Jeremy Bond thinks this uranium deposit is a ‘geological freak’ poised for a nuclear bull market

Pic: alberto clemares expósito/iStock via Getty Images

- Terra Capital’s Jeremy Bond delivered the only mining pick for this year’s Heart and Minds Conference portfolio – Canadian uranium developer NexGen Energy

- Bond tells us why its Rook I discovery is a “geological freak”

- The fund manager reckons uranium could surpass its 2007 highs of US$149/lb in an emerging bull market

Despite its dominance in the Australian investing landscape, fund managers presenting at the Sohn Hearts and Minds Investment Conference rarely pick resources stocks.

Since its establishment in 2018, Hearts and Minds has invested around $700m and donated almost $44m to medical research, and introduced punters to ideas from some of Australia’s top fundies.

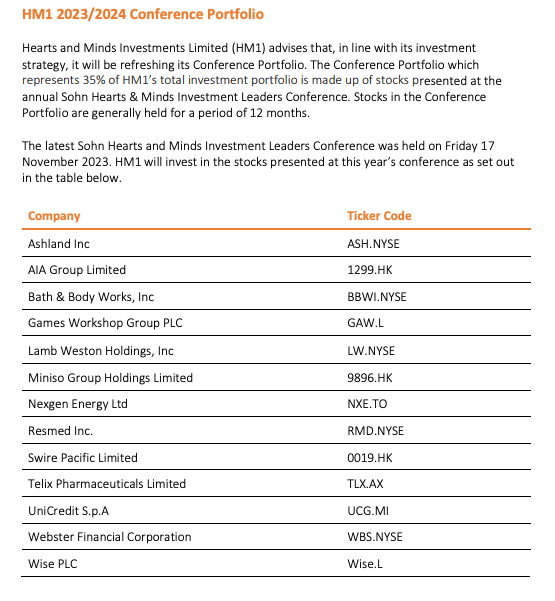

35% of the portfolio is made up of stocks selected by presenters at the SHM Investment Leaders Conference at the Sydney Opera House, held last Friday.

Last year’s sole mining selection — high grade Canadian iron ore miner Champion Iron (ASX:CIA) — netted a 21% gain for Hearts & Minds Investments (ASX:HM1). Kudos to Regal’s Tim Elliott on that one.

This year again resources was an outlier, with just one pick in the 2023-24 conference portfolio.

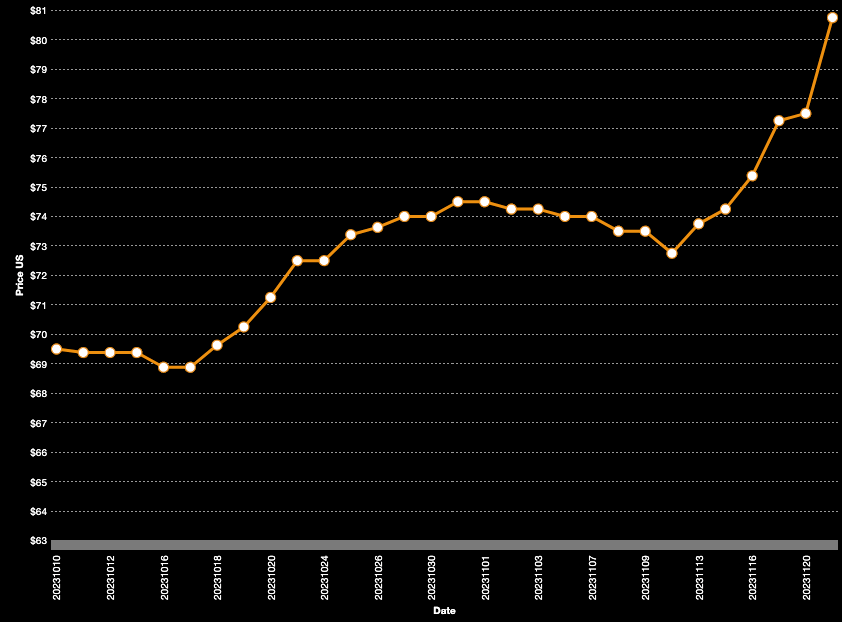

That was dual-listed uranium developer NexGen Energy (ASX:NXG), now sitting on a C$4.6 billion market cap after a ~50% rise in its share price this year on the back of uranium’s 60% lift in prices to a 15-year high of US$80.75/lb yesterday.

The fundie who picked it — Terra Capital’s Jeremy Bond — reckons this uranium run has way more legs, saying fundamentals are there to surpass 2007’s boom-time highs of US$149/lb.

“It’s hard not to be pretty excited on a 12-month basis on that uranium price. The market has got so tight,” he told Stockhead.

“You can see the reactors under construction plus the extensions, coupled with your things like Sprott Uranium Trust and Yellowcake — over the last 18 months they’ve just been slowly taking pounds out of the market.

“And you’re coming into the contracting cycle. If your nuclear facility’s to be constructed by ’25 or ’26 or you’re extending like you need the pounds now, you can’t borrow them in ’25 or ’26 pounds now… there’s just not the pounds there.

“You’re seeing the price having to gap up like a dollar each night sort of thing and the market’s small so it’s got the capacity to do that.

“You look back at the last boom and it was pretty aggressive. I think this one’s based a bit more on fundamentals so I don’t think it’d be quite as boom and bust but I think you could easily see the price go past the last high.”

Why NexGen?

NexGen is the owner of the Rook I discovery in Canada’s Athabasca Basin, a geological miracle in the backwoods of the Saskatchewan Province.

Where most economic uranium deposits — like those found in southern Africa — grade in the parts per million, Athabasca mines can grade as high as 17-20% U3O8.

That’s one in five.

NexGen’s Rook I isn’t quite at that level for grade, but it does the rest for scale.

A 2021 feasibility study put a $1.3 billion capex bill on developing the project which at that point had 3.75Mt of ore grading 3.10% U3O8 for 256.7Mlb of yellowcake.

At 29Mlbpa for its first five years of a 10.7 year mine life, Rook I would be the largest uranium producing mine in the world.

With operating costs of just US$5.69/lb, that mine once developed could pay back that enormous initial outlay in just nine months — and that’s at US$50/lb.

If prices run to US$100/lb, Bond says the mine would on its own generate as much free cash as Freeport McMoran did last year. For context, that’s the world’s top producing copper miner.

“It’s one of the best undeveloped assets of any kind in the commodity market,” Bond said.

“If you put a gold equivalent and a copper equivalent on it, it’s a geological freak.

“At US$100/lb it’s doing free cash flow of a billion and a half US, which is the same free cash flow that say Freeport did.

“Freeport’s capped at US$60b, so call it C$90b, NexGen is C$4.5b.

“Admittedly it’s not in production, so it’s not like for like but even more interesting is that Freeport free cash flow comes off 22 assets, whereas this could come from one. So it really is quite a unique asset.”

NexGen Energy (ASX:NXG) share price today

High conviction

Sohn asks fundies to give their high conviction bets and that would certainly describe Bond’s approach to uranium.

“If we really are going to achieve any of those 2050 targets, you just can’t really see a world in which those targets are achieved without a much larger adoption of uranium,” he said.

“We’re all for renewables and I believe in the lithium story and the copper story very much so.

“A solid part of that demand is predicated on the rollout of renewables, but in a high cost, high rate environment I think there’s going to be a push for other energy sources and baseload power and uranium does fit that bill

“In Australia, we don’t see it because we’re just anti-nuclear. But China I think needs to do nine reactors a year for the next 10 years or something.

“There’s 450 reactors globally now. And they’re looking to build 90 over the next 10 years.

“We think the long term story is real, the short term story is real — as in there’s a physical squeeze in the market at the moment.

“So you’ve got a short term story in a spot market squeeze and then a long term story and I just think the adoption nuclear is going to become more mainstream.”

Other uranium stocks Bond likes include IsoEnergy (TSX.V:ISO), which has made the world’s highest grade uranium discovery at Hurricane in the Athabasca.

On the ASX he says Terra has also been in Paladin (ASX:PDN) and Lotus Resources (ASX:LOT) previously, though they’re not currently in the fund.

Where to for mining?

Terra has all up $185m of funds under management, with around $170m in its natural resource fund, a surprisingly under-serviced part of the Australian investment landscape.

Outside of uranium, Bond has a number of picks across lithium, copper, iron ore, met coal and specialty metals.

“We have started buying some lithium and copper exposure. I think they’re the two commodities that sort of got a bit beaten up this year,” he said.

“I think now it’s time to start sort of scaling into some of those producers.

“I’m thinking Pilbara Minerals (ASX:PLS) in the lithium space. In copper, we tend to express that offshore so we’ve been buying Lundin Mining (TSX:LUN) and Capstone Copper (TSX:CS).”

Bond also likes Champion Iron, which is ramping up to 15Mtpa of high grade magnetite concentrate from its Bloom Lake complex in Canada.

“We think that high grade product is only going to become more and more valuable. We also think when you look at Champion, those high grade producers assets other than Champion’s really all owned by steel mills,” he said.

“Champion’s the last sort of decent, unencumbered one and look you at the consolidation in the steel industry and I don’t think it’s a stretch to think that one of those companies might find Champion interesting.

“We don’t own it for M&A, but I wouldn’t be surprised if there was M&A.”

Other ASX companies on Terra’s radar include Queensland met coal producer Stanmore Coal (ASX:SMR), Brazilian rare earths darling Meteoric Resources (ASX:MEI), Orica backed Alpha HPA (ASX:A4N) and resurgent WA gold explorer Spartan Resources (ASX:SPR).

Terra ASX picks share prices today

At Stockhead we tell it like it is. While Spartan Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.