Who Made the Gains? October shows it’s not just gold stocks eyed by investors

October's winners include those eyeing graphite, nickel, rutile and, of course, gold. Pic: Getty Images

- Green Critical Minerals pumps on ‘revolutionary’ graphite tech

- Polymetals Resources rises on imminent Endeavour mine restart

- James Bay Minerals shows a pivot to gold can whet investor appetites

As we look towards a clean energy future, critical minerals stocks are up and about October’s winners list for resources across graphite, base metals, rutile, copper and nickel.

And that’s something of a sea change from recent domination by gold in September, antimony (at mainly gold deposits) in August and gold again back in July.

You’d have to go back to June’s ASX small cap resources winners list to find critical minerals at the fore because gold is on such a heater at the moment – consistently pushing through all-time highs and now up around $4200/oz mark ahead of the US election outcome.

READ MORE: Gold Digger: Who’s better for gold, Trump or Kamala?

Not-gold ressie winners

Coming in at second place on our resources winners list for last month, Green Critical Minerals (ASX:GCM) has just locked in a purchase deal with Cerex for its late-stage graphite tech, which can produce saleable graphite blocks from graphite powder.

The junior rose 300% in October for its ability to produce very high density (VHD) blocks, a graphite material that has among the highest thermal conductivity ever recorded for any bulk material and can be used in solar-thermal systems, nuclear reactors and other high-performance electronics.

Trading under 2c a share in September and coming in at fifth on the ressie list is Asian Battery Metals (ASX:AZ9), which had a rocket put under its stock during October, up 179% after it encountered some outstanding copper and nickel hits at at the Oval prospect in Mongolia’s Gobi desert.

A highlight sulphide intercept in hole OVD021 of 8.8m at 6.08% copper and 3.19% nickel from 107.2m was intersected during Phase 1 diamond drilling and its shares rose significantly on the news.

AZ9 says a boost from BHP’s (ASX:BHP) Xplor program during 2023 helped it get to this stage and the junior is now trading at 9.5c.

In seventh with a 150% rise, Peak Minerals (ASX:PUA) has exploration on its mind after snapping up the Minta rutile project in Cameroon, which spans across 8800km2 and is prospective for zircon and monazite REEs, too.

Polymetals Resources (ASX:POL) made waves coming in at sixth with a 167% rise in value as it looks to reboot the historical Endeavour silver and base metals mine, while in ninth Lunnon Metals (ASX:LM8) rose 118% searching for nickel and gold at the Lady Herial tenements near the prolific Foster nickel mine.

Creeping into tenth place is lithium junior Evergreen Lithium (ASX:EG1), bucking price trends to rise 105% for the month with a spodumene discovery at Bynoe.

And galloping up into eighth with a 129% increase in share price, penny stock Australian Mines (ASX:AUZ) is racing ahead with development of its Flemington scandium project in NSW.

It’s looking to become a pure-play scandium producer where others such as Rio Tinto (ASX:RIO), Sunrise Energy Metals (ASX:SRL) and small cap resources winner alumni Rimfire Pacific Mining (ASX:RIM) are proving up some of the highest ex-China grades of the stuff that the world has ever seen. Not sure exactly why scandium is so popular…

READ MORE: Is scandium ready to pop, too? Here are some ASX juniors rising on deposits of the stuff

And the winner is…

Numero uno for October, James Bay Minerals (ASX:JBY) is showing a pivot to gold is still whetting investor appetites, gaining a whopping 367% over the month to currently trade at 62c a share – more than double its IPO price of 30.5c back in September 2023.

For about a year the junior had been exploring across its highly prospective La Grande lithium tenements in Quebec, Canada, yet a bottoming out of Li2O prices across the period made it difficult to get investors on board.

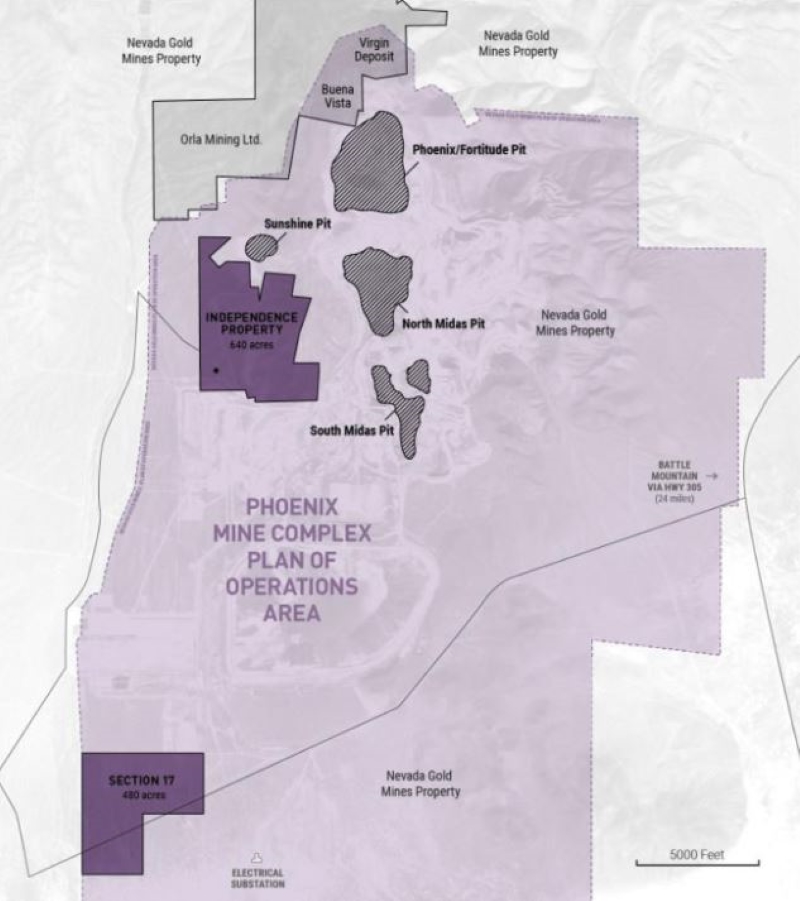

JBY’s share price hit a rock bottom of just 9.9c a share on August 20, yet a couple of months later on October 14, the company shocked the bourse with its acquisition of the advanced Independence gold project in the Nevada desert.

For just $2.4m it snapped up a non-JORC 1.18Moz gold and 7.6Moz silver project with a high-grade 796,200oz resource at 6.53g/t gold and a mineralised strike open in all directions.

With easy infrastructure to gold mining giants Newmont and Barrick Gold’s Phoenix mine, which churns out upto 1.8Moz gold a year, it’s got the potential for permitting within little as eight months and a recent 9.1g/t near-surface gold discovery over 24.4m outside the current resource has seen investors pour in to the small cap.

WATCH MORE: Long Shortz with James Bay Minerals: JBY’s golden opportunity with Independence project acquisition

Other gold explorers making gains include Yandal Resources (ASX:YRL) in third place, up 222% in October after making the Siona gold discovery east of Wiluna in WA and Black Dragon Gold (ASX:BDG) in fourth, which has gone gangbusters in share price, up 214% on minimal news about its 1.5Moz Salave gold project in northern Spain where it’s still waiting on environmental approvals.

The top 50 ASX resources stocks for October

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| JBY | James Bay Minerals | 0.7 | 367% | $23,409,750 |

| GCM | Green Critical Min | 0.008 | 300% | $12,208,341 |

| YRL | Yandal Resources | 0.29 | 222% | $77,664,208 |

| BDG | Black Dragon Gold | 0.044 | 214% | $11,770,778 |

| AZ9 | Asian Battery Met PLC | 0.081 | 179% | $24,479,414 |

| POL | Polymetals Resources | 0.8 | 167% | $155,808,532 |

| PUA | Peak Minerals Ltd | 0.005 | 150% | $12,485,551 |

| AUZ | Australian Mines Ltd | 0.016 | 129% | $22,376,194 |

| LM8 | Lunnon Metals | 0.36 | 118% | $79,368,749 |

| EG1 | Evergreen Lithium | 0.084 | 105% | $4,723,320 |

| CCZ | Castillo Copper Ltd | 0.008 | 100% | $11,629,883 |

| GCR | Golden Cross | 0.004 | 100% | $4,389,024 |

| MKG | Mako Gold | 0.018 | 100% | $17,759,143 |

| ODE | Odessa Minerals Ltd | 0.008 | 100% | $10,146,260 |

| PEC | Perpetual Res Ltd | 0.017 | 100% | $12,512,517 |

| TKL | Traka Resources | 0.002 | 100% | $3,891,317 |

| EWC | Energy World Corpor. | 0.02 | 100% | $61,578,425 |

| AVM | Advance Metals Ltd | 0.047 | 96% | $7,919,461 |

| A1G | African Gold Ltd. | 0.082 | 91% | $29,434,681 |

| LRV | Larvotto Resources | 0.71 | 89% | $227,487,649 |

| NVA | Nova Minerals Ltd | 0.25 | 85% | $67,984,220 |

| G88 | Golden Mile Resources | 0.018 | 80% | $7,402,011 |

| EEL | Enrg Elements Ltd | 0.002 | 80% | $2,326,032 |

| TZN | Terramin Australia | 0.077 | 75% | $162,975,329 |

| MM8 | Medallion Metals | 0.091 | 72% | $37,127,550 |

| CY5 | Cygnus Metals Ltd | 0.145 | 71% | $68,824,203 |

| GW1 | Greenwing Resources | 0.067 | 68% | $16,123,649 |

| SLZ | Sultan Resources Ltd | 0.01 | 67% | $1,975,865 |

| ARD | Argent Minerals | 0.03 | 67% | $43,317,770 |

| RWD | Reward Minerals Ltd | 0.068 | 66% | $15,494,013 |

| LRL | Labyrinth Resources | 0.028 | 65% | $124,363,210 |

| SPD | Southern Palladium | 0.74 | 64% | $66,415,000 |

| MKR | Manuka Resources | 0.055 | 62% | $42,887,222 |

| SUH | Southern Hem Min | 0.037 | 61% | $27,240,882 |

| NMR | Native Mineral Res | 0.032 | 60% | $12,747,940 |

| STM | Sunstone Metals Ltd | 0.008 | 60% | $40,983,229 |

| CAY | Canyon Resources Ltd | 0.15 | 56% | $212,082,643 |

| USL | Unico Silver Limited | 0.33 | 53% | $116,526,439 |

| PLL | Piedmont Lithium Inc | 0.205 | 52% | $84,948,925 |

| AYM | Australia United Min | 0.003 | 50% | $5,527,732 |

| NNL | Nordicnickellimited | 0.105 | 50% | $15,325,329 |

| R8R | Regener8Resourcesnl | 0.15 | 50% | $4,725,375 |

| TSL | Titanium Sands Ltd | 0.006 | 50% | $13,270,483 |

| ZMI | Zinc of Ireland NL | 0.012 | 50% | $6,068,831 |

| DME | Dome Gold Mines Ltd | 0.15 | 50% | $56,539,299 |

| ERA | Energy Resources | 0.003 | 50% | $66,444,898 |

| LKE | Lake Resources | 0.061 | 49% | $105,964,686 |

| OSM | Osmondresources | 0.41 | 46% | $30,078,710 |

| GLN | Galan Lithium Ltd | 0.175 | 46% | $127,512,452 |

| ASQ | Australian Silica | 0.032 | 45% | $9,019,532 |

At Stockhead we tell it like it is. While James Bay Minerals and Australian Mines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.