Who’s out front to be the Pilbara’s next De Grey? These intrepid ASX gold explorers reckon they’d be mad not to make a go of it

Who are the front runners to uncover the next monster gold deposit in the Pilbara? Pic via Getty Images.

Stockhead’s Mining Precinct Spotlight column delves into prospective gold regions around the world, highlighting what makes the geology stand out and who’s exploring in the area.

Gold mining in Western Australia has long shaped the state’s identity ever since three intrepid Irishmen: Paddy Hannan, Thomas Flanagan and Daniel Shea wandered towards Mt Yuille in 1893 – north of today’s Kambalda in the Goldfields region – picking up a storied 100,000oz of gold along the way.

Don’t get us Stockhead’s wrong here, the Goldfields is still, and for a long time will be, a hub of gold mining in WA, yet there are bountiful caches of gold littered all over WA – Boddington southeast of Perth, the Murchison, Gascoyne region and even in the Kimberley.

This article, however, will shine a spotlight on gold explorers in the Pilbara, where there’s plenty of opportunity and where signs of the precious metal has been vastly underexplored.

Proving up Pilbara shiny

Why you ask? Well, the Pilbara’s ground cover makes it difficult – even today – to unearth sizeable deposits without a lot of effort, and of course luck.

Yet there are producers active in the region, such as Calidus Resources (ASX:CAI) with its 1.6Moz Warrawoona gold project, Capricorn Metals (ASX:CMM) 1.2Moz Karlawinda and one of Australia’s oldest gold mines – Newcrest’s Telfer, which produced an impressive 338,327oz Au last year.

Proving up tangible gold projects has always been tricky in the Pilbara – regard the hype, then ultimate failure of 2017’s Pilbara “conglomerate gold” rush.

Artemis Resources (ASX:ARV) and JV partner Novo Resources (ASX:NVO) shocked the market in 2017 when they shouted “Witwatersrand-style” gold mineralisation – namedropping the world’s largest gold precinct in South Africa.

Other explorers too have gotten a bit Witwatersrandy on the back of seeming high-grade ‘results’, jumping into Pilbara tenements certain of paydirt.

Unfortunately most of that gold mineralisation turned out to be just a bunch of little gold nuggets in trenches, and no tangible mass production was ever realised.

Well, almost none…

It took a while, but one lone Pilbara explorer doggedly kept its head above water for years at its project, and is now set to rocket itself into becoming one of Australia’s largest gold producers.

And the winner is…

If De Grey Mining (ASX:DEG) has anything to thank for its success, it’s likely the Witwatersrand hype.

De Grey’s now massive Hemi deposit at its Mallina gold project is the one that wasn’t supposed to be. Yet it was the only one out of that hype five or so years ago that looks like it is.

When De Grey took a leap of faith and bought Indee Gold for $15m some six years ago as a penny stock with a market cap of just $3m, it jumped on the right nuggety gold bandwagon.

The transition since is astronomical.

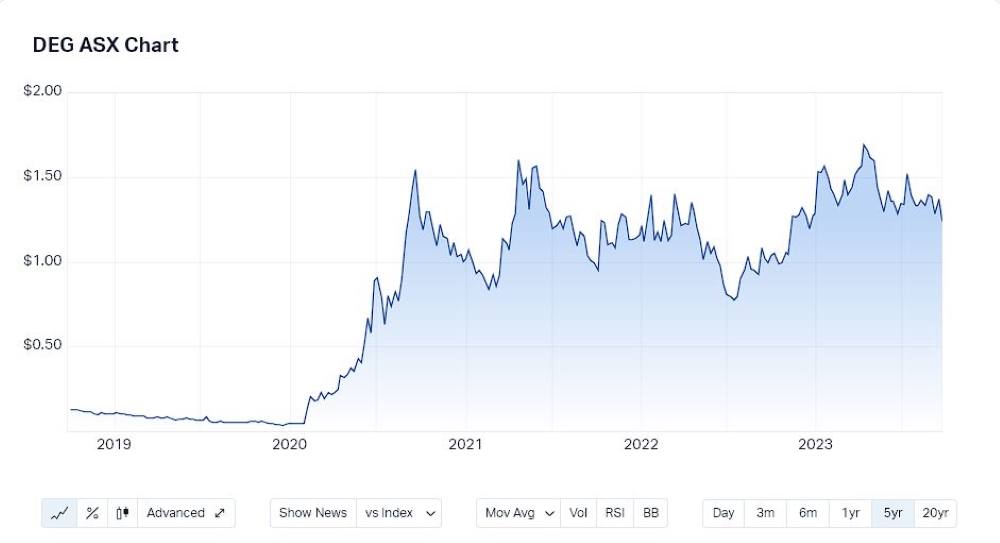

On the 31st of January 2020, the gold hunter was trading at 5c/sh – they now have a market cap of almost $2 billion.

Here’s a chart for the 99.95% of us that missed the boat:

De Grey, after a few changes in management, cleared enough hurdles and proved up its now world-class 11.7Moz Mallina project.

And Kudos to them. It’s burgeoned a lot of exploration based on their persistence, progress and undeniable results.

The gold sector in Australia and observers with skin in the game around the world are hotly anticipating the results of Hemi’s definitive feasibility study (DFS) – one of the last hurdles to sign off before go time for project development.

It’s targeting a massive 500-600kozpa from Mallina, and >95% of it is from the Hemi deposit alone.

Hold onto your hats though, there’s more to come. In tandem with DFS work, it’s still drilling holes and proving up resources within the project area, so the aforementioned target could end up a lot, lot bigger.

Good projects ride the cycles. It doesn’t matter what the gold price does, Tier 1 developments will always rise to the top.

Previous failures aside, De Grey’s success has inspired a few intrepid explorers that aren’t looking to board a hype train, but willing to put in time and effort to find the next Hemi.

Who’s out in the Pilbara nowadays not making the same mistakes?

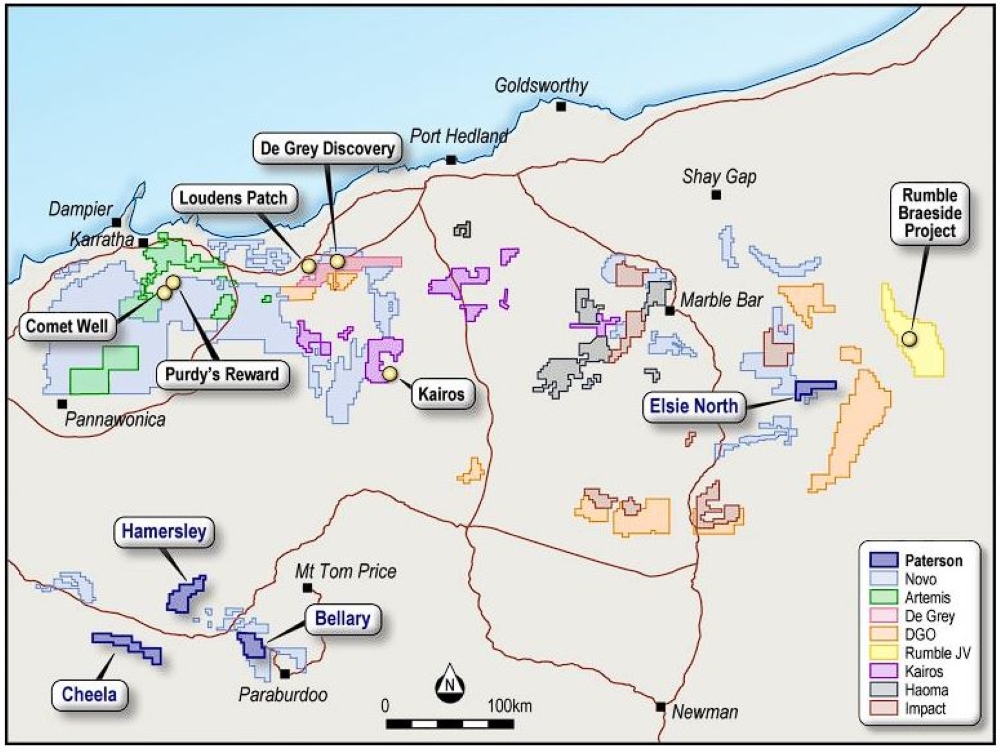

There’s a few ASX-listed explorers finding their feet in the Pilbara, quite rightly on the heels of the excitement around De Grey’s massive Hemi deposit.

Golden State Mining (ASX:GSM) is one of them, drilling for gold north just 12km north of Hemi.

An 8,000m AC drill program is underway at its Yule project in order to dial in on prospective targets for a deeper look down hole to get a better idea of the gold mineralisation.

The ~700km2 project area includes the Yule River Shear zone, which hosts a 9km gold-copper-arsenic bedrock anomaly outlined by previous exploration.

Stockhead spoke to GSM MD Mike Moore to get his thoughts on gold exploration in the Pilbara and the company’s Yule project.

Moore says historically, breaking ground cover to look for gold has been the biggest initial hurdle to overcome, yet De Grey’s discovery of Hemi “really endorsed our view that our tenure is in a highly-prospective area for a major gold discovery”.

“The skepticism about another significant gold discovery in the Pilbara will ultimately evaporate at some point, and our significant footprint around Hemi gives us every chance to become the next cab off the rank to discover a sizeable deposit,” Moore said.

“The exploration isn’t as easy, but the prize is fantastic and we’ve drilled about 60,000m so far, so we are optimistic about what we’re going to get out of our current program.

“13km from a monster? We’d be mad not to look for gold here.”

Another Pilbara gold digger, Black Cat Syndicate (ASX:BC8) , is restarting the historic Paulsen’s mine which it bought off Northern Star Resources (ASX:NST) for $44.5m last year packaged with the Coyote gold project in the Tanami Desert to boot.

What Northern Star saw as surplus to requirements, Black Cat sees as an opportunity.

BC8 has been conducting an aggressive exploration program for more than a year now in order to increase resources at the tenure and has produced some very high-grade gold hits up to an eye-whopping 64.1g/t Au outside the mine plan.

These are what they call ‘bonanza’ grades that will support an imminent restart study that looks to upgrade Paulsen’s current resource of 471koz @ 3.6g/t Au.

Surface RC drilling is planned to commence in mid-October 2023 along the >2.5km Belvedere trend, the >1km Pantera prospect and the near-mine Apollo extension.

Peregrine Gold (ASX:PGD) has tenements just north of De Grey’s Hemi deposit at its own Mallina gold project where EM surveys have been conducted and plans to follow up with identifying potential drill targets.

Recently, five core and rock samples collected at its Newman project uncovered visible gold and provided valuable information on the geology in an area with limited historical exploration and drilling.

And awaiting heritage approvals, Mantle Minerals (ASX:MTL) plans to drill >250 AC holes for 15,000m at its own Mallina gold project, which includes the Robert’s Hill and Mt Berghaus deposits.

At Stockhead we tell it like it is. While Golden State Mining, Peregrine Gold and Black Cat Syndicate are Stockhead clients, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.