Why are metal inventories so low and what does it mean for base metals?

Pic: Andrey Rudakov/Bloomberg Creative Photos via Getty Images

- Base metal inventories have fallen 70% since the start of the pandemic, putting a floor under prices despite demand concerns in China and elsewhere

- Commodities like copper, normally running on 5-10 days of global demand, are at less than 2 days on LME stores

- Aluminium inventories are rising as want away buyers force Russian metal to the market of last resort

Stocks at the London Metals Exchange, the largest market of last resort in the world and source of base metals prices, have told an interesting story about the state of the commodities complex in the past year.

Late in 2021 the combination of a rapid rise in industrial demand, the growth of the electric vehicle sector and the dramatic impact of Covid restrictions the world over on supplies of metals like copper and nickel sent warehouse stores to multi-year lows.

In the case of some small but significant commodities like tin, essential for the electronics sector as the primary source of solder for circuit boards, less than three days of inventories were available to be purchased from the major exchanges.

Prices of many of these commodities shot up. Some of them, like tin, copper and, briefly, nickel, hit record price levels.

Over the past 6 to 8 months prices of all of these commodities have trended down, despite the short-term bump provided by Russia’s invasion of Ukraine and the likely banning of Russian metal by many customers.

The primary reason has been faltering demand from a slowing China, which has been hit by a wave of lockdowns to limit the spread of Covid-19.

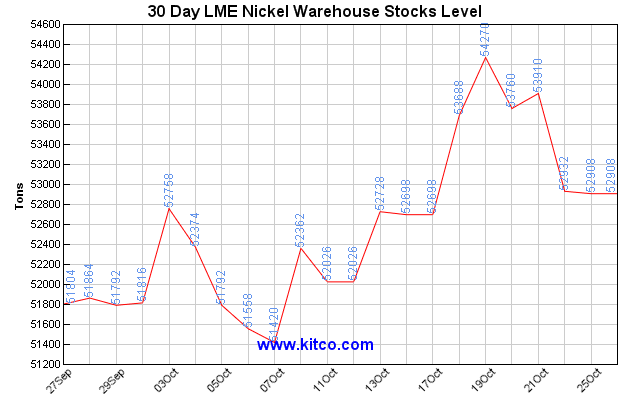

That has seen the price of copper drop 20% over the past 6 months, nickel is down around a third (though still above levels of 12 months ago), zinc is off almost 30% and aluminium has dropped heavily as well.

With falls like that you’d think buyers are shunning commodities and unwanted metal is building up in warehouses like a hoarder’s dream.

But in reality stocks are even lower than the critical levels they hit a few months ago.

“If inventories are rising, generally you tend to see perhaps a cap or a negative trend in the relevant commodity pricing and where we are in the market’s really interesting at the moment,” MineLife Analyst Gavin Wendt told Stockhead.

“I was looking at copper. Copper prices, and copper inventory should be under pressure, because there are all sorts of alarm bells out there about the world economy and copper is tied directly into economic growth expectations.

“If I told you there were declining copper inventories, not only on the LME, but in Shanghai and elsewhere, the ordinary person would be really surprised by that.”

Copper stocks running low: Trafigura

One of the world’s largest traders, Trafigura, says copper stocks are running so low there is a touch under 5 days’ inventory left on the various exchange inventories.

By the end of the year, its head of mining and metals trading Kostas Bintas told a summit hosted by the Financial Times last week, it could fall to just 2.7 days.

Yikes.

Bintas says recession fears are not reflecting the reality of the physical copper market, with demand from electric vehicles going forward to more than make up for declines from the Chinese property sector.

Freeport McMoran CEO Rick Adkerson called the dissonance between real and financial markets on the commodity ‘striking’, saying on a recent conference call physical premiums were showing how strong demand actually is for the red metal, calling inventory levels “historically low”.

A market in backwardation, a situation where prices for metal now are higher than contracts for future delivery, suggests how hard it actually is for consumers to get their paws on the commodity.

“Backwardation is strong,” he said. “It’s just striking to see that the price of copper dropped $0.70 from a quarter a year ago and yet the day-to-day business that we have is one where customers are really fighting to get product.”

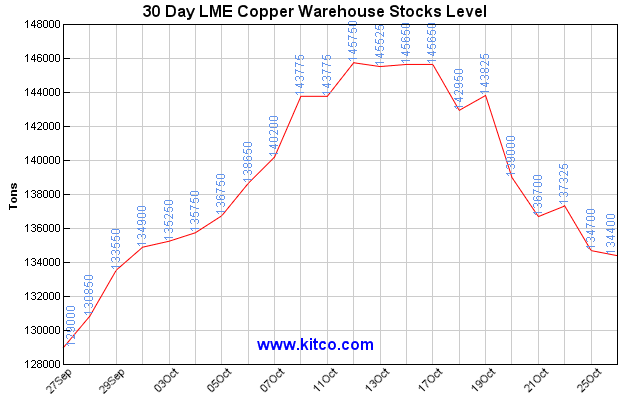

According to ANZ commodity strategists Daniel Hynes and Soni Kumari, copper stockpiles on the LME currently sit at around 1.95 days of global demand. They normally cover 5-10.

Total exchange inventories have fallen an almost unbelievable 70% since the start of the pandemic.

“The premium for cash copper over three-month futures on the LME has traded as high as US$133/t in recent weeks,” they wrote in a note this week.

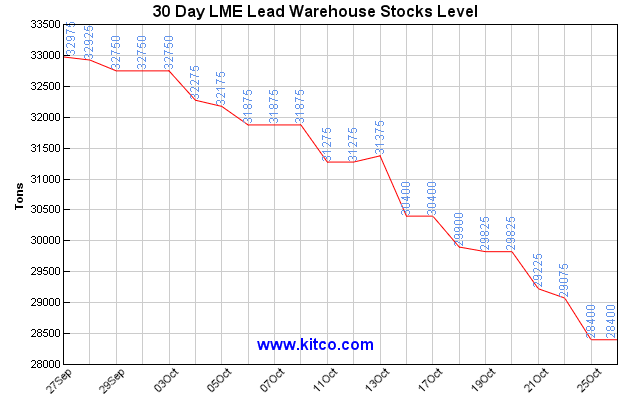

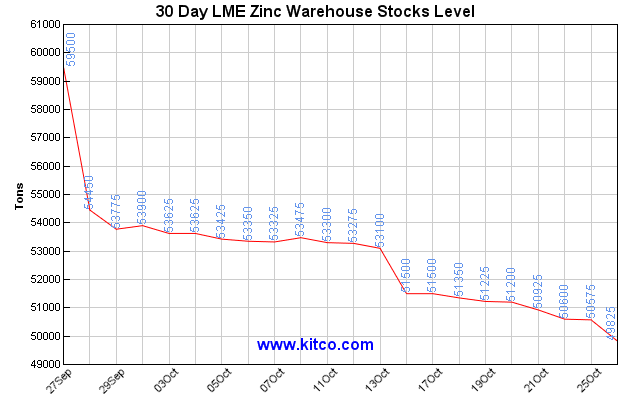

“This is opposed to a small discount as recently as July 2022. Zinc and lead futures curves are also in deep backwardation (ie spot prices lower than futures).

“The most notable sign of tight physical markets is the continued fall in inventories.

“Total exchange inventories for the base metals complex hit a record high of nearly 9Mt in mid-2013 following the huge ramp up in supply as demand rebounded

following the financial crisis in 2008.

“Since then, those inventories have fallen nearly

90% to around 1Mt.”

Let’s have a look at some graphs

Over the past month copper, nickel, lead and zinc have all trended down or sideways, with nickel and copper stocks rising before sliding back in the past week or so.

All are at levels far below the norm.

While these low inventories appear to be propping up prices against falling demand for now, major increases in demand for base metals — largely from the seemingly exponential growth in electric vehicles, renewable power and transmission infrastructure needed to fuel the energy transition — are expected in the coming years.

Supplies at these levels, impacted by energy shortages for zinc and aluminium and ESG and labour issues surrounding major copper producers Chile and Peru, could place the market under real pressure in years to come.

“Despite demand holding up better than expected, supply side issues are driving the tightness. The rally in prices over the past two years has failed to meaningfully lift capital expenditure, and the outlook looks challenging,” Hynes and Kumari note.

“The industry is facing rising costs and an uncertain economic backdrop that is likely to keep supply growth subdued.

“This leaves base metal markets ill-prepared to deal with any future hit to supply or a sudden pick-up in demand, which could lead to a supply squeeze if conditions change quickly.”

Big outlier

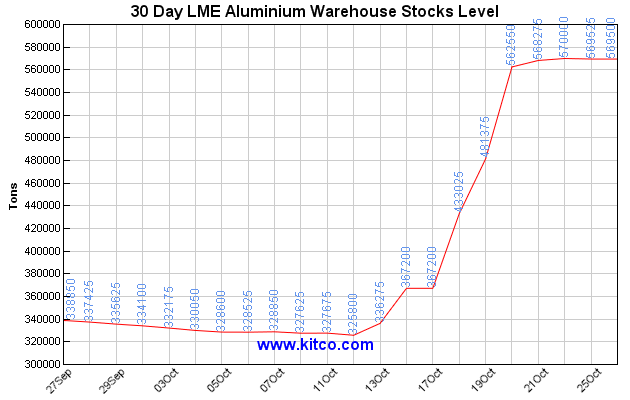

The big outlier is aluminium, which has seen stores on the LME increase by over 200,000t over the last fortnight to 569,500t, a bit over two days of global aluminium demand.

That remains below 16 year lows originally hit back in April, but is a significant improvement on the 325,800t in LME stores on October 11, though warehouse stocks can also be found on the SHFE and elsewhere.

The drain on aluminium supplies over the past year has come from a surge in energy prices in Europe and China, which has forced marginal producers to take energy hungry smelters offline to conserve cash.

The recent build-up could signal a bigger ethical and market management issue for the LME.

It likely comes from a dumping of Russian aluminium from its State producer Rusal.

Regular customers aren’t taking the metal, it seems. It’s a problem for the LME, which is concerned it could be housing hundreds of thousands of tonnes that can’t be moved, distorting the aluminium market.

The LME has already gone out to its stakeholders requesting feedback on the impact of barring Russian metal from the exchange.

“Really a lot of it has to do with Russia,” Wendt said.

“I think that’s fair to say that obviously Russia is one of the biggest producers of aluminium in the world. Europe and the Western world generally has been cracking down on Russian trade in the metal.

“I think Russia produces about 6% of the world’s aluminium and the US in particular, I think, has been very aggressive in trying to block trade in its metal.

“The LME is also talking about considering barring Russian metal from its system. So as a result of that, if you’ve got end users that are potentially shying away from Russia’s product, the US and the LME are going to make it harder for end users to buy Russian product.

“What we’re starting to see is a build up in inventories around the world. So that’s having an impact on pricing as well. I think if you have a look at the chart of the aluminium price, it’s been trending down.”

China is emerging as a potential buyer of cheap Russian production, but as a major producer itself already has a ready made supply of many of the major commodities, Wendt noted.

So what does this mean for traders?

Wendt says having an understanding on what inventories are and what they mean can be a tool for traders to identify sectors and stocks of interest.

While it is not always the case, LME, COMEX and SHFE (Shanghai) inventory levels can be a pointer to current or future price movements for commodities.

That is especially notable in base metals, where the LME is the pimary price-setter.

“I think it’s a tool to look at that can assist investors, when you’re looking at a particular commodity,” he said.

But Wendt noted different stocks in the same commodity could be more or less sensitive to price movements.

“Some investors will have a top down approach, some investors will have a bottom up approach,” he said.

“At the end of the day, certain stocks can perform well, irrespective of what the underlying commodity price might be doing and irrespective of the demand-supply dynamics for a particular commodity.

“For example, a company that’s operating in an industry that’s way down the bottom of the cost curve.

“A classic example, I think, was a company like Western Areas, which typically used to be way down the bottom end of the cost curve in the lowest 25% quartile.

“Nickel was in the doghouse for a long time as far as a commodity that would excite investors was concerned because its pricing was unspectacular. But for a company like Western Areas it didn’t really matter, they had such high margins.”

Stocks higher up the cost curve may be more leveraged to commodity price movements, says Wendt.

“It’s often those marginal producers that are punished in a soft commodity price environment,” he said.

“But equally, they can turn around really, really quickly, and be favoured by investors that are looking for that sort of thing.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.