West African gold back in vogue with investors

Pic: John W Banagan / Stone via Getty Images

There’s a growing number of small caps poised to benefit from a torrent of investor interest in West African gold.

Traditionally seen as a more risky jurisdiction, West Africa is back in vogue; sparked by a burgeoning gold price, a wave of M&A action, successful mine building, and some very significant discoveries.

When it comes to gold, the West African countries that matter — Ghana, Mali, Guinea, Ivory Coast, Burkina Faso, Senegal, Mauritania and Niger — are those with the same mineral-rich greenstone belts mined in Western Australia.

These under-explored countries are richly endowed with often large scale (+5moz) and relatively high-grade gold deposits, ideal assets for mid-tier and major producers.

Merger & Acquisition blitz

A booming gold price has seen the merger and acquisition action that defined West African gold in 2019 continue into 2020.

A number of advanced juniors with cheap valuations are being ‘scoped out and scooped up’ by the bigger players.

Ghana-based mine developer Azumah Resources (ASX:AZM) was taken out by its ~1.1-million-ounce (moz) Wa project joint venture partner Ibaera Capital early this year for just $30m.

In April, brand new miner West African Resources (ASX:WAF) paid ~$70m for the neighbouring Toega 1.1moz gold deposit in a deal with Canadian miner B2Gold.

In June, +5moz Cardinal Resources (ASX:CDV) — also in Ghana — recommended a takeover offer from China’s Shandong Gold Mining that values it at about $300m.

The 60c all-cash offer represented a 39.9 per cent premium to the company’s 20-day volume weighted average price and a 31.1 per cent premium to Russian gold miner Nord Gold SE’s takeover proposal in March.

Then, $1.76bn gold miner Perseus Mining (ASX:PRU) announced a deal to acquire Exore Resources (ASX:ERX) in an all-share deal that values the Côte d’Ivoire explorer at $59.8m.

This acquisition blitz is bound to continue, with other advanced explorers like Tietto Minerals (ASX:TIE) in Côte d’Ivoire or Oklo Resources (ASX:OKU) in Mali almost certainly in the crosshairs.

Tietto is currently charging through a massive 50,000m drilling program to grow its 2.2moz resource at the Abujar project.

A resource update is due in Q3, ahead of a project pre-feasibility study in the beginning of 2021. Investors like the story, with the stock up 720 per cent since the start of 2019.

“We are almost knocking on the door of 3moz,” Tietto exec director Mark Strizek says.

“But [longer term] when we look at the acreage here, and the scale of the province, the thought is that it could be anywhere between 5 and 10moz.”

TIE and OKU share prices:

Some very significant gold discoveries

Because exploration is relatively cheap, these jurisdictions are ideal hunting grounds for junior explorers — and yet early stage discoveries across West Africa are still limited.

That’s because from about 2013 until recently there was no love, or money, for West African exploration.

It was tough to raise capital and many — but not all — explorers were forced to stop work or abandon their ground.

But the discovery period is where massive value can be created for investors. This puts a number of the more established juniors in a very good position.

This was highlighted most recently by Predictive Discovery’s (ASX:PDI) success in Guinea.

In April, the long-time West African prospect generator rocketed from 0.7c to 7c per share – a 900 per cent gain – on a new gold discovery at the Kaninko project in Guinea.

An initial drilling program at North-East Bankan by Predictive returned numerous shallow, thick, and high-grade gold intercepts like 10m at 26.52 grams per tonne (g/t) gold.

Predictive is currently up 1,370 per cent over the last three months:

PDI share price:

So, which other early stage explorers are ostensibly on the cusp of their own success?

The prospectivity of this region is like Australia 100 years ago, says Golden Rim Resources (ASX:GMR) managing director Craig MacKay.

“You roll up to a piece of exploration ground that has never been explored before,” Mackay says.

“There’s mineralisation, mined by artisanal workers, but you are the first company to put a drill hole into what is essentially an outcropping orebody.”

That was Golden Rim’s experience at its flagship 1.4moz, and growing, Kouri project in Burkina Faso.

Now, a new discovery called the ‘Diabatou Gold Shoot’ could be a watershed moment for the ~$20m market cap explorer.

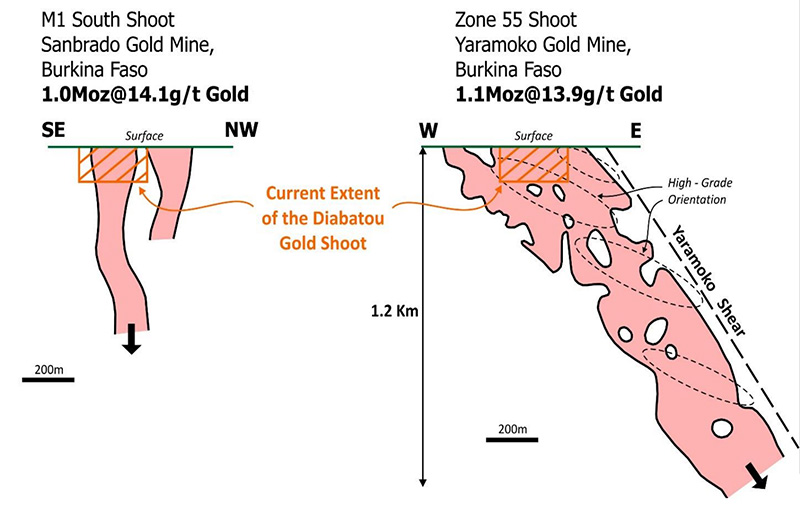

Diabatou, where Golden Rim hit eyewatering grades in maiden drilling last year, is now interpreted to lie within the upper part of the steeply plunging, high-grade ‘Gold Shoot’.

Elsewhere in Burkina Faso, these shoots can extend vertically for more than 1km and host more than 1 million ounces of gold.

TSX-listed Roxgold, for example, outlined a 1moz resource grading 13.9g/t at the Yaramoko gold mine.

Freshly minted producer West Africa Resources has similarly delineated a 1moz resource grading 14.1g/t gold in the M1 South Shoot.

“A few years ago, West African Resources was unloved,” MacKay says.

“Then they found the M1 South chute and that really was the game-changer. We are hoping that Diabatou is similar.”

Early indications are promising. Fresh drilling is currently underway, targeting extensions to this emerging discovery.

Also in Burkina Faso, Arrow Minerals (ASX:AMD) is now drilling a brand new, +3km-long gold discovery called Dassa, where drilling earlier this year hit some thick, high-grade intersections like 13m at 3.8g/t and 3m at 13.1g/t.

Dassa remains ‘open’ to the north, south, east and downdip to the east. The gold keeps going in most directions, in other words.

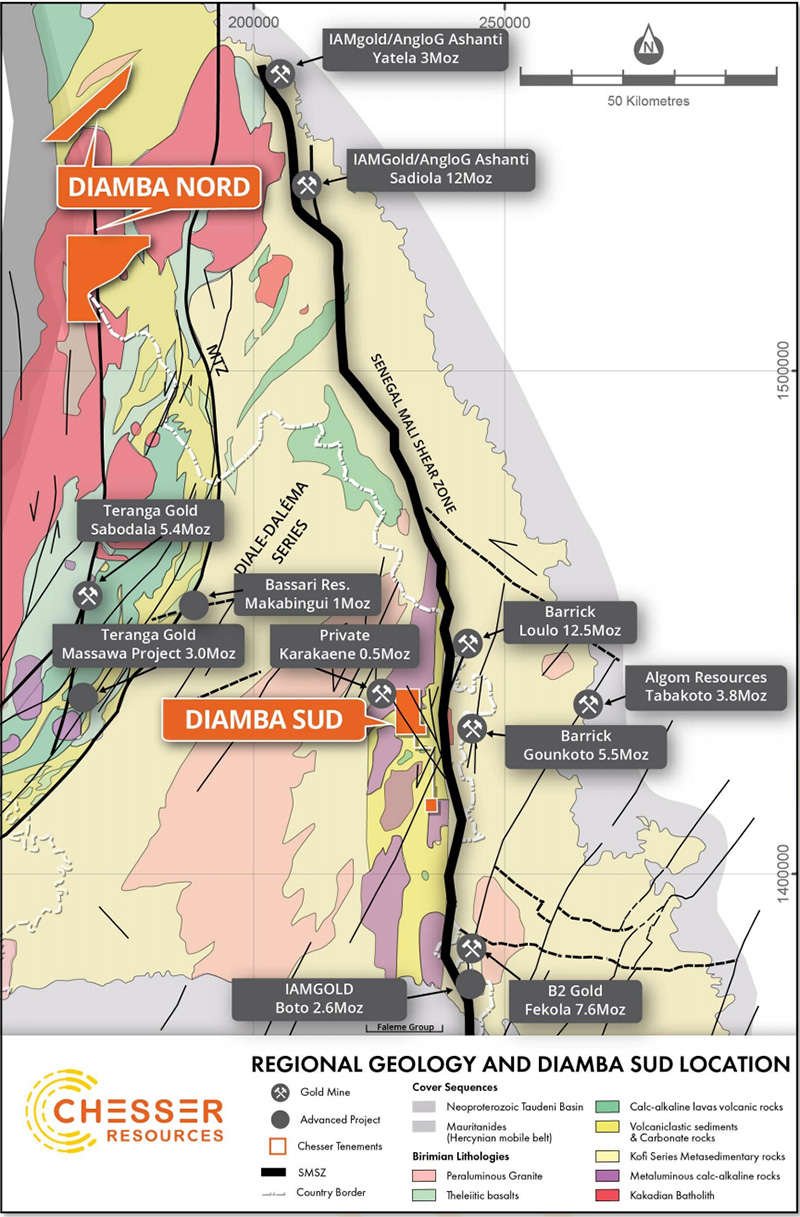

In Senegal, ~$30m market cap Chesser Resources (ASX:CHZ) is poking the edges of a high-grade gold discovery along the prolific Senegal-Mali Shear Zone.

This is a part of the world where a 2.6moz gold deposit is considered ‘small’.

Companies had previously discarded the western side of this shear zone as being “low potential”, but Chesser has proven the opposite, hitting similar rock types and the same mineralisation as the Tier 1 assets immediately to the east.

Intersections on the first trend identified at ‘Area A’ include 21m at 6.62g/t gold, 14m at 9.53g/t gold and 16m at 8.51g/t.

“Our discovery at Diamba Sud certainly has grade and is shallow – [now] it needs more drilling to determine size,” Chesser managing director Mike Brown says.

“The really encouraging element is that we are seeing all the characteristics of the major deposits on the Mali side of the Senegal-Mali shear zone (Loulo-Gounkoto-18Moz, Fekola-7.5Moz) at Diamba Sud.

“We are sandwiched between IAMGOLD and Barrick, which gives us significant encouragement that if the geology stacks up, we will have numerous interested parties.”

Barrick also appears to have found something in Senegal on the Bambadji tenement, to the east of Diamba Sud.

“It’s on strike to Fekola, so although disclosure is limited, I’d be very surprised if that doesn’t grow into something,” Brown says.

“It’s certainly a very interesting time to be advancing a high-grade shallow discovery in a gold belt and jurisdiction that ticks all boxes.”

CHZ, GMR and AMD share prices:

A new ‘golden age’ for exploration

We are entering another golden period for West African gold exploration and development, Brown says.

“There has been a marked increase in activity at the frontiers, Cote D’Ivoire being the prime example in terms of activity from existing explorers and entry by new explorers, with Guinea appearing to follow that,” he says.

“Discoveries create hype, create pegging rushes and get capital for exploration, so are critical for the industry.

“The discovery potential has been highlighted most recently by Predictive Discovery in Guinea. Its early days for them but the signs are very positive.

“As more auger/aircore programs are followed up I expect we will see a significant boom.”

Brown also expects a number of companies/projects to change hands in the next 12 months, in particular those companies pushing towards resources in the near term “or where the quantification of potential resource is visible”.

“The attractive economics of the projects and the potential new discoveries will see more heated activity from the majors pool, given West African government/political risk is largely low — unlike in other parts of Africa where foreign state controlled acquisition is really the only show in town,” he says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.