Who made the gains? Here are June’s top 50 small cap miners and explorers

Pic: Tyler Stableford / Stone via Getty Images

Base metals recovered this month, with nickel the standout performer for the year so far. Battery metals plays suffered as cobalt languished, and lithium and vanadium prices continued to soften across the board.

Rare earths prices were robust in response to global macroeconomic issues (aka pesky trade wars), while ongoing supply issues saw iron ore prices hit five-year highs near the end of the month.

- Scroll down for June’s Top 5 >>>

But gold is a clear winner this month. On June 19, gold breached the psychologically significant $2000/oz mark for the very first time.

And many analysts reckon there’s a good chance it will keep going.

Investors responded by piling into gold-focused miners and explorers in record numbers.

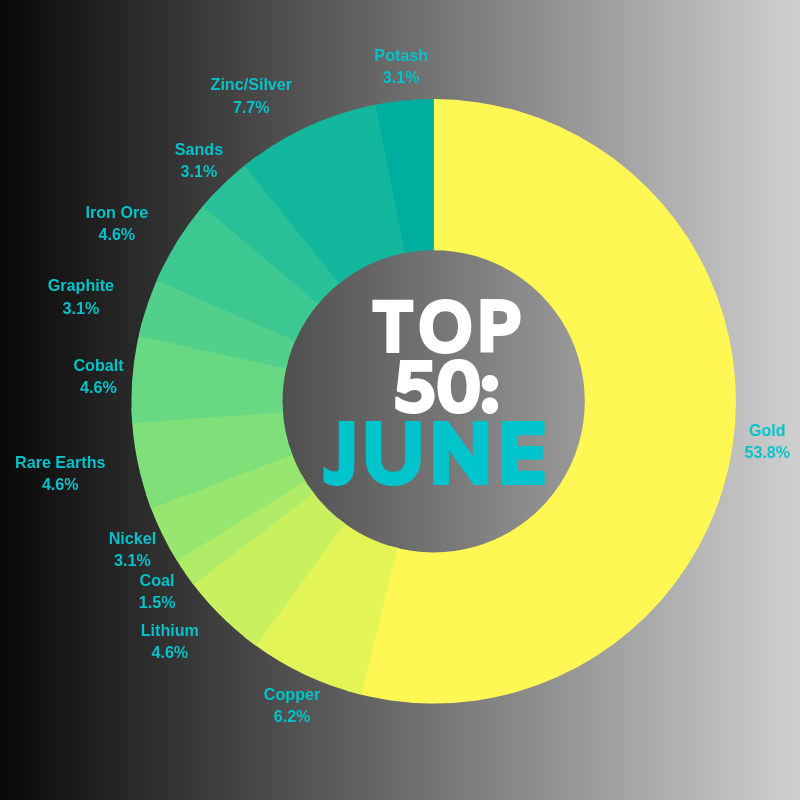

In May, 23.2 per cent of our top 50 movers had gold exposure; in June that had jumped to 53.8 per cent:

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

OUR JUNE TOP 5

#1 Marquee Resources (ASX:MQR) +198%

Marquee Resources was a stock in demand when it announced an acquisition in the lithium-rich Centenario Salar region of northern Argentina.

As part of the deal the shareholders of the target company — Centenario Lithium — had agreed to tip in no less than $500,000 in a capital raise at 10c per share; a significant premium to MQR’s last traded price.

Marquee followed up days later with a rare earths acquisition in WA – just a figurative stone’s throw from Lynas’ Mt Weld project.

#2 Hylea Metals (ASX:HCO) +181%

There’s a lot of buzz around uranium right now.

It hasn’t taken off yet, but industry watchers are optimistic that a shortage of projects and rising demand is setting the uranium industry up for a biiiig run.

So it’s no real surprise that Hylea Metals caught a rocket after announcing the acquisition of Paladin Energy’s (ASX:PDN) stake in the Kayelekera uranium mine in Malawi for $10m.

Managing director Simon Andrew said it was an “excellent opportunity” for Hylea.

“Kayelekera is a world class uranium asset that has produced over 10.9 [million pounds] of uranium and represents an opportunity to use the past production information to re-engineer certain mining and processing processes in order to reduce the overall capex and opex of the operations,” he says.

“We are optimistic about the global uranium market and the outlook for firmer pricing.”

#3 Bligh Resources (ASX:BGH) +108%

On June 14, $2.85 billion market cap gold miner Saracen (ASX:SAR) announced an off-market takeover bid for micro-cap WA gold explorer Bligh Resources.

The all-share deal valued Bligh at $38.2m, or 12.8c per share – a 97 per cent premium to Bligh’s last closing share price of 6.5c.

Saracen had offered Bligh the low, low price of $8.5m in February 2017, an offer that the explorer initially accepted. This deal would’ve valued to stock at 3.8c per share.

By April that year the offer was increased to $9m, which Saracen called its “last and final offer”. Obviously not.

The deal failed due to a savvy move by then 20 per cent shareholder Zeta Resources (ASX:ZER), which made a successful takeover bid of its own for the company. This time though, Bligh directors and Zeta Resources have indicated they will accept the offer.

#4 Equus Mining (ASX:EQE) +100%

Gold and base metals explorer Equus Mining has executed a non-binding deal with TSX-listed Mandalay Resources to acquire all the mining properties, resources, and mine infrastructure at the Cerro Bayo project in Southern Chile.

The explorer called it a “transformational deal”.

“[It has] the potential to transform Equus, at very low cost, into an advanced brownfields exploration company holding the permitted rights to explore a +350 sq km land package in a proven highly prospective district,” the company said.

“Subject to successful exploration results, the company will then be well positioned to transition to production by virtue of the Cerro Bayo mine infrastructure and processing plant.”

#5 Legacy Iron Ore (ASX:LCY) +100%

Legacy Iron Ore does technically own an iron ore project, but it’s all about the nickel nearology right now.

In June, the company kicked off drilling at its Mt Bevan project in WA, which is immediately south of St George Mining’s (ASX:SGQ) Mt Alexander Project.

St George is having significant success identifying massive nickel-copper sulphide mineralisation at Cathedrals, Stricklands and Investigators prospects.

And here are the top 50 mining small caps for the month of June:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Ticker | Name | Price 31 May | Price 30 June | Return | Market Cap |

|---|---|---|---|---|---|

| MQR | MARQUEE RESOURCES | 0.042 | 0.125 | 198 | $4,701,871.00 |

| HCO | HYLEA METALS | 0.016 | 0.045 | 181 | $4,606,403.00 |

| BGH | BLIGH RESOURCES | 0.065 | 0.135 | 108 | $37,753,572.00 |

| EQE | EQUUS MINING | 0.005 | 0.010 | 100 | $8,972,769.00 |

| LCY | LEGACY IRON ORE | 0.002 | 0.004 | 100 | $7,341,321.00 |

| KGM | KALNORTH GOLD MINES | 0.004 | 0.008 | 100 | $5,365,440.50 |

| AHN | ATHENA RESOURCES | 0.013 | 0.025 | 92 | $6,773,773.00 |

| BCB | BOWEN COKING COAL | 0.026 | 0.050 | 92 | $30,369,794.00 |

| ORM | ORION METALS | 0.008 | 0.015 | 87 | $7,171,461.50 |

| AHK | ARK MINES | 0.007 | 0.013 | 86 | $664,683.63 |

| FMS | FLINDERS MINES | 0.034 | 0.063 | 85 | $230,021,232.00 |

| HGM | HIGH GRADE METALS | 0.004 | 0.007 | 75 | $3,170,565.00 |

| DAF | DISCOVERY AFRICA | 0.007 | 0.012 | 71 | $2,551,285.75 |

| PDI | PREDICTIVE DISCOVERY | 0.009 | 0.015 | 67 | $4,131,989.00 |

| KGD | KULA GOLD | 0.026 | 0.043 | 65 | $2,528,167.00 |

| GPR | GEOPACIFIC RESOURCES | 0.013 | 0.021 | 62 | $57,580,048.00 |

| BLK | BLACKHAM RESOURCES | 0.007 | 0.011 | 57 | $41,287,756.00 |

| VRX | VRX SILICA | 0.058 | 0.089 | 53 | $38,814,588.00 |

| ERM | EMMERSON RESOURCES | 0.073 | 0.110 | 51 | $44,609,656.00 |

| ADN | ANDROMEDA METALS | 0.010 | 0.015 | 50 | $20,332,488.00 |

| QGL | QUANTUM GRAPHITE | 0.002 | 0.003 | 50 | $15,321,162.00 |

| RNX | RENEGADE EXPLORATION | 0.002 | 0.003 | 50 | $2,137,880.00 |

| AVW | AVIRA RESOURCES | 0.002 | 0.003 | 50 | $3,000,000.00 |

| MML | MEDUSA MINING | 0.395 | 0.575 | 46 | $127,793,496.00 |

| MSE | METALSEARCH | 0.005 | 0.007 | 40 | $3,366,371.00 |

| NVA | NOVA MINERALS | 0.015 | 0.021 | 40 | $16,256,817.00 |

| OKR | OKAPI RESOURCES | 0.130 | 0.180 | 38 | $6,181,716.00 |

| BCN | BEACON MINERALS | 0.021 | 0.029 | 38 | $75,383,600.00 |

| ARM | AURORA MINERALS | 0.008 | 0.011 | 37 | $1,405,599.38 |

| GTR | GTI RESOURCES | 0.012 | 0.016 | 33 | $2,767,908.25 |

| PNX | PNX METALS | 0.006 | 0.008 | 33 | $17,047,016.00 |

| OVL | ORO VERDE | 0.002 | 0.002 | 33 | $3,111,357.00 |

| MZZ | MATADOR MINING LIMITED | 0.210 | 0.280 | 33 | $22,134,666.00 |

| SVL | SILVER MINES | 0.039 | 0.052 | 33 | $35,598,212.00 |

| PSC | PROSPECT RESOURCES | 0.170 | 0.225 | 32 | $53,089,144.00 |

| GMN | GOLD MOUNTAIN | 0.050 | 0.066 | 32 | $34,082,424.00 |

| ZNC | ZENITH MINERALS | 0.061 | 0.080 | 31 | $17,020,970.00 |

| AOP | APOLLO CONSOLIDATED | 0.180 | 0.235 | 31 | $54,261,752.00 |

| ALK | ALKANE RESOURCES | 0.350 | 0.455 | 30 | $215,090,896.00 |

| SO4 | SALT LAKE POTASH | 0.555 | 0.720 | 30 | $183,853,392.00 |

| NML | NAVARRE MINERALS | 0.065 | 0.084 | 29 | $32,625,768.00 |

| RED | RED 5 | 0.140 | 0.180 | 29 | $211,338,384.00 |

| STN | SATURN METALS | 0.235 | 0.300 | 28 | $18,456,430.00 |

| RXL | ROX RESOURCES | 0.011 | 0.014 | 27 | $18,077,928.00 |

| RFR | RAFAELLA RESOURCES | 0.130 | 0.165 | 27 | $5,326,125.00 |

| TBR | TRIBUNE RESOURCES | 4.300 | 5.450 | 27 | $315,812,192.00 |

| LEX | LEFROY EXPLORATION | 0.175 | 0.220 | 26 | $17,513,878.00 |

| APC | AUSTRALIAN POTASH | 0.076 | 0.095 | 25 | $34,684,588.00 |

| HRN | HORIZON GOLD LIMITED | 0.140 | 0.175 | 25 | $13,392,858.00 |

| SVM | SOVEREIGN METALS | 0.096 | 0.120 | 25 | $44,909,208.00 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.