Who made the Gains? Here are the top 50 resources winners for December

Butterbean v Ken Craven at the Mandalay Bay Resort in Las Vegas, Nevada in 1999. Butterbean defeated Craven by a TKO in the third round. Pic: Al Bello /Allsport/ Getty Images

There was some exciting stuff happening December but first, a quick look back at the last 6 months of 2021.

In July, strange bedfellows battery metals and coal were building up a head of steam, just as iron ore was losing it.

The steel making ingredient happily bounced between $US210/t and $220/t for most of the month before plummeting to ~$US180/t when China dusted off ‘straight-from-the-playbook’ move to cut steel production in efforts to dampen prices look after the environment.

Iron ore kept tumbling in August, while lithium continued its inexorable rise. A remarkable 22 of the top 50 stocks in August enjoyed exposure to the battery metal.

Meanwhile, premium Low Vol CFR China – a benchmark for Chinese coking coal imports — hit an all-time high of $US410/t. That’s a 248% increase over the past year. Thermal coal prices were doing even better.

Uranium was a standout in September. The spot price punched through $50/lb for first time in nine years, sparked by the Sprott Physical Uranium Trust (SPUT), which started buying up physical uranium and taking it out of market circulation in August.

In October, investor sentiment for commodities went ballistic (almost) across the board.

Copper was back in vogue, rising above US$10,000/t for the first time since May.

Magnesium price went ballistic — going from ~$3,200 per tonne in September to $11,000 per tonne in October 2021 – while potash prices were up 300% since the start of the year.

Then there’s lithium, which continued to surprise to the upside.

Slow’vember certainly lived to its name, with only five stocks making gains of 100% or more — a trend which carried through to the last month of the year.

That doesn’t mean December was boring. Two very interesting themes emerged.

One: iron ore prices made a recovery, shooting several beleaguered iron ore stocks – large and small — back into our top 50.

Two: several potentially company making copper discoveries were made, all within the space of a few weeks.

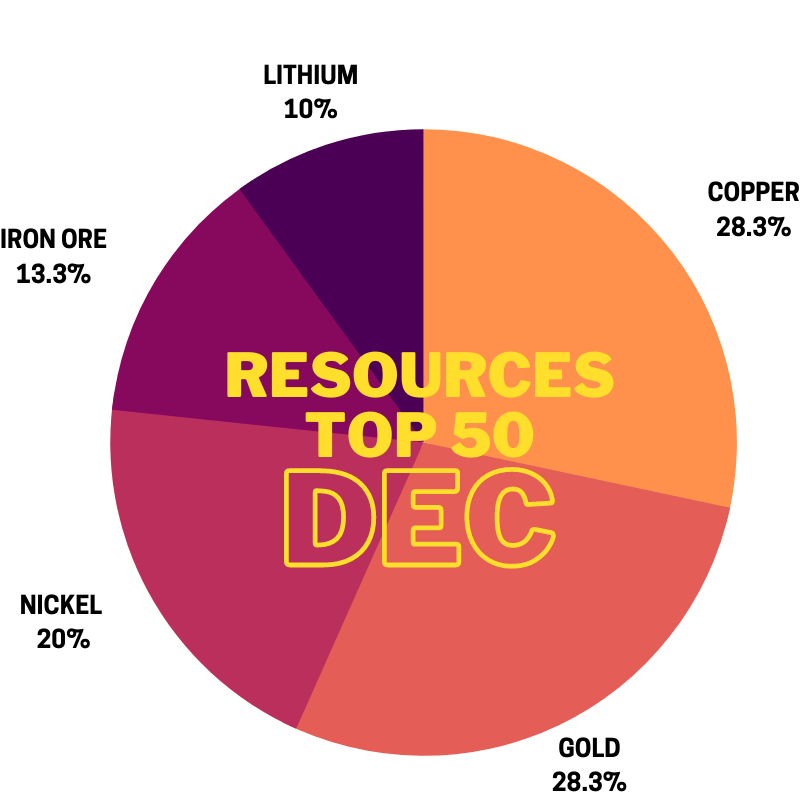

This is reflected in our tasty pie chart, which shows iron ore and copper-facing stocks commanding a solid chunk of December’s top 50:

Here are the top 50 ASX resources stocks for the month of December >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | MONTHLY RETURN % | SHARE PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| AHK | Ark Mines | 547 | 0.22 | $ 6,833,222.66 | COPPER, NICKEL, COBALT, IRON ORE |

| CNB | Carnaby Resources | 457 | 1.365 | $ 140,504,058.03 | COPPER, GOLD |

| QGL | Quantum Graphite | 224 | 0.165 | $ 48,345,000.00 | GRAPHITE |

| SPQ | Superior Resources | 117 | 0.039 | $ 58,344,381.40 | COPPER, GOLD, NICKEL,PGE |

| DCX | Discovex Resources | 100 | 0.01 | $ 23,117,976.68 | COPPER, GOLD |

| ERM | Emmerson Resources | 89 | 0.14 | $ 67,262,196.02 | COPPER, GOLD |

| DM1 | Desert Metals | 58 | 0.38 | $ 12,938,250.00 | NICKEL, COPPER, PGE |

| TMS | Tennant Minerals | 57 | 0.036 | $ 14,996,745.54 | COPPER, GOLD |

| ATR | Astron Corp | 50 | 0.45 | $ 55,114,685.10 | RARE EARTHS, MINERAL SANDS |

| SYR | Syrah Resources | 50 | 1.785 | $ 897,722,501.40 | GRAPHITE |

| GL1 | Global Lithium | 50 | 0.93 | $ 108,862,278.43 | LITHIUM |

| PBX | Pacific Bauxite | 50 | 0.003 | $ 1,189,842.10 | PGE |

| HFR | Highfield Resources | 48 | 0.89 | $ 326,164,748.87 | POTASH |

| GWR | GWR Group | 45 | 0.145 | $ 44,017,591.42 | IRON ORE |

| MCR | Mincor Resources | 44 | 1.785 | $ 845,186,143.20 | NICKEL |

| HMX | Hammer Metals | 43 | 0.06 | $ 48,899,677.38 | COPPER, GOLD |

| GMR | Golden Rim Resources | 41 | 0.14 | $ 33,205,231.53 | GOLD |

| CSE | Copper Strike | 41 | 0.12 | $ 15,003,627.38 | SHELL, SYR SHAREHOLDER |

| TRN | Torrens Mining | 38 | 0.18 | $ 12,539,688.84 | COPPER, COBALT, GOLD |

| GRR | Grange Resources | 38 | 0.7425 | $ 844,857,249.54 | IRON ORE |

| CUF | Cufe | 38 | 0.04 | $ 33,113,932.78 | IRON ORE, COPPER |

| MLX | Metals X | 37 | 0.54 | $ 435,487,712.16 | TIN |

| LM8 | Lunnon Metals | 35 | 0.46 | $ 34,087,069.42 | NICKEL |

| HIO | Hawsons Iron | 34 | 0.1475 | $ 103,682,677.75 | IRON ORE |

| COD | Coda Minerals | 33 | 0.92 | $ 84,139,733.44 | COPPER, COBALT, GOLD |

| REZ | Resource & Energy Group | 32 | 0.062 | $ 30,987,958.92 | GOLD, NICKEL |

| IR1 | Iris Metals | 30 | 0.56 | $ 22,687,499.45 | GOLD |

| RMI | Resource Mining Corp | 30 | 0.026 | $ 8,846,996.13 | NICKEL |

| MHK | Metal Hawk | 30 | 0.285 | $ 12,432,002.44 | GOLD, NICKEL |

| NWF | Newfield Resources | 29 | 0.45 | $ 296,958,638.80 | DIAMONDS |

| BDC | Bardoc Gold | 28 | 0.5 | $ 141,001,117.21 | GOLD |

| COB | Cobalt Blue | 28 | 0.485 | $ 143,206,676.03 | COBALT |

| KCN | Kingsgate Consolidated | 27 | 1.925 | $ 412,762,644.85 | GOLD |

| GT1 | Green Technology | 27 | 0.495 | $ 51,940,000.00 | LITHIUM |

| GEN | Genmin | 25 | 0.2 | $ 56,457,570.00 | IRON ORE |

| RRR | Revolver Resources | 25 | 0.45 | $ 36,842,603.40 | COPPER, ZINC |

| XTC | Xantippe Resources | 25 | 0.005 | $ 30,574,233.01 | LITHIUM, GOLD |

| SKY | SKY Metals | 25 | 0.11 | $ 41,446,181.70 | TIN, COPPER, LEAD, ZINC |

| NMT | Neometals | 25 | 1.395 | $ 660,793,557.18 | TITANIUM, VANADIUM, LITHIUM |

| JMS | Jupiter Mines | 24 | 0.23 | $ 460,362,892.76 | MANGANESE |

| MIN | Mineral Resources | 24 | 56.21 | $ 10,866,441,140.94 | IRON ORE, LITHIUM |

| SFM | Santa Fe Minerals | 24 | 0.13 | $ 9,466,442.57 | NICKEL, LEAD, ZINC, COPPER, PGE, SILVER, GOLD, VANADIUM |

| PLS | Pilbara Minerals | 23 | 3.205 | $ 9,611,008,227.89 | LITHIUM |

| ENT | Enterprise Metals | 23 | 0.016 | $ 9,168,322.32 | GOLD, NICKEL, COPPER, ZINC, COBALT, POTASH |

| PAN | Panoramic Resources | 23 | 0.27 | $ 543,492,211.06 | NICKEL |

| DVP | Develop Global | 23 | 3.85 | $ 527,617,552.50 | COPPER, ZINC, SILVER |

| RNX | Renegade Exploration | 21 | 0.0085 | $ 6,597,199.79 | GOLD, COPPER |

| POS | Poseidon Nickel | 21 | 0.11 | $ 321,715,750.23 | NICKEL |

| CIA | Champion Iron | 21 | 5.42 | $ 2,735,056,130.40 | IRON ORE |

| RDG | Res Dev Group Ltd | 33 | 0.08 | $ 224,809,301.44 | GARNET, MANGANESE |

Nerves of steel

The iron ore rollercoaster kept coastin’ in December.

A perfect storm had pushed prices to record levels early in the year before China slammed on the brakes, sending the benchmark price as low as US87/t in the September quarter.

Another bull rally in December sent prices above US$120/t to end the year, and iron ore stocks followed in lockstep.

Leading the rebound were iron ore producers Grange Resources (ASX:GRR), Champion Iron (ASX:CIA) and Mineral Resources (ASX:MIN), which is also heavily exposed to lithium.

Also well represented were the advanced explorers/ near term miners; guys like GWR Group (ASX:GWR), CuFe (ASX:CUF), Hawsons Iron (ASX:HIO) and Genmin (ASX:GEN).

What does 2022 have in store for iron ore? Here’s a biblically long and detailed analysis. You’re welcome.

A swarm of copper discoveries

CARNABY RESOURCES (ASX:CNB) and DISCOVEX RESOURCES (ASX:DCX)

On December 13 CNB announced visible copper in drilling at the ‘Greater Duchess’ copper-gold project in Mt Isa, Queensland (CNB 82.5%, DCX 17.5%).

At the ‘Nil Desperandum’ prospect, the first the first diamond hole in the current program hit an 80m downhole interval of intermittently disseminated, semi massive to breccia hosted copper mineralisation.

On December 29 the major discovery was confirmed by assay — 41m at 4.1% copper, which included a 9m chunk grading 10.3%. Very nice.

“Nil Desperandum is shaping up as a major Iron Oxide Copper Gold discovery which is rapidly getting bigger and better at depth,” managing director Rob Watkins says.

“The scale of the mineralised system we are seeing is exceptional.

“We look forward to 2022 as being an incredible ride for Carnaby shareholders as we escalate the exploration at the Greater Duchess Copper Gold Project to a whole new level.”

In late December SPQ announced visual copper and disseminated copper over much of a 659m-long hole at the ‘Bottletree’ porphyry copper-gold prospect.

The strongest copper mineralisation occurs over a 200m interval, the company says. All-important assays are pending.

And this isn’t even the main target at Bottletree — a large, interpreted copper-gold porphyry system located 500m west.

“It must be noted that these copper-mineralised zones are a secondary target and appear to be mere outer zones of mineralisation, or ‘leakage’ related to potentially, a much larger porphyry copper-gold system,” SPQ managing director Peter Hwang says.

“The next program at Bottletree, aimed for the end of Q1, 2022, will be extensive and will target the interpreted porphyry system and the ‘satellite’ copper zones, including further drilling at the copper zone associated with the chargeability anomaly.”

And last but not least, a contender for one of the best drill hits of 2021.

On December 8 ERM announced a “stunning” 117m at 3.38% copper from 75m in drilling at the ‘Hermitage Project’ in the NT.

Due to drilling difficulties the vertical hole (HERC003) was abandoned in high grade mineralisation –3m at 14.91g/t gold and 4.24% copper, to be exact. Amazing stuff.

This drill hole will be continued with a diamond ‘tail’ in 2022, ERM says.

“Whilst it is still early days, the metal zonation and mineralisation in drill hole HERC003 displays increasing gold and copper grades with depth – the subject of future diamond drilling,” ERM managing director Rob Bills says.

“Although based on limited data (i.e. rock chips), it appears that HERC003 intersected a subvertical, brecciated, high grade metal rich feeder zone which has channelled and concentrated the copper and gold and remains open at depth.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.