

| LMG | Latrobe Magnesium | -5% | -8% | -12% | 189% | 0.078 | $125,716,547 |

| AM7 | Arcadia Minerals | -5% | 6% | 15% | 45% | 0.275 | $12,608,431 |

| KFM | Kingfisher Mining | -5% | -22% | 90% | 139% | 0.455 | $18,582,900 |

| ARR | American Rare Earths | -6% | -8% | -58% | 12% | 0.2125 | $88,876,160 |

| EMT | Emetals Limited | -6% | 21% | 13% | -11% | 0.017 | $14,450,000 |

| MMC | Mitremining | -6% | 23% | -11% | -37% | 0.16 | $4,333,616 |

| HAS | Hastings Tech Met | -6% | -34% | -39% | -27% | 3.585 | $405,997,395 |

| WC8 | Wildcat Resources | -6% | 19% | -18% | -3% | 0.031 | $20,003,455 |

| VMC | Venus Metals Cor Ltd | -6% | -6% | -21% | -21% | 0.15 | $24,812,196 |

| GSM | Golden State Mining | -7% | -23% | -49% | -68% | 0.043 | $4,797,582 |

| MOH | Moho Resources | -7% | -21% | -49% | -58% | 0.027 | $4,485,504 |

| PNT | Panthermetalsltd | -7% | -14% | -24% | 0% | 0.19 | $5,490,000 |

| PUR | Pursuit Minerals | -8% | -8% | -57% | -71% | 0.012 | $11,479,061 |

| KOB | Kobaresourceslimited | -8% | -29% | 0% | 0% | 0.12 | $8,125,000 |

| NWM | Norwest Minerals | -8% | -44% | -46% | -53% | 0.035 | $7,551,651 |

| BUX | Buxton Resources Ltd | -8% | -18% | -14% | 32% | 0.09 | $13,124,618 |

| TNG | TNG Limited | -8% | -30% | -14% | -9% | 0.077 | $104,131,367 |

| ENT | Enterprise Metals | -8% | 22% | -39% | -21% | 0.011 | $7,182,788 |

| LPD | Lepidico Ltd | -9% | -28% | -49% | 0% | 0.021 | $136,651,016 |

| BKT | Black Rock Mining | -9% | 11% | -39% | -18% | 0.155 | $141,711,279 |

| AOU | Auroch Minerals Ltd | -9% | -10% | -49% | -64% | 0.061 | $22,266,708 |

| CXO | Core Lithium | -10% | -11% | -26% | 175% | 1.14 | $1,841,427,077 |

| AR3 | Austrare | -10% | -13% | -57% | -66% | 0.325 | $31,416,512 |

| BMM | Balkanminingandmin | -10% | 46% | -7% | -61% | 0.27 | $9,661,250 |

| BYH | Bryah Resources Ltd | -10% | -10% | -48% | -54% | 0.026 | $7,260,590 |

| POS | Poseidon Nick Ltd | -10% | -16% | -54% | -53% | 0.043 | $131,750,260 |

| FRB | Firebird Metals | -11% | -12% | -48% | -68% | 0.17 | $11,769,805 |

| STM | Sunstone Metals Ltd | -11% | -24% | -58% | 42% | 0.034 | $88,279,178 |

| SRL | Sunrise | -11% | -19% | -2% | 44% | 2.36 | $217,039,488 |

| XTC | Xantippe Res Ltd | -11% | -11% | -27% | 300% | 0.008 | $65,161,839 |

| DTM | Dart Mining NL | -11% | -35% | 0% | -43% | 0.071 | $10,991,521 |

| WIN | Widgienickellimited | -11% | -19% | -57% | 9% | 0.235 | $61,329,625 |

| LEL | Lithenergy | -12% | -25% | -31% | 19% | 0.715 | $39,999,750 |

| STK | Strickland Metals | -12% | -29% | -31% | -37% | 0.037 | $52,533,809 |

| MRC | Mineral Commodities | -12% | -9% | -41% | -49% | 0.074 | $40,161,798 |

| CZL | Cons Zinc Ltd | -12% | -20% | -51% | -31% | 0.0185 | $8,332,586 |

| FG1 | Flynngold | -13% | 6% | -32% | -40% | 0.105 | $6,726,410 |

| CRR | Critical Resources | -13% | 44% | -33% | 170% | 0.062 | $86,420,884 |

| GW1 | Greenwing Resources | -14% | 25% | -21% | 17% | 0.35 | $43,210,335 |

| NVA | Nova Minerals Ltd | -14% | -27% | -23% | -45% | 0.66 | $113,869,991 |

| LSR | Lodestar Minerals | -14% | -14% | -57% | -33% | 0.006 | $10,430,624 |

| ESR | Estrella Res Ltd | -15% | -27% | -59% | -70% | 0.011 | $14,774,654 |

| G88 | Golden Mile Res Ltd | -16% | -23% | -56% | -43% | 0.027 | $5,523,923 |

| NC1 | Nicoresourceslimited | -16% | -39% | -49% | 0% | 0.52 | $47,479,501 |

| 1VG | Victory Goldfields | -17% | -35% | 21% | -13% | 0.175 | $7,753,304 |

| CMO | Cosmometalslimited | -17% | -14% | -31% | 0% | 0.12 | $3,061,200 |

| DRE | Dreadnought Resources Ltd | -17% | -35% | 133% | 153% | 0.091 | $282,955,620 |

| MTM | Mtmongerresources | -19% | -21% | -35% | -35% | 0.11 | $4,126,104 |

| BOA | Boadicea Resources | -20% | -17% | -53% | -40% | 0.1075 | $7,769,990 |

| RFR | Rafaella Resources | -21% | 0% | -36% | -63% | 0.03 | $9,827,768 |

| RAG | Ragnar Metals Ltd | -34% | -26% | -29% | -36% | 0.025 | $9,479,622 |

Weekly Small Cap Standouts

Lithium explorer QXR Resources (ASX:QXR) appointed new managing director, Steve Promnitz.

Steve was previously managing director of lithium project developer Lake Resources (ASX:LKE), which he took from a small cap nobody to $2.1bn market cap near-term miner.

Eastern Resources (ASX:EFE) hits thick pegmatites (lithium bearing rock) in 30 of 32 drillholes at the Trigg Hill project in WA.

This former iron ore junior went all-in on lithium after cementing a deal with Chinese battery materials giant Yahua to find and develop Aussie projects late last year.

Yahua Group is one of China’s major lithium chemicals producers.

QXR and EFE share price charts

Alchemy Resources (ASX:ALY) was drawn first in a ballot for new ground along strike of Global Lithium Resources’ (ASX: GL1) 9.9Mt Manna lithium deposit and adjacent to Breaker Resources’ (ASX: BRB) 1.7Moz Lake Roe gold project.

It’s no wonder the 24.8sqkm tenement was in demand. ALY beat out “multiple parties”, the company says.

It will be added to ALY’s 1,220sqkm Karonie lithium and gold project, about 120km east of Kalgoorlie.

Winsome Resources (ASX:WR1) is reporting “exceptionally high-grade assays” up to 4.89% lithium in sampling of a new discovery at the Adina project in Quebec.

10 of the 26 samples collected graded over 2% Li2O. But the proof will be in the drilling, which is set to kick off early next month.

Prospect Resources (ASX:PSC) acquired 51% of the Omaruru lithium project in Namibia, which offers potential “to establish a resource quickly, with walk-up drill targets and a great operating environment,” boss Sam Hosack says.

PSC recently sold its 72.7Mt Arcadia lithium project in Zimbabwe to a subsidiary of lithium-ion battery material producer, Zhejiang Huayou Cobalt Co, for ~$466m net.

It returned most of that to shareholders.

ALY, WR1 and PSC share price charts

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.