Where are the next generation of tier 1 copper mines coming from? Explorers, that’s who

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Copper prices may be down 23 per cent in 2020, but a big supply deficit still looms in the medium term driven in large part by the EV revolution. Even the short-term outlook looks positive.

In an early March report, Fitch analysts anticipated that increased stimulus from the Chinese government would lift copper prices higher as early as the second half of 2020.

Fitch expects that most manufacturing hubs and supply chains closed by COVID-19 in China — which consumes about 50 per cent of the world’s supply of copper — will be up and running by April.

This will coincide with constrained supply as major global mining operations go into ‘skeleton crew mode’ or shut down completely for a (hopefully) short period to control the spread of COVID-19.

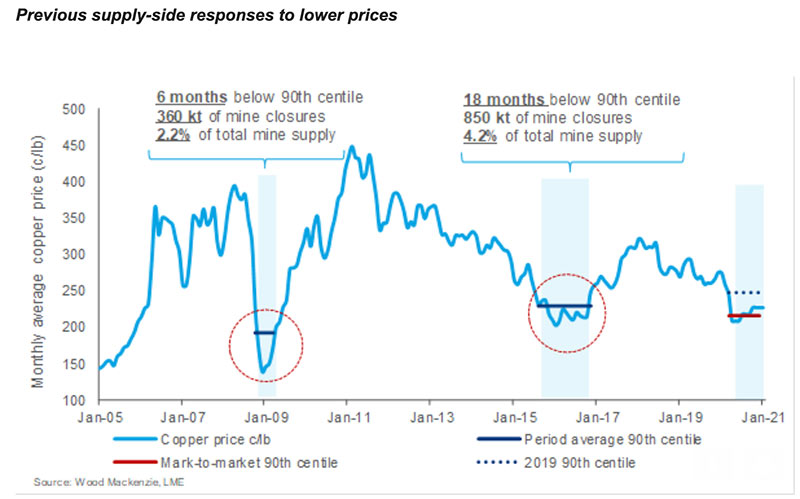

In 2020, Wood Mackenzie says weak copper prices and the containment measures implemented for COVID-19 will pose a significant risk to global mine supply (short-term problem) and project development (long-term problem).

This current supply-side outlook is similar to the market in 2008-09, Wood Mac says. At the start of 2008, there was healthy pipeline of near-term projects.

But a severe demand shock, brought about by the Global Financial Crisis, triggered project delays.

“During the 12 months between Q3 2008 and Q3 2009, we estimate the mining industry deferred up to 2.2 million tonnes per annum of new copper supply,” Wood Mac says.

“While projects eventually hit the market, they were later than expected.

“This undoubtedly contributed to the tighter market and high prices experienced in 2010 and 2011, once the market recovered.”

Beyond 2020, Fitch analysts forecast the copper market to switch back into a deficit as consumption growth recovers and production growth slows. For explorers, long-term fundamentals are the most important thing.

Sweden-based explorer Alicanto (ASX:AQI) is hunting high-grade and bulk-tonnage copper-gold deposits in the historic mining district of Bergslagen in Sweden.

“As an explorer, sentiment is still important, but we are not overly affected by the copper price today,” Alicanto chief exec Peter George told Stockhead.

“But longer term — where are the next copper projects coming from? The answer is that they are going to come from exploration companies like Alicanto.”

Low copper prices for much of the last decade means there has been very little investment in new projects, George says.

“The fundamentals for copper have not really changed,” he says.

“We are rapidly approaching a supply and demand divergence, where the amount of copper being produced is going to be far outstripped by demand.”

Another issue is that the big miners have, until recently, relied on smaller explorers to go out and find the next tier 1 deposits, George says.

“For example, Sweden had some of the largest copper mines deposits in the world [at one point], but there haven’t been any new discoveries for decades,” he says.

“There’s been no desire by the big guys to get out there and find more copper deposits.

“Now all of a sudden, these major miners are asking ‘where’s our future supply going to come from?’”

In 2016-17, ASX-listed majors Newcrest Mining (ASX:NCM) and BHP (ASX:BHP) took large equity positions in an early stage explorer called Solgold, which now has one of the biggest undeveloped copper gold projects in the world.

The copper price at the time was in the doldrums, just like it is right now.

In recent times, both BHP and fellow major miner Rio Tinto (ASX:RIO) have sunk hundreds of millions into their respective tier 1 Australian greenfields discoveries, Oak Dam and Winu, all while the copper price continued to suffer.

Hot Chili (ASX:HCH) managing director Christian Easterday says copper will continue to play a key role in the long-term strategy of many major miners – regardless of the current price.

Hot Chili is a copper-gold porphyry play based in Chile. In late 2019, the explorer unveiled one of the best global drill results of the year from the tier 1 Cortadera project— 972m grading 0.5 per cent copper and 0.2g/t gold from surface.

That’s a casual 12-minute walk end-to-end.

“Rio and BHP now have massive copper exploration budgets because uncovering large-scale, multi-generational projects like Cortadera is incredibly rare — particularly the ones that have quality about them,” Easterday says.

“It’s clear the long-term forecasts for copper have not materially changed.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.