VRX got its key mining lease for the Muchea silica sand project

VRX Silica is taking off after securing the key mining lease for its Muchea silica sand project. Pic: Getty Images

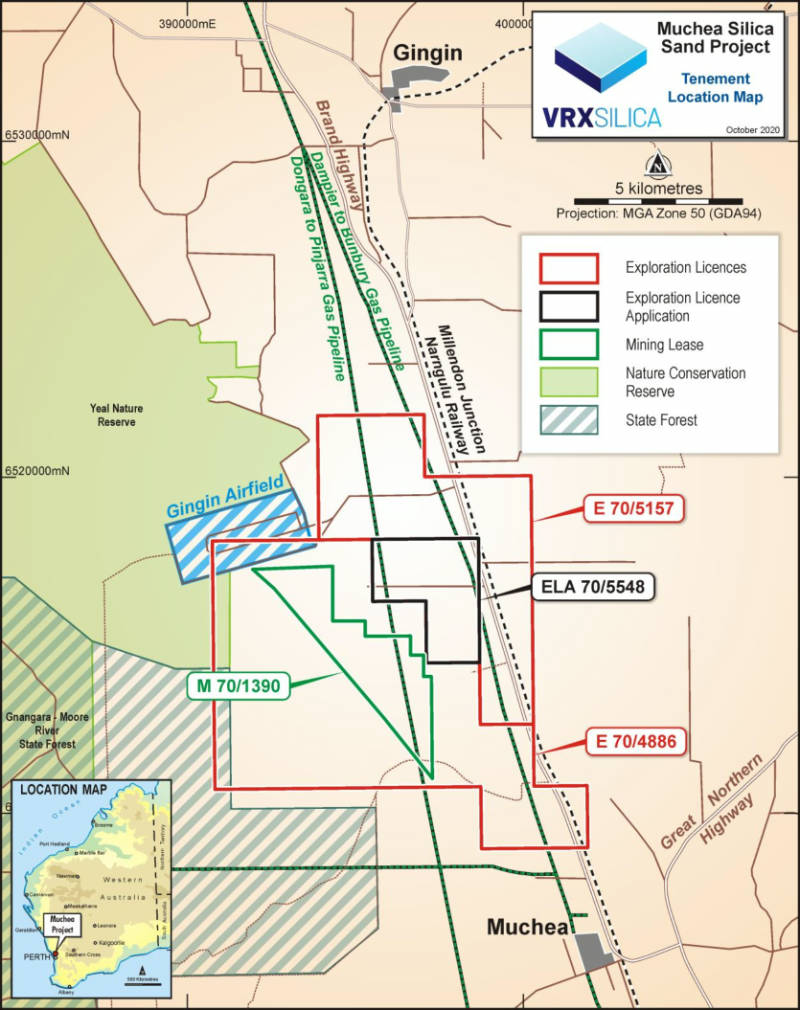

Special Report: VRX has a clear pathway to develop its high grade Muchea silica sand project in Western Australia after securing the critical mining lease.

Muchea is the most attractive of the company’s three silica sand projects thanks to its higher quality sand that makes it especially suitable for the ultra-clear glass used in high-tech applications such as solar panels, fibre-optics, LCD panels and LED lights.

The lease covers about 1,008 hectares, which VRX Silica (ASX:VRX) says is sufficient for at least 25 years of production – in line with the project’s bankable feasibility study (BFS).

Managing director Bruce Maluish says the grant of the leases is a significant milestone and a major step forward for the company’s goal of becoming a global, long-life supplier of silica sand.

“Demand from potential customers for long-term supply of silica sand from the Muchea project is strong,” he added.

“With the mining lease secured, we look forward to stepping up negotiations to finalise sales contracts for high-quality silica sand products and secure the necessary funding for the project’s $32 million development.”

High-grade silica sand

Muchea has an ore reserve of 18.7Mt grading 99.9 per cent SiO2 and an overall resource of 208Mt at 99.6 per cent SiO2.

Of this amount, a reserve of 14.6Mt at 99.9 per cent SiO2 and a separate inferred resource of 61.4Mt at 99.6 per cent SiO2 is contained within the mining lease area.

The reserve makes up about 30 per cent of the estimated total production target over a 25-year mine life.

VRX plans to mine solely from the reserve during the first 9-10 years of mining operations.

It added the ore that forms the inferred resource is contiguous with the indicated resource that the reserve is estimated from and has been categorised as lower confidence because of wider-spaced drilling.

While there appears to be no difference between the modelled sand in each category, the company notes that more drilling is required to upgrade the current inferred resource.

In the company’s BFS, Muchea is expected to generate net present value (NPV) of $337.9m and internal rate of return (IRR) of 96 per cent.

Both NPV and IRR are measures of a project’s expected profitability.

Capex is estimated at $32.8m with payback expected in 2.3 years. Total sales are estimated to be $1bn based on the reserves alone and $3.3bn if the inferred resources are included.

Further work

VRX is currently finalising further studies and compilation of necessary data to support formal referrals to the Federal Department of Agriculture, Water and Environment and the State Environmental Protection Authority to secure environmental approvals.

These approvals are required for development of the Muchea project.

The company is also seeking to expedite approval for its mine plan and the issue of a mining permit from the Department of Mines, Industry Regulation and Safety.

Additionally, VRX notes that the mining lease is a conversion of part of the exploration licence, which in turn covers a portion of file notation area 12671 (FNA).

The FNA ground is located outside the current proposed development area and the company is seeking access to extend the project’s mine life.

As such, it is assessing all available options to do so while addressing concerns related to the FNA.

This article was developed in collaboration with VRX Silica, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.