‘Substantial increase in cashflow’: Grades up to ~65g/t outside Paulsens mine plan are all upside for Black Cat’s restart study

The restart study for the gold mine is expected in November. Pic: via Getty Images.

- New high grade intercepts represent walk-up mining opportunities with strong cashflow potential

- Paulsens is one of Australia’s highest grade gold deposits

- Restart study includes production of 136koz gold over the first 3 years

- A resource update for the project is scheduled in October

Black Cat Syndicate has reported more super high-grade assays outside current resources at its Paulsens gold operation in WA. These could represent walk-up mining opportunities with strong cashflow potential, the company says.

Paulsens Underground is one of Australia’s highest-grade gold deposits with a current resource of 328koz at 9.9g/t gold, with open pit and underground resources totalling 471koz at 3.6g/t gold.

Notably, the underground production head grade of 4.3g/t gold is in the top 10 for Australian gold producers and the AISC is in the lower half of Australian gold producers.

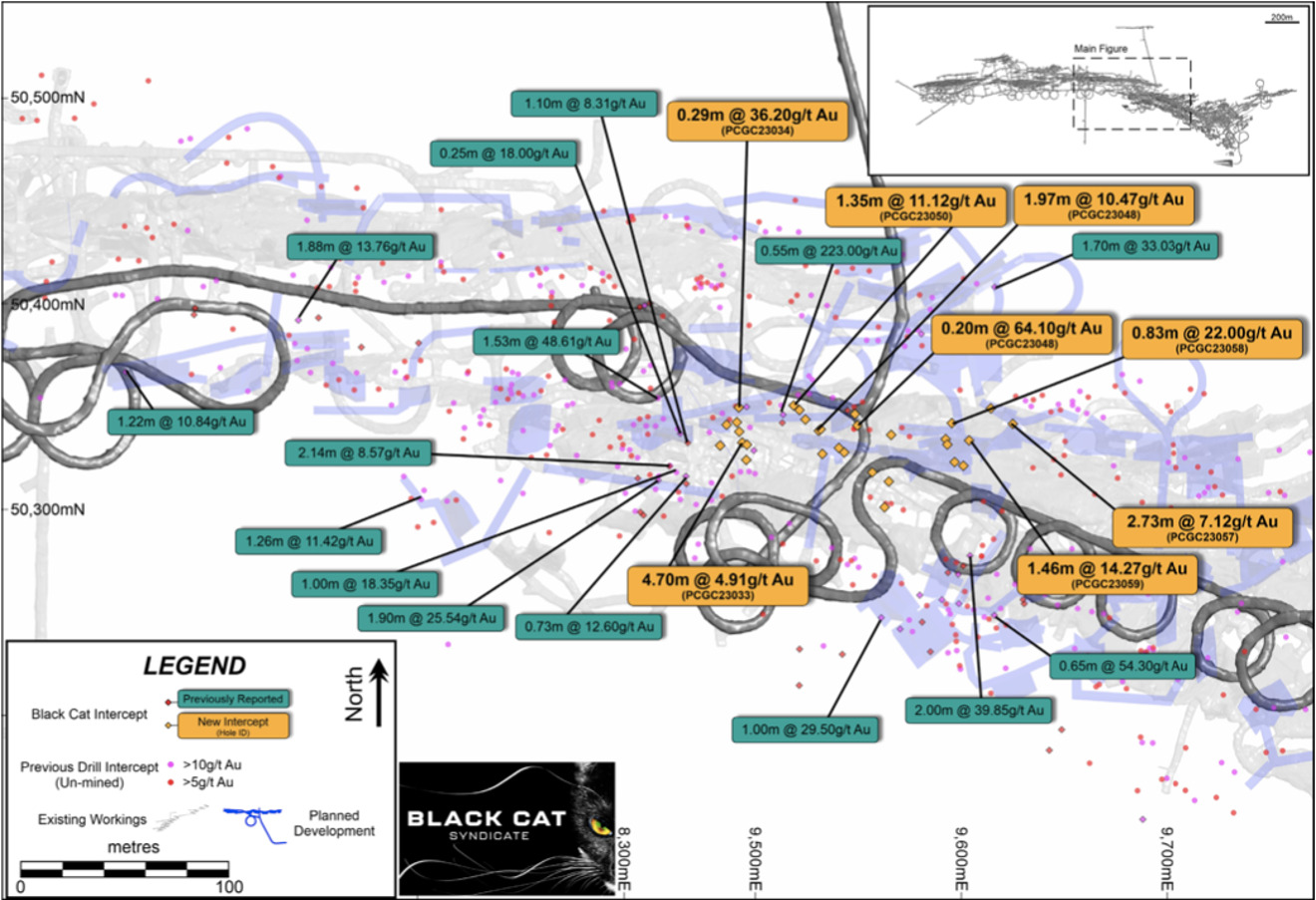

The latest drilling at the project was targeted at increasing planned production from the Main Zone in the central part of the mine. It continues to intersect high-grade gold, which highlights the growth potential of the current resource and the potential for a substantial increase in cashflow, the company says.

An upgraded Resource is planned for mid-October 2023 to support an updated Restart Study in early-November 2023.

Adding more high grade ounces to mine plan

The project boasts massive upside.

These latest intercepts — outside the current production plan in the Main Zone in the central part of the mine — are adjacent to existing development and require minimal capital to mine.

They also highlight the growth upside of the current resource and potential for a significant increase in cashflow.

Drill results include:

- 1.97m at 10.48g/t gold from 86.03m (PGGC23048);

- 1.33m at 15.50g/t gold from 72.61m (PGGC23050);

- 0.83m at 22.00g/t gold from 34.76m (PGGC23058);

- 1.46m at 14.27g/t gold from 34.68m (PGGC23059);

- 0.20m at 64.10g/t gold from 49.43m (PGGC23061); and

- 4.70m at 4.91g/t gold from 59.70m (PGGC23033).

Results to be included in restart study

“Continued high grade intercepts outside of the current mine plan highlight the upside at Paulsens,” Black Cat Syndicate (ASX:BC8) MD Gareth Solly said.

“There is little to no additional capital to potentially produce from these areas which will be factored into the November 2023 restart study.

“Optimisation of the restart study is progressing well, with targeted reductions in upfront capital along with additional Resources and life of mine extensions underway.

“Paulsens is a high-grade gold mine with significant upside potential and proven ability to generate strong cashflow.”

Upgraded resource expected in October

Current underground drilling is aimed at maximising cashflow and extending the production plan with a strong focus on extending the Resource within the Main Zone.

Surface RC drilling is expected to commence in mid-October 2023 along the 2.5km long, undrilled Belvedere trend where there are numerous historic workings and gold-silver-copper rock chips up to 47.3g/t gold, 158g/t silver and 1.3% copper.

An upgraded resource is planned for mid-October 2023 to support an updated restart study in early-November 2023.

This article was developed in collaboration with Black Cat Syndicate, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.