Gold Mountain secures funds as PNG exploration beckons

Pic: John W Banagan / Stone via Getty Images

Special Report: Gold Mountain has secured $2 million in funding and is advancing exploration at its flagship Wabag copper-gold project in Papua New Guinea.

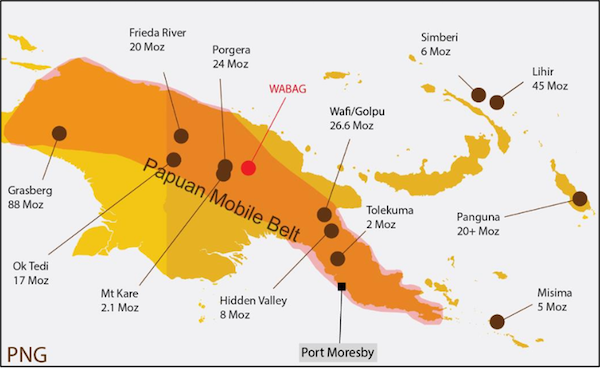

Gold Mountain (ASX:GMN) is in the process of advancing the Wabag project, located on the highly prospective Papuan Mobile Belt, and has commenced the next phase of drilling at its Monoyal copper gold porphyry target.

The capital raising is by way of placement at a price of 5.5c per share – a 31% premium to Gold Mountain’s volume-weighted average price (VWAP).

Gold Mountain has also issued shares to satisfy placement fees and has agreed an adjustment mechanism if its volume-weighted average price falls below 5.5c per share between six and 24 months after the placement.

Measuring porphyry potential

GMN’s Wabag project covers more than 2,500 km2 of the Papuan Mobile Belt, an area rich with mineral deposits, and sits some 70km from the 24 million ounce Porgera gold mine.

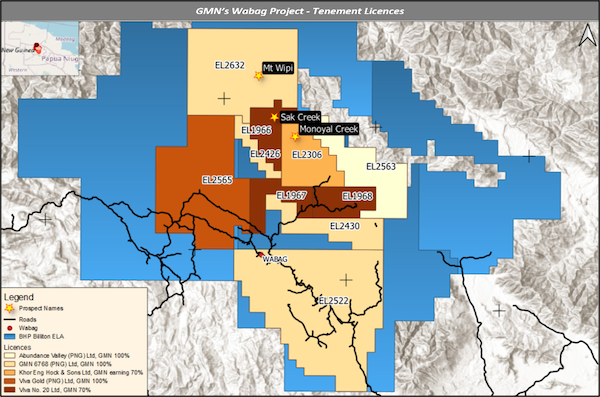

The Wabag project covers three highly prospective targets at Monoyal, Mt Wipi and Sak Creek. Each target has the potential to host large-scale copper-gold-molybdenum mineralisation contained within the same north west – south east striking structural corridor.

The raising comes on the back of the recommencement of drilling at Monoyal, which was announced to market earlier in the month.

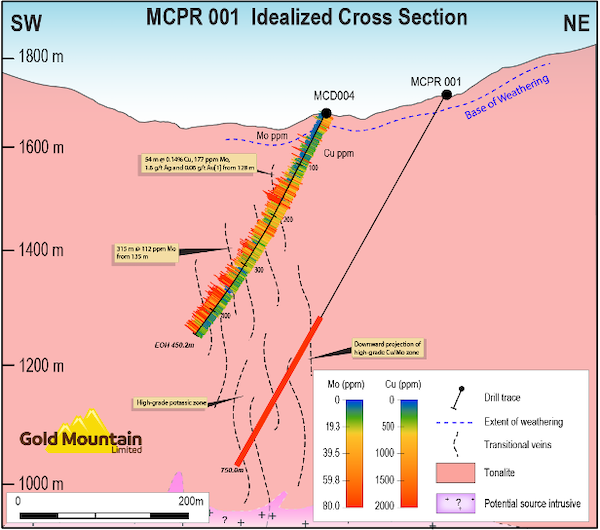

After a review of the geochemical, geological, structural data and core photographs GMN’s porphyry expert, Phil Jones, has postulated that the holes drilled at Monoyal to date have tested either the top part of, or the periphery to, a large porphyry system, and that it is possible that the main zone of mineralisation hosted by the Monoyal tonalite could potentially occur at depths below the previous drilling or adjacent to it.

Mr Jones has designed two holes to depths of between 700m and 750m to test the deeper parts of the porphyry system and a further two follow-up holes pending the results of the first holes.

The company has also commenced reconnaissance exploration activities at the project’s Mt Wipi target which was previously held under an exploration application by BHP. Samples yielded exciting results in Septemberwith rock samples collected from outcrops returning assay values to 9.64% copper and gold to 1.96 g/t Au.

These copper and gold bearing rocks have been collected from five locations which cover a 2km-long by 1km-wide area. Mr Jones has used these initial results along with airborne magnetic data to identify several targets for ground checking in the coming months.

Mr Jones was recently interviewed on the potential of Gold Mountain by Stockhead columnist Barry FitzGerald, where he detailed the recent developments at all three of GMN’s targets. That conversation, published earlier in the month, can be found here.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.