Waratah adds scale to emerging Spur gold discovery in NSW

Waratah keeps expanding known gold mineralisation at Spur. Pic: Getty Images

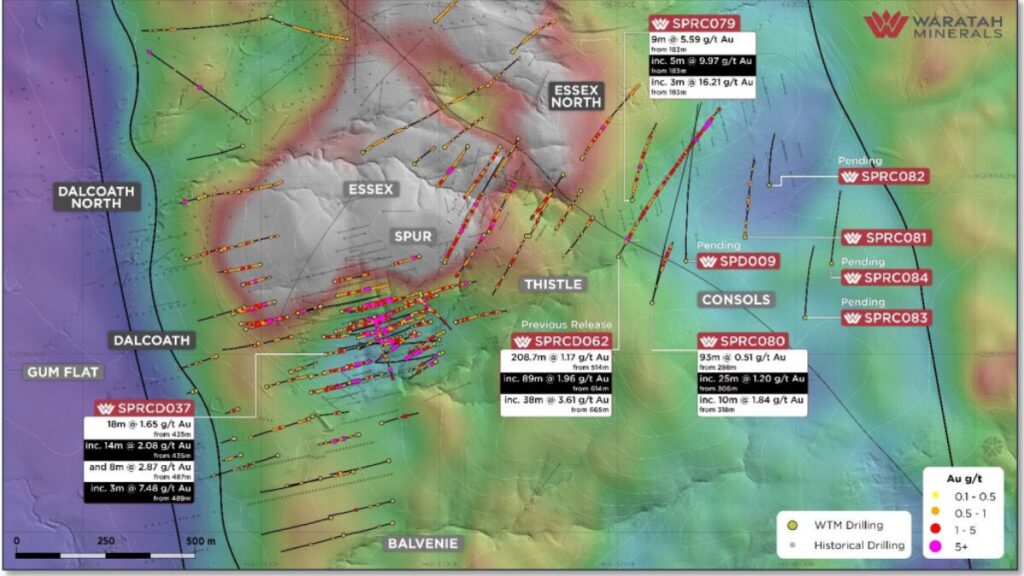

- NSW gold explorer Waratah Minerals continues to grow the scale of its Spur Gold Corridor discovery with results from drilling at the Consols Zone

- Located on the doorstep of Newmont’s Cadia mine, the company’s shares have more than doubled in the past six weeks

- Drilling will expand after $30m raising, with two more diamond rigs en route

Special Report: It’s been the most exciting early stage gold exploration story in Australia in the past couple months.

And Waratah Minerals (ASX:WTM) has added more credibility to the narrative that its Spur Gold Corridor could deliver a significant gold discovery with fresh drilling results.

Drilling at the Consols Zone will be closely watched by the market after a hit of 208.7m at 1.17g/t from 514m in hole SPRCD062 was announced in early August, which triggered a more than doubling of the explorer’s share price to 72c with a market cap closing on $200m.

The latest results from reverse circulation are less spectacular in thickness, but strong on grade at relatively shallow depths, extending the Consols Zone system in NSW’s Lachlan Fold Belt 160m to the south and 160m to the north-northwest.

Both SPRC079 – 160m northwest of SPRCD062’s collar – and SPRC080 – 160m south – encountered mineralisation linked to the shallow RC portion of the standout hole SPRCD062.

Some of those highlights included:

- 9m at 5.59g/t Au from 183m, including 5m at 9.97g/t from 183m and 3m at 16.21gt from 183m (SPRC079); and

- 93m at 0.51g/t Au from 288m, including 25m at 1.2g/t from 306m and 10m at 1.84g/t from 318m (SPRC080).

Two diamond holes have been sunk to target the high-grade portion of SPRCD061 as well, meaning more newsflow in the pipeline.

“Our understanding of the Consols Zone within the wider Spur Gold Corridor is growing with RC drilling results extending mineralisation in the upper levels and further expanding the system,” Waratah managing director Peter Duerden said.

“Results from current diamond drilling, including a wedge hole off SPRC080, will test for up-dip and along strike extensions of the high-grade mineralisation encountered in SPRCD062.”

Exploration activity is about to ramp up as well, with last month’s drilling success leading to a $30m raising at a now very in the money 57.5c, the second $18.3m tranche of which is expected to be issued after an EGM later this month.

“With two more diamond drill rigs arriving on site within three weeks, the company is set to expand its drilling campaign at the Spur Gold Corridor, driving momentum and fast-tracking the delivery of further results,” Duerden added.

Spurred on

The Consols Zone is not the only area of the Spur Gold Corridor, located tantalising close to one of Australia’s largest gold and copper mines, Newmont’s Cadia Valley, where drilling is turning up promising results.

A diamond tail added to SPRC037 at the eponymous Spur Zone picked up two significant intercepts at depth, along strike from high grade intercepts in holes SPRCD050 and SPRCD053, associated with quartz-carbonate-sulphide veining in the contact between intrusive units and host volcanoclastic rocks.

They included 18m at 1.65g/t Au from 435m – including 14m at 2.08g/t from 435m – and 8m at 2.87g/t Au from 487m – including 3m at 7.48g/t from 489m.

Three RC drill holes at Consols are still being assayed, meaning more results are on the way in the coming weeks.

Four diamond drill holes have also been drilled and processed at the Spur Zone along strike from previous drilled high-grade material.

Once the new rigs arrive, two will be slated to expand and infill the high-grade Spur Zone with another two to focus on funding the edges of the growing Consols Zone.

This article was developed in collaboration with Waratah Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.