Who made the gains? Here are April’s top 50 small cap miners and explorers

Pic: John W Banagan / Stone via Getty Images

Again, it was a mixed bag for metals prices last month, but floating about on the peripheries was was a general sense of positivity — like investors are expecting good things to happen.

Citi, a New York-based investment bank, is calling it “Springtime for Commodities”.

(We know it’s coming into winter over here, but calling it ‘Autumn for Commodities’ doesn’t really work thematically)

Anyway, Citi says:

“While 2018 was a difficult year for commodities, 2019 is looking to be structurally more constructive and it is now a fortuitous time to adopt a commodities portfolio and its strong returns in 2019.

“Now that the March quarter is over, much of the fog hanging over the market has lifted.

“There is now significant optimism over the outcome of the US and China trade talks and the impact of Chinese fiscal and investment policies.”

Commodity Focus

Lithium spodumene producers reported lower prices for the March quarter, but it was a different story for cobalt. Prices trended upwards for the first time in a long time, with many calling it a turning point for the much maligned battery metal.

Vanadium softened slightly from March. Mastermines had the Chinese spot price for 98% flake at $US12.32/lb, which is still a profitable level for incoming producers.

And while base metals and gold fell back last month, the overall trend for 2019 is still upwards. And for nickel and copper especially, the outlook is bullish.

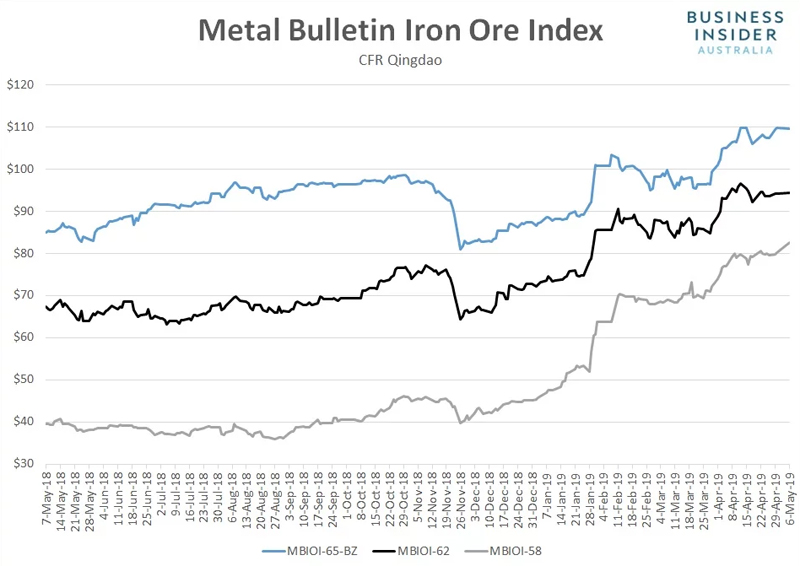

But the standout performer was iron ore, with prices for the benchmark 62% product reaching $US93.65/ tonne at the end of the month.

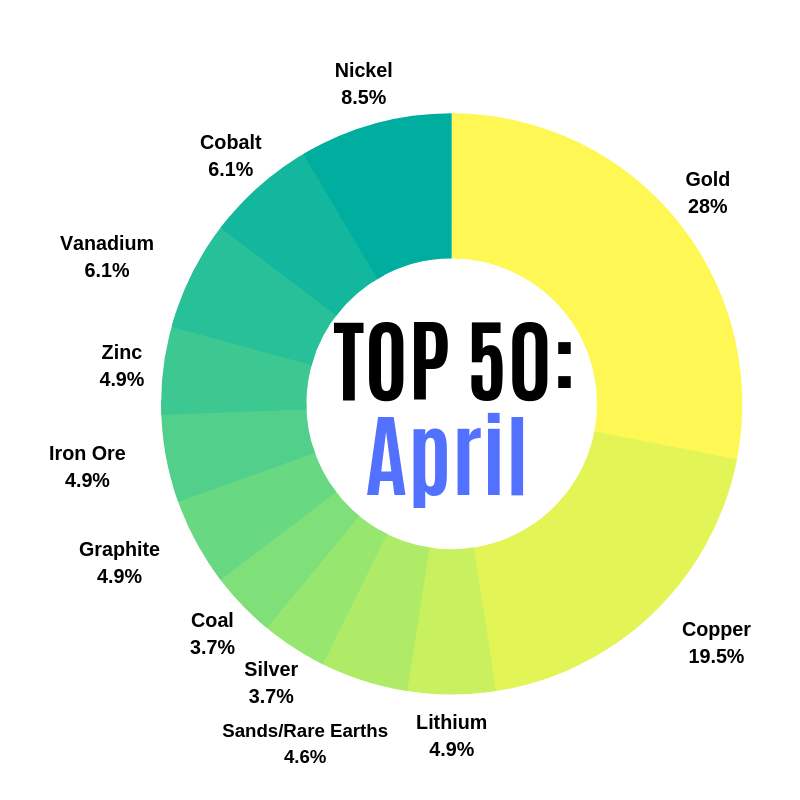

Our top 50 mining stocks for April are, once again, dominated by gold.

But stocks in our top 50 with a copper focus are closing ground fast, and it was iron ore, vanadium and nickel plays which made the biggest moves into our top 50.

TOP 50 HIGHLIGHTS

Walkabout Resources (ASX:WKT) is developing the high-grade Lindi graphite project in South East Tanzania to take advantage of forecast demand for large and jumbo flake graphite.

On April 11, Walkabout locked in its third sales deal in two weeks, sending the stock up 65 per cent for the month, and 206 per cent over the past 12 months.

The company told investors that it had signed a binding sales, purchase and marketing agreement with international commodities trading house Wogen Pacific, two days after announcing its second offtake deal for a quarter of its planned production.

That upward trajectory continued into May as the company moves ahead with procurement, manufacturing and siteworks while project funding is being finalised.

Tungsten play King Island Scheelite (ASX:KIS) caught a rocket when it signed an offtake agreement, accounting for about 20 per cent of proposed annual production from its advanced Dolphin project in Tasmania.

More offtakes were “in an advanced stage of negotiations”, the company said.

“With a favourable tungsten price environment expected to persist, King Island is developing the project with the right commodity, in the right place and time.”

Copper explorer Hot Chili (ASX:HCH) is one of those interesting stocks that appears to surge on no news at all.

In April, the stock flew 77 per cent to 3.7c in a single week, with the company maintaining there was no reason for the spike. The same thing happened in February, when shares shot up 93 per cent in a week.

Here are the top 50 mining small caps for the month of April:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | 1 Month Price Change % | 1 Year Price Change % | Share Price [1/04] | Market Cap |

|---|---|---|---|---|---|

| VAL | VALOR RESOURCES | 150 | -57 | 0.006 | $11,359,154.00 |

| DRE | DREADNOUGHT RESOURCES | 100 | -40 | 0.003 | $3,328,444.75 |

| GES | GENESIS RESOURCES | 100 | -57 | 0.006 | $4,697,048.00 |

| SUH | SOUTHERN HEMISPHERE MINING | 79 | 18 | 0.059 | $5,219,699.00 |

| SRN | SUREFIRE RESOURCES | 67 | -58 | 0.005 | $2,515,768.25 |

| SI6 | SIX SIGMA METALS | 67 | -69 | 0.005 | $2,287,515.75 |

| WKT | WALKABOUT RESOURCES | 65 | 206 | 0.28 | $79,104,936.00 |

| KIS | KING ISLAND SCHEELITE | 56 | 80 | 0.085 | $22,265,094.00 |

| HCH | HOT CHILI | 52 | 0 | 0.03 | $35,609,788.00 |

| HNR | HANNANS | 50 | 0 | 0.019 | $33,795,228.00 |

| VKA | VIKING MINES | 50 | -64 | 0.016 | $4,078,332.25 |

| ARO | ASTRO RESOURCES | 50 | -33 | 0.002 | $2,544,194.75 |

| SBR | SABRE RESOURCES | 50 | -75 | 0.004 | $1,627,894.38 |

| HAV | HAVILAH RESOURCES | 50 | -19 | 0.175 | $37,102,340.00 |

| RMG | RMG | 45 | 21 | 0.017 | $10,469,703.00 |

| FND | FINDERS RESOURCES | 41 | 21 | 0.23 | $181,416,128.00 |

| MTH | MITHRIL RESOURCES | 40 | -68 | 0.006 | $2,534,335.25 |

| KP2 | KORE POTASH | 40 | -66 | 0.06 | $51,554,068.00 |

| ARD | ARGENT MINERALS | 38 | -39 | 0.016 | $8,632,982.00 |

| BDC | BARDOC GOLD | 38 | -44 | 0.064 | $73,279,344.00 |

| LNY | LANEWAY RESOURCES | 37 | 233 | 0.01 | $36,800,660.00 |

| GGG | GREENLAND MINERALS | 37 | -19 | 0.075 | $82,683,392.00 |

| GPX | GRAPHEX MINING | 37 | -7 | 0.26 | $21,833,780.00 |

| STA | STRANDLINE RESOURCES | 36 | 12 | 0.14 | $44,896,592.00 |

| LTR | LIONTOWN RESOURCES | 35 | 87 | 0.049 | $75,539,264.00 |

| AOA | AUSMON RESOURCES | 33 | -76 | 0.004 | $2,198,557.25 |

| S2R | S2 RESOURCES | 32 | -22 | 0.11 | $26,031,094.00 |

| ATU | ATRUM COAL | 32 | 291 | 0.33 | $144,987,392.00 |

| AHQ | ALLEGIANCE COAL | 31 | 71 | 0.084 | $42,937,896.00 |

| TNG | TNG | 31 | -24 | 0.11 | $105,981,416.00 |

| EUC | EUROPEAN COBALT | 30 | -62 | 0.024 | $18,280,736.00 |

| STN | SATURN METALS | 29 | 33 | 0.24 | $13,560,000.00 |

| PEK | PEAK RESOURCES | 29 | -10 | 0.037 | $29,572,468.00 |

| RVR | RED RIVER RESOURCES | 29 | -25 | 0.2 | $95,536,744.00 |

| CMM | CAPRICORN METALS | 27 | 12 | 0.085 | $70,649,608.00 |

| CZR | COZIRON RESOURCES | 27 | -50 | 0.014 | $24,997,718.00 |

| KTA | KRAKATOA RESOURCES | 27 | -37 | 0.025 | $2,937,500.00 |

| PLL | PIEDMONT LITHIUM | 27 | 3 | 0.16 | $107,260,856.00 |

| MRR | MINREX RESOURCES | 25 | -72 | 0.014 | $1,342,288.13 |

| MDX | MINDAX | 25 | -44 | 0.005 | $4,554,620.00 |

| ANL | AMANI GOLD | 25 | -80 | 0.002 | $7,380,455.00 |

| AYR | ALLOY RESOURCES | 25 | -63 | 0.003 | $4,731,233.00 |

| LPD | LEPIDICO | 24 | -7 | 0.038 | $127,534,656.00 |

| MRC | MINERAL COMMODITIES | 23 | 2 | 0.185 | $77,901,944.00 |

| AQX | ALICE QUEEN | 23 | -62 | 0.016 | $10,426,563.00 |

| LSR | LODESTAR MINERALS | 22 | -67 | 0.009 | $6,742,965.00 |

| PNL | PARINGA RESOURCES | 22 | -45 | 0.155 | $71,028,936.00 |

| CRB | CARBINE RESOURCES | 22 | 3 | 0.03 | $5,992,402.00 |

| FTZ | FERTOZ | 22 | 0 | 0.165 | $21,131,406.00 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.