Welcome to Africa: Where ASX explorers roll the dice and often win

Exploration and development issues in Africa are not so different than anywhere else. Via Getty Images.

- Project stalls are not unique to Africa

- Projects in Africa have some of the lowest capex and production costs in the world

- A bunch of ASX players have, and are again, hitting paydirt on the continent

- Which Aussie junior is ready to be the next big thing in Africa?

While mining exploration and development in Africa is often thought of as being fraught with risk from regional conflicts, political tensions and corruption, changes have been afoot with those in power realising just how lucrative stabilising the sector is for taking advantage of Africa’s untapped resources.

Mining, like any business in Africa, is a risk. The corruption, history and other nuances of the developing world are well documented. Yet, is it the cradle of humanity that is to blame nowadays?

The advantages of less regulation, cheap labour and an abundance of underexplored, shallow, or just easy-to-mine deposits are known to be able to drop exploration, development and production all-in-sustaining costs (AISC) to some of the cheapest on Earth.

It seems to this Stockhead that if companies have enough “cojones” to stick out a project in Africa through “potential” bad times, they’re almost pinned on to reap high-margin rewards.

Whatever the reasons, it seems the jury is still out, so let’s look at the winners, those who lost and stayed, and the newbies in play, so everyone gets to make their minds up.

Recent winners

One of the more recent West African success stories is, well, West African Resources (ASX:WAF), which in its first full year of operations at the Sanbrado mine in Burkina Faso had exceeded the upper end of its 280,000ozpa production target and delivered almost 289,000oz at a super-low US$796/oz.

In years since, it’s still met between the bullseyes of guidance, delivering solid quarter after quarter.

It’s now in the middle of constructing its Kiaka long-life, low-cost mine near Sanbrado and has pegged an AISC of $1,052/oz – basically on par with Sanbrado when you factor in currency fluctuations and the rising price of gold.

West African CEO Richard Hyde says the company’s flagship Sanbrado gold mine continues to deliver solid quarters of low-cost gold production.

“A total of $50m of capex was invested in the development of Kiaka during the fourth quarter of 2023 – and the project remains on budget and schedule to pour first gold in H2 2025,” Hyde says.

“Kiaka will be a long-life low-cost mine, averaging 219,000ozpa for 18.5yrs @ an AISC of US$1,052/oz.”

Not bad for an ASX player in a perceived “volatile” mining jurisdiction.

One could also take a page from the book of the highly successful and now-sold Cardinal Resources, whose old team is now looking to replicate past successes with Bishop Resources – which is exploring and developing +1Moz projects in both Senegal and Ghana.

Acquired this year in eastern Senegal, Bishop’s flagship asset is the proven 1.05Moz Makabingui gold deposit, surrounded by a whopping +60Moz of proven Tier 1 gold deposits in the prolific Birmian belt geology.

Target generation is underway and Bishop chair David Michael says he’s very pleased to have obtained very detailed mapping generated by SRK and is confident that further exploration will add to the existing 1.05Moz resource.

“We’ve also had institutional interest recently visiting site with a view to provide additional funding and look forward to future developments at the project over the coming months,” Michael said.

Once stalled, now back in gear

Last year, Leo Lithium (ASX:LLL) ran into hurdles at its enormous Goulamina hard rock lithium project, suspending direct shipping ore production due to a tiff with the Malian Government over its stake in the project.

Its China-backed JV partner, Ganfeng, had to come to the rescue last year with $213m to fund capital costs, forcing Leo to hand over a 5% stake and decreasing Leo’s share of the project to 45%.

Such is the demand to get low-cost mining projects off the ground in Africa, that earlier this month a sale of an additional 5% for $98m was announced, leaving Leo with 40% of the project and Ganfeng 60%.

This has affected Leo’s share price short-mid term, yet the dispute with the Malian Government is being resolved and the project remains on schedule to produce first spodumene concentrate in Q2 this year.

In Tanzania, OreCorp (ASX:ORR) has been the subject of great interest for its undeveloped 2.83Moz Nyanzaga gold project, recently by Canadian-listed Silvercorp and fellow ASX miner Perseus Mining (ASX:PRU), which already operates three gold mines in West Africa.

Perseus – OreCorp’s largest shareholder with a 19.9% stake – last week declared its intentions to make a bid for the Matt Yates-chaired company.

The 55c/sh offer to acquire all the issued shares it does not already own represents a 4% premium to the recently updated takeover proposal from Silvercorp, which currently has the backing of the OreCorp board.

Looking elsewhere, a dip in graphite prices caused by China flooding the market in recent years saw the world’s largest graphite producer outside of the Middle Kingdom, Syrah Resources (ASX:SYR), put the brakes on its flagship Balama, Mozambique graphite operation due to market unsustainability.

In September last year, it received a shot in the arm when the US International Development Finance Corporation provided a US$150m loan for capital requirements at the Balama mine – as Syrah has agreements to be America’s only producers of active anode materials for batteries.

More recently, China decided to restrict graphite exports, a move that was enacted on December 1 last year, causing price increases and uncertainty around ex-China supply.

Paladin Energy (ASX:PDN) has had its troubles too in the past; those that have held on through the doldrums of depressed uranium prices (or those that jumped in a year ago) are now reaping the benefits of skyrocketing demand for the yellowcake.

Paladin is inching towards the revival of the Langer Heinrich uranium mine in Namibia after six long years in the doldrums, feeding first ore to its processing plant as spot prices sit at 16-year highs of $106/lb.

Already up over 20% year to date, Paladin shares have been on a tear in recent times some six years after shutting the mine and seven since falling into administration.

It says the restart of the Langer Heinrich mine is now >93% complete with capex estimates pushed up from US$118m to US$125m – not awful by the standards of modern project overruns.

Commercial production is pegged for somewhere between the end of Q1 and Q2 this year.

Movers and shakers

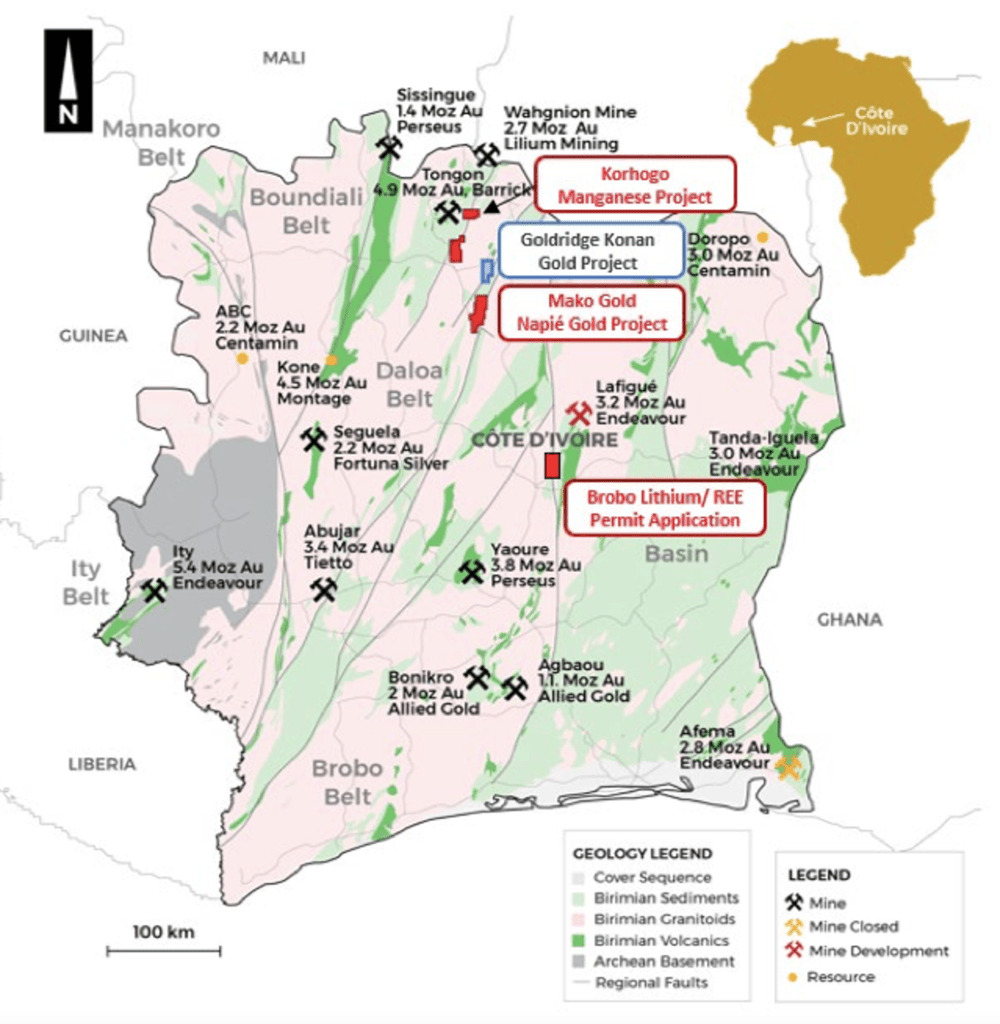

Starting in Côte d’Ivoire a couple of intrepid ASX-listed companies have had major successes, including $2.5bn market-capped Perseus and the $690m-valued Tietto Minerals (ASX:TIE).

The acquisition-hungry Perseus owns the nearby 1.4Moz Sissingue and 3.8Moz Yaoure gold mines, while Tietto has the 3.4Moz Abujar gold operation – with the latter currently the subject of a takeover bid from a Chinese shareholder.

Tietto’s founders are associated with privately owned Goldridge Resources and its Konan project – which Mako Gold (ASX:MKG) is looking to acquire to expand Napié’s already 868,000oz resource.

Mako is led by West African gold mining expert Peter Ledwidge and team members from now-de-listed Orbis Gold fame – which bought and sold a gold deposit in Burkina Faso – and was acquired in 2015 for $178m.

The ASX junior is accelerating exploration and expansion plans for Napié with geochemical mapping and target generation underway and due diligence over the proposed Goldridge acquisition that would increase Mako’s landholding to 374km2 and the strike length to 50km, creating a ‘district-scale’ gold camp.

Explorers with a lot to offer

A DFS update for Toubani Resources’ (ASX:TRE) Kobada gold project in Mali has pegged its development as a bulk mining operation that will bring forward the processing of large tonnage oxide ore.

Kobada’s 2.4Moz resource occurs across a shallow 4.5km-long strike, lending itself to a predominantly free-digging oxide, open pit development – where 77% of the resource is found at depths of up to just 150m.

Toubani chief Phil Russo says the optimisation studies have highlighted the benefit to the project of targeting areas within the pit shell for resource definition drilling to convert the Inferred material, currently classified as waste, to Indicated with drilling planned to commence shortly.

“With the completion of these initial studies, a key milestone has been met that validates our strategy that Kobada has the attributes to become a mine and we look forward to continuing this momentum in 2024.”

Ionic Rare Earths (ASX:IXR) has the chance to make a name for itself in East Africa, with its flagship, 60%-owned Makuutu project in Uganda one of the only proven ionic adsorption clay-hosted (IAC) REE deposits on the continent.

IAC deposits have bonkers high percentages of lucrative magnetic rare earth oxides (MREOs) contained in the total rare earth oxides (TREOs).

Makuutu is advanced, with a pivotal mining licence recently being granted for the massive 532Mt @ 640ppm TREO being updated even further and a demonstration plant being readied.

An FID is due later this year and first production has been pegged for 2026.

At Stockhead, we tell it like it is. While Toubani Resources, Mako Gold and Ionic Rare Earths are Stockhead advertisers, they did not

sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.