The Explorers: Vimy Resources’ Mike Young on the near-term catalysts that could set the stock alight

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with Vimy Resources boss, Mike Young.

Advanced WA uranium explorer Vimy wants its shovel-ready Mulga Rock project up and running in 2022 to take advantage of a predicted uranium price surge.

But first it needs to lock down some big offtake and financing deals, which Mike Young – as founding managing director of iron ore upstart BC Iron – knows a lot about.

Here’s what Young told us about the debacle that is Section 232 (you can read more about that here) and the near-term catalysts that could put a rocket under the Vimy share price.

What’s your background?

“All through the 1990s I was a consultant geologist doing resource estimation and feasibility studies across just about every commodity.”

“Then in 2006, the beginning of the iron ore boom, I joined a start-up iron ore company called BC Iron. We listed that company in December 2006; I was the only employee. In January 2007 I was up in the Pilbara putting drill hole pegs into the ground, and by April we were drilling.”

“Four years later we were exporting iron ore out of Port Hedland. We achieved that by doing a deal with [iron ore major] Fortescue Metals Group (FMG), who had deposits close to ours.”

“FMG got half of our deposit for $9m, and in exchange for that we got access to their infrastructure. I copped a lot a lot of criticism from the mining community for that deal, but my thesis was that 50 per cent of something is better than 100 per cent of nothing.”

“That was proven when a lot of other iron ore hopefuls just couldn’t get off the ground. It didn’t matter how good the grades were; if these companies didn’t have port access, or a way of getting their ore to port, then they were stranded.”

“BC Iron was a $650m company by the time I left [in 2013]. I left because we weren’t really developing any other deposits. Frankly, I just got bored. I took some time off, and then the Vimy oppotunity came up in 2014.”

Your Mulga Rock project in Western Australia is essentially shovel ready — you just need to tick a few regulatory boxes, score offtake and financing.

“We completed a definitive feasibility study on Mulga in January 2018. That deposit has a $530m NPV at a $US60/lb price. We have state and federal approvals; we are working through the secondary approvals now.”

“It will take us the rest of 2019 to secure contracts, then we will be moving into financial investment decision ahead of a two-year build at Mulga. We plan to deliver first uranium in 2022.”

How are the contract talks going?

“We need $US55/lb contracts [from US utilities]. In the US, we know we can sell all our offtake for the right price. When we do have discussions on price we aren’t laughed out of the room. They have basically said that when Section 232 gets resolved we’ll have a chat, which is encouraging for us.”

“In 2021/2022 the US utilities – which is about 30 per cent of the global market – go from 66 per cent contract coverage to about 36 per cent contract coverage in about one year. That means they don’t have contracted uranium in the early 2020s.”

“These utilities have to plan three years in advance. But because we have had 18 months of Section 232 uncertainty, the utilities have been unable to write contracts. They are heading to a point where they are going to need to.”

“The US utilities manage their contracts through something called ‘portfolio management’. They will baseload these contracts with the big guys like Cameco and Orano, and then diversify the rest. They want to diversify country risk and company risk, which means they have space in their contract portfolios for juniors.”

“There is enough open requirement for a company like Vimy.”

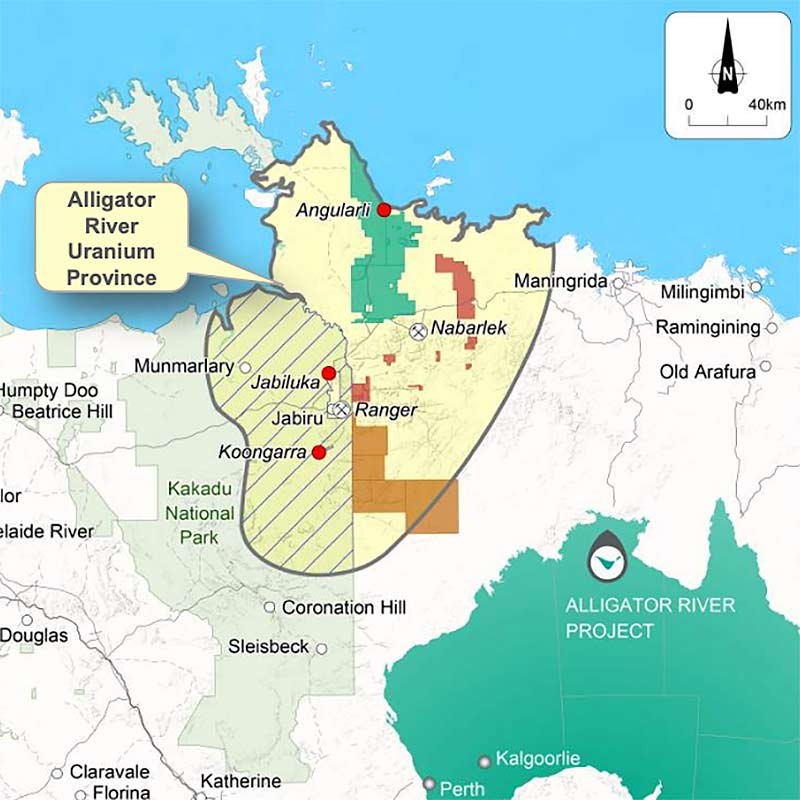

Is the early stage Alligator River project in the Northern Territory good enough to make money in the current pricing environment?

“Angularli [deposit] is sitting at 25 million pounds at 1.3 per cent — so it’s the grade that makes it attractive. It’s quite small, about 280m long, so you would mine that in about 14 months and then treat stockpiles for about 9 years.”

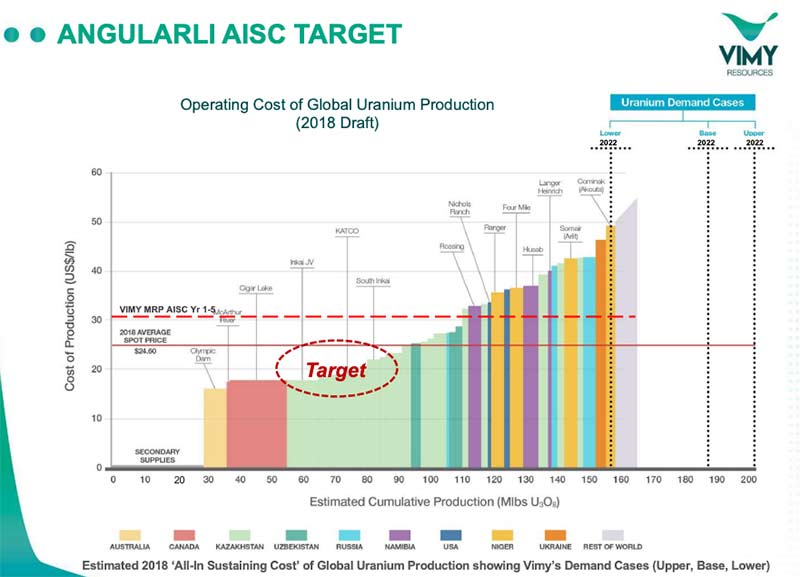

“That would be small, very lucrative underground mine. We can’t produce any guidance on operating costs at this stage, but as an aspirational statement we can say we expect to be in the first quartile of the cost curve [the cheap end], around the low $US20s.”

Being in the first quartile is a big deal.

“It is — and that’s why we are excited about the Alligator River province, which is geologically identical to the Athabasca Basin [major uranium province in Canada], with fewer geotechnical issues.”

“When you look at the geology, the mineralisation, and alteration its identical. We have two targets that are high grade MacArthur River lookalikes, and two which look like Jabiluka and Ranger, which are low cost deposits in the Northern Territory.”

“What we want to double the resource at Angularli before we advance it. With the amount of work that needs to be done that mine could come into production in the mid 2020s.”

And we’ve barely scratched the surface at Alligator Creek. When I look at that entire tenement package that we have it really excites me. The potential just stirs the inner geologist in me. We are really looking forward to the upcoming field season.”

Are uranium spot prices a good indicator of pricing trends?

“Whenever I write the words ‘spot price’ I put them in quotations, because it isn’t really a spot market.”

“A spot market in nickel or copper, for example, is where metals are traded through a clearing house, like the LME, in an open market. Every transaction informs spot prices. In uranium it’s different because there’s nothing governing the market.”

“During the 2007 price spike, traders started to get into the market. So when you see volumes recorded on the spot market it actually includes churn. If a single pound of uranium is traded seven times, then that is called seven pounds on the spot market.”

“We recently saw the spot price rise to over $US30/lb and then fall again. But that did not reflect what is going on in the contract market at all. In fact, no utilities have been writing new contracts because of Section 232.”

“That increase was driven by speculative traders who believed that [major producer] Cameco’s requirements for material was going to drive the spot price up. A whole bunch of arbitrage traders piled in. That price increase was churn; one trader selling to another as the price went up.”

“Then everyone realised that there was no one on the buy side. None of the utilities are writing contracts. And when you have sellers but no buyers the price goes down again.”

Would you say higher uranium prices are inevitable?

“If the price isn’t in the mid $US50/lb by 2022 then the world is going to run out of uranium. At today’s ‘spot price’ two-thirds of world production is unprofitable on an all-in sustaining cost basis. I’m not even talking about making a profit.”

“That’s why the thesis is that if the price doesn’t go up, if the contracts being written aren’t high enough to sustain production, then production stops.”

What are some catalysts that could give your share price a boost in the near future?

“The first one is Section 232. There are two outcomes – good and better. What we are going see off the back of 232 is contracting returning and a corresponding uplift in the ‘spot price’ – or the arbitrage floor price — which drives sentiment. Hate it or love it, the spot price drives sentiment.”

“The second one hasn’t really resonated but will be important. The World Nuclear Association (WNA) is bringing out the biennial fuel report in September. I believe it’s going to show is that there will be a structural shortage of uranium in the next few years.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“People say, ‘but major producers will just ramp up production and flood the market!’ No, they won’t. They want the price to be higher, which means the shortfall can be made up by the higher cost, lower margin producers like us.

“That will be a significant catalyst – analysts are going to look at the report and go ‘oh my god, Mike was right!’”

“The third catalyst for us will be exploration at Alligator River. We are doing groundwork and sampling on two of our deposits called Southern Flank and Condor, which are Jabiluka/ Ranger lookalikes. Then we will do some follow-up drilling on some really good targets at Such Wow and Angularli.”

“Then later in the year my expectation is that we will be negotiating contracts for Mulga.”

Such Wow?

“Don’t get me started. It comes from the Doge meme and was named by someone before me. I would’ve named it after a bicycle.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.