‘We cannot stress enough the fragility of supply’: Canaccord says these uranium stocks have another +20% to run

Mining

Mining

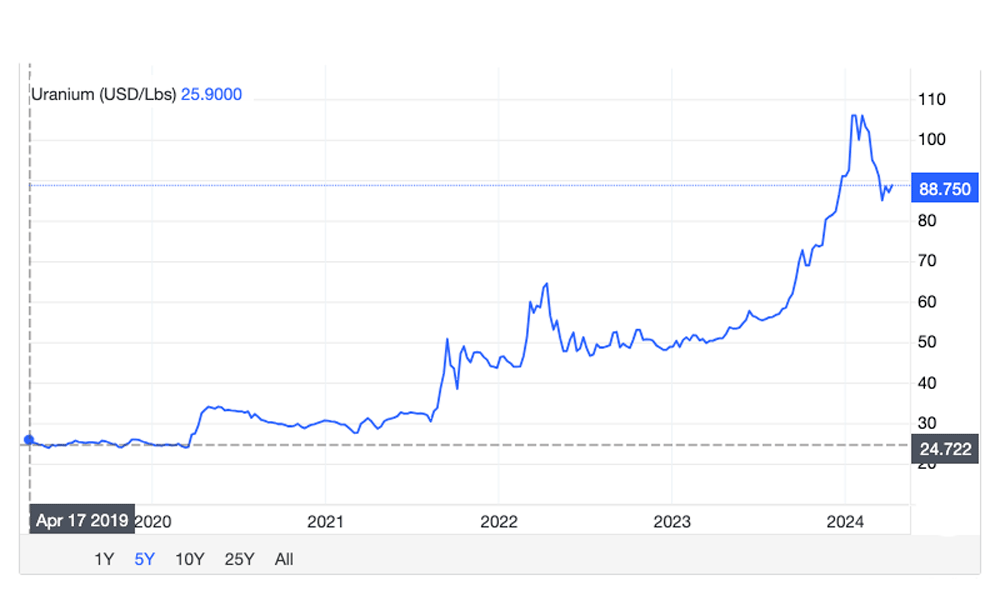

The uranium spot price is taking a breather in the high US$80s a pound, following a scorching run through the psychologically important $100/lb mark in late 2023, early 2024.

The equities trade has also died off somewhat alongside prices, and perhaps as shinier prospects, like gold, take centre stage.

Still, Canaccord Genuity says the structural supply deficit which triggered this long-awaited, +200% spot price run in the first place – from US$28/lb in August 2021 to US$88/lb currently — has not gone away.

Nuclear power, seen as critical to global decarbonisation, is becoming mainstream again. Conservatively, CG expects capacity to expand at a compound annual growth rate of ~3.5% to 2035, versus 3.2% previously.

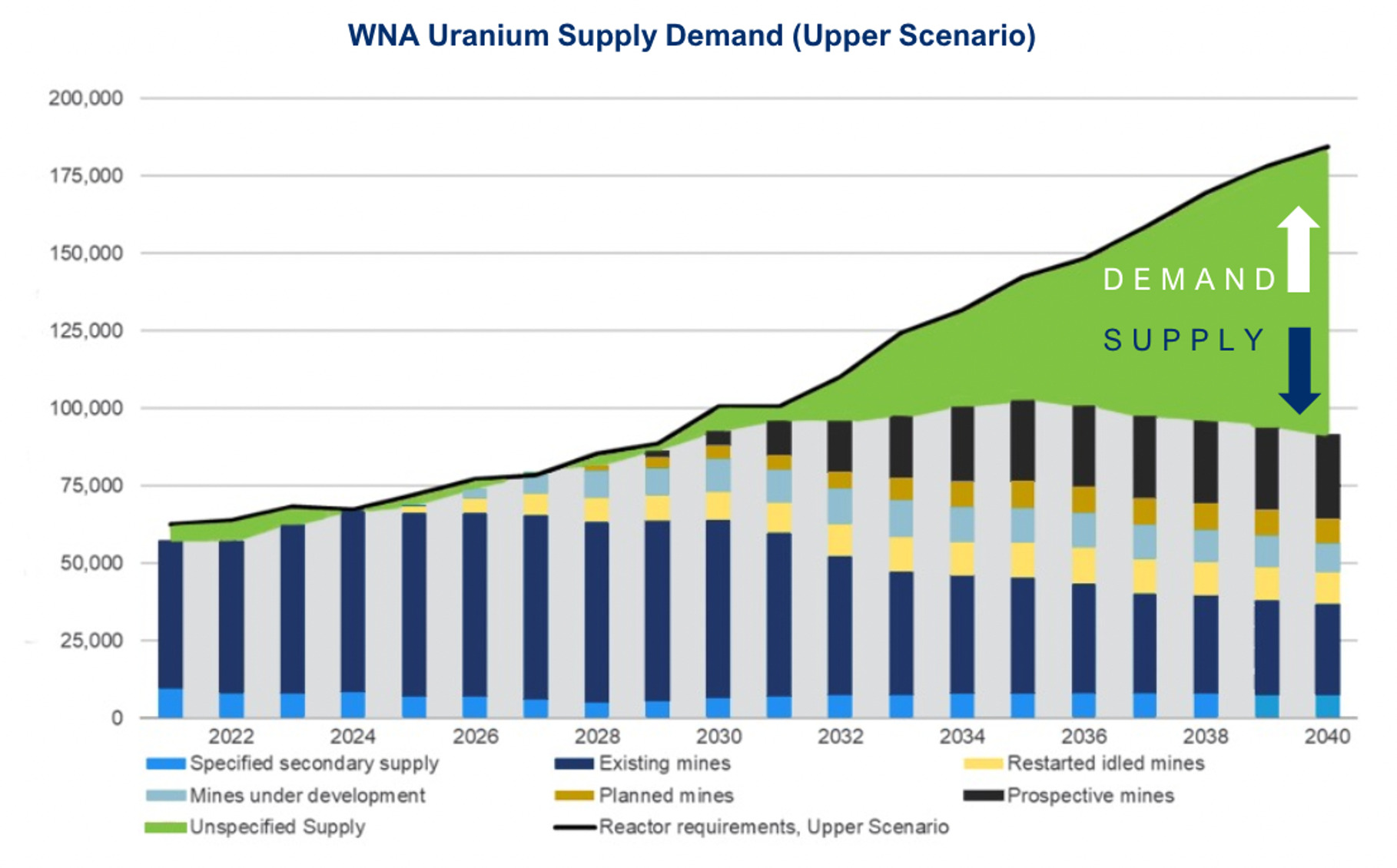

More power plants = increased uranium demand, which supply will struggle to meet. Here’s why.

It is difficult to bring additional mine supply online at the best of times (an average of +10 years from discovery to production, the experts reckon).

As it turns out, it’s also difficult for current miners to hit production targets.

“We cannot stress enough the fragility of primary mine supply,” CG says.

“This has become particularly clear in the past 12 months, which have been marked by several production downgrades from incumbent producers (Kazatomprom (LSE:KAP) and Cameco (NYSE: CCJ)).

“The most notable downgrade was KAP’s FY24 guide in early February, where it announced a 9Mlb downgrade due to acid supply constraints and delays at some of its newly developed deposits.

9Mlbs a year is a lot; about ~6% of global production.

For context, fledgling producer Boss (ASX:BOE) will produce an initial 2.45Mlbs a year, while Paladin (ASX:PDN) is looking at peak production of 6Mlbs from the Langer Heinrich mine.

“We will be closely watching for a revision to KAP’s 2025 production target in August as the company has already flagged its 2025 target of 81Mlbs as ‘at risk’; we expect a material downgrade,” CG says.

Even mine restarts in 2024 – which CG expects to push supply up ~7% to 150Mlbs per annum – won’t be enough to balance the market. CG estimates a structural deficit of 22mlbs in 2024 and 16mlbs in 2025.

“’Difficult pounds will need to be developed,” it says.

But the only greenfields (new) projects currently under construction are KAP’s Budenovskoye and Global Atomic Corp’s (TSX:GLO) Dasa, CG says, both of which are facing delays.

“Other notable projects are still several years away from production when considering hurdles such permitting and financing.”

The biggest greenfields project on the horizon is Nexgen Energy’s (NYSE, TSX:NXE; ASX:NXG) large, high-grade Rook I operation in Canada’s Athabasca Basin, one of the world’s top uranium jurisdictions.

NXE is also a favourite of Argonaut’s fund manager extraordinaire David Franklyn and many other professional stock pickers.

Rook I – which Terra Capital’s Jeremy Bond calls “a geological freak”– will be the largest and lowest cost uranium mine in the world, pumping out 30Mlbs a year.

Rook I will cost CAD$1.3bn to build, but because of it’s high margins the payback period is expected to be only ~0.6 years — and that’s at US$50/lb.

At a US$100/lb uranium price, NXE could be making a monstrous $3.4bn CAD each year in EBITDA.

But even this won’t be enough to touch the supply deficit, says the company, which requires “over 5 new Rook I sized projects to be found, permitted, financed and constructed over the next 20 years”.

Given extreme tightness in the spot market, CG “continues to believe that spot prices could trend higher over 2024 and model an average price of US$105/1b (+15% vs. previous)”.

“A re-evaluation of the cost curve has also driven us to increase our Iong term price assumption to US$90/lb, from US$75/lb-$80/lb previously.”

This mean CG’s favoured uranium equities have price targets that are, on average, 13% higher.

“Our preferred equity exposures are NexGen Energy and EU in North America; Paladin and Lotus (ASX:LOT) in Australia; and KAP in the UK,” it says.

“For pure spot price exposure, we like U.UN (SPUT) and YCA.”