Who made the gains in July? Here are the top ASX resources winners

Pic: Getty Images

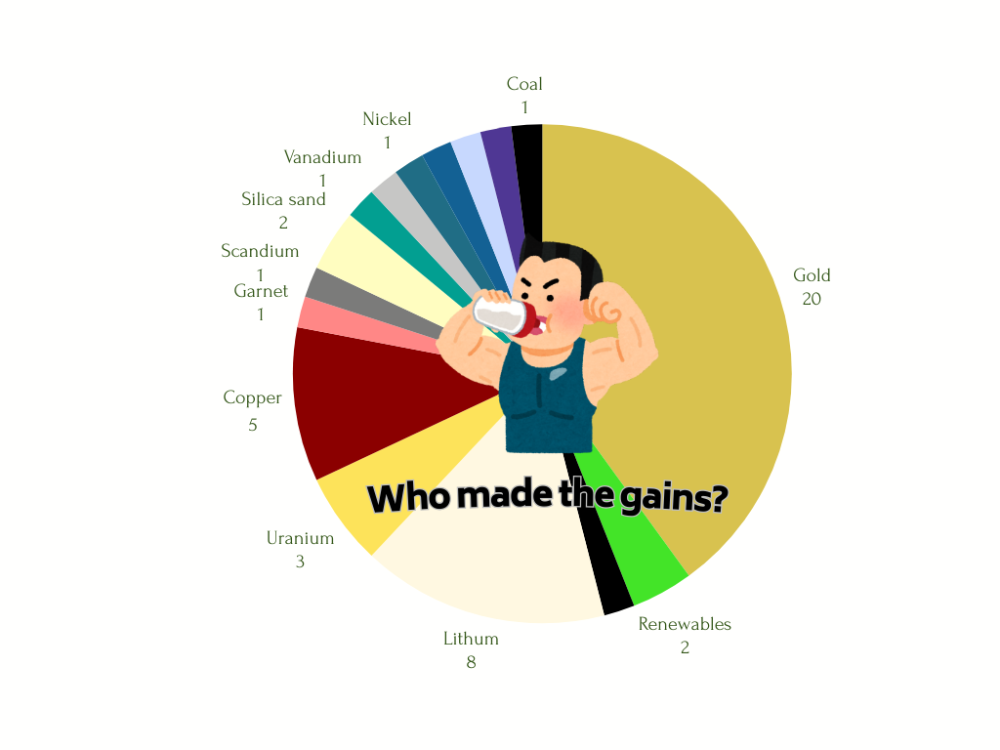

- The top 3 commodities for July include gold, lithium and copper

- Infini Resources tops the charts for the biggest monthly stock gain

- Labyrinth Resources soars on gold acquisition

Markets were as good as gold in July with the metal taking out the month’s top spot for BIGGEST commodity winner.

A total of five gold companies flew past the +100% mark as second-quarter gold demand hit record highs (up 4% year on year to 1,258t) and prices reached $2,450/oz on Friday.

The month was an improvement on May’s winners list, which saw just two stocks increase in value in triple digits and is a far cry from the biggest gains of June 2023, which saw 28 of the top 50 stocks holding lithium in their portfolios.

It seems analysts still have high hopes for gold, with Shaw and Partners upgrading price predictions almost 40% over the next 24 months from US$2250 in 2025 and US$2150 for 2026 up to US$3000 for both years.

The biggest driver right now is all the weak US economic data that reinforced expectations of Federal Reserve rate cuts while concerns of a broader conflict in the Middle East has kept gold’s appeal as a safe haven.

Most popular commodities in July:

Here are the top 50 ASX resources stocks for the month of July>>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | GAIN | PRICE | MARKET CAP | COMMODITY |

|---|---|---|---|---|---|

| WTM | Waratah Minerals Ltd | 129% | 0.275 | $54,909,505.33 | Gold |

| VPR | Voltgroupltd | 100% | 0.002 | $21,432,416.42 | Hydrogen/Renewables |

| VAR | Variscan Mines Ltd | 40% | 0.007 | $2,996,002.58 | Zinc |

| TX3 | Trinex Minerals Ltd | 50% | 0.003 | $5,485,956.87 | Lithium |

| SVG | Savannah Goldfields | 108% | 0.027 | $7,308,207.82 | Gold |

| SRI | Sipa Resources Ltd | 38% | 0.018 | $4,106,846.43 | Gold |

| SLM | Solismineralsltd | 42% | 0.115 | $8,849,718.05 | Copper |

| RWD | Reward Minerals Ltd | 60% | 0.04 | $8,886,272.38 | Potash |

| RMX | Red Mount Min Ltd | 50% | 0.0015 | $5,135,365.97 | Lithium |

| RIM | Rimfire Pacific | 68% | 0.047 | $110,131,251.74 | Scandium |

| REZ | Resourc & En Grp Ltd | 100% | 0.022 | $13,579,421.56 | Gold |

| RDS | Redstone Resources | 33% | 0.004 | $3,701,513.84 | Copper |

| PUR | Pursuit Minerals | 50% | 0.003 | $10,906,199.96 | Lithium |

| PSL | Paterson Resources | 80% | 0.027 | $12,313,022.73 | Gold |

| PNT | Panthermetalsltd | 50% | 0.036 | $3,137,981.83 | Nickel |

| NAE | New Age Exploration | 67% | 0.005 | $8,969,494.55 | Gold |

| MOM | Moab Minerals Ltd | 67% | 0.005 | $3,969,071.19 | Uranium |

| MLM | Metallica Minerals | 55% | 0.034 | $33,597,337.27 | Silica sand |

| MAU | Magnetic Resources | 25% | 1.44 | $402,000,000.00 | Gold |

| M2M | Mtmalcolmminesnl | 46% | 0.038 | $8,774,049.14 | Gold |

| LSA | Lachlan Star Ltd | 37% | 0.07 | $14,945,270.04 | Gold |

| LRL | Labyrinth Resources | 275% | 0.015 | $18,527,278.49 | Gold |

| LM1 | Leeuwin Metals Ltd | 40% | 0.073 | $3,420,171.98 | Lithium |

| KPO | Kalina Power Limited | 33% | 0.004 | $9,945,576.05 | Renewables |

| KLI | Killiresources | 104% | 0.094 | $11,060,584.36 | Gold |

| JAV | Javelin Minerals Ltd | 33% | 0.002 | $8,553,692.36 | Gold |

| JAL | Jameson Resources | 62% | 0.06 | $29,343,847.32 | Coal |

| IVZ | Invictus Energy Ltd | 38% | 0.087 | $127,610,599.32 | Oil and Gas |

| IEC | Intra Energy Corp | 33% | 0.002 | $3,381,563.17 | Lithium |

| I88 | Infini Resources Ltd | 358% | 0.71 | $26,968,160.75 | Lithium/Uranium |

| HVY | Heavymineralslimited | 43% | 0.097 | $6,107,700.74 | Garnet |

| FEG | Far East Gold | 35% | 0.135 | $34,774,222.73 | Gold |

| ENT | Enterprise Metals | 33% | 0.004 | $4,373,269.00 | Gold |

| EEL | Enrg Elements Ltd | 75% | 0.0035 | $2,019,930.06 | Uranium |

| DUN | Dundasminerals | 33% | 0.028 | $2,369,585.29 | Gold |

| DRX | Diatreme Resources | 42% | 0.027 | $130,287,407.18 | Silica sand |

| CY5 | Cygnus Metals Ltd | 48% | 0.062 | $22,714,977.45 | Lithium |

| CMG | Criticalmineralgrp | 43% | 0.2 | $8,438,781.40 | Vanadium |

| CAZ | Cazaly Resources | 53% | 0.026 | $10,609,968.79 | Lithium |

| AYM | Australia United Min | 50% | 0.003 | $5,527,732.46 | Gold |

| ASR | Asra Minerals Ltd | 50% | 0.006 | $13,234,515.77 | Gold |

| APC | Aust Potash Ltd | 100% | 0.002 | $6,105,284.24 | Rare earths/niobium |

| AOA | Ausmon Resources | 50% | 0.003 | $3,176,998.03 | Copper |

| ALR | Altairminerals | 33% | 0.004 | $17,186,310.07 | Copper |

| AL8 | Alderan Resource Ltd | 33% | 0.004 | $4,427,445.22 | Lithium |

| AHN | Athena Resources | 200% | 0.006 | $7,493,272.91 | Iron ore |

| AAU | Antilles Gold Ltd | 33% | 0.004 | $5,114,997.04 | Gold |

| AAJ | Aruma Resources Ltd | 67% | 0.02 | $3,740,938.61 | Copper |

| A1G | African Gold Ltd. | 43% | 0.03 | $8,133,334.17 | Gold |

| SPR | Spartan Resources | 28% | 1.27 | $1,400,000,000.00 | Gold |

Small Cap Standouts

Infini Resources (ASX:I88) +358%

Lithium/uranium explorer I88 rocked the charts last month when initial results from soil sampling at the Portland Creek uranium project pulled in 11,792ppm and then a second, even-better eye-watering peak grade of 74,997ppm.

The results were so rich in uranium they fell outside the detection limits of conventional technology with I88’s results sitting a casual ~9375 times higher than the normal ~8ppm U3O8 level.

A favourite stock pick of Lowell Resources Fund chief investment officer John Forwood, I88 only listed on the ASX seven months ago with a diverse portfolio of eight greenfields and brownfields projects in Tier 1 mining jurisdictions across Canada and WA.

It closed a $5.3m raise with funds to be used over its assets at a time when uranium headwinds worked in its favour.

From the lows of US$18/lb in 2018, uranium spot prices more than doubled from January 2023 to 2024, hitting a 16-year high of US$107/lb.

Although they’ve since pulled back, Tribeca’s Guy Keller believes prices have found a new base level above US$80/lb and wouldn’t be surprised to see them hit the US$100 – $120/lb range in Q3 and Q4 as utilities come back on in the Northern Hemisphere.

The results of a recent UAV survey at the Taulus prospect within the wider Portland Creek ground holding identified a prolific fault system and numerous magnetic anomalies within the highly prospective 3.2km long radiometric corridor.

I88 is now looking to get boots back on ground this month to complete its second, much larger geochemical sampling program, which will help to refine existing anomalies and potentially identify new ones to be fed into planning for a large diamond drill program.

Labyrinth Resources (ASX:LRL) +275%

Shares in LRL shot up last month after it entered a 12-month option to acquire the remaining 49% of the Comet Vale gold project from Sand Queen Gold Mines for $3m.

The acquisition reflected the company’s broader strategy to consolidate and grow underexplored high-grade gold mines across the Menzies, Leonora and Leinster corridor that are close to infrastructure.

Comet Vale resides in WA’s Goldfields region, one hour north of the Kalgoorlie township, and sits within the Bardoc Tectonic Zone and the Boulder Lefroy Fault that hosts the world-class Superpit mine.

The project is currently endowed with a resource of 96,000oz at 4.8 g/t gold but LRL plans to grow its inventory even further with high-priority work programs during the current quarter.

LRL also snapped up the Vivien gold project by acquiring private company Distilled, whose vendors Alex Hewlett and Kelvin Flynn boast experience in driving value creation for exploration companies including Red Dirt Metals (now Delta Lithium), Mineral Resources, Silver Lake and Wildcat Resources.

The Vivien project is a short 6km from South African mining major Gold Fields’ >250,000opzpa Agnew mine, previously owned by gold producer Ramelius Resources (ASX:RMS).

Athena Resources (ASX:AHN) +200%

AHN emerged out of the woodwork at the end of July with a boardroom shuffle that saw experienced mining executive John Welborn take on the role of non-exec chair and Garry Plowright appointed to non-exec director.

Those names might ring a bill with Fenix Resources (ASX:FEX) now a +30% major shareholder in AHN if it chooses to convert some notes.

FEX is led by Welborn, the former Wallabies, Waratahs and Western Force second rower who rose to prominence in the mining game at the helm of African goldie Resolute Mining (ASX:RSG).

At the time of the agreement, FEX said the funding would be used to assist AHN in completion of a scoping study at the 29.3Mt at 24.7% iron Byro Magnetite project in WA’s Mid-West region.

That study has since been released, highlighting a base case of 2.4Mt of magnetite ore per year, producing a coarse P100 -150um high-grade magnetite concentrate for the purposes of steel making at an average output of 720,000tpa (dry) and a grade of 70% Fe.

A mining schedule to deliver the 2.4Mtpa of ore was developed with a nominal mining target of 12Mtpa for the initial four years of the project, reducing to 4Mtpa for remaining years as waste strip requirements reduced.

To achieve this, it is estimated that pre-production funding of ~$150m including additional studies and before working capital will be required.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.