VRX Silica holds three standout high-demand silica sand projects

Mining

Mining

Special Report: VRX Silica is on the verge of developing the first of its three silica sand projects in Western Australia with a bankable feasibility study and native title agreement already in place.

Sand — one of the most used and abundant commodities in the world – is encountering a looming shortage of better quality product – particularly silica sand – that is used in concrete and glass-making sectors.

The most abundant source of sand – deserts – yield a sand that is unsuitable for use in construction, as its grains are too fine and smooth to bind together, and in glass making, as it contains significant iron.

High-quality silica (SiO2) sand is an invaluable element in ultra-clear glass that is used on solar panels, or ground to a powder to make LCDs. Samsung alone consumes one million tonnes of silica sand per annum for its LCD displays.

It is especially telling when China includes silica sand in its list of “strategic minerals,” alongside commodities such as uranium and rare earths.

Listen: Explorers Podcast: What is silica sand? And what’s the investment potential for the quiet commodity?

VRX Silica (ASX:VRX) managing director Bruce Maluish told Stockhead that the price for glass-quality sand has grown steadily to the point that it can absorb shipping costs from Australia.

“We have been exporting sand from Australia for a very long time, but it tends to be held by very large multinationals such as Mitsubishi’s Cape Flattery in northern Queensland, and WA’s Kemerton and Albany Sands down south, which are owned by Japanese giants Tochu Corporation and Toyota Tsusho Corporation,” he noted.

The rising worldwide demand for silica sand has several ASX-listed companies now looking to develop their projects, although VRX is looking to capitalise on its first- mover advantage.

“We started earlier than anyone else and we remain ahead of the game.”

VRX was originally floated in 2011 as Ventnor Resources around its flagship Thaduna/Green Dragon copper project that was sold to Sandfire in 2016.

The Company then went exploring for gold and base metals in the Eastern Goldfields before Maluish steered the company toward silica sand.

“In 2017, I pivoted the company into silica sand after I noticed media reports about sand shortages in Asia – particularly in India,” he explained.

“I did a little more research and found that there is in fact a looming shortage of good quality silica sand in Asia, that has really been exacted by governments restricting dredging in rivers and lakes, which is predominantly where the high-grade sand is coming from.”

VRX acquired its first silica sand project in 2017 and the rest, as they say, is history.

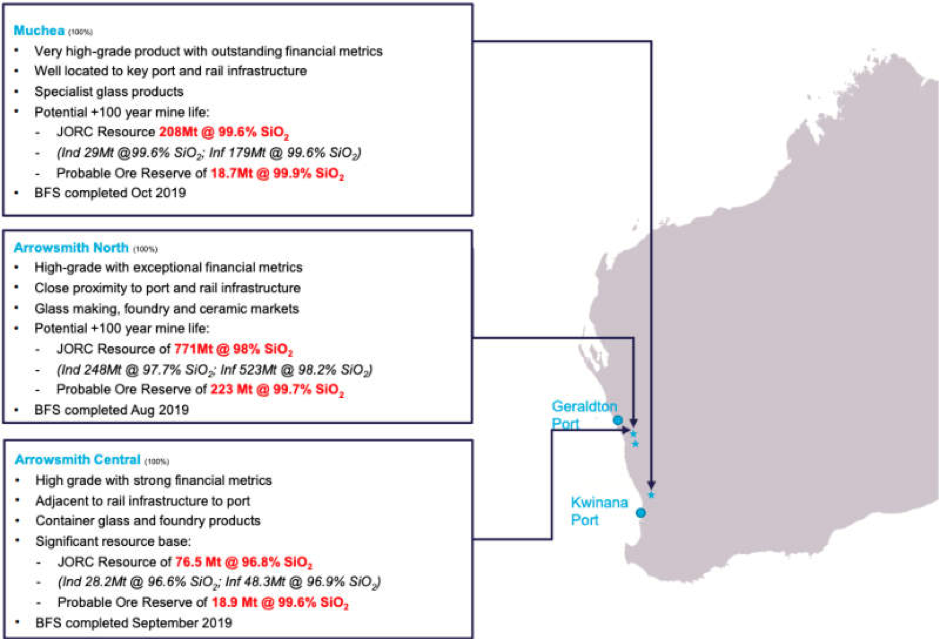

The company now holds three advanced silica sand projects in Western Australia: the Arrowsmith North and Arrowsmith Central projects between Eneabba and Dongara, as well as the high-grade Muchea project that is just 50km north of Perth.

Each of these has large established ore reserves and are the subject of individual bankable feasibility studies (BFS) that have highlighted robust financials for each project.

“While we would prefer to develop the high-grade sand at Muchea first, the environmental approvals required for Muchea are more onerous than for Arrowsmith North and Arrowsmith Central, which are expected to have a far faster run through the environmental approvals process.”

Do not infer anything is wrong with either project.

Arrowsmith North is expected to generate net present value (NPV) of $242.3m and an internal rate of return (IRR) of 77 per cent. NPV and IRR are both measures of a project’s anticipated profitability.

The project is expected to generate total sales of nearly $2.8bn from the mining of 53 million tonnes (Mt) of silica sand, at a rate of 2 million tonnes per annum. This is only an assessment from 25 years of a potential 100 year project! Payback of the palatable capex estimate of $28.26m is just 2.4 years.

Arrowsmith Central has an estimated NPV of $147.6m, IRR of 60 per cent, and sales of just under $2.2bn. Capex is estimated at $25.9m with a payback of 2.8 years.

Muchea is the jewel in this crown of three projects with its higher-quality sand expected to deliver NPV of $337.9m, IRR of 96 per cent, and total sales of $3.3bn plus. Capex is just a little more than its sister projects at $32.8m with a payback of 2.3 years.

The real kicker is that: these are based on conservative BFS figures and, both Arrowsmith North and Muchea have large Resource bases that give them the potential to be multi-generational projects.

Arrowsmith North has an ore Reserve of 223 million tonnes grading 98.7 per cent SiO2 within a massive global resource of 771Mt at 98 per cent SiO2 while Muchea’s current ore reserve of 18.7Mt grading 99.9 per cent SiO2 sits in a 208Mt Resource grading 99.6 per cent SiO2.

All three projects are also in close proximity to existing rail infrastructure and connection to ports, which are a definite plus for a bulk mining project.

Mining methods are clean and simple with much of the required equipment being similar to that used by the mineral sand sector with no chemicals required.

“We are taking the top two thirds of these Aeolian sand dunes, which are up to 25m high in some places, so we end up with a relatively flat, undulating surface,” Maluish said.

He added that the Company had developed a mining technique that involves taking the top soil off, mining the sand and putting the top soil back to the previously mined area to retain all of the qualities of the topsoil.

“Its continuous, almost instantaneous rehabilitation that preserves the topsoil, so the rehabilitation results are going to be better than any other method that can be employed.”

Because the projects are long term, they are obvious candidates for renewable energy supply with options being assessed for solar power.

Additionally, the Arrowsmith North project is right next door to the producing Waitsia gas field, giving it another potential source for power.

Beyond export, VRX is eyeing downstream opportunities for WA.

Maluish flagged that in the longer-term, the company would like to get a glass factory built in Western Australia.

“A glass manufacturing plant costs in the hundreds of millions (of dollars) and the more recent plants that have been built are in the order of $US500m ($816m),” he said.

“That’s obviously out of our reach, but we do have a strategic alliance with one of the largest producers in China, and we are encouraging them to build a glass plant alongside our Muchea deposit.”

He added that while the most expensive component of producing glass is energy, the giant Dampier to Bunbury Natural Gas Pipeline runs alongside its projects, providing them with “an obvious potential source of energy.”