Which uranium producers are ready to pounce when the price is right?

Pic: Schroptschop / E+ via Getty Images

The uranium price is going gangbusters, and the spot price has punched through $50/lb for first time in nine years.

The spark for this price rise is the Sprott Physical Uranium Trust, which used a US$300 million at-the-market equity raise to buy up 28.3 million pounds of uranium in recent weeks.

That’s more than the amount of nuclear fuel required to power France for a year.

And it’s aiming to ramp its buying spree up even further, revealing plans to increase its at-the-market offer limit by US$1 billion to US$1.3 billion.

#Uranium reaches a new multi-year high at $50 lb today! #SPUT $U.UN $U.U $SRUUF #U308 pic.twitter.com/lSjoYYjPHs

— Sprott Asset Management (@Sprott) September 17, 2021

When will the price be right for uranium producers to restart?

Lotus Resources (ASX:LOT) managing director Keith Bowes agrees with the general consensus that aroundUS$60/lb is the magic number that will justify new operations to start – or to dust off operations like the company’s Kayelekera project in Malawi.

“There’s a common theme with most of the developers in the last two years or so – and you’ll see that when you look their reporting, the scoping studies and feasibility studies – that the mid-60s is a realistic number for development to come back online again,” Bowes said.

“There’s obviously a little bit of flexibility around there, depending how you want to go about your contracting.

“If you could get your initial period at maybe $55 or $60 and know that’s going to grow as you go through your production protocol, that may be something that somebody would have a look at – if you can get the pounds into a contract.”

Spot price still has plenty of room to grow

The company doesn’t know when it will look to lock in prices just yet, especially since Bowes reckons there’s still some spot price growth to come.

“There’s been a massive rise because of Sprott coming in, but they’ve only effectively used a very small portion of the $1.3 billion available to them – they’ve probably only used $200 million at the moment,” he said.

“So, there’s still a lot of buying power to come from Sprott and I think we can expect to see the spot price increasing more over the coming months.

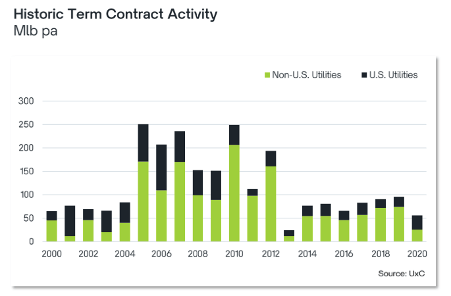

“And then you’ll see the term price coming up with that as well.”

The prevailing spot price would influence the starting point of discussions, but it’s just an indicator of the term contract market, where most of the action happens between uranium miners and the utilities.

As for #Uranium sector catalysts on horizon we’ll be watching for a jump in Long-term #U3O8 price from its notional $35 level⬆️ next Monday from UxC & next Thursday from TradeTech, followed by typical Seasonal return of absent #Nuclear fuel buyers starting in October. pic.twitter.com/XiVc7OJUgt

— John Quakes (@quakes99) September 22, 2021

Mothballed projects have a better chance of catching the uranium ride

Kayelekera produced 11Mlbs over five years, ceasing operations in 2014 due to sustained low uranium prices.

And projects that can be restarted quickly are better placed to catch the uranium ride at the peak of the cycle.

“If you have a look at the way the cycle is going at the moment, realistically, you’d expect to reach a peak maybe next year or the year after,” Bowes said.

“And the only company that are really in a position to catch the next cycle are those companies that have got assets that are in care and maintenance and can be brought back on relatively quickly.

“Any of the companies that have got greenfield projects, it’s a 5-to-10 year sort of timeline for them to come into production.

“And I don’t know whether they’d make the cycle this time.”

Not to mention, the cost of restarting a mine is much less than developing one – and Lotus is looking at around US$50 million to recommence production at Kayelekera.

Focusing on feasibility study in the meantime

While they’re waiting for the price to peak, Bowes said the company is focusing on having its feasibility study in place.

“We want to have the results from our feasibility study available so we can provide assurance to any utilities that we understand what is required to restart the asset back up again,” he said.

“Our feasibility study will be finished the middle of next year and we would expect to start serious negotiations with utilities after that.

“However, we have already started the process with North American utilities – so those in the US and in Canada – to reintroduce the Kayelekera project to them, and to introduce Lotus as a new company.”

He said because Kayelekera product has been previously sold and processed by utilities in the US and Canada, it’s known to the market – which gives the company an advantage over its peers who are starting from scratch.

But the fact remains that most stocks are years away from even thinking about production.

Which other uranium producers are waiting in the wings to restart?

Here are the companies like Lotus who have been doing the work quietly in the background before the uranium market exploded – and could potentially pull the trigger on production once the price is right.

Paladin is a former producer at the Langer Heinrich mine in Namibia which has been on care and maintenance, but – following a big $218 million cap raise earlier this year — is ready to relaunch.

Peak production was 5.6 million pounds in 2014 (2,540t) before operations were suspended due to low prices.

The company’s timetable envisages a restart of production with a modest capital outlay of around $80m once contracts with utilities have been signed.

Advanced uranium explorer, Vimy, wants its shovel-ready Mulga Rock project up and running to take advantage of the uranium price surge.

It raised $18.5 million this year to advance early works at Mulga Rock in WA and to continue exploration at the Alligator River project in the Northern Territory.

In August the Project Management Plan was approved, with just two WA Government departmental approvals remaining.

“Combined with renewed activity in the term uranium market, this approval augurs well for a project Final Investment Decision in the year ahead,” managing director and CEO Mike Young said.

Boss has just appointed the key EPC contractor for the electrical, instrumentation and control system at its 2.25-million-pound Honeymoon project in South Australia.

CEO Duncan Craib said the company was advancing multiple work streams in parallel to minimise the lead time between FID and the start of production.

“We are making project preparations on several fronts to ensure we can capitalise on the rapidly turning uranium market at the moment of our choosing,” Mr Craib said.

“We are already the most advanced of all the non-producing Australian uranium projects, with a production plant and key infrastructure in place.

“By making these preparations now, we are ensuring Boss is on track to be Australia’s next uranium producer.”

In March, Boss raised $60 million to buy 1.25 million pounds of uranium on the spot market at an average price of US$30.15 per pound – which it says will provide greater flexibility for financing and off-take negotiations.

Deep Yellow has three uranium projects in Namibia – Reptile, Nova and Yellow Dune.

A PFS was completed in early 2021 on its 3 million pound per annum Tumas project – within the Reptile tenements — and a DFS commenced March 2021.

The company raised A$42 million in July to advance feasibility studies on the Reptile project and M&A activities.

Bannerman’s Etango-8 project — also in Namibia — has been ‘reimagined’ as smaller scale mine initially, but with the ability to ramp up production as demand improves.

In February, it raised $12 million to complete the Pre-Feasibility Study (PFS) at the Etango-8 Project, and is busy with a Definitive Feasibility Study (DFS).

The company says the Etango-8 development pathway will enable it to get into production to benefit from the current uranium cycle – whilst having the option of increasing the production rate in the future to take advantage of deepening forecasted deficits in the uranium market.

Project developer Berkeley Energia (ASX:BKY) is battling through the approvals process to build its contentious Salamanca uranium mine in Spain.

This US-based company can get back into production within six months – and for just $US6 million — once a final investment decision is made.

The flagship 3 million pound per annum ‘Lance’ project, located in Wyoming, is the only US-based uranium project authorised to use the industry leading, low-cost, low pH ISR process.

In early September, the company completed a sale of 200,000 pounds of U3O8 pursuant to a long-term contract.

The uranium was sourced from the existing portfolio of binding purchase agreements and a net cash margin of US$3.8 million will be generated from the sale.

This long-suspended uranium stock has re-joined the ASX with a bang last week and is focused on the advanced ‘Tiris’ project in Mauritania, which the company calls “one of the most compelling uranium development projects in the world today”.

The company says it has executed an offtake agreement for the project, with financing discussions currently advancing.

Highlights of recent DFS include low start-up costs of $US74.8 million and a low All-In Sustaining Cost (AISC) of US$29.81/lb – well below current prices.

Vanadium by-product recovery may lower costs further, Aura says.

At Stockhead we tell it like it is. While Lotus Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.