Which commodities cross the line into 2020 as winners?

Jacob Birtwhistle celebrates winning the ITU World Triathlon in Germany. Pic: Getty

As global economic uncertainty grows, we ask the experts: which commodities will be frontrunners over the next six months?

Gold, iron ore and rare earths will maintain momentum

In a recent note, Argonaut analysts Matthew Keane, Helen Lau, and James Wilson saw gold, iron ore and rare earths continuing their stellar runs into the second half of the year.

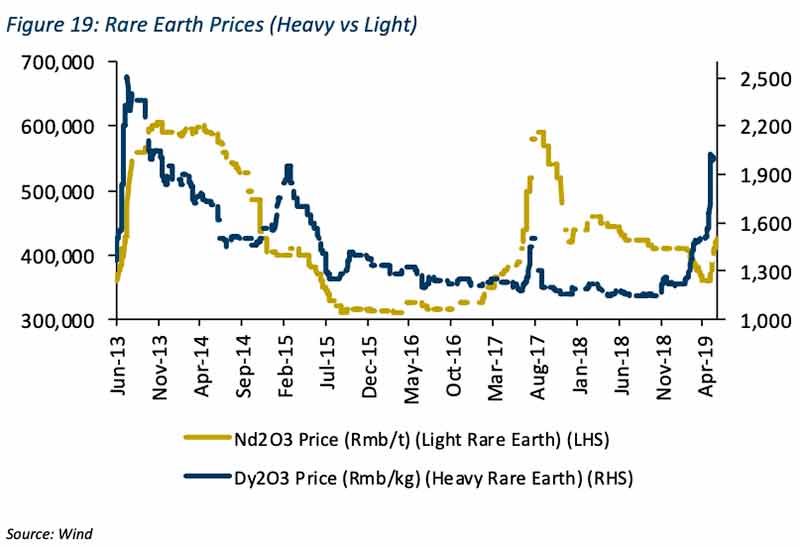

Argonaut believes rare earths prices will continue to rise based on the recent “weaponization” of these minerals in the US/China trade war.

“Heavy rare earth prices have increased by ~30 per cent in the wake of President Xi’s visit to a processing plant in Jiangxi where most heavy rare earths are produced,” Argonaut says.

“As China dominates in global processing capacity (90 per cent), China’s export ban of processed products could drive global supply tightness.

“In response, the US has started to actively look for alternative sources, however due to lack of domestic processing capacity and long lead time to build new processing plants (at least 1.5 years), rare earth prices should continue to rise in the medium term.”

Argonaut also remains bullish on gold as China ramps up its physical gold purchases and the US Fed contemplates rate cuts to boost the local economy.

“Market consensus is that the Fed will cut interest rates 25-75 basis points in the coming 12 months,” Argonaut says.

“In addition, the dovish stance by the European Central Bank, Chinese central banks and Bank of Japan point to more monetary easing ahead. Hence, increased liquidity and the prospect of a US weak dollar will be a boon for gold prices.”

For iron ore, Chinese government stimulus should sustain steel demand while ongoing supply disruptions from major miner Vale will likely keep prices high.

Wood Mackenzie principal analyst Rohan Kendall says from a pure supply/demand perspective the market shows no sign of easing as we enter the second half of the year.

“Iron ore loadings ex-Brazil and Australia are on the rise but the upside for volumes is limited and further disruptions cannot be ruled out,” he told Stockhead.

“Rio Tinto’s guidance cut is a timely reminder that mining and transportation systems are operating close to capacity and when things go wrong it takes time (and money) to fix.

“Higher cost (lower quality) ore suppliers are doing their best to fill the gap, but it is not enough, and we now forecast a net 30 million tonne fall in global exports in 2019.”

All this points to “stronger for longer” prices as we enter the second half – but there are risks on the horizon.

The most immediate of these is decreasing steel mill margins, Kendall says.

“So far this has impacted the choice of ore type rather than the tonnage requirement, with mills opting for lower grade (less productive) feed to control costs,” he says.

“But there will come a point when steel mills’ ability to pay caps the upside for iron ore pricing.”

Base metals will pull back … maybe

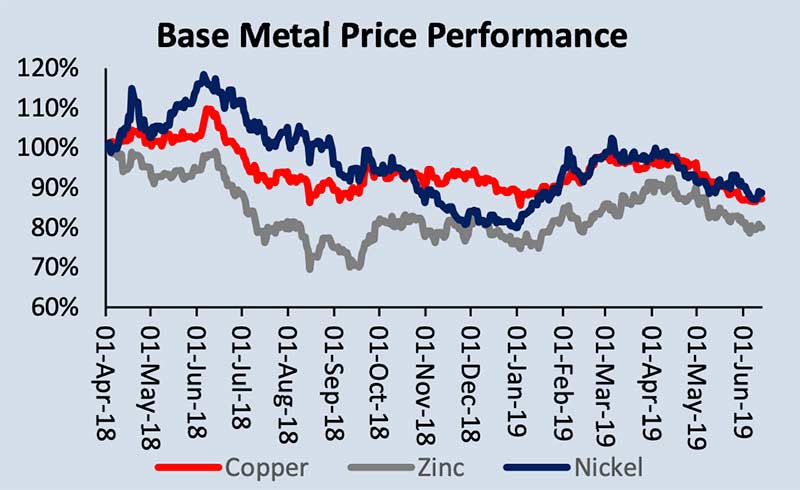

Nickel prices have been volatile in 2019, as lower prices — resulting from trade tensions — are balanced by unforeseen production outages.

Despite nickel prices rallying in June and July, the near-term risk for nickel prices is weighted towards the downside, says Angela Durant, principal analyst at Wood Mackenzie.

“Strong stainless-steel production rates have been maintained in China since March, but this defies persistent comments about falling demand, high stocks and the need for production cuts,” Durant told Stockhead.

Looking ahead, the risks for the next six months are that there could be more supply and lower demand, says Durant.

But senior resources analyst at Minelife Gavin Wendt says if you look at inventories for nickel, copper and zinc – which are a pretty good guide these days — the fundamentals still look really, really strong.

“People keep talking about a deteriorating macro picture, but low inventories tells us that even if there are concerns around the world economy it’s not being reflected in demand,” he told Stockhead.

“In the copper space, anything coming onto the market really isn’t making a difference to those inventory levels.

“Nickel – people keep talking about the new supply coming from the HPAL plants in Indonesia, but they haven’t really started to make a difference in terms of inventories either.

“Zinc demand is also still pretty robust.

“Base metals prices aren’t exactly setting the world on fire, but if you look at the inventory picture they probably should be doing better than what they are.”

Battery metals languish, but vanadium is due a (small) recovery

Argonaut expects battery metals prices, including lithium and cobalt, to remain weak. But consultancy Mastermines told Stockhead that vanadium could be about to recover – albeit mildly – from recent lows of around $US7/lb.

Mastermine’s David Gillam says they fully expect a vanadium price recovery to come “around the second half of August”.

“At $US7/lb we see both high cost supply cease production and the viability of battery projects increase demand,” says Gillam.

“Vanadium batteries are, in our opinion, not viable at levels of over $US10/lb in any form and prices below should spark the battery sector into action.”

Vanadium redox flow batteries can soak large volumes of V205 from the supply chain and, with pricing at current levels, Mastermines says that projects currently on hold will restart and assist the recovery.

“For this reason, we do not anticipate a further decrease in price and feel an upside is more likely,” says Gillam.

“However, the feeling is that any run will be constrained for some time in a range of USD $US8/lb to $US10/lb for 98 per cent V205.”

NOW READ: Think high vanadium prices are good news? You’re wrong.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.