Some iron ore prices have hit three-year highs ahead of Chinese holidays

Picture: Getty Images

Iron ore prices continued to push higher on Tuesday, supported by ongoing strength in Chinese steel futures.

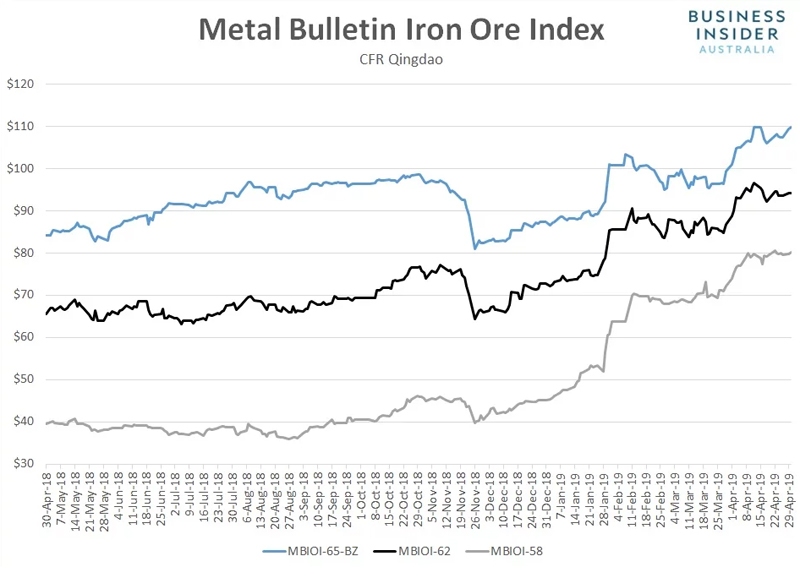

According to Metal Bulletin, the spot price for benchmark 62% fines rose 0.1% to $94.17 a tonne, outpaced by gains of 0.5% and 0.7% respectively for 65% and 58% fines which settled at $109.80 and $80.16 a tonne.

65% fines closed at the highest level since Metal Bulletin first reported pricing for this grade at the start of 2016.

The gains in spot markets mirrored similar moves in Chinese steel and bulk commodity futures during the session.

Rebar and hot-rolled coil finished at 3,828 and 3,789 yuan respectively, retaining the strong gains achieved in overnight trade on Monday.

“Seasonal demand improvement will continue to support steel prices,” Richard Lu, analyst at CRU consultancy in Beijing, told Reuters. “Construction activities typically pick up in May and June when the weather is usually favourable.”

The strength in steel markets flowed through to Dalian iron ore futures which rose to 639 yuan, up four yuan from Monday’s night session close.

“Ahead of the long holiday in China there are currently some restocking efforts,” Lu told Reuters. “[Steel] inventories continue to decline across the entire supply chain, indicating that demand remains quite good.”

Signs of firmer demand for steel and iron ore helped to offset the release of disappointing Chinese economic data with activity levels at manufacturers and non-manufacturing both improving at a slower pace than a month earlier.

Chinese markets will close for the remainder of the week for Labour Day holidays, including commodity futures. With the world’s largest consumer of iron ore offline for three days, movements in spot markets are likely to be negligible to non-existent.

As is always the case when Chinese markets take an extended break, if spot markets move we’ll report on it. If they don’t, we won’t.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. https://www.businessinsider.com.au/macquarie-commodity-forecasts-2019-1” target=”_blank” rel=”noopener”>Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.