Why a former Rio Tinto executive is backing Gold Mountain’s PNG porphyry potential

Are there porphyry elephants lurking for Gold Mountain in PNG? Pic: Getty Images

Special Report: Having spent more than half of his three-decade career at Rio Tinto scouring the world for new opportunities, when Matt Liddy puts his faith in an emerging mining stock, it’s hard to ignore.

It should be telling, then, that Liddy’s fingerprints were all over a recent capital raising by Gold Mountain (ASX:GMN), which brought $2 million worth of funding into the PNG-focused copper-gold exploration play.

The capital raising served as a further opportunity for Liddy to boost his stake in a company in which he has been a shareholder since 2018, and a part-time adviser since June of this year.

Liddy, who only left his role as vice president of Business Development in Rio Tinto’s aluminium product group in March, told Stockhead that Gold Mountain was a company he had faith in.

Having initially planned to travel the world after leaving Rio Tinto, global circumstances kept Liddy in Queensland and ultimately led him to his advisory role with Gold Mountain.

“It would be fair to say that GMN is the only mining stock I’m heavily exposed to,” he said.

“What really stands out for me on a higher level when I look at Gold Mountain is that they have three clearly defined targets, and all those targets are based around porphyry copper-gold systems.

“At Rio Tinto, the key ingredients we’d always look for were large operations, long life, and being able to mine at low cost. When I looked at GMN I could see that there were multiple porphyry targets which had those potentials.”

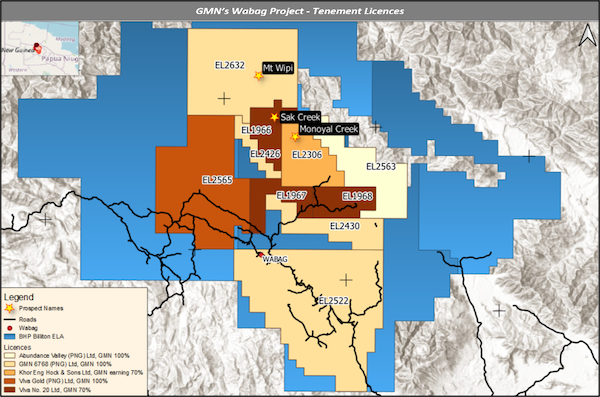

The targets Liddy refers to make up Gold Mountain’s flagship Wabag project – comprising the Monoyal, Mt Wipi and Sak Creek prospects.

All were previously held under exploration licence applications by BHP, and each are prospective for potentially company-making porphyry bodies.

“Many other exploration companies will try to find one target, and then look to turn that into a discovery. Some of them don’t ever find that target,” Liddy said.

“When I looked at Gold Mountain, they already had three very clear targets. When I looked at the probability of those being converted into discoveries, in my view it was much higher than what I’d seen in many other exploration companies.”

Liddy said the fact that each of the targets at Wabag is held on a separate exploration lease, offered Gold Mountain flexibility in terms of prospective JVs, farm-ins and its own project development when compared against multiple targets held on a single mining lease.

The team that has been assembled at Gold Mountain also impressed Liddy, particularly CEO Tim Cameron. Cameron previously worked for BHP in project development and project management – positions that included involvement all the way from exploration to operations at their Ekati diamond mine in Canada.

Cameron and his team are dedicated to bringing on the best technical support, engaging with local landowners and streamlining the exploration activities as a means of maximising the probability of success.

Gold Mountain has recently brought porphyry expert Phil Jones onboard to further understand the potential of the land on which they sit, and now feel they are better placed to capitalise on any mineralisation beneath their feet at Wabag.

Are there elephants in the room?

Gold Mountain believes it is sitting on porphyry orebodies at Wabag and is currently drilling deeper than ever before at its Monoyal target to prove it.

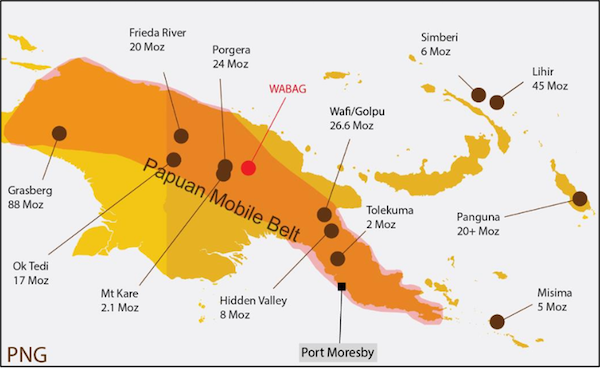

Large copper–gold porphyry systems have often been referred to as ‘elephants’. This is based on the massive size of these ore bodies, and also takes into account that the Papuan Mobile Belt, where Gold Mountain is exploring, is no stranger to elephants – including world-class mines such as Grassberg, Ok Tedi and Panguna.

Liddy said the addition of Jones to the exploration team has made a huge difference, with the expert’s world-renowned knowledge of the mining industry’s elephant orebodies.

“If you look at the infamous porphyry systems around the world – ones like Cadia in New South Wales, Oyu Tolgoi in Mongolia, and Resolution in the US – initially they were drilled to around 300-350m and some mineralisation was found, but it wasn’t until they went deeper that they really found significant orebodies,” he said.

“The fact that Phil’s very confident we’re sitting on top of the porphyry and has used geomagnetic data and geoscientific interpretation to point to where he thinks we have the best chance of finding something – I get quite excited by that.

“Phil has designed a deeper drilling program for the Monoyal target. The first of these 750m holes is currently being drilled and will test mineralisation at depths below previous drill holes.

“Obviously it is exploration, and there is no guarantee that any hole will hit the main mineralisation, but if it’s there then I think that would have a huge impact for Gold Mountain.”

Granted in August, Liddy said he was also particularly interested in the progress of the Mt Wipi target, where early chip samples have returned copper levels above 9% in some streams.

“When you look at early results on a map, the samples that were presented about a month ago basically showed outcropping occurring in a ring about 1km across and 2km wide,” he said.

“Again, all indications are that there would be a porphyry system under there, and the geomagnetic data is very indicative of what people would expect around a porphyry system.”

Jones was interviewed in early November by Stockhead columnist Barry FitzGerald on the potential of all three Gold Mountain targets at Wabag. That conversation can be found here.

Part of the community

Different jurisdictions come with different risk profiles – something Liddy knows well from his time tracking down prospective bauxite and energy projects for Rio.

While some may baulk at the thought of mining in PNG, the Gold Mountain advisor said there was plenty of jurisdictional familiarity for Australian operators in the nation.

With a mining code built off the one established for New South Wales and a legal system based on Australia’s, the legal infrastructure in PNG is familiar. This is evidenced by a number of companies in the gold and copper spaces, from Australia and abroad, who mine in the locale.

Further to this, Liddy said Gold Mountain’s management has made a clear effort in fostering relationships with local stakeholders, including landowners and the provincial and federal governments, and that they have garnered very strong support in the community.

“I think part of that is a long history there, but also during COVID and other recent times, when many people have moved back or pulled away, Gold Mountain has continued to meet and exceed its commitments and I think that’s been very well received,” he said.

In closing, Liddy said he believed “it is rare that you see all of the key elements of a project starting to align, but that’s what I believe is happening with Gold Mountain and I eagerly await the outcomes of the exploration activities at Monoyal and Mt Wipi.”

This article was developed in collaboration with Gold Mountain, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.