VMM pens ‘globally significant’ 201Mt rare earths resource at Colossus

Viridis has reason to stand tall with its maiden Colossus resource taking up just 7% of the project area. Pic: Getty Images

- VMM unveils significant maiden resource of 201Mt at 2590ppm TREO at its Colossus project

- Resource includes higher confidence indicated resource of 62Mt at 2590ppm

- About 26% of the total resource consists of high-value MREOs

- Further infill and step-out drilling to be carried out along with scoping study work

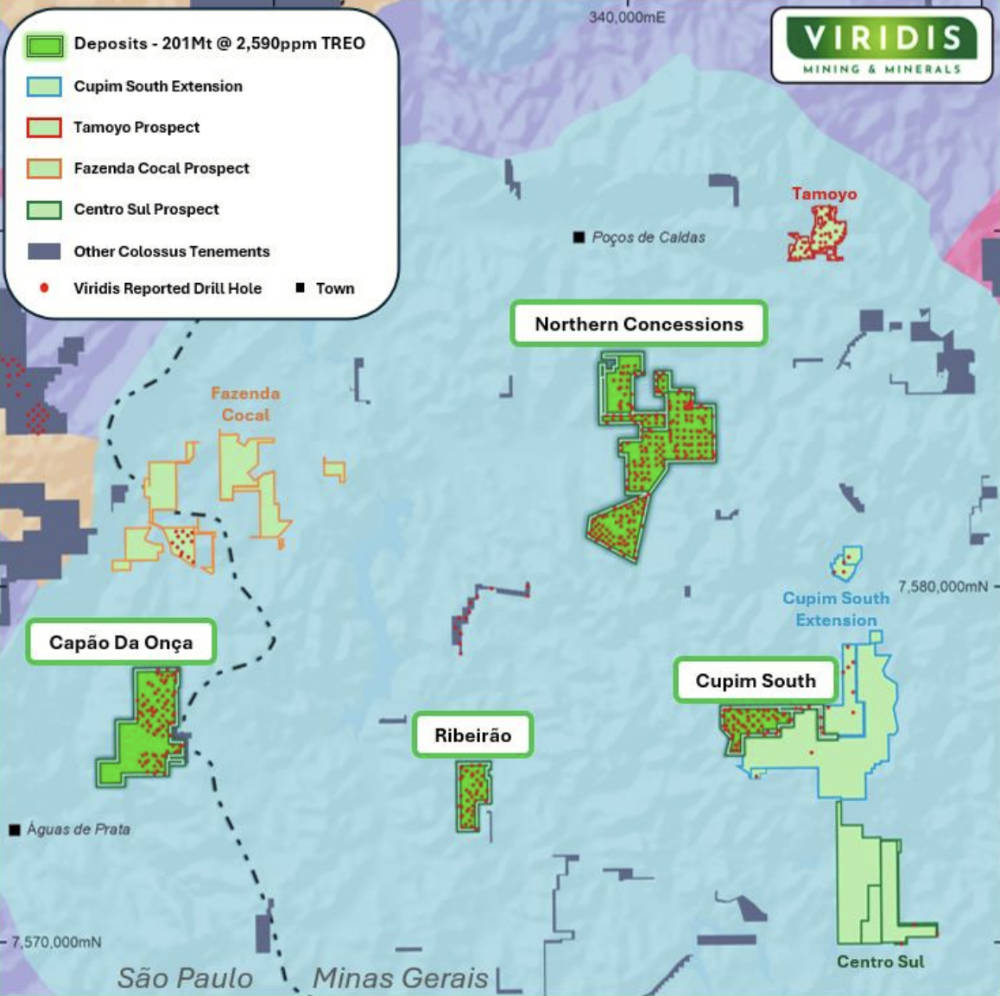

Special Report: Viridis Mining & Minerals’ Colossus project in Brazil is living up to its name with the estimation of a maiden resource weighing in at 201Mt grading 2590ppm total rare earth oxides hosted in ionic adsorption clays.

The maiden resource estimate comes just 10 short months after the company acquired the project.

Not only does Colossus have significant scale and grade, but more than a quarter (26% or 668ppm) of the TREO resource is made up of the valuable magnet rare earth oxides (MREOs) neodymium, praseodymium, dysprosium and terbium used to manufacture permanent rare earth magnets found in electric vehicle motors and wind turbines.

Making it just that much more attractive for Viridis Mining & Minerals (ASX:VMM), a significant part of the resource – 62Mt at 2590ppm TREO – is contained within the higher confidence indicated category that lends itself for mine planning.

Ionic adsorption clay-hosted (IAC) rare earth deposits are known for their potential to deliver low-cost, high-margin operations despite their lower grades compared to their hard rock counterparts due to the simple processing methodology, non-radioactive waste and attractive mineralogy weighted towards the high MREO content.

Initial bulk leach testing using standard ammonium sulphate (AMSUL) has already returned very high recoveries of MREO averaging 62% NdPr and 56% DyTb across the entire project.

There is also plenty of room for growth as the resource takes up just ~7% of the company’s landholding and is mostly open at depth, opening up the transitional horizon for potential resource updates.

All this is contained within the Poços de Caldas complex of Brazil’s pro-mining state, Minas Gerais, where some of the world’s highest grade IAC projects can be found, providing access to local established brownfield infrastructure and a supportive town with ample mining professionals.

As icing on the cake, the company has environmentally and socially derisked Colossus with dual memorandums of understanding signed with local and state governments that allow the project to be fast-tracked through permitting towards production, with minimised bureaucratic roadblocks.

High IAC basket value

Chief executive officer Rafael Moreno said the maiden resource estimate was an outstanding outcome as it was defined just 10 months from project acquisition and covers just a small portion of its land holdings, which highlights Colossus’ enormous potential.

“The key highlight and what differentiates our ionic adsorption clay project from our peers is the high levels of magnet rare earth content,” he says.

“The grades themselves are incredible, but more importantly, we have some of the highest contents of the four critical and valuable Rare Earths – Nd, Pr, Dy, Tb and the catalyst for Colossus having one of the highest IAC basket values in the world.

“Furthermore, Cupim South, has shown to be one of the highest-grade IAC deposits globally and has a spectacular 857ppm MREO. The Cupim South deposit was delineated by exploring a 1.69km2 area, a mere 15% of the overall Cupim South landholding.

“We’ve received one batch of results back from the Cupim South extension within granted mining licenses, which confirmed incredibly high grades of mineralisation with elevated levels of Dy & Tb near surface, so we’re confident in the immense scalability potential here and for this resource to continue getting better into future upgrades.

“As we continue aggressively with our development timeline, infill drilling is critical for mine planning as we look to maximise revenue in the early years of operations.

“Having already identified 47Mt above 4,000ppm TREO and 1,180ppm MREO, and having extensive untested tenements around the highest-grade global deposit at Cupim South bodes extremely well for project economics.”

Next steps

While the maiden resource is a key step forward for the company, it nonetheless represents only an initial step towards defining a measured resource and an important input towards engineering work that is being run in parallel.

VMM plans to carry out infill drilling at a 200m by 200m spacing at the Northern Concessions and Cupim South Extension to define an indicated resource at both concessions.

It also intends to carry out step-out drilling at Cupim South Extensions and the Fazenda Cocal prospect along with further resource development drilling at Capão Da Onça.

Along the way, the company will carry out metallurgical testing with the Australian Nuclear Science and Technology Organisation to optimise leaching conditions and kick off impurity removal and mixed rare earth carbonate (MREC) precipitation testing.

VMM is also looking to complete the scoping study with Hatch Engineering in Q3 2024 and move straight into a pre-feasibility study, complete environmental baseline survey and studies, and carry out downstream study and product testing with Ionic Rare Earths (ASX:IXR) for selective separation to produce rare earth oxides.

This article was developed in collaboration with Viridis Mining & Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.