Up, Up, Down, Down: Which commodities won in June? Uranium. Only uranium.

Pic: Tom Werner/ Digital Vision via Getty Images

What’s that, you say? Which commodities won and lost in June?

Let’s have a rummage around…

WINNERS

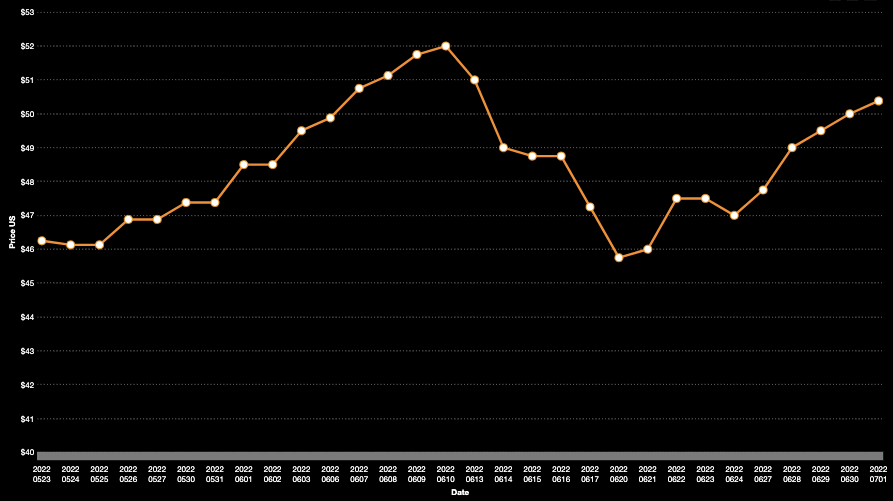

Uranium

Price: US$50/lb

%: +5.53%

In a month signposted by tumbling markets, global geopolitical dysfunction, rising interest rates and inflation up the wazoo, the nuclear fuel stood out as one commodity that swam against the tide and made it back to shore in June.

Uranium had been on a downward trajectory since an initial bump in spot prices in March beyond US$60/lb, the generally accepted price level needed to incentivise new production in the nuclear industry.

That lift had come from one major factor, Russia’s war with Ukraine.

After initial tumbling amid (unfounded) fears that Russian forces would cause a major disaster by bombing Europe’s largest nuclear power plant at Zaporizhzhia in Ukraine, spot buying increased as fears Russian, Uzbek and Kazakh supply could be hit by sanctions emerged.

The latest tailwinds for uranium prices have come from a similar source. America still gets 20% of its electricity supply from nuclear, a penetration that is unlikely to drop as the US looks to switch fossil fuels to carbon-free sources of energy including nuclear.

The Biden Administration is keen to reduce its reliance on Russia to fill its energy needs, so much so the Prez is pushing Congress to back a US$4.3b plan to buy enriched uranium from US producers.

That will require a lot more production not just from the States but other non-Russian jurisdictions like Australia, where Boss Energy (ASX:BOE) recently announced the restart of the Honeymoon uranium mine in South Australia.

Uranium bulls are betting that prices of U3O8 will continue to go higher as supplies at nuclear plants run up, though they are already around three times stronger than their cyclical lows from around five years ago.

Early in June, famed investor Rick Rule told Stockhead’s Oriel Morrison an incentive price of US$75/lb would now be needed to fulfil the global nuclear power sector’s needs.

“Given [the world is] using 180 million pounds and producing 120 million pounds – meaning that there is a 60 million pound per year shortfall – it’s pretty simple to figure out that over the five-year time frame that the price of uranium needs to go through the incentive price of $US75.

“Either that, or the lights go out. Those are the only two choices.

“Which of those happens? I suspect that the price of uranium goes up.”

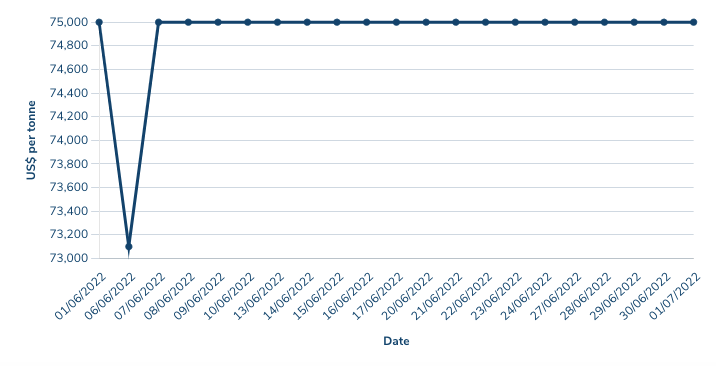

Lithium

Price (Fastmarkets Lithium Carbonate): US$73,000/t

%: 0.00%

There are a host of price reporters who have different numbers for lithium products, but from most angles the sector is currently running in place.

The good news for investors is that place is extraordinarily high.

Fastmarkets MB says prices for lithium carbonate have held at US$73,000/t for the past month, while lithium hydroxide is fetching around US$75,000/t on the spot market.

What has made lithium a winner this month though is the latest Battery Materials Exchange auction from miner Pilbara Minerals (ASX:PLS).

The Pilgangoora miner sold a cargo of 5.5% Li20 concentrate before the auction even began to a pre-auction bid of $6350/dmt.

At the 6% benchmark for spot prices that would be a record US$7017/t. Just astounding given how jazzed the market was about a winning bid at the first auction of just US$1250/t less than a year ago.

Experts say the market is unlikely to enter major deficits in the foreseeable future given the pace of growth in the electric vehicle industry, with the European Union recently revealing plans to restrict new internal combustion engine car and truck sales from 2035.

Fastmarkets’ last spodumene spot assessment came in at US$6625/t, US$335/t higher than a fortnight earlier.

&nsbp;

LOSERS

Iron Ore (62% Fe)

Price: US$119.44/t

%: -10.27%

Iron ore has begun to look challenged by some serious ructions in the Chinese steel market, with steel margins dropping or heading negative for a number of factories and expectations growing that the world’s largest steel producer will bring in environmental curbs on output in the second half of 2022.

In a way the strength of the steel market in the first half of the year may be a minor curse for iron ore producers, with higher than expected production increasing the risk of the same output cuts that took iron ore prices from US$237/t to US$87/t in six months last year growing.

Chinese authorities want to keep iron ore production below 2021 levels this year, enforcing what would be a second straight year of contraction in the industry.

China is the destination for around 80% of the iron ore that leaves Australian shores and produces almost 60% of the world’s crude steel, mostly for domestic consumption.

Weakness in its property sector and infrastructure spending during sustained lockdowns to contain the spread of Covid-19 in Shanghai and Beijing have contributed to lower steel prices.

Some respite could come if steel prices improve as MySteel chief analyst Wang Jianhua suggests.

Mysteel’s surveys have shown that nearly 90% of domestic steelmakers were suffering losses from sales during June.

Also weighing against iron ore prices is increasing supply from Australian and Brazilian miners, which were impacted by weather and Covid cases in the March quarter.

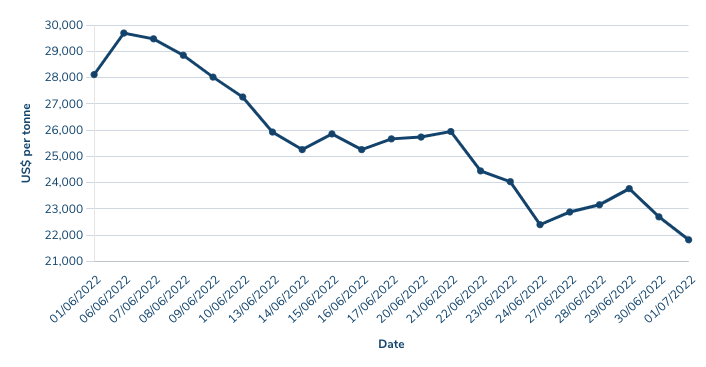

Nickel

Price: US$22,698/t

%: -20.05%

Industrial metals have spent the past month on a downward spiral to rival the final days of Kurt Cobain.

Nickel is no exception, with the stainless steel and battery metal tumbling from elevated levels seen since a radical short squeeze in March which sent prices as high (very briefly) as US$100,000/t.

The London Metals Exchange, a stockist of last resort and keeper of the keys when it comes to base metals prices, controversially reset prices back to ~US$48,000/t and cancelled a bunch of trades.

With restrictions on the volatility of daily movements in place since then, nickel prices have reverted back to the mean.

At ~US$22,000/t they remain especially high in historical terms — prices were as low as US$7600/t in February 2016.

Mincor Resources (ASX:MCR) announced last month it had raked in $25.3 million from the delivery of 1003t of nickel in concentrate from its Kambalda mines, treated at BHP’s Kambalda nickel concentrator.

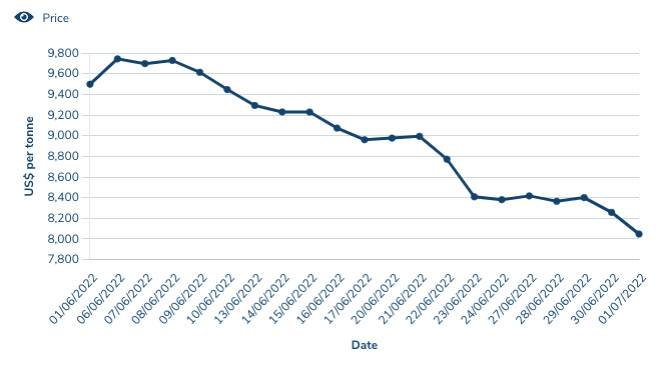

Copper

Price: US$8258/t

%: -12.59%

If Dr Copper is the thermometer for the health of the global economy, the red metal’s performance over the past month would seem to deliver a poor diagnosis.

The fall in copper prices over the past quarter is the fastest in a decade, shielded by coming off a very high base near historic highs of over US$10,000/t.

The big fears seem to be tightening monetary policy and high energy prices, which could hamper investment in infrastructure and property.

Prices sunk further on Friday to their lowest level in almost 18 months despite supply shortages, particularly in Chile where workers at Codelco, the world’s largest copper miner, have been striking hard.

“Copper, which is seen as an economic bellwether, ended the week down nearly 4% as investors appear convinced that tighter monetary policies will see economic growth weaken,” ANZ’s David Plank said.

“Aluminium, nickel and zinc also recorded falls, with only tin and lead managing to end the week higher.

“However, there are some bright spots for metals. Chinese demand is recovering as COVID-19 restrictions ease and the government boosts fiscal stimulus measures.

“This may offset any weakness from developed economies in coming months. Supply side issues also haven’t eased.”

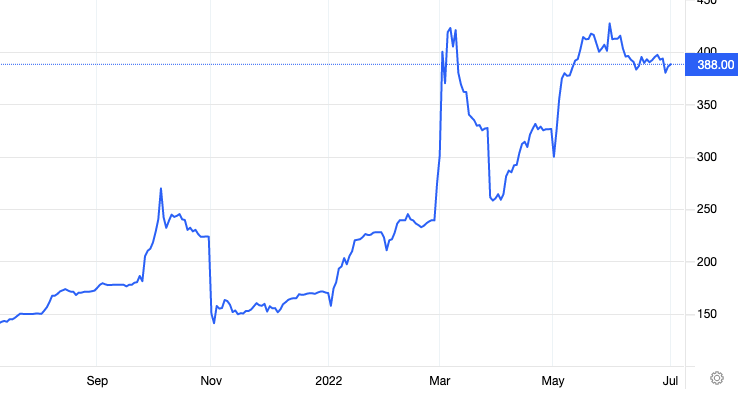

Coal (Newcastle 6000kcal)

Price: US$385.95/t

%: -7.00%

A strange sort of arbitrage is potentially opening up in coal markets, with the prices of metallurgical and thermal coal flipping for the first time in recent memory.

Typically ‘lower quality’ coal for energy sells at a discount to higher energy coal suitable for being converted into coke for steelmaking.

But steel production has been waning, down 6.3% globally between January and May this year, with only the Indian market delivering a substantial increase in output.

Meanwhile energy shortages just about everywhere and stonkingly high gas prices have kept thermal coal prices elevated.

While premium hard coking coal prices have slid from highs verging on US$670/t post-invasion in March to US$286/t by the end of June, energy coal prices have been stubbornly high.

Despite falling 7% from US$415/t to US$385.95/t across the month, thermal coal miners are still making bank against suggestions the fossil fuel sectors was at death’s door a couple years ago.

Against that backdrop BHP (ASX:BHP) last month decided to dump its sale of the Mt Arthur coal mine in New South Wales and instead run the asset down by 2030, ekeing a few years of profitability out of the mine in its final days.

The Queensland Government has responded to the run in coal prices by controversially increasing its royalty rates, introducing three new tiers including one which will deliver the State 40% on each dollar of coal sold above $300/t.

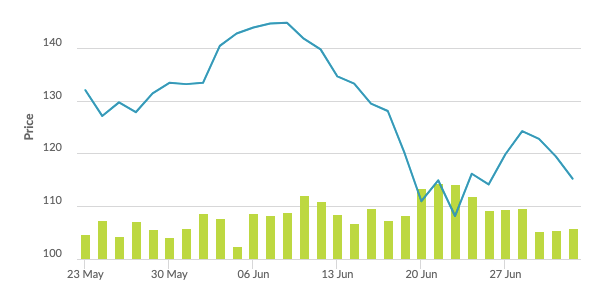

Rare Earths (NdPr Oxide)

Price: US$139.15/kg

%: -2.19%

Rare earths prices have held relatively firm in the face of falling industrial demand in China, where lockdowns have hampered factory productivity.

The Shanghai Metals Market, the main monitor of rare earths prices, said supply and demand forces in the industry, largely driven by demand for magnets used in electric vehicles and wind turbines, were in a wait and see mode.

“Affected by the macro front and the pandemic, the orders received by magnetic material enterprises dropped to varying degrees,” the price agency said.

“Some large listed companies said that the order volume was relatively stable, and some indicated that orders from sectors like wind power and home appliances had shrunk.

“Although with the improvement of the pandemic situation, large-scale vehicle enterprises have resumed work and production, with improved production and sales, the demand in wind power, home appliances, consumer electronics and other fields was still weak, and some industry players were worried about the future demand.”

At the same time, efforts have ramped up to increase the supply of separated rare earths from outside the Chinese market.

ASX-listed Lynas (ASX:LYC) received a US$120 million contract to build a heavy rare earths processing plant in Texas from the Pentagon.

It also emerged that it may have become the subject of a disinformation campaign on social media from Chinese intelligence forces called Dragonbridge, which reportedly saw allegedly fake social media accounts generated to create the impression of community opposition to Lynas’ American expansion.

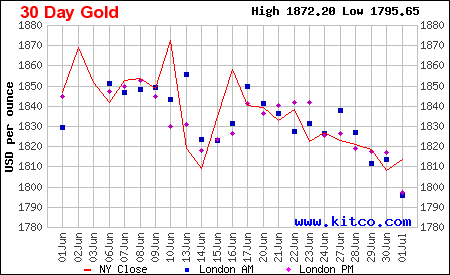

Gold

Price: US$1810/oz

%: -1.52%

The yellow metal is an investment asset and from that perspective it is outperforming the broader market.

“In comparison to the rest of the market experiencing downfalls, at the end of the June quarter gold is up 5% for the year and 11% year on year,” Rush Gold director Mark Pey says.

“Gold is doing its job.”

As Stockhead’s indomitable small cap lion Reuben Adams reports, Pey says it’s an inflation hedge par excellence.

And rising consumer prices mean gold is looking less risky by the day against traditional conservative investments like bonds and term deposits.

“The RBA’s predicted inflation rate rise to 7% by year-end may be wishful thinking, and inflation could be much higher,” Pey says.

“Globally we are seeing countries such as the UK already at 11%, and Estonia and Latvia sitting at a massive 20% annualised inflation.

“These rises playing out globally reinstate Rush Gold’s opinion that investing is always a forward-looking exercise and gold fits the criteria of a top performing inflation hedge.”

As a mined commodity it’s been less exciting. Gold miners are down more than 20%, with performance and rising costs largely to blame.

Since they pretty much all refine their own metal, gold producers tend to wear a lot more of the costs of production than base metals and iron ore miners who ship crushed ore or concentrates.

Margins are tighter, which means cost pressures are amplified.

Still, bullion prices continue to be strong, ranging between US$1800-1900/oz for most of the year. Sector leaders don’t expect a major crash any time soon either.

Tom Palmer, the Australian boss of the world’s largest gold miner Newmont, said last month on the sidelines of the PDAC Conference in Toronto that gold had found a new floor upwards of US$1600/oz.

“I see no reason why you wouldn’t, over the next year or two, see it around current levels, but more importantly sitting on top of a floor that has fundamentally moved given the events of the last couple of years,” he told Bloomberg.

Other Metals

Silver

Price: US$20.25/oz

%: -6.21%

Tin

Price: US$26,451/t

%: -23.71%

Zinc

Price: US$3157/t

%: -19.33%

Cobalt

Price: $US70,460/t

%: -4.78%

Aluminium

Price: $2445.50/t

%: -12.25%

Lead

Price: $1907.50/t

%: -12.06%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.