Who made the gains? Here are the top 50 ASX miners and explorers for April

(Photo by Dylan Burns/AFL Photos via Getty Images/ Stockhead)

In April, the mining and exploration cohort was going gangbusters, until it wasn’t.

Hitting an all-time high of 19,321.70 points on April 19, the S&P/ASX 200 Materials index (XMJ) then plummeted ~11% in a week to erase a full month of gains.

XMJ contains the 39 large cap companies in the S&P/ASX 200 that are classified as members of the Materials sector. Constituents are involved in commodities and related industries (like mining, forest products and construction materials. But mostly mining.)

Part of the fall can be attributed to a disappointing earnings season for several of the big miners, caused by weaker than expected production, a lack of workers, and cost blowouts (hi, inflation).

The other part is China – our biggest export partner — playing silly buggers with commodity prices, which they do on the reg.

“China’s economy is either imploding or getting ready for an upwards swing and which way you go really depends on what data you believe and who you read,” says Stockhead’s own Josh Chiat.

And the data is all over the joint. On the upside, Premier Xi Jinping moved quickly late in the month to quell economic fears, pledging to ramp up public investment in infrastructure construction.

That could be great for commodity demand.

Meanwhile, metals prices are chugging along nicely. While gains across the metals complex in April were rare, losses were minimal.

(Read our in-depth analysis of the best and worst performing metals here.)

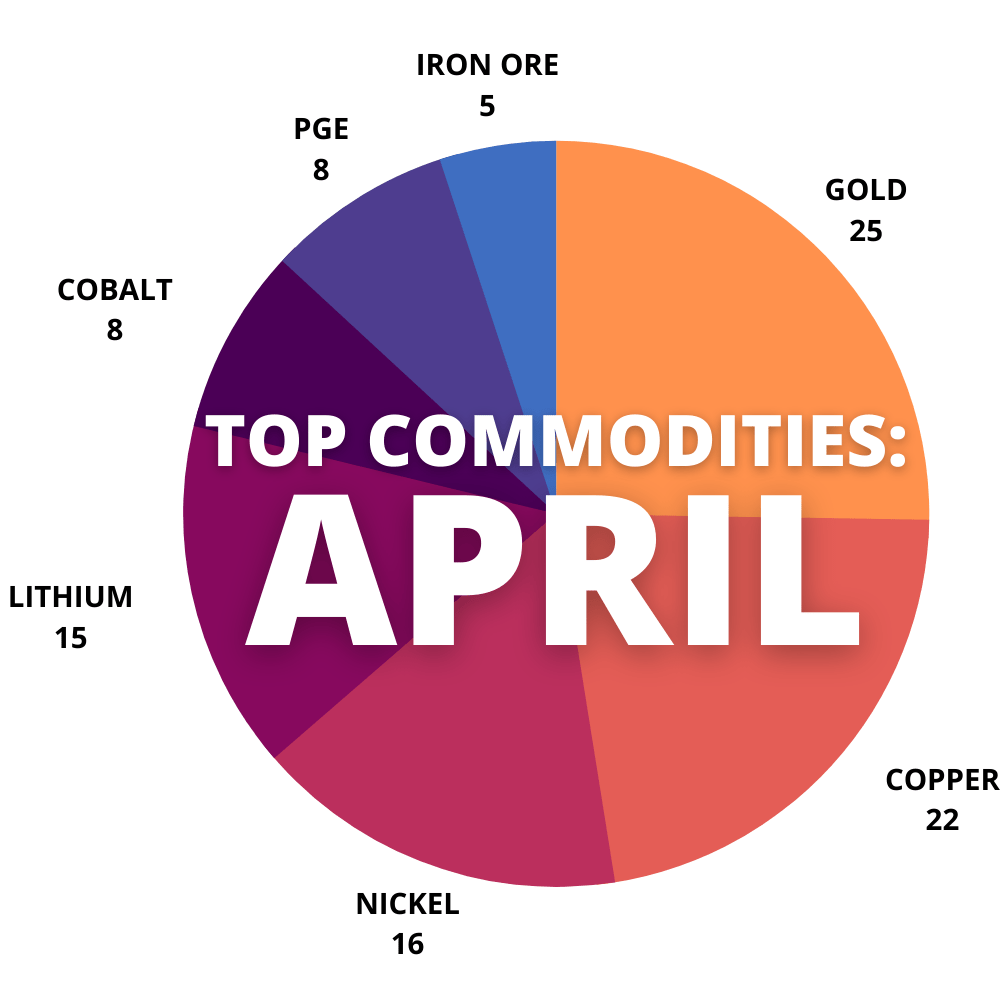

Here’s a breakdown of the most popular commodities for April:

Here are the top 50 ASX resources stocks for the month of APRIL >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 MONTH RETURN % | PRICE | MARKET CAP | COMMODITY FOCUS |

|---|---|---|---|---|---|

| SRN | Surefire Resources | 212% | 0.039 | $44,461,174.56 | VANADIUM, GOLD, IRON ORE |

| ALY | Alchemy Resources | 192% | 0.038 | $36,189,105.82 | GOLD, NICKEL, COBALT, ALUMINA |

| HIO | Hawsons Iron | 181% | 0.745 | $532,714,447.75 | IRON ORE |

| PTR | Petratherm | 161% | 0.12 | $23,870,136.72 | RARE EARTHS, COPPER, GOLD |

| HAW | Hawthorn Resources | 147% | 0.18 | $60,032,810.34 | IRON ORE, GOLD, NICKEL, COPPER, LITHIUM |

| KTA | Krakatoa Resources | 113% | 0.115 | $33,891,640.46 | RARE EARTHS, MINERAL SANDS, NICKEL, COPPER, PGE |

| MM1 | Midas Minerals | 103% | 0.345 | $18,781,153.13 | LITHIUM, GOLD, PGE |

| CZR | CZR Resources | 100% | 0.016 | $55,781,172.43 | IRON ORE, COPPER, GOLD |

| CSE | Copper Strike | 95% | 0.195 | $25,788,992.00 | SHELL (LOOKING FOR PROJECTS) |

| PNN | PepinNini Minerals | 91% | 0.86 | $52,785,206.42 | LITHIUM, KAOLIN, COPPER, GOLD |

| CPO | Culpeo Minerals | 88% | 0.235 | $10,339,327.20 | COPPER, GOLD |

| ODE | Odessa Minerals | 83% | 0.022 | $11,817,324.38 | LITHIUM, DIAMONDS |

| MPG | Many Peaks Gold | 83% | 0.53 | $17,014,060.00 | COPPER, GOLD |

| OAR | OAR Resources | 82% | 0.01 | $21,545,647.24 | GRAPHITE, NICKEL, COPPER, PGE, GOLD |

| LRV | Larvotto Resources | 81% | 0.435 | $17,925,262.50 | GOLD, COPPER, LITHIUM |

| VR8 | Vanadium Resources | 79% | 0.145 | $68,601,294.23 | VANADIUM |

| LRS | Latin Resources | 78% | 0.135 | $258,000,134.04 | LITHIUM |

| VAN | Vango Mining | 76% | 0.051 | $64,256,819.23 | GOLD |

| XTC | Xantippe Resources | 75% | 0.014 | $107,302,746.59 | LITHIUM |

| GED | Golden Deeps | 73% | 0.019 | $21,948,027.57 | VANADIUM, LEAD, SILVER, COPPER |

| TMX | Terrain Minerals | 71% | 0.012 | $8,829,132.11 | GOLD, LOOKING FOR PROJECTS |

| GME | GME Resources | 71% | 0.145 | $86,128,660.49 | NICKEL, COBALT, GOLD |

| AHK | Ark Mines | 70% | 0.51 | $16,988,152.53 | NICKEL, COBALT, COPPER |

| IKW | Ikwezi Mining | 66% | 1.58 | $64,226,958.92 | COAL |

| MCM | MC Mining | 65% | 0.165 | $31,809,271.56 | COAL |

| TBA | Tombola Gold | 64% | 0.059 | $49,240,397.24 | GOLD, COPPER, COBALT |

| KMT | Kopore Metals | 63% | 0.044 | $31,477,111.60 | URANIUM, COPPER, GOLD |

| TRM | Truscott Mining Corp | 63% | 0.052 | $7,900,960.29 | GOLD, COPPER |

| SMI | Santana Minerals | 62% | 0.9 | $119,373,559.20 | GOLD |

| LEL | Lithium Energy | 61% | 1.45 | $65,250,000.00 | LITHIUM |

| RMI | Resource Mining Corp | 59% | 0.051 | $20,077,326.93 | NICKEL, COBALT |

| ICL | Iceni Gold | 59% | 0.175 | $22,434,374.90 | GOLD, COPPER |

| RGL | Riversgold | 58% | 0.076 | $40,014,317.15 | LITHIUM |

| RAG | Ragnar Metals | 58% | 0.049 | $18,261,559.56 | NICKEL, COPPER |

| MXR | Maximus Resources | 56% | 0.098 | $31,154,765.26 | GOLD, NICKEL, LITHIUM |

| NIM | Nimy Resources | 55% | 0.55 | $25,822,352.60 | NICKEL, COPPER |

| WMG | Western Mines | 52% | 0.335 | $12,271,887.50 | NICKEL, COPPER, PGE, LITHIUM |

| AMN | Agrimin | 52% | 0.54 | $155,170,342.44 | POTASH |

| MLS | Metals Australia | 51% | 0.14 | $53,687,659.48 | LITHIUM, GRAPHITE, COPPER, COBALT, GOLD |

| MRZ | Mont Royal Resources | 50% | 0.39 | $24,701,020.89 | NICKEL, COPPER, PGE |

| PBX | Pacific Bauxite | 50% | 0.15 | $1,189,875.90 | PGE |

| NC1 | Nico Resources | 48% | 1.475 | $128,693,752.95 | NICKEL, COBALT |

| JRL | Jindalee Resources | 45% | 4.38 | $251,319,871.08 | LITHIUM |

| SRL | Sunrise | 44% | 3.32 | $298,992,158.28 | NICKEL, COBALT |

| ESS | Essential Metals | 43% | 0.66 | $161,266,617.60 | LITHIUM |

| BMG | BMG Resources | 43% | 0.06 | $19,199,499.48 | GOLD |

| MEU | Marmota | 43% | 0.06 | $58,804,878.96 | GOLD, URANIUM, RARE EARTHS |

| PUR | Pursuit Minerals | 42% | 0.027 | $25,529,828.24 | NICKEL, COPPER, PGE, GOLD, VANADIUM |

| SCN | Scorpion Minerals | 42% | 0.088 | $29,201,144.90 | LITHIUM, NICKEL, COPPER, PGE, GOLD |

| JNO | Juno Minerals | 40% | 0.14 | $18,992,120.14 | IRON ORE |

LITHIUM: PRICES ARE ALL OVER SHOP

SHOCK HORROR: Supercharged lithium prices began to slow their ascent last month. Or did they?

While prices have been sliding from record levels in China for lithium carbonate, Pilbara Minerals (ASX:PLS) last week sold a shipment of lithium spodumene at auction for an outrageous US$5,650/dmt.

So, lithium companies are still sitting pretty. There are 15 in our top 50 for April, many of them baby stocks dipping their toes into battery metals exploration for the first time.

Alchemy Resources (ASX:ALY) found multiple lithium anomalies at its Karonie gold project, 8km along strike and within contiguous tenure to Global Lithium Resources’ (ASX:GL1) ‘Manna’ lithium deposit (9.9Mt at 1.14% Li201).

Midas Minerals (ASX:MM1) entered into an agreement with DiscovEx Resources (ASX:DCX) to acquire the ‘Newington’ project in WA, which is prospective for gold and lithium.

Diamond explorer Odessa Minerals (ASX:ODE) is also branching out into lithium and rare earths after acquiring the 606sqkm ‘Lyndon’ project near Carnarvon in WA.

And former goldie Xantippe Resources (ASX:XAN) is now all-in on lithium after locking in a deal to buy ground next door to Lake Resources (ASX:LKE) advanced Kachi project in Argentina.

GOLD: MAKING A BIT OF A COMEBACK

Gold hasn’t been cool since sometime in 2020, when prices briefly peaked above ~$US2020/oz.

Back then, every stock exploration was spruiking a gold project, just like every small cap is now spruiking a lithium project. Markets change fast.

(Side note: beware the bandwagoners.)

Prices then dropped. Goldies were still making good coin at lower prices around $US1,800/oz, but the small cap cheer squad had moved onto cooler things.

In April, prices danced around the $US2,000/oz mark once again … before plummeting back to earth late in the month.

Still, investors have begun to reward positive announcements again.

Leading the pack last month was fresh IPO Many Peaks Gold (ASX:MPG) which is targeting gold and gold-copper in the southern part of the Yarrol Geological Province in Queensland.

Reconnaissance work across mineral occurrences and historical workings has identified three project areas – the Mt Weary gold project, Rawlins gold-copper project, and the Monal gold project.

Advanced explorer Vango Mining (ASX:VAN) scored a sweet $10m via a new strategic investor, before hitting thick high grade gold (like 19m at 4.7g/t from 81m) at the 1Moz ‘Marymia’ project.

And Tombola Gold (ASX:TBA) remains on track for first gold production and cashflow from its Mt Freda Complex in Queensland in Q3 this year.

Mt Freda is expected to produce ~64,000oz of gold over initial 30-month life of mine, it says.

At a gold price of $2,285/oz Aussie (currently $2,600/oz), TBA expects to make a nice $79m profit.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.