Up, Up, Down, Down: Which commodities won and lost in November?

Traders are optimistic China could pop its Covid bubble. Pic: Colin Anderson Productions pty ltd/DigitalVision via Getty Images

- Speculation China will be forced to unwind Covid Zero sends commodities soaring in November

- Iron ore up more than 30% as coal, nickel and copper prices record double digit gains

- Lithium and rare earths stagnate and uranium falls but market players remain bullish

WINNERS

Iron Ore

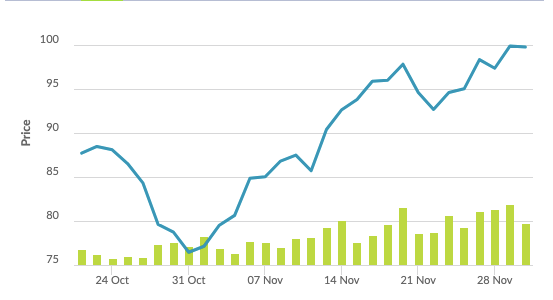

Price (SGX 62% Fe Futures): US$100.90/t

%: +30.75%

If the big story of commodity markets in October was the rapid decline in the value of iron ore, something which prompted high cost miners to ice their operations, then its swift rebound in November was the big one last month.

While the coronation of Xi Jinping as China’s (likely lifetime) ruler at the National Congress in October seemed to signal a long haul continuation of its economy-threatening Covid Zero policy, that has since unwound in a mess of garbled policy directions and, unusually for China, public protests.

Now traders are upbeat on the prospect of China making a faster than expect return to “normality”, buffeting demand for metals led by iron ore, along with measures to improve liquidity in its debt-riddled property sector.

At the same time market fundamentals have not been as rosy as sentiment. MySteel says blast furnace utilisation in China, responsible for almost 60% of global steel production, has slid for six straight weeks.

The big iron ore miners have made extraordinary gains over the past month, with Fortescue Metals Group (ASX:FMG) up over 26%, BHP (ASX:BHP) lifting ~18% and Rio Tinto (ASX:RIO) up ~22%.

BHP, in particular, has remained bullish about the outlook for Chinese steel and commodity demand.

“We continue to believe that over the next 12 to 18 months, which is what we’ve said previously, China’s going to provide an underpinning of stability for the global economy,” CEO Mike Henry told reporters after the world’s biggest miner held its AGM in Perth last month.

“So where other economies are turning down more strongly, we think demand out of China is going to be a positive.

“Now, as we move into the winter period, depending on what’s happening with COVID, could we see a bit of turn down in steel? Yes, of course.

“But again, the decisions in BHP and the way that we run the company really isn’t informed by what’s happening over the next three months, the next six months.

“We want to make sure that we’re running as efficiently, productively and safely as we can at all points in the cycle.”

Lithium

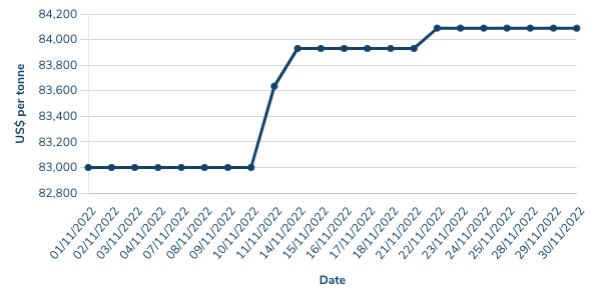

Price (Fastmarkets Lithium Hydroxide): US$85,000/t

%: +3.66%

Lithium price assessments range in value across different analysts, though one thing is for certain. Despite recent market ructions, EV sales remain strong and lithium prices remain high.

The evidence has been contradictory.

Credit Suisse prompted a slide in Australian lithium equities that has re-emerged persistently since early last month, after reporting the Wuxi futures price of lithium carbonate, one of two key lithium battery chemicals and the one closest linked to the fast growing lithium-iron-phosphate segment of the EV market, dropped 7% on concerns CATL could scale back production heading into the end of 2022.

Morgan Stanley, which famously tipped the supply-led lithium price crash between late 2018 and 2020, has also expounded on its concerns that Chinese EV demand could stagnate after an ‘overproduction’ of batteries in 2022.

Those close to the coal face have been more skeptical.

Ken Brinsden, who led Pilbara Minerals (ASX:PLS) from penny stock status to the cusp of becoming the $15 billion mining behemoth it is today, says those analysts expecting the market to go into oversupply are discounting how hard it is to build new mines.

“There’s a lot of ill-informed commentary in lithium markets. And it’s kind of a shame because, in some respects the investing public put faith in especially the big banks, but the truth is, the big banks are not close to the lithium market, really, at all,” Brinsden, now non-exec chair at Canadian explorer Patriot Battery Metals (ASX:PMT) told Stockhead.

“And as a result, a lot of their commentary is just fundamentally flawed.

“Analysts want to sort of imply that supply will come easily but nothing could be further from the truth.

“Lithium raw material supply is really difficult to develop and will be for quite some time because the mines are measured in five to seven to 10-year increments for development, and that’s just not the speed that’s required for the demand side growth that’s going on.”

Speaking of PLS, its sale of a 5.5% Li2O spodumene cargo at US$7805/t in mid-November (US$8575/t on a 6% basis), a new record through its BMX auction platform, showed converters are still desperate for feedstocks.

Others are considering starting up as DSO miners, with current prices making a small package of unprocessed lithium rocks almost as valuable as a 190,000t capesize iron ore vessel.

Lithium stocks prices today:

Rare Earths

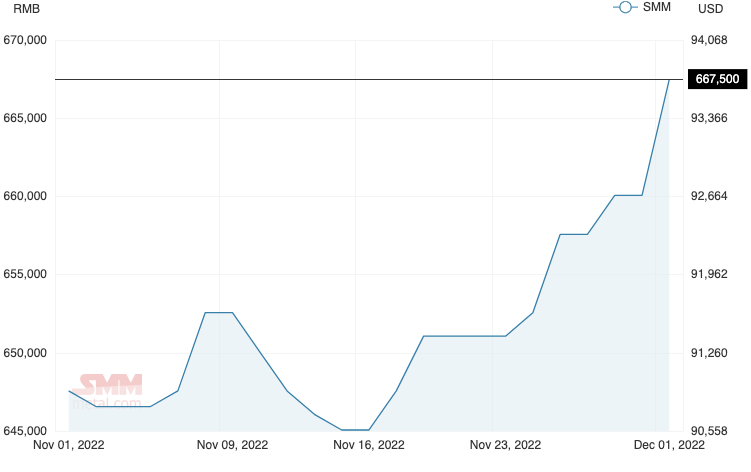

Price (NdPr Oxide): US$94.51/kg

%: +5.92%

NdPr prices returned to positive territory after what is considered a typical slowdown period in Chinese demand through August and September.

According to the Shanghai Metals Market, demand has remained sluggish in one of the many critical minerals markets that remain extremely reliant on activity in Covid-afflicted China.

But that could paint a rosier picture for magnet materials neodymium and praseodymium if China reopens and boosts its weak manufacturing sector, given it is the central hub globally for the production of EVs and wind turbines, two major energy transition technologies which used oodles of rare earths magnets.

According to a presentation at the AGM of Lynas Rare Earths (ASX:LYC), the largest producer of heavy rare earths outside mainland China, another 5,000t of NdPr oxide supplies will be needed for every 10 million hybrid electric vehicles on the roads, 3000t for every 10GW of direct drive wind capacity and 7000t for every 10m battery EVs.

Lynas recently ratcheted up its growth ambitions in light of these significant coming demand shifts, increasing the scale of a major expansion of its Mt Weld mine and downstream processing capacity to ramp up to 12,000tpa by 2024, up from a previously announced target of 10,500tpa.

However, the growth of the market and attractive prices are pulling additional players into the space.

Arafura Rare Earths (ASX:ARU) announced binding offtake agreements last month with Korean autos Hyundai and Kia to underpin a future FID on its Nolans project while FMG executive chairman, founder and mining magnate Andrew Forrest signalled his intention for the iron ore miner to diversify into rare earths and critical minerals at the company’s AGM.

Rare Earths share prices today:

Coal

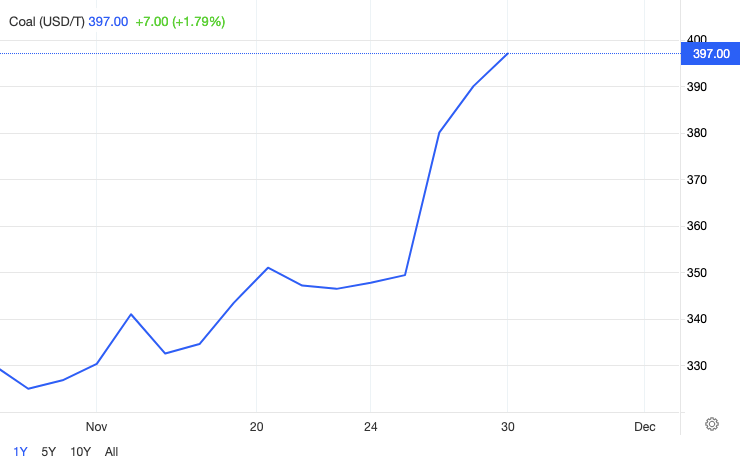

Price (Newcastle 6000kcal): US$397.00/t

%: +11.67%

The relief of a milder than expected start to winter in Europe has been eroded with the emergence of a cold snap which has brought a run on gas supplies and with it coal.

High caloric value Newcastle coal prices erased losses from October, lifting 13% in the final week of November to again threaten US$400/t.

Thermal coal tends to rise in concert with gas demand because it still produces, even at current extortionate prices, cheaper energy than LNG.

Australian producers have become more exposed to the European market than ever before thanks to a ban on Russian coal, the main source of supply for EU nations before Putin’s invasion of Ukraine.

China could also be forced to import more coal as Covid lockdowns hamper domestic supply.

Runaway prices for coal and gas have seen the Albanese Government contemplate domestic price caps, which along with IR changes contested by big businesses and a rumoured ‘windfall tax’ have descended into the largest government v resources industry scrap since 2010.

New Hope Group (ASX:NHC) CEO Rob Bishop told shareholders at the coal producer’s AGM that high prices would remain for some time to come.

“Looking ahead, we expect that coal prices will remain well above historical averages, as uncertainty remains about security of global energy supply,” he said.

“The supply demand imbalance was clear prior to the Russian invasion of Ukraine which only caused a further supply shock to the global energy market.

“We believe prices will remain elevated due to this imbalance, coupled with the time it will take for the world to transition responsibly to a decarbonised energy market given the investment required to … accommodate renewables and increasing electrification.”

Or at least we assume he did. The company copped flack from activist shareholder group Market Forces after hosting its AGM in remote Muswellbrook, near its Bengalla mine in the Hunter Valley, without offering an online stream.

Coal miners share prices today:

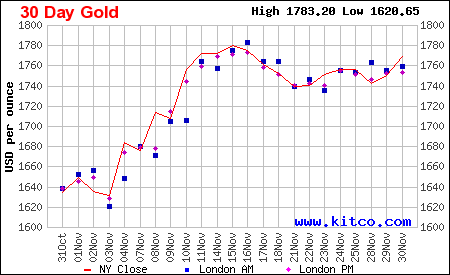

Gold

Price: US$1765/oz

%: +7.69%

Gold prices have been resurgent over the past month largely thanks to increased optimism that the US Fed could slow the pace of its interest rate hikes.

Lower inflation increases over the past month have led market watchers to believe Fed chair Jerome Powell will back slower rate rises after four 75bps lifts in a row, a perspective largely endorsed in a speech this week by the powerful monetary figure.

“This is a pivotal moment for gold as it is poised to have its best month since May 2021,” OANDA senior market analyst The Americas Ed Moya said of this week’s speech by the Powellinator.

“If China lifts more lockdowns, a risk rally should help keep gold prices supported, but first we need to see Fed Chair Powell allow markets to continue to expect a downshift in rate hikes next month and that they could pause their tightening soon after.

“Gold should find strong resistance at the $1800 level but if Fed Chair Powell eases up on the hawkish rhetoric, it could make a run for the $1825 level. If Powell sticks to the script and risk appetite stalls, gold could soften towards the $1750 level.”

A commodity that tends to do well when times are tough, gold is nothing if not a vampire. And miners have leapt on the despair of the crypto markets following the collapse of crypto exchange FTX in the States, a symbol of fears over the regulatory framework around digital currencies, a competitor to gold’s status as the world’s leading store of wealth.

“A stronger US dollar and the Federal Reserve’s aggressive monetary tightening, particularly since June, have until recently been a key headwind for the gold price whilst inflation has concurrently put upward pressure on costs,” Evolution Mining (ASX:EVN) executive chairman Jake Klein said.

“Looking forward though the outlook for gold is stronger with the Fed expected to ease interest rate increases within 12 months as inflation reduces and the global economy is expected to slow significantly.

“The recent developments in the crypto space, with significant losses incurred by investors in FTX and other crypto assets, have also reinforced gold’s worth as a superior storer of value.

“In uncertain times like this, we believe that Evolution is well placed to prosper through these headwinds the sector is currently experiencing.”

The All Ordinaries Gold Sub-Index on the ASX is up ~21% over the past month, outpacing the movement in the gold price in much the same way the value of gold shares collapsed earlier this year at a far faster rate than bullion.

Gold miners share prices today:

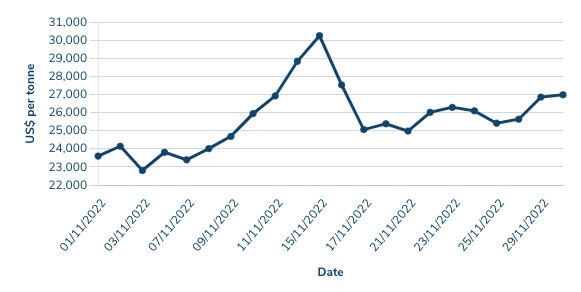

Nickel

Price: US$26,987/t

%: +23.74%

Nickel prices have quietly recharged among a host of commodities receiving a serious boost from rumours of China’s reopening after its Covid nightmare.

It also experienced one serious as hell lift from (also a rumour and an unfounded one at that) reports about an explosion at a plant in Indonesia, briefly climbing above US$30,000/t before coming back to earth.

The macro outlook for nickel is generally positive, with private equity play Kinterra’s $45 million cash takeover bid for junior Cannon Resources (ASX:CNR) a sign of the growing appetite for battery ready forms of nickel from the investment community.

Mining advisory practice RFC Ambrian reckons between 0.7 and 1.1Mt of additional demand will come from the battery market alone by 2030 fuelling total growth in the nickel market from 2.4Mt in 2020 to between 3.8-4.8Mt by 2030, a CAGR of 4.6-6.9%.

At the same time demand issues have emerged within the battery specific segment of the nickel market, with Fastmarkets reporting nickel sulphate premiums at their lowest level since April 2021.

The LME meanwhile has been in court, defending itself against claims brought by traders critical of its decision to suspend the market and reverse trades made at as much as US$100,000/t during a short squeeze in March.

The LME, which also this month moved to keep accepting Russian metal, said the market would have faced a US$20 billion ‘death spiral’ had it not acted.

Nickel miners share price today:

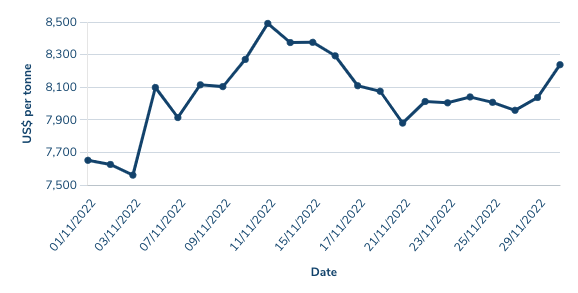

Copper

Price: US$8239/t

%: +10.59%

Major mining deals are pretty rare these days, with global mining giants chastened by serious M & A failures in the boom not keen to blow their wads on what could turn out to be overpriced junk.

So BHP’s decision to up its bid and splash $9.6 billion to get OZ Minerals’ (ASX:OZL) board onside for a $28.25 per share acquisition is an exciting moment for Australian mining investors, mainly those who have ridden OZ’s rise from $3 a share over the past six years.

BHP’s CEO Mike Henry had held steadfast over recent months since OZ rejected a $25 per share bid in August, calling it full and fair in numerous media and shareholder engagements.

But eventually a rise in copper prices, as China moves to potentially reopen, may have twisted its arm.

BHP wants OZ’s Carrapateena and Prominent Hill mines, which will add value to its massive Olympic Dam operation ahead of what could be billions of dollars of investments in a smelter expansion and a new orebody called Oak Dam, around 500km away.

Copper miners share prices today:

LOSER

Uranium

Price (Numerco): US$49.75/t

%: -5.49%

The sole commodity on our priority watchlist to fall in November, spot uranium prices have been a drifter so far in 2022, a brief run to decade highs after the invasion aside, having been one of the most volatile and exciting to watch last year.

But emerging miners and explorers are growing more bullish on its outlook by the day, expecting moves to shut down fossil fuel production and future supply shortages to dramatically change the power dynamic between utilities and miners in the coming years.

“What’s happened in lithium to galvanise it, the price went up 10 times what it was, and those bloody battery makers were saying at that time when it was US$500 ‘oh, if it goes to US$1,000 I’m not going to build any batteries’,” Deep Yellow (ASX:DYL) managing director John Borshoff told Stockhead on the sidelines of the IMARC event in Sydney in November.

“Bulls..t.

“The market controls it, not what the utility thinks or the battery maker thinks, and the supplier and the consumer as dictated to by a market that references supply-demand.

“That’s why I think that they can’t hold off much more. They’ve held off, they thought there’ll be some sort of relief happening, but it’s not.”

Uranium share prices today:

Other Metals

Silver

Price: US$21.56/oz

%: +12.47%

Tin

Price: US$22,921/t

%: +30.00%

Zinc

Price: US$3037.50/t

%: +12.63%

Cobalt

Price: $US51,995/t

%:0.00%

Aluminium

Price: $2477.5/t

%:+11.50%

Lead

Price: $2193/t

%: +11.15%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.