Here’s all you need to know about record fertiliser prices, supply shocks and the outlook for producers

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Potash prices have soared by up to 300% since the start of the year, sitting above US$700 per tonne (CFR Brazil Spot).

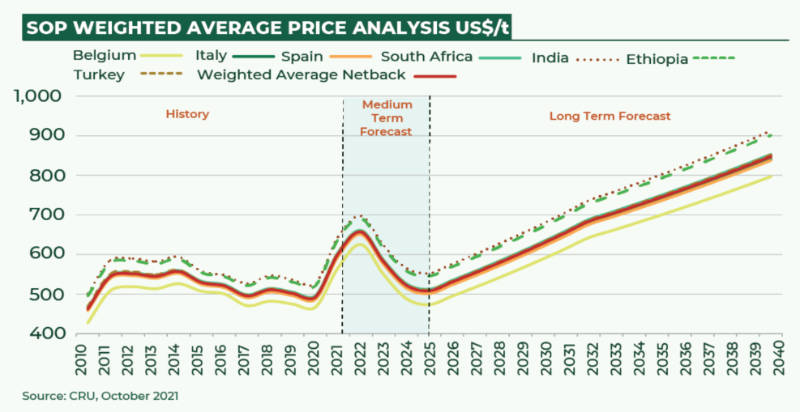

CRU Group’s updated Sulphate of Potash (SOP) Price Forecast Analysis says this is a combination of rising demand, poor international crop yields, surging crop prices and margins.

Not to mention the impact of EU sanctions on Belarus muriate of potash (MOP) sales since June which usually account for around 20% of the global supply.

Added to this, Bloomberg’s Green Markets reported that North America’s nutrient gauge (fertiliser prices) surged past the 2008 peak to hit a new record of US$996.32/t.

And the current MOP prices FOB Vancouver are over US$550/t.

CRU forecasts that all specialty potash fertiliser prices will move higher through 2021-23 with a pullback from 2024-2027 before rising steadily until 2040.

Supply chain uncertainty boosts prices

Kalium Lakes (ASX:KLL) CEO Rudolph van Niekerk said there has been some supply uncertainly with Belarus sanctions which has pushed MOP prices which in turn pushed up SOP prices.

“The SOP price is looking strong and stable for the next 12-18 months,” he said. “There’s quite a big demand for SOP and fertiliser in general.”

Kalium is Australia’s first potash producer, having kicked off production at its Beyondie project in WA earlier this month.

And the company just raised $50 million and secured restructuring with its major lenders, with the aim of accelerating its production from 90,000 tonnes per annum to 120,000 tonnes per annum.

And the competition has gone belly up

Things are looking peachy for Kalium, especially considering potential competitor Salt Lake Potash (ASX:SO4), has gone into receivership owing US$127 million just months after its plans to start production at its SOP plant in the WA were delayed.

“The potash industry in Australia is a 7 million pounds per annum market and we’ll produce just over 1% of that,” van Niekerk said.

“It’s a market that is growing, and it’s only a matter of time before other players get up and running as well.

“It’s definitely a sector to look out for and to get excited about, because it’s a growing industry and will be a very strong industry in Australia.”

Any import or export regulation changes will have a flow-on effect

Apart from keeping an eye on the agricultural sector demand, van Niekerk said investors should keep an eye on the global trade markets.

“Any changes in regulation on imports or exports, any sanctions impact trade patterns in those markets, and (they) are likely to cause changes in SOP and MOP pricing,” he said.

“The other thing is that half of global production used Mannheim process where MOP is mixed in with sulfuric acid to produce SOP and hydrochloric acid.

“It’s a high energy process and it does attract environmental regulation.

“Many of these operators find it hard to operate with increase environmental regulatory pressure, and high energy costs mean high MOP prices.”

Nitrogen prices are up too – but so is exposure to Europe’s gas crisis

Potash isn’t the only fertiliser on the rise.

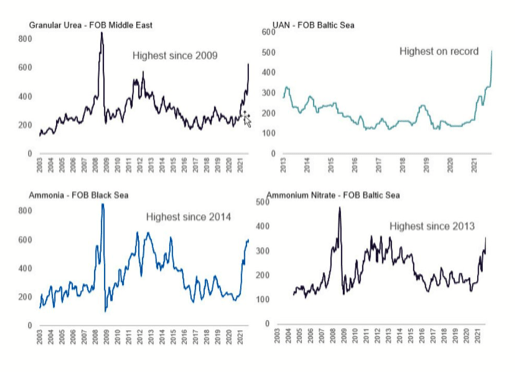

Nitrogen is vital for plant growth, with urea the most concentrated and most commonly used nitrogen fertiliser.

But the production process uses natural gas and CRU Group principal nitrogen analyst Shruti Kashyap said that Europe’s nitrogen capacity is heavily exposed to rising natural gas prices.

This time last year gas prices were $2/mmbtu and the cost for production using ammonia, which is the raw material for nitrogen fertilisers, was around $150 per tonne,” she said.

“Today the gas price currently is in the range of $30-$45/mmbtu, and that has led to an increase in the cost of using ammonia for European producers to about $1,200 per tonne of ammonia.

“Europe is highly dependent on spot gas price markets and that’s why nitrogen production is being impacted.”

Kashyap expects prices to remain high at least for the next six months.

“At the end of the fourth quarter is when we believe gas prices will start to come down and that’s when we will see some sort of moderation in nitrogen prices as well,” she said.

“However, there will be a time lag between when gas prices decline and the response from the nitrogen sector because it is very easy to shut down production, but it is difficult to bring it back online immediately.”

Price is going to impact the agricultural sector

But it’s not just producers who are going to feel the pinch.

Nitrogen products have become expensive and Kashyap says farmers will see an impact in the next two three months.

“Right now, distributors and other people in supply chain are being more being impacted by this price hike,” she said.

“Farmers who usually buy their product sometime in December/January would rather buy the products now because there is a possibility that the price will go up.

“There is also a demand season, farmers normally start restocking ahead of the spring and winter wheat application in October or November, so we will see some sort of farmer buying happening now.”

But on the flip side, high crop prices are also adding pressure to the mix, with farmers wanting to plant more thus pushing up fertiliser prices even more.

Kashyap said that going forwards the nitrogen portfolio remains robust because it’s a vital fertiliser and that demand isn’t going away.

Reduced capacity could mean opportunities for other producers

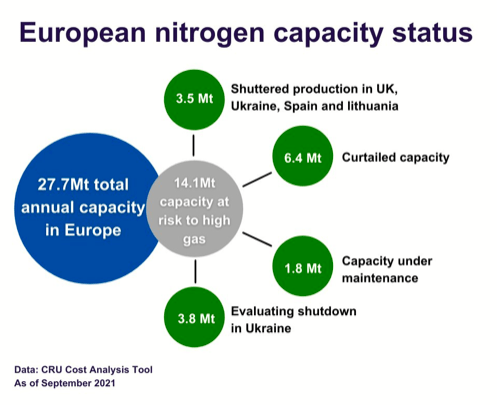

Kashyap said European ammonia production is about 28 million tonnes of ammonia annually and around 17 million tonnes have been impacted in some form or another.

“Some plants have undertaken maintenance, some plants have completely shut down, and some plants are evaluating shutdowns,” she said.

“It definitely provides opportunities to countries like Russia, countries like Egypt, Algeria, Trinidad, and also the Middle Eastern countries to supply ammonia to Europe.

“Whether they will be able to that’s another question, because if you look at their current capacity utilisation levels, they may not have much excess capacity.”

Countries like the US – who have access to their own shale gas – are too busy dealing with supply issues from Hurricane Ida’s impact on ammonia production to pick up any slack.

Luckily there’s an Aussie player waiting in the wings

Leigh Creek Energy (ASX:LCK) is developing low-cost nitrogen-based fertiliser project in South Australia which will initially produce 1Mtpa (with potential to increase to 2Mtpa) of zero carbon urea.

While the company won’t hit full production until around 2024, the demand for the urea fertiliser is around 110Mt – and it’s only going to grow.

In Australia and Southeast Asia region, the demand for urea annually is approximately 2Mt and 24Mt respectively, and since we rely heavily on imports, being able to manufacture urea in country will be vital for food security.

The company is targeting the final investment decision process for the project in the middle of next year.

But what about phosphate?

In China, some provincial governments have requested fertiliser producers and traders to stop exports, causing a phosphate price spike to $643.8/mt for di-ammonium phosphate (DAP) and $147.5/mt for phosphate rock last month.

Essentially, the country is diverting some exports for domestic supply and stockpiling which is having a major impact on India which imports around 40% of China’s phosphate.

This in turn has caused the Indian government to subsidise phosphate fertilisers for farmers which has bumped the price up even more.

Small cap player just signed offtake with Samsung

Small cap Aussie phosphate rock player Centrex Metals (ASX:CXM) just announced subsidiary Agriflex signed an offtake and marketing agreement with Samsung C&T, one of the world largest fertiliser traders.

The initial deal is for the first three years of production from Agriflex’s planned $78 million, 800,000tpa ‘Ardmore’ phosphate project in Queensland.

In August, an updated definitive feasibility study envisaged gross revenue of $1.453 billion and free cash of $429m over a 10-year life.

Centrex is also in advanced discussions with several other Australian and international potential customers and kicked off direct-to-farmer sales in August.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.