Uranium is coming back into play as America outlines its nuclear ambitions

A bright future is on the cards for yellowcake hopefuls. Pic: Getty Images

- US reaches US$80bn partnership deal with Westinghouse to build new nuclear reactors

- New reactors around the world expected to drive significant increases in uranium demand

- VanEck uranium ETF launch recognition of “long runway for the nuclear ecosystem”

The stars appear to be aligning for uranium’s ascension with a number of key developments occurring within a short period of time.

Most prominently, the US Government unveiled a plan to quadruple the country’s nuclear-powered electricity generation capacity by 2050.

This will be achieved through a US$80bn partnership with Westinghouse to build new reactors – a sum that’s reportedly enough for eight AP1000 power plants that can each generate 1 gigawatt of power.

While sceptics will point to cost overruns associated with the construction of just two reactors at Vogtle in Georgia, the initiative is nonetheless hugely positive for the sector.

Combined with a growth surge from China’s reactor building spree, the news suggests that demand for uranium will be on track to lift significantly.

This is in line with the World Nuclear Association projections.

In its latest nuclear fuel report, a biennial publication, the WNA forecast an annual growth rate of 5.3% in nuclear reactor uranium requirements to 2040. That’s up from previous prediction of 4.1%, portending growing deficits with mined uranium production already well shy of annual consumption.

Demand recognition

As a further sign that uranium’s time is coming, investment company VanEck launched its Uranium and Energy Innovation exchange traded fund in October 2025.

This is due to increased global demand for alternative energy supplies that support decarbonisation and the transition to clean energy.

The ETF will provide exposure to the largest global companies involved in the uranium mining and nuclear energy sector to investors, which it said are typically under-represented in benchmarks.

VanEck Asia Pacific managing director Arian Neiron said the world was in the early phases of a global nuclear power renaissance.

“Major governments have committed to ramping up nuclear power capacity and utilisation, recognising the vital role it can play as part of a resilient, low-carbon energy mix,” he added.

“We anticipate a long runway for the nuclear ecosystem as more countries come on board, existing capacity expands, and new technologies such as small modular reactors provide safer and more efficient means of production.”

Standout ASX uranium plays

With sentiment continuing to improve, this might be the right time for uranium companies on the ASX to shine. We’ve scanned the market for a few juniors with huge potential leverage to the uranium price, with long-term prices have hit a decade long high of US$85/lb in October.

American Uranium (ASX:AMU)

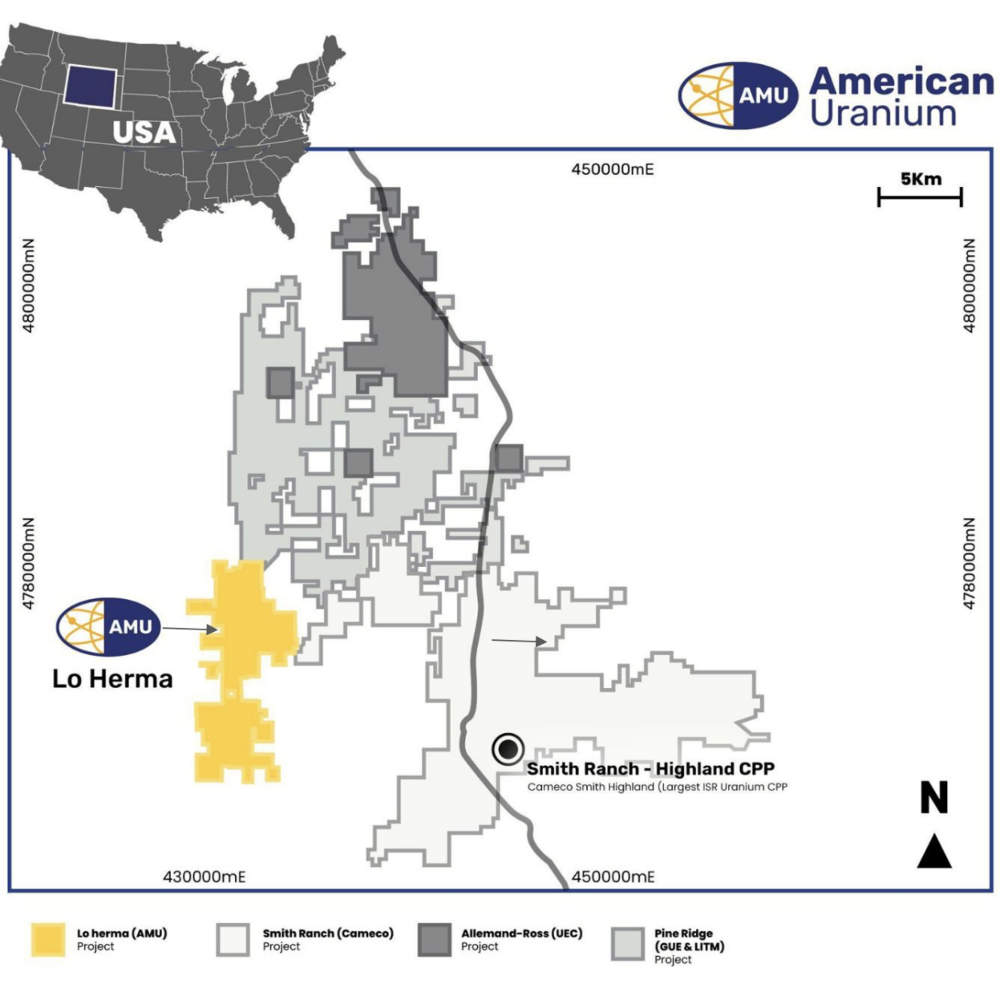

American Uranium holds the Lo Herma uranium project in Wyoming’s Powder River Basin.

It has a resource of 6.21Mt at 630ppm eU3O8, or 8.57Mlb of contained uranium, with a third contained within the higher confidence indicated category.

An exploration target of 6.16-10.95Mlb U3O8 at a grade range of 500-700ppm offers potential for resource growth with more drilling.

Wyoming’s roll front uranium deposits are noted to be amenable for in-situ recovery (ISR) mining if sufficiently below the ground water table and contained in a subterranean aquifer which is geologically amenable to control of underground leaching solutions.

ISR mining offers low capital and operating costs compared to hard rock mining with seven ISR uranium processing facilities currently operating in the state.

Lo Herma’s location in Wyoming’s premier jurisdiction of the Powder River Basin places it at the heart of America’s uranium revival, with five permitted ISR production facilities – including operations owned by Cameco, Ur-Energy, UEC and Energy Fuels – all within 100km.

This includes Cameco’s idled Smith Ranch-Highland facility in Wyoming’s Great Divide Basin – one of the largest and most advanced ISR operations in the US – that can be quickly restarted if demand surges.

American Uranium is actively pursuing key permitting approvals, conducting pre-development drilling, and hydrogeological testing to grow the resource, convert inferred resources to the indicated category and strengthen the overall resource model.

In late October 2025, the company launched Phase 1 of a two-phase resource development drilling campaign at Lo Herma.

This will see 50 step-out holes drilled totalling over 15,000m to expand the resource base by targeting known mineralised roll fronts.

Most of the holes will test areas to the north of the proposed MU1 and MU2 mining units.

Resource areas will be infilled by the second phase of drilling to increase confidence and resource category ahead of scoping study update in Q2 2026.

Aura Energy (ASX:AEE)

Aura Energy is focused on progressing its Tiris uranium project in Mauritania to become the first yellowcake producer in the northwestern African country.

The project sits within a remote, sparsely populated country that is home to a handful of large gold and iron ore operations.

It is expected to have a capital cost of US$230m and all in sustaining cost of US$35.7/lb, generate NPV of US$499m and IRR of 39% after tax with a payback period of just 2.25 years at a commodity price of US$80/lb.

Its prospectivity is clearly highlighted by the company recently reaching a long-term offtake agreement with a major US-based nuclear utility and a master spot sales agreement with a leading global uranium trading group.

This marks Aura’s first long-term offtake agreement with a nuclear power utility – a Fortune 500 company – marking a major milestone for the project.

The total contracted volume represents approximately 10% of Tiris’ projected uranium output over the agreement term of a four-year period.

Discussions are also well advanced with several potential strategic partners regarding funding and investment in Tiris.

Over in Sweden, the company is now examining options to include uranium in its plans to develop the Häggån polymetallic project after the government voted to overturn the uranium mining ban that has been in place since 2018.

In September 2023, Aura published a scoping study that was constrained by the uranium mining prohibition.

However, executive chairman Phil Mitchell said early November 2025 that it is economically sensible, more resource efficient and less environmentally wasteful to use Swedish uranium to support the country’s nuclear ambitions and a global nuclear renaissance.

Häggån has a resource of 2.0Bt grading 0.3% vanadium, 3.8% potassium oxide and 155ppm U3O8.

Elevate Uranium (ASX:EL8)

Elevate Uranium has several projects in Australia and Namibia that collectively host 160Mlb uranium.

The bulk of the resource is contained in the Erongo Uranium Province of Namibia at the 100%-owned Koppies (66Mlb at 192ppm U3O8) and 75%-owned Marenica (46Mlb U3O8 at 93ppm net to EL8) projects.

EL8 recently raised $25m for a number of initiatives, including to expand the pilot plant testing its unique U-pgrade process confirm expected results on the Marenica project, provide design parameters and operation readiness for a commercial scale plant.

The plant will arrive imminently in Namibia and was expected to be commissioned before the end of November 2025.

Testing of U-pgrade on ore from Marenica has already succeeded in lifting grades from 93ppm to 5000ppm, reducing waste and improving the purity of the feedstock.

Funds have also been set aside for major drill programs aimed at growing resources across its projects.

More recently, the company started drilling at the 30.8Mlb Angela project in the Northern Territory to test geophysical anomalies that display similar properties to those coincident with the known mineralisation.

The program, which is co-funded by the NT government, is expected to take about four weeks to complete and will inform future exploration programs that will boost resources.

Heavy Rare Earths (ASX:HRE)

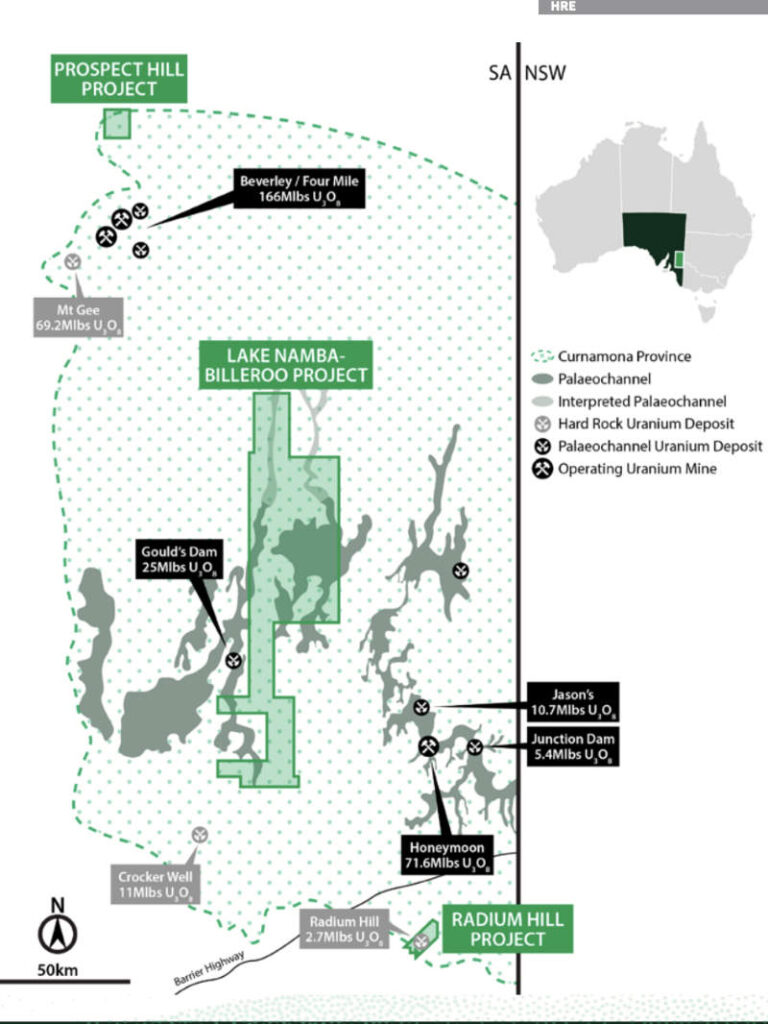

Heavy Rare Earths holds three uranium projects in South Australia that it acquired in 2024 and is progressing to attract acquisition interest.

The Radium Hill, Lake Namba-Billeroo and Prospect Hill projects sit in prospective geological settings within the Proterozoic Curnamona Province in northern South Australia.

Proterozoic basement provinces in the state have been the focus of major milestones in Australia’s uranium industry.

These include initial uranium production at Radium Hill – the nation’s first major uranium-only operation in the 1950s – and the subsequent development of Olympic Dam, the world’s largest uranium deposit.

It is also the location of two of Australia’s uranium producing mines including Beverly/Four Mile, owned and operated by Heathgate Resources, and Boss Energy’s (ASX:BOE) Honeymoon project, which produced more than 850,000lb of yellowcake in FY25 and is ramping up to 1.6Mlb this year.

At Radium Hill, the company believes there is considerable potential to discover high-grade extensions along the main lode system northeast of the Radium Hill Mine, which produced 2.6Mlb of U308 at 1200ppm from 1954 to 1961.

Recent reconnaissance sampling returned high-grade values for scandium and rare earths in March up to 16,273ppm US08, 1081ppm Sc203 and 36,371ppm TREO, potentially expanding the search profile for the project.

Processed and interpreted data from an airborne magnetic-radiometric survey is now being corroborated against the historical to determine priority drill hole targets.

At Prospect Hill, regional magnetic, radiometric and gravity data is being interpreted to assist with planning of a maiden drill program in the Wattleowie Valley.

During the September quarter, the company combined seismic and gravity data from the Billeroo Palaeochannel at its Lake Namba-Billeroo uranium project with regional magnetic, radiometric and gravity data, and data from an adjacent Boss Energy passive seismic survey.

This will assist with planning HRE’s maiden drilling program in the Billeroo Palaeochannel.

At Stockhead, we tell it like it is. While American Uranium, Aura Energy, Elevate Uranium and Heavy Rare Earths are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.