These analysts say iron ore prices will be stronger for longer

Strongmen pose at the Arnold Schwarzenegger Sports Festival in Melbourne. Pic: Getty

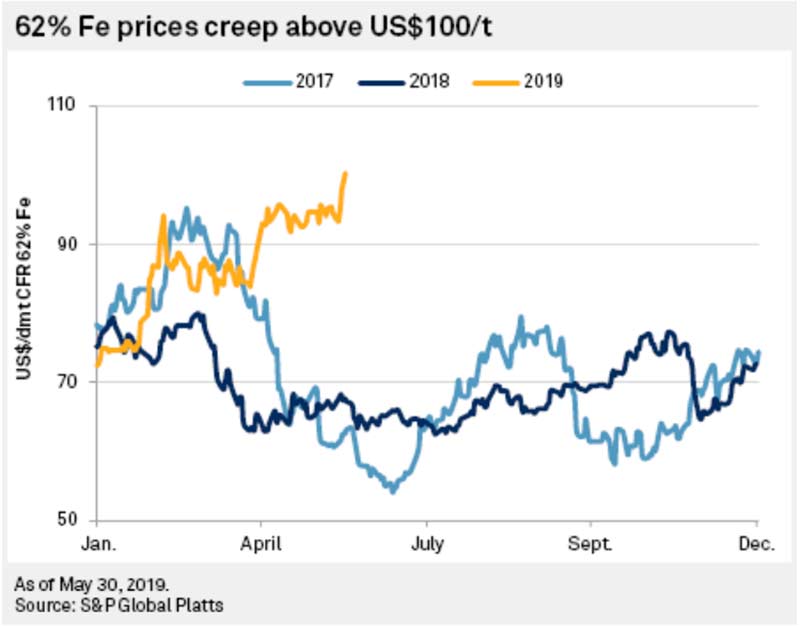

The iron ore price revival triggered by Vale’s dam disaster in Brazil might last longer than expected, analysts say.

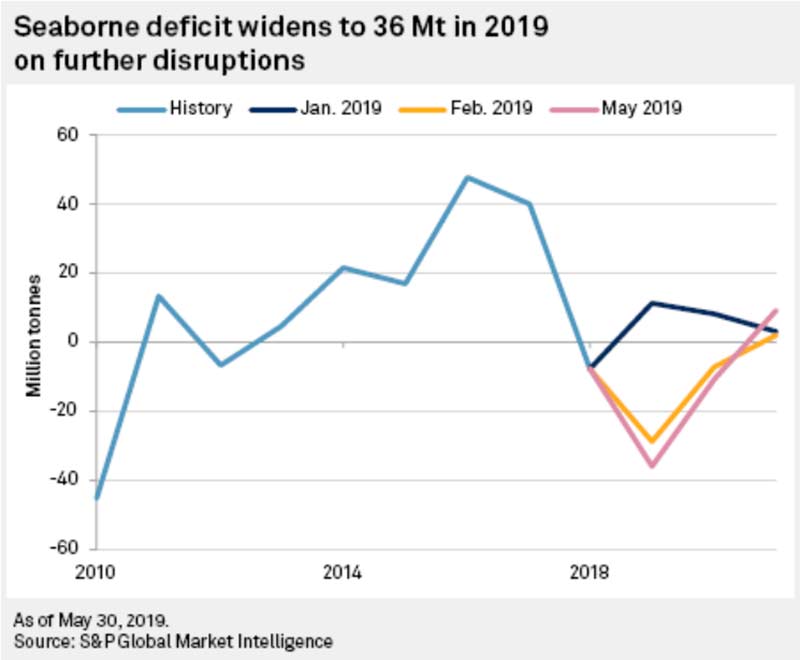

The seaborne iron ore market will record an even bigger deficit this year than S&P Global Market Intelligence previously thought – which should keep prices higher for longer.

Deficits of 36 million tonnes and 11 million tonnes are now predicted for 2019 and 2020, respectively, before a return to a more balanced market in 2021.

Data shows that Vale’s Brazilian exports fell 33.8 per cent year-on-year in March to their lowest point since 2014.

And the company needs to secure nine more dams “that bear some degree of collapse risks before being able to leave these tragedies behind”, S&P Global says.

But it’s not just Brazil – Australian miners are expected to produce 16 million fewer tonnes than in 2019.

“We believe prices for iron ore are likely to remain elevated, due to a number of factors including lower levels of stocks, greater disruption, and a change to penalties for alumina,” S&P Global says.

End users in Tangshan, one of China biggest steelmaking cities, have been cushioned from the impact of tightening supply due to a ramp-up in domestic production, S&P says, but market sources doubt this is sustainable.

“Lowering inventories from miners suggest that current supply would not be able to sustain current high levels of demand over the long run,” S&P Global says.

There’s also the threat of more stringent environmental regulations leading to curbs in this local Chinese production.

These ASX players are almost ready to push the button on development

Up until fears of an iron ore shortage began to emerge, Venture Minerals (ASX:VMS) was primarily focused on developing its tin project in Tasmania.

That tin project, called Mt Lindsay, is still the main game.

But Venture also has a development-ready iron ore mine just down the road, called Riley, which the company is now fast-tracking to production.

It’s not a big deposit, but at current prices Riley represents a potential cashbox for Mt Lindsay’s development.

Last year, Vale was on pace to boost 2019 output to a record 400 million tonnes; now it says it will take two to three years to meet that target.

Venture managing director Andrew Radonjic says this latest report looks in line with that statement.

“And it certainly looks like there’s only going to be incremental increases from other producers,” he told Stockhead.

“So I’m not totally surprised; it seems to be in line with the conclusions people are coming to about the iron market going forward.”

Venture hope to make a call on the commencement of mining at Riley around the end of June/early July and then move quickly towards production.

“We have a granted mining lease, the equipment, and a lot of other things in place which will allow us to get those shipments rolling out later in Q4,” Radonjic says.

“That’s a tight timeframe, but we need to achieve that in order to meet that price window opportunity.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Venture isn’t the only one. High grade iron ore play Fenix Resources (ASX:FEX) is serious about getting its open pit DSO project into production ASAP.

As is Centaurus Metals (ASX:CTM), which reckons its development‐ready Jambreiro project in Brazil is in a good spot to capitalise on these positive market dynamics.

Centaurus managing director Darren Gordon told delegates at the recent Resources Rising Stars conference there were indications that supply out of Brazil “will continue to be impacted for some time to come”.

“Projects with existing permits and strategic location are best placed to capitalise on this environment,” he says.

At Stockhead, we tell it like it is. While Fenix is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.