Well-funded Galan eyes four-phase approach to 60ktpa lithium production in Argentina

Galan is taking a measured approach to its Hombre Muerto Salar and Candelas lithium developments. Pic via Getty Images.

After completing work on its initial Stage 1 definitive feasibility study (DFS) lithium brine-focused Galan Lithium has revised and upgraded the scale of the studies at its Hombre Muerto Salar (HMW) into four project phases.

The now completed Phase 1 DFS focused on the first production phase at HMW, being 4ktpa LCE equivalent, which gives Galan Lithium (ASX:GLN) the advantage of significantly low initial capital expenditure to start receiving cash flows from the project as it opens up early offtake opportunities and pre-payments.

Phase 2 DFS optimisation work being conducted by the team is ongoing, which Galan expects to release in August 2023, addressing the full 20ktpa LCE production rates it has flagged for the second half of 2026.

The company is currently evaluating Phase 3, which is a plan to increase production to 40ktpa in 2028 at HMW.

Phase 4 is planned to incorporate both HMW and the company’s Candelas project nearby for a total output of 60ktpa LCE equivalent by 2030.

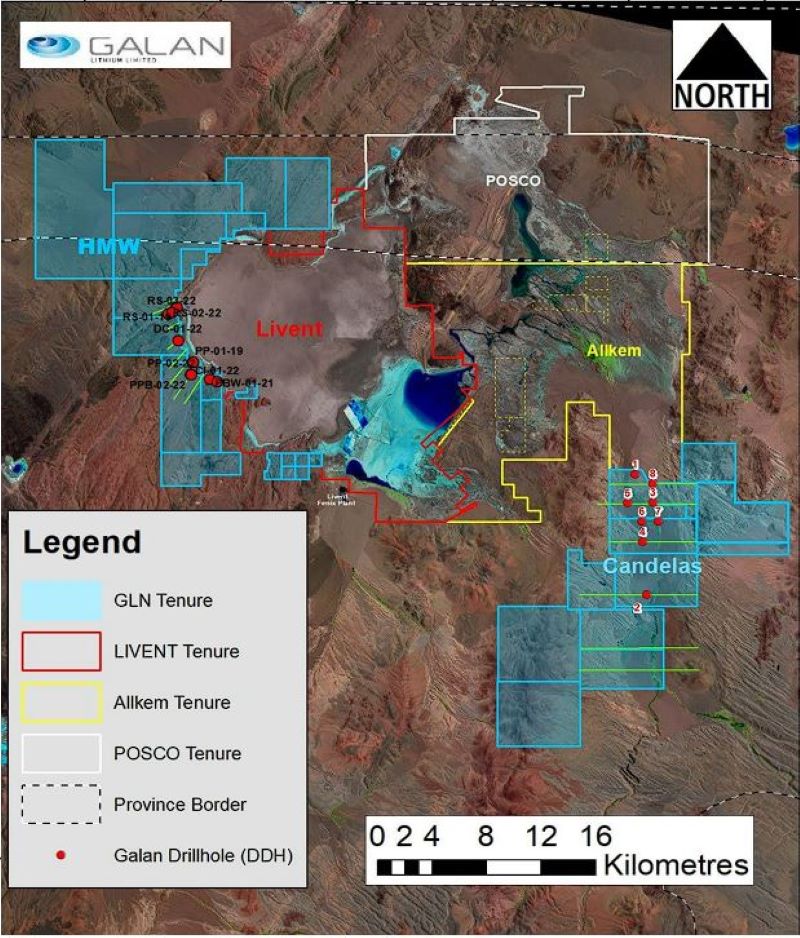

Both projects together have a total resource of 7.3 million tonnes (mt) @ 852mg per litre lithium and are in a 20km radius of world-class brine projects operated by POSCO, Livent and Allkem.

Galan recently went to market to raise $31.5m, and upon completion of the share placement, it will have ~$50m to advance the development of its projects.

Galan Lithium webinar

Shareholders and investors are invited to attend a zoom webinar on Friday 2 June at 11am AEST/9am AWST, where Galan MD Juan Pablo Vargas de la Vega will provide an update on the company.

This article was developed in collaboration with Galan Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.