What made this vanadium stock jump 36pc in a matter of seconds?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

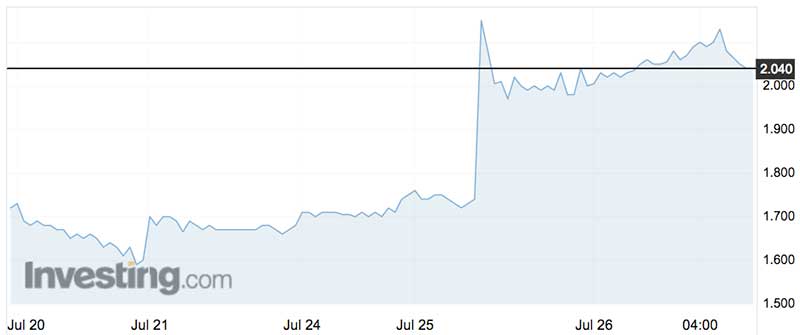

Special report: Billionaire fund manager Leon Cooperman of Omega Advisors announced a long position on canadian vandium play Largo Resources live on CNBC this week, causing the price to jump 36 per cent in seconds.

(Scroll down to watch the video.)

Investors take a long position, as opposed to a short position, when they think a stock is going to increase in value.

Largo is a vanadium-focused company based out of Toronto. Omega has a cool $US3.5 billion under management.

Here’s a graph showing the jump in Largo’s stock (TSX:LGO) this week on the Toronto stock exchange:

Compare that to ASX-listed Technology Metals (ASX:TMT) which plans to produce more vanadium than Largo.

Largo has a market cap of about $1.1 billion – compared to $40 million for Technology Metals.

Largo produces 10,000 tonnes each year from its Maracás Menchen mine but has announced an upgrade to attain a production rate of 12,000 tonnes per annum by June 2019.

Even at the expanded capacity of 12,000 tonnes per annum, Largo will still be producing less than Technology Metals’ target production rate based on the pre-feasibility study.

Technology Metals’ initial reserve estimate of 16.7 million tonnes at 0.96 percent V2O5 also compares very favourably to Largo, which last reported a reserve of 19 million tonnes at 1.15 percent V2O5.

And Technology Metals will be producing at a low cost that is comparable to Largo, which says it is one of the lowest cost producers of vanadium.

Largo produced vanadium at about $US4.11 per pound in the first quarter of this year, and has provided average cost guidance of $US4.15 per pound over the course of 2018.

Technology Metals estimates its cost of production will be about $US4.27 per pound.

Watch the CNBC video:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.