Who Made The Gains? Here are May’s top 50 miners and explorers

Pic: Getty

Investors – where to put your money when everything looks so bloody good?

Iron ore touched $200/t once again to close out a volatile month in positive territory.

Gold bounced back to record its biggest month-on-month gain since July last year.

Poor cousin silver and the platinum group elements – platinum, palladium, rhodium – weren’t far behind.

Red hot base metals nickel (+1.6%), copper (+2.5%), lead (+0.65%), zinc (+2.83%) and tin (+3%) got hotter.

Meanwhile, battery metals like lithium, cobalt and graphite continued their resurgence.

It’s hard to argue against experts who say we are in the midst of a ‘commodities super cycle’. So, what were the top 50 resources winners for May searching for?

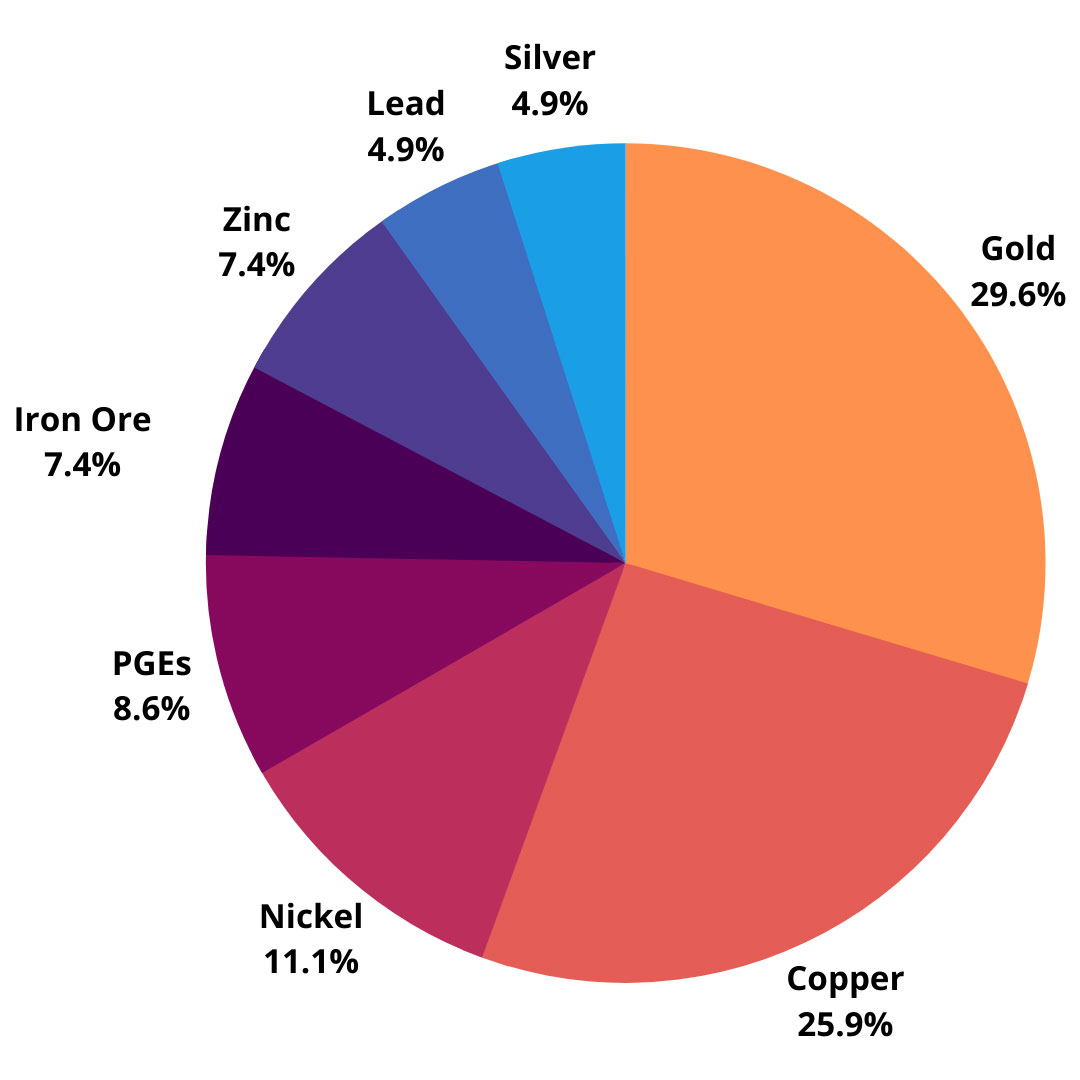

Mostly gold and copper, but with a healthy amount of everything else, sans battery metals (don’t worry, there’s always next month).

Here are the top 50 ASX resources stocks for the month of May >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | PRICE | MONTHLY RETURN % | MARKET CAP |

|---|---|---|---|---|

| MDX | Mindax | 0.072 | 2300 | $ 115,515,825.60 |

| CPN | Caspin Resources | 2.72 | 306 | $ 148,978,366.56 |

| CAP | Carpentaria Resources | 0.14 | 186 | $ 73,739,799.98 |

| BPM | BPM Minerals | 0.515 | 134 | $ 14,321,250.00 |

| 4CE | Force Commodities | 0.035 | 133 | $ 37,699,331.75 |

| GBR | Great Boulder Resources | 0.12 | 131 | $ 45,807,831.03 |

| HLX | Helix Resources | 0.036 | 125 | $ 51,435,357.60 |

| CLZ | Classic Minerals | 0.002 | 100 | $ 40,221,264.37 |

| ASQ | Australian Silica | 0.18 | 98 | $ 38,859,088.24 |

| VAR | Variscan Mines | 0.061 | 91 | $ 13,204,885.49 |

| ODY | Odyssey Gold | 0.14 | 84 | $ 61,091,611.43 |

| TKL | Traka Resources | 0.031 | 82 | $ 15,700,417.11 |

| TAR | Taruga Minerals | 0.1 | 82 | $ 53,075,033.13 |

| RDS | Redstone Resources | 0.02 | 82 | $ 12,222,984.07 |

| BUX | Buxton Resources | 0.125 | 76 | $ 15,646,374.68 |

| CVV | Caravel Minerals | 0.515 | 69 | $ 194,679,471.28 |

| LOT | Lotus Resources | 0.2 | 67 | $ 195,291,549.32 |

| ATR | Astron Corp | 0.57 | 61 | $ 70,424,319.85 |

| LCD | Latitude Consolidated | 0.073 | 59 | $ 62,172,278.57 |

| TLM | Talisman Mining | 0.22 | 57 | $ 41,058,244.70 |

| SLZ | Sultan Resources | 0.28 | 56 | $ 18,426,613.09 |

| MSR | Manas Resources | 0.01 | 54 | $ 24,842,462.38 |

| POD | Podium Minerals | 0.545 | 54 | $ 180,834,574.89 |

| MTC | MetalsTech | 0.19 | 52 | $ 26,148,998.46 |

| CR1 | Constellation Resources | 0.47 | 52 | $ 13,613,173.58 |

| PBX | Pacific Bauxite | 0.003 | 50 | $ 1,189,842.10 |

| SVL | Silver Mines | 0.33 | 47 | $ 351,308,176.33 |

| VRC | Volt Resources | 0.033 | 43 | $ 80,931,155.43 |

| ACS | Accent Resources | 0.05 | 43 | $ 23,301,364.15 |

| IVR | Investigator Resources | 0.12 | 43 | $ 139,014,393.74 |

| LTR | Liontown Resources | 0.555 | 42 | $ 909,554,990.50 |

| HGO | Hillgrove Resources | 0.069 | 41 | $ 62,776,948.53 |

| PF1 | Pathfinder Resources | 0.335 | 40 | $ 16,160,361.75 |

| AIS | Aeris Resources | 0.16 | 39 | $ 326,304,320.94 |

| PEX | Peel Mining | 0.33 | 38 | $ 135,881,771.03 |

| VXR | Venturex Resources | 0.785 | 37 | $ 357,095,628.96 |

| STM | Sunstone Metals | 0.019 | 36 | $ 41,989,765.27 |

| CAZ | Cazaly Resources | 0.062 | 35 | $ 22,912,922.55 |

| MZZ | Matador Mining | 0.49 | 34 | $ 84,229,588.32 |

| DM1 | Desert Metals | 0.715 | 34 | $ 24,500,000.00 |

| ALY | Alchemy Resources | 0.02 | 33 | $ 12,772,625.61 |

| ERW | Errawarra Resources | 0.25 | 32 | $ 7,641,135.90 |

| RSG | Resolute Mining | 0.61 | 31 | $ 645,777,233.01 |

| BKT | Black Rock Mining | 0.19 | 31 | $ 125,348,075.65 |

| ALK | Alkane Resources | 0.93 | 30 | $ 523,942,144.00 |

| E25 | Element 25 | 2.48 | 30 | $ 358,584,789.29 |

| TIE | Tietto Minerals | 0.37 | 30 | $ 164,226,764.16 |

| ACP | Audalia Resources | 0.035 | 30 | $ 34,606,809.55 |

| VMS | Venture Minerals | 0.11 | 29 | $ 145,659,721.13 |

| PEK | Peak Resources | 0.115 | 29 | $ 169,186,300.29 |

There’s nothin’ like nearology

In April, Rumble Resources (ASX:RTR) gained 500% after hitting the zinc-lead motherlode at ‘Chinook’, part of the Earaheedy project in WA.

It didn’t take long for the ‘nearologists’ – stocks that pick up ground near a major discovery – to benefit.

Recent IPO BPM (ASX:BPM) gained 134% after picking up three projects next to Rumble.

The projects – Hawkins, Ivan Well and Rhodes – cover the same rock layer ‘target zone’ as Chinook, BPM says.

Importantly, the ground was pegged prior to the recent Rumble discovery, “delivering a first mover advantage with all surrounding ground now fully pegged”.

Great Boulder Resources (ASX:GBR) raised $5.5m to explore the Whiteheads (gold, nickel) and Side Well (gold) projects, as well as the ‘Wellington’ acquisition near Rumble in the Earaheedy Basin.

Special mention goes to hard-working tiddler Variscan Mines (ASX:VAR) which — on the same day market darling Rumble launched a new drilling campaign – re-rated on a big discovery at its Novales lead-zinc project in Spain.

Nearologists also continue to dine out on Chalice Mining’s (ASX:CHN) Julimar discovery.

Before Chalice came crashing in, tearing up the rulebook, companies had only really explored and mined the area for bauxite and mineral sands.

It was not a known nickel-copper-PGE province at all. This is true frontier exploration, despite being less than an hour from Perth.

In May, standout explorers included Caspin Resources (ASX:CPN) (+306%), Liontown Resources (ASX:LTR) (+42%) and Venture Minerals (ASX:VMS) (+29%) – although Liontown (lithium) and Venture (iron ore, tin) have other very attractive irons in the fire to explain their gains.

Special mention goes to Errawarra Resources (ASX:ERW) which is hunting ‘Julimar style’ deposits at its Errabiddy project in WA’s Mid-West.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.