Who made the gains? December’s top 50 resources stocks

Aldoro led resources companies in December on strong niobium sampling results at its Kameelburg project in Namibia. Pic: Getty Images

- Aldoro races ahead in the December race with a 332% gain

- Technology a winner for both MTM Critical Metals and Green Critical Minerals

- Gold plays dominate, taking 15 of the 50 positions

December 2024 has proved to be a cracker for junior resource companies, with three in the critical minerals space marking gains of more than 150%.

Niobium and rare earths explorer Aldoro Resources (ASX:ARN) leads the pack comfortably with a 332% gain for December 2024.

Surface sampling at the company’s Kameelburg project in Namibia has continued to deliver with assays confirming that the entire 262m length of Line 4 is mineralised with niobium at an average grade of 0.52% niobium oxide.

The same is true of Line 3 with 220m of the 388m length mineralised with niobium – at an average grade of 0.7%.

Diamond drilling using the company’s own equipment has also started with an initial seven holes to be drilled across the carbonatite.

Niobium is a strategic commodity in the US, Japan and EU thanks to its use in high-strength alloys, its superconducting properties and more recently in enhancing batteries.

The top 50 ASX resources stocks for December

| CODE | COMPANY | PRICE | MONTH % CHANGE | MARKET CAP |

|---|---|---|---|---|

| ARN | Aldoro Resources | 0.38 | 332% | $51,157,022 |

| MTM | MTM Critical Metals | 0.26 | 217% | $105,718,282 |

| GCM | Green Critical Min | 0.014 | 180% | $26,705,746 |

| BDG | Black Dragon Gold | 0.069 | 116% | $20,829,908 |

| CLE | Cyclone Metals | 0.056 | 115% | $59,625,607 |

| AYM | Australia United Min | 0.004 | 100% | $7,370,310 |

| LM1 | Leeuwin Metals Ltd | 0.14 | 92% | $6,559,234 |

| AHN | Athena Resources | 0.005 | 79% | $7,971,402 |

| TVN | Tivan Limited | 0.1 | 75% | $190,996,314 |

| CMD | Cassius Mining Ltd | 0.012 | 71% | $6,504,054 |

| CRB | Carbine Resources | 0.005 | 67% | $2,758,689 |

| EPM | Eclipse Metals | 0.006 | 67% | $13,727,133 |

| 5EA | 5Eadvanced | 0.13 | 65% | $43,799,744 |

| ETM | Energy Transition | 0.039 | 56% | $54,939,638 |

| PTR | Petratherm Ltd | 0.305 | 53% | $94,304,960 |

| NVA | Nova Minerals Ltd | 0.37 | 51% | $103,209,122 |

| M4M | Macro Metals Limited | 0.012 | 50% | $44,807,325 |

| GMN | Gold Mountain Ltd | 0.003 | 50% | $11,902,420 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | $9,296,169 |

| NFM | New Frontier | 0.018 | 50% | $26,167,236 |

| OD6 | Od6Metalsltd | 0.048 | 50% | $6,177,128 |

| TX3 | Trinex Minerals Ltd | 0.0015 | 50% | $2,742,978 |

| ERA | Energy Resources | 0.003 | 50% | $1,216,188,722 |

| A11 | Atlantic Lithium | 0.335 | 49% | $232,204,350 |

| PMT | Patriotbatterymetals | 0.405 | 47% | $234,314,743 |

| CUF | Cufe Ltd | 0.01 | 43% | $13,366,749 |

| COD | Coda Minerals Ltd | 0.093 | 41% | $23,146,144 |

| BEZ | Besragoldinc | 0.09 | 41% | $37,394,006 |

| MXR | Maximus Resources | 0.059 | 40% | $25,247,734 |

| AM5 | Antares Metals | 0.014 | 40% | $7,132,733 |

| HOR | Horseshoe Metals Ltd | 0.014 | 40% | $9,285,944 |

| NYM | Narryermetalslimited | 0.049 | 40% | $8,115,997 |

| ICL | Iceni Gold | 0.071 | 39% | $21,859,869 |

| DYM | Dynamicmetalslimited | 0.275 | 38% | $9,900,000 |

| RON | Roninresourcesltd | 0.22 | 38% | $8,882,502 |

| ILT | Iltani Resources Lim | 0.205 | 37% | $9,095,367 |

| SCN | Scorpion Minerals | 0.015 | 36% | $6,141,843 |

| MM8 | Medallion Metals. | 0.12 | 35% | $49,129,964 |

| DUN | Dundasminerals | 0.035 | 35% | $3,752,642 |

| QPM | QPM Energy Limited | 0.056 | 33% | $141,191,441 |

| ESR | Estrella Res Ltd | 0.02 | 33% | $38,020,771 |

| HLX | Helix Resources | 0.004 | 33% | $13,056,775 |

| NTM | Nt Minerals Limited | 0.004 | 33% | $4,843,612 |

| RGL | Riversgold | 0.004 | 33% | $6,734,850 |

| ERM | Emmerson Resources | 0.077 | 31% | $48,942,654 |

| COY | Coppermoly Limited | 0.013 | 30% | $9,199,547 |

| RXL | Rox Resources | 0.2 | 29% | $102,985,241 |

| AKA | Aureka Limited | 0.135 | 29% | $13,828,711 |

| PEN | Peninsula Energy Ltd | 1.26 | 28% | $201,140,038 |

| CYM | Cyprium Metals Ltd | 0.023 | 28% | $39,368,562 |

Technology a drawcard

Meanwhile, possessing innovative, proprietary technology has proven to be a real draw for investors.

MTM Critical Metals (ASX:MTM) clinched the second spot with the company progressing its Flash Joule Heating technology – a metal recovery and mineral processing method that efficiently extracts metals like lithium from spodumene, gallium from scrap and gold from e-waste.

Gallium – used in the production of semiconductors – is of particular interest as it subject to Chinese export restrictions.

The technology also promises to reduce energy consumption, reagent use, and waste.

MTM recently reached a deal with New York-listed Indium Corporation to test the tech’s ability to extract gallium, germanium and indium.

Likewise, Green Critical Minerals (ASX:GCM) has been making gains since acquiring ground breaking tech to produce very high density graphite blocks in late October 2024.

The tech is able to produce VHD graphite blocks that have amongst the highest thermal conductivity ever recorded for any bulk material and lowest electrical resistivity ever measured for any bulk graphite product.

That it can do so in just 24-36 hours at around half the temperature of the primary synthetic graphite process is a real differentiator.

VHD blocks can be used in materials for the defence and nuclear industries, electrical discharge machining, thermal energy storage, electronics, aerospace, semiconductors and heat sink appliances.

The company started construction of a pilot plant in mid-December and after month’s end said it had started commissioning of the plant.

Gold still shining

Despite tapering off from its highs in the previous month, gold maintained a steady position well above the US$2600/oz (~$4200/oz) mark – retaining its position as one of the top performing commodities of 2024.

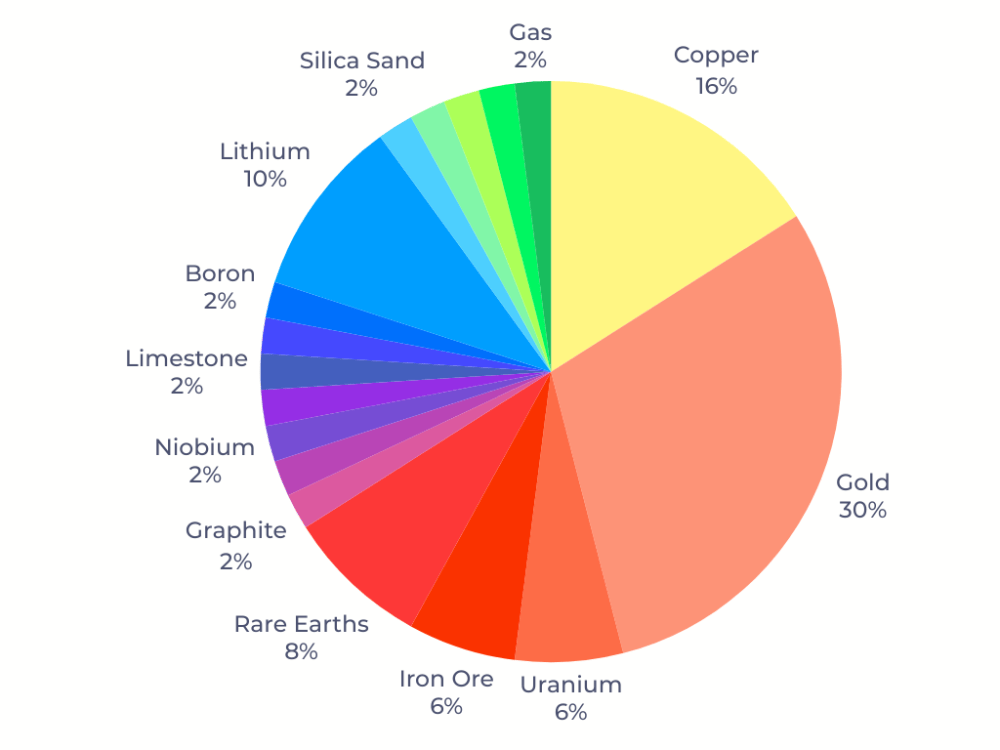

This strength has rubbed on juniors, with 15 of the 50 companies on our list having gold as their primary commodity.

Black Dragon Gold (ASX:BDG) took fourth spot with a 116% gain in December 2024 after investors piled in on Christmas Eve on hopes that some reputed regulatory changes in Spain’s Asturias region could be beneficial for progressing its 1.5Moz Salave gold project, currently stalled at the local council level.

In early December, the company said it was assessing the Tapia de Casariego Council’s ‘highly frustrating decision’ to knock back an application to rezone land from agricultural to industrial use.

Gold-antimony play Nova Minerals (ASX:NVA) saw a 51% gain in December after reporting first rock chip assays of up to 56.7% antimony at the Stibium prospect within its Estelle project in Alaska’s Tintina gold belt and follow-up results of up to 141g/t gold.

Estelle currently has a resource of 9.9Moz gold though there’s likely more to be found given that this is contained within a 35-kilometre-long corridor with more than 20 prospects including four known large intrusion-related gold systems.

Other small-cap standouts

Fourth-placed Cyclone Metals (ASX:CLE) made gains in December despite a lack of any critical news.

Shares in the company had already more than doubled in November 2024 after it signed a memorandum of understanding with Brazil’s Vale, one of the world’s largest iron ore producers, over a farm-in and potential JV at the Iron Bear project near Schefferville in Canada.

That 16.6Bt magnetite resource, which grades around 29.5% iron, has been shown to be capable of upgrading to a direct reduction grade concentrate in excess of 71% iron.

That would put its potential product in league with the less than 10% of seaborne iron ore products capable of being used in the low emissions DRI process, which could in turn attract a premium.

Petratherm (ASX:PTR) – also one of our top gainers for 2024 – made big gains in November 2024 after returning impressive metallurgical test results of samples from its Muckanippie heavy mineral sand project in South Australia.

It packed on the pounds again in December after assays of maiden drilling at the Rosewood prospect within Muckanippie returned bonanza-grade HM sand concentrations.

The first five step out holes returned results topping up at 22m at 19.1% HM from 8m, including 4m at 27.9% HM from 9m.

Preliminary visual analysis suggests the high value minerals leucoxene and rutile are present, which is consistent with recently reported historical results located 1km to the east.

At Stockhead we tell it like it is. While Cyclone Metals, Green Critical Minerals, MTM Critical Minerals and Petratherm are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.