MoneyTalks: Namibian energy players Pancontinental and Bannerman get lots of love from brokers

Pancontinental Enegy could be on the verge of big things, says broker. Picture Getty

- Namibian oil explorer Pancontinental Enegy could be on the verge of big things, says broker

- Namibian uranium stock Bannerman also got big price target

Pancontinental could double on Namibian offshore drill

Broker Euroz Hartleys has initiated a coverage on Pancontinental Energy (ASX:PCL), with a ‘Speculative Buy’ recommendation and a price target of 4c (versus current price of 1.9c at time of writing).

Pancontinental is gearing up to participate in drilling in offshore Namibia – one of the largest untested prospective oil structures on the planet.

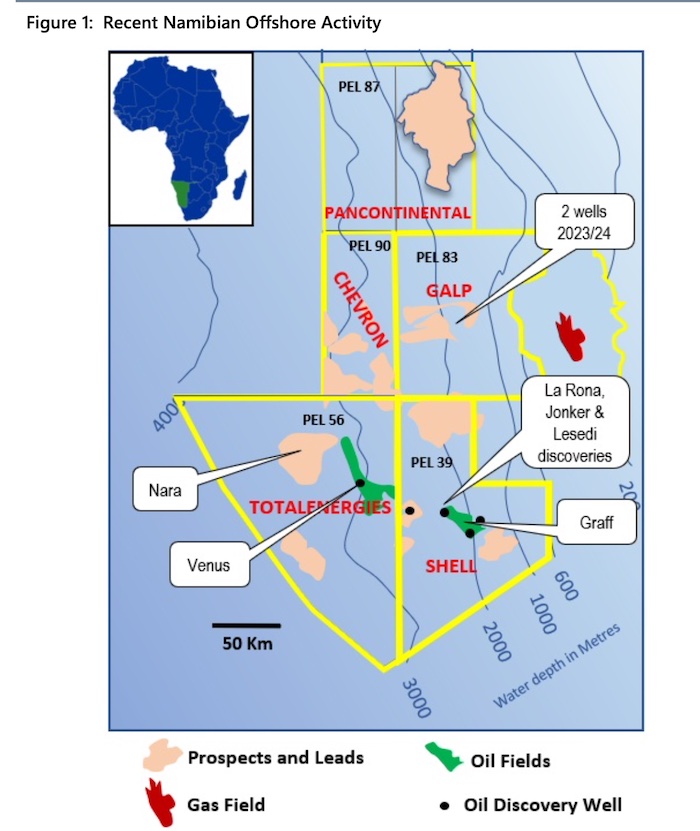

In December 2017, the company signed a petroleum agreement with the Namibian government and partners for the PEL 87 licence in the Orange Basin, offshore Namibia.

The PEL 87 permit is a large, 10,947km2 area, offshore deepwater block covering water depths of between 500-3,200m.

There has been no significant discoveries in the Namibian offshore Orange Basin for a number of decades. However that all changed in 2022 with with the discovery of the Venus and Graff oil discoveries in the Basin (>2km water depth).

According to top Namibian petroleum officials, Shell and TotalEnergies have discovered at least 11 billion barrels of light oil and up to 8.7 trillion cubic feet of associated gas in the Orange Basin over the last 18 months – which they state are ‘conservative’ estimates.

Namibian state-owned NAMCOR recently commissioned Wood Mackenzie to carry out an independent assessment of resources discovered, calculating 5.1 billion barrels of oil in place for Venus – making it the largest discovery offshore Namibia to date.

Maggy Shino, petroleum commissioner at Namibia’s Ministry of Mines & Energy, stated at the recent Namibia Oil & Gas Conference that recoverable reserves at Venus could be at least 2 billion barrels.

Although data has been difficult to find due to the limited information released from the major players, upon flow testing results, a Shell spokesperson stated that oil reportedly flowed ”like a train”.

Shell has since followed up with three additional discoveries, at LaRona, Jonker and most recently Lesedi; planning up to eight further wells. TotalEnergies is currently testing Venus-1X and drilling a possible vast extension at Nara-1X.

The PEL 87 block (see map) meanwhile lies on trend of these significant recent oil discoveries.

In March this year, Pancontinental announced that Woodside Energy (WDS.ASX) had entered into an Option Deed with Pancontinental earning an option to acquire a 56% participating interest in PEL 87.

Under the deal, Woodside will fully fund the US$35m+ 3D seismic survey for the Saturn prospect/drilling in PEL 87.

Although early in the E&P cycle, Euroz says that the Saturn prospect/drilling in PEL 87 has the potential to discover a world-class scale field.

“This is due to the size of the complex, the premier location with nearby recent supergiant discoveries, and a solid partner in Woodside looking to farm-in,” said Euroz.

“As a current valuation, we look to FAR (ASX:FAR), Invictus Energy (ASX:IVZ) and 88E Energy (ASX:88E) as companies which all achieved market caps of ~$250 million prior to drilling results for potential giant discoveries.”

Nambian uranium play Bannerman gets big price target

Canaccord Genuity has a ‘Speculative Buy’ rating on uranium stock Bannerman Energy (ASX:BMN), another Namibia play, with a price target of $3.33 (versus current price of $2.47 at time of writing).

Bannerman is developing the 95%-owned 3.5Mlb/y Etango Uranium project in the prolific Erongo Region of Namibia, 50km NW of Paladin Energy’s (ASX:PDN) proven large-scale Langer Heinrich Mine.

The Etango-8 Project is also located 37km east of Swakopmund and 67km northeast of the deep-water port of Walvis Bay.

The deposit is a large and shallow uranium deposit, which is amenable to bulk open pit mining, followed by crushing, heap leaching, ion exchange, nano filtration and uranium recovery.

The site has good access, with a main road that services the Langer Heinrich Mine and well equipped for mining services.

The majority of the power supply will be sourced from the Namibian power grid (NamPower), with approximately 30% of power requirements sourced from solar generated by independent producers.

Being a desert location, water supply is critical, and the DFS assumes water supply via overland pipeline from the Erongo Desalination Plant.

And with over 35 years of uranium exports, the deep-water harbour at Walvis Bay is a fully equipped and permitted export terminal, where access via road and rail from Swakopmund is available.

“Etango-8 is all but shovel ready. With a mineral Resource of 207Mlbs U3O8 it is very material and is already attracting significant buyer interest,” said Canaccord.

“At 225ppm, it is not high-grade but cash flow is more important than grade, and with AISC of US$38.1/lb, it is highly economic under our long-term US$75/lb U3O8 price deck.”

BMN is currently working through its FEED process to ensure that all technical requirements have been met and that cost estimates remain refreshed.

“That said, based on our interactions with the company, it appears that material changes to the 2022 DFS are not expected,” says Canaccord.

“Under a US$65/lb price scenario, economic outcomes include a NPV8% (post tax) of US$209m, IRR of 17% and project net cash flow (post tax) of US$695m; at US$80/lb the project NPV more than doubles.”

Canaccord also says the uranium market is starting to see the first wave of mine restarts, but it is confronted by a ~30Mlb deficit, which the broker expects to grow as overfeeding increases.

“Etango-8, located in a Western and uranium friendly jurisdiction which is large and all but shovel ready, is extremely well-placed, in our view, to capitalise on this market setup,” says the note out of Canaccord.

Share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.