Who Made the Gains? Here are September’s top ASX miners and explorers

Picture: Getty Images

- September was the time to buy uranium stocks as spot prices punched through 15 year highs

- Rare earths, lithium stocks also popular

- Top large cap winners: Bannerman Energy, Deep Yellow

- Top small cap winners: Torque Metals, OzAurum Resources, Cauldron Energy, Aurora Energy Metals

Are we nearing the bottom of this bear market for junior resources companies?

Late September it went “from bad to worse” as several stocks that had been inspirational in a bear market decided to give in to the overriding sentiment, says ASX stock picking doyen and veteran resources analyst Warwick Grigor.

“More money was pulled out of the market, and it seemed like the focus was on stocks that have enough liquidity to make the selling worthwhile,” he says.

“Is this what you call capitulation? Maybe. If so, does that mean it is almost time to buy?”

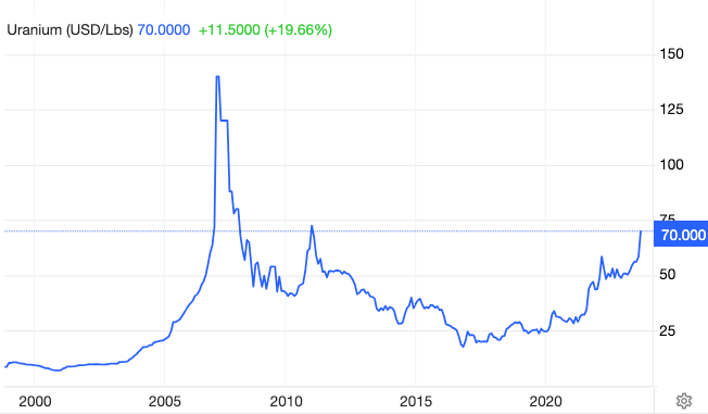

It was certainly time to buy uranium stocks, which reacted positively to a spot price finishing the month at 15-year highs.

The last time things were this good for yellowcake was 2008 but this time, prices are heading in the other direction:

Rare earths also remained popular, as prices recorded a second straight monthly gain, albeit from a low base and well south of the record of US$175/kg seen early last year.

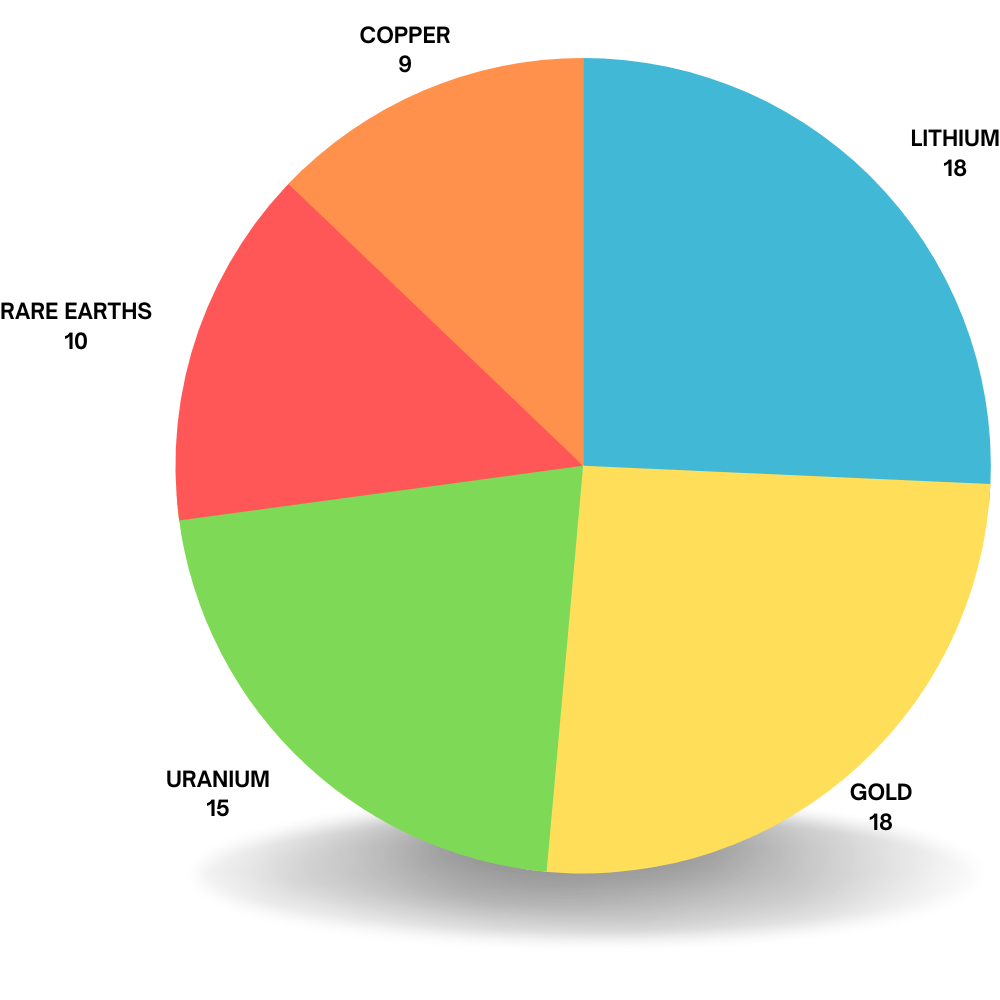

Everything else, sentiment wise, hit the skids. We continue to see outsized representation from the lithium cohort in the top 50, despite prices plunging another ~25% in September.

READ: Up, Up, Down, Down: Did we finally press the button in September on the great uranium bull run?

Favourite commodities in September’s Top 50

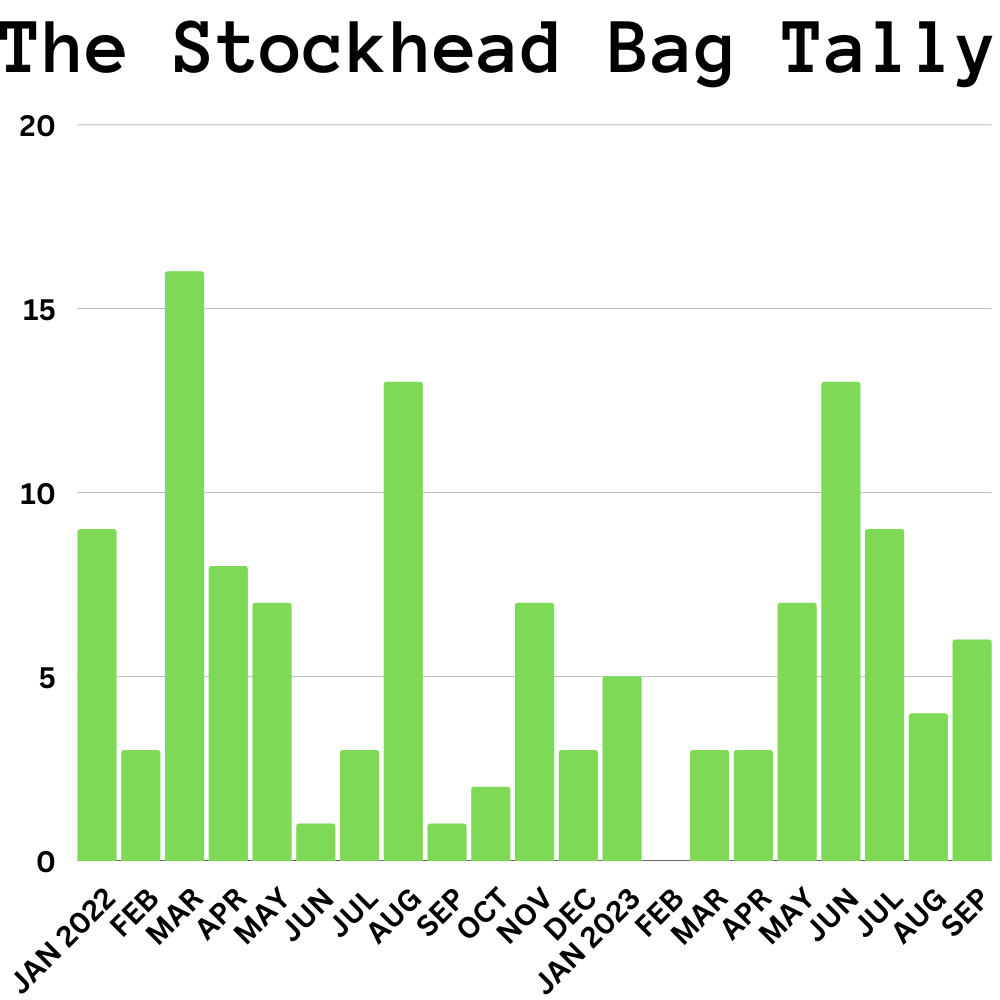

September’s Bag Tally — stocks with gains of 100% or more — was solid, but unremarkable. There are no discernible patterns from almost two years of Bag Tally data, but we’ll keep at it.

Maybe in a year or two we’ll have some ground-breaking insights to share.

Here are the top 50 ASX resources stocks for the month of September >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | SEPTEMBER RETURN | PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| TOR | Torque Metals | 180% | 0.35 | $42,131,253 | LITHIUM, GOLD, NICKEL |

| OZM | Ozaurum Resources | 133% | 0.1 | $17,462,500 | LITHIUM, GOLD |

| CXU | Cauldron Energy | 117% | 0.013 | $11,418,824 | URANIUM, NICKEL, COPPER, PGE |

| 1AE | Aurora Energy Metals | 114% | 0.15 | $23,085,005 | URANIUM |

| LPM | Lithium Plus Minerals | 104% | 0.46 | $27,385,103 | LITHIUM |

| MTL | Mantle Minerals | 100% | 0.002 | $12,294,892 | GOLD, NICKEL |

| GCX | GCX Metals | 89% | 0.053 | $10,775,164 | NICKEL, COPPER, PGE |

| HAR | Haranga Resources | 85% | 0.24 | $11,179,084 | URANIUM |

| BCB | Bowen Coal | 80% | 0.155 | $277,678,164 | COAL |

| ODE | Odessa Minerals | 79% | 0.0125 | $12,312,454 | LITHIUM, RARE EARTHS |

| OKR | Okapi Resources | 79% | 0.17 | $34,664,193 | URANIUM |

| EME | Energy Metals | 75% | 0.21 | $35,646,163 | URANIUM, RARE EARTHS |

| RML | Resolution Minerals | 75% | 0.007 | $8,801,043 | URANIUM, SILICA SANDS, GOLD, MANGANESE, COPPER, NICKEL, COBALT |

| ELE | Elmore | 67% | 0.005 | $6,996,919 | IRON ORE |

| SXG | Southern Cross Gold | 62% | 0.795 | $70,243,386 | GOLD |

| EEL | Enrg Elements | 60% | 0.008 | $7,069,755 | URANIUM, LITHIUM, TIN |

| STK | Strickland Metals | 58% | 0.068 | $97,614,701 | GOLD |

| GLA | Gladiator Resources | 57% | 0.022 | $11,225,140 | URANIUM |

| LPI | Lithium Power International | 54% | 0.355 | $220,233,146 | LITHIUM |

| BNR | Bulletin Resources | 54% | 0.08 | $21,725,741 | LITHIUM, GOLD, RARE EARTHS |

| PRX | Prodigy Gold | 50% | 0.009 | $15,759,970 | GOLD |

| WCN | White Cliff Minerals | 50% | 0.012 | $15,084,223 | RARE EARTHS, LITHIUM |

| BMN | Bannerman Energy | 48% | 2.91 | $425,945,168 | URANIUM |

| DYL | Deep Yellow | 48% | 1.37 | $978,320,434 | URANIUM |

| SPR | Spartan Resources | 48% | 0.415 | $329,107,513 | GOLD |

| AKN | Auking Mining | 45% | 0.064 | $13,266,741 | URANIUM |

| AUN | Aurumin | 45% | 0.029 | $8,057,963 | LITHIUM, GOLD |

| BUR | Burley Minerals | 44% | 0.18 | $18,233,416 | LITHIUM |

| NIM | Nimy Resources | 42% | 0.185 | $14,331,516 | LITHIUM, NICKEL, RARE EARTHS |

| SPD | Southern Palladium | 41% | 0.41 | $17,662,114 | PGE |

| VTX | Vertex Minerals | 40% | 0.14 | $9,361,250 | GOLD |

| FL1 | First Lithium | 39% | 0.25 | $18,563,692 | LITHIUM |

| BUS | Bubalus Resources | 38% | 0.2 | $5,267,167 | LITHIUM, RARE EARTHS |

| TMR | Tempus Resources | 37% | 0.026 | $8,107,794 | LITHIUM, GOLD |

| SI6 | SI6 Metals | 36% | 0.0075 | $15,950,875 | LITHIUM, RARE EARTHS, COPPER, SILVER |

| IXR | Ionic Rare Earths | 35% | 0.023 | $90,990,413 | RARE EARTHS |

| NFL | Norfolk Metals | 35% | 0.175 | $4,851,999 | URANIUM, COPPER |

| IPX | Iperionx | 34% | 1.48 | $282,342,511 | TITANIUM |

| ENT | Enterprise Metals | 33% | 0.004 | $3,197,884 | GOLD, LITHIUM, NICKEL |

| GTR | GTI Energy | 33% | 0.01 | $20,449,471 | URANIUM |

| MTH | Mithril Resources | 33% | 0.002 | $6,737,609 | SILVER, GOLD |

| RDS | Redstone Resources | 33% | 0.008 | $6,971,028 | LITHIUM, COPPER |

| SUH | Southern Hemisphere Mining | 33% | 0.024 | $14,762,658 | COPPER, GOLD, MOLY |

| VAL | Valor Resources | 33% | 0.004 | $15,493,339 | URANIUM, RARE EARTHS |

| PEN | Peninsula Energy | 32% | 0.145 | $157,224,773 | URANIUM |

| BUX | Buxton Resources | 31% | 0.21 | $35,968,499 | GRAPHITE, COPPER, MOLY |

| KLI | Killi Resources | 31% | 0.055 | $3,276,628 | GOLD, COPPER |

| KNG | Kingsland Minerals | 31% | 0.235 | $10,956,351 | GRAPHITE |

| VMM | Viridis Mining | 31% | 0.86 | $36,980,092 | RARE EARTHS, GOLD, KAOLIN |

| NAE | New Age Exploration | 30% | 0.0065 | $10,051,292 | LITHIUM, GOLD |

September Big Cap Belters

Bannerman Energy (ASX:BMN) +48%

Last month Canaccord Genuity slapped a ‘Speculative Buy’ rating on the stock with a price target of $3.33 (versus current price of $2.64 at time of writing).

Bannerman is developing the 95%-owned 3.5Mlb/y Etango Uranium project, 50km from Paladin Energy’s (ASX:PDN) proven large-scale Langer Heinrich mine.

“Etango-8 is all but shovel ready. With a mineral Resource of 207Mlbs U3O8 it is very material and is already attracting significant buyer interest,” said Canaccord.

“At 225ppm, it is not high-grade but cash flow is more important than grade, and with AISC of US$38.1/lb, it is highly economic under our long-term US$75/lb U3O8 price deck.”

Deep Yellow (ASX:DYL) +48%

DYL is led by John Borshoff, a veteran best known for his stewardship of the above-mentioned Paladin Energy in the last uranium boom.

It hopes to reach an FID on the Tumas project in Namibia mid-2024 ahead of production in 2026, with the Mulga Rock project in WA targeting production by 2028.

September Big Cap Bumblers

Leo Lithium (ASX:LLL) -56%

The emerging producer continues to feel the fallout from the Mali Government’s decision to halt direct shipping ore (DSO) exports from its 211Mt Goulamina lithium development JV with Ganfeng.

While the company said this doesn’t delay any aspect of the main spodumene project, investors – already rattled by a series of calamitous project failures and coups across the continent – bailed in droves.

The company also sold Ganfeng an additional 5% stake in the project, which tipped the scales – the Chinese lithium major now holds 55%, LLL 45%.

LLL entered another trading halt late in the month “pending an announcement in relation to correspondence from the government of Mali”.

It is now suspended by the ASX “following a failure to respond to ASX queries adequately”.

Chalice Mining (ASX:CHN) -55%

A frightful month for the former market darling.

Chalice was shanked in the guts (and then slowly bled out) after its Gonneville scoping study was accused of using over-optimistic price assumptions, including a palladium price of US$2000/oz that came in at almost double spot rates.

Neighbouring explorers who had entwined their fortunes to the monster development were also punished.

September Small Cap Top 4

Torque Metals (ASX:TOR) +180%

In September the explorer announced plans to buy a collection of gold, nickel and lithium-rich tenements near its Paris gold camp in the Goldfields.

This includes New Dawn, an untapped lithium and tantalum occurrence just 600m along strike of the established 26.5Mt at 1% Li2O spodumene Bald Hill lithium and tantalum mine.

TOR has an option to acquire 100% of the project, which occupies two pre-native title and granted mining licences, providing ability to fast-track any potential discovery into development.

The news lit a rocket under the stock, partly because – by some stroke of luck – this all happened as mining giants MinRes and Glencore were in a takeover tussle for Bald Hill itself.

OzAurum Resources (ASX:OZM) +133%

A sniff of Sigma-like success has early-stage lithium explorers flooding Minas Gerais and other mining-friendly Brazilian hotspots.

OZM’s deal announced last month was a game changer, with the stock soaring 130% on volume thanks to “a +7m wide spodumene zone with an average grade of spodumene crystals of 6.94% LiO2” at the Jaime Linopolos project.

Aurora Energy Metals (ASX:1AE) +117% and Cauldron Energy (ASX:CXU) +114%

Two juniors set to ride a potential uranium price wave.

1AE’s namesake project in the US has one of the country’s largest uranium deposits — 107.3Mt @ 214ppm U3O8 for 50.6Mlb U3O8.

More drilling, assay results and met test work will culminate in a scoping/pre-feasibility study on the uranium deposit sometime this year.

When the WA state government implemented a ban on most new uranium mines in 2017, CXU stopped work at its flagship ‘Yanrey’ uranium project and began searching for other dirt to play with.

But it never really got over the yellowcake fever. With uranium sentiment on the up it has been poking around Yanrey again, already one of WA’s largest deposits.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.