Up, Up, Down, Down: Which commodities won and lost in August?

Pic: Maxiphoto/iStock via Getty Images

- Uranium, lithium and coal are the big winners and energy shortages and the green energy transition emerge as the key thematics in August

- Iron ore, copper, gold, rare earths and nickel all hammered late in August by China’s Covid lockdowns

The story last month? Winners, energy, losers the rest, as the twin pillars of Russia’s invasion of Ukraine and China’s startling economic slowdown wreak havoc on global commodity markets.

Policies to encourage the take up of low carbon energy and electric vehicles are driving gains for uranium and lithium.

But energy shortages are also keeping thermal coal prices at absolute record levels, fetching more than US$400/t.

At the same time a wave of Covid cases late in August sent industrial and bulk metals wedded to Chinese economic growth to the dogs, plunging hard commodities into heavy losses.

Here is your list of winners and losers of the ASX’s main commodity markets in the month of August.

WINNERS

Uranium

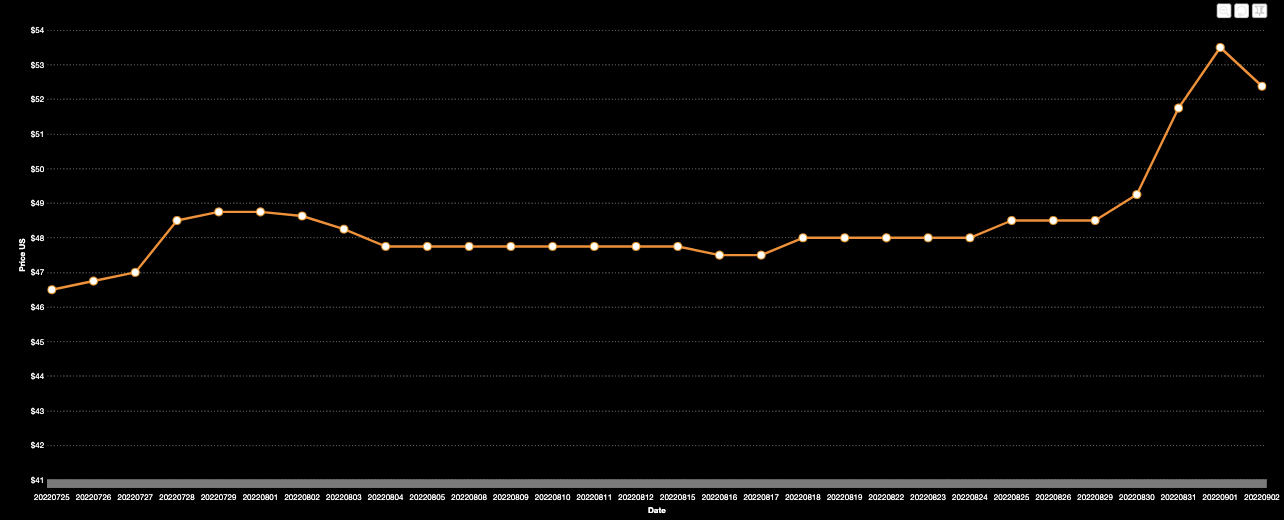

Price: US$51.75/lb

%: +6.15%

Weighed down for years by plans to close controversial nuclear power plants and the devastating reputational impact of the Fukushima disaster, uranium looks to be mounting a comeback as tightening supplies and a shift back to the non-renewable but low carbon energy source takes shape.

Back in fashion with spot prices above US$50/lb supporting a stronger contracting environment than at any point since 2016, two Aussie uranium companies, Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) have announced plans to restart shuttered uranium mines at Langer Heinrich in Namibia and Honeymoon in South Australia.

Japan’s nuclear reactor fleet is finally showing signs of being brought back to life.

As governments around the world gawk at the ludicrous prices their utilities are being forced to pay to import coal, gas and oil after Russia’s invasion of Ukraine made its supplies less than Kosher, nuclear has reemerged as an option to firm the growing renewable power supply in countries with shuttered power plants.

Japan has set a target of 20-22% of its energy supply coming from nuclear power by 2030, up from under 5% in 2020 but less than the third of the grid supplied by nuclear in 2010 before the Tohoku Earthquake.

Elon Musk — eye rolls — has also weighed in, saying while he sees the world moving to solar long term it is “total madness” to shut down nuclear power plants until widespread renewable and battery penetration is achievable.

The next cab off the rank in terms of restart projects could be Lotus Resources’ (ASX:LOT) Kayelekera mine in Malawi, formerly owned and operated by Paladin Energy, where a final investment decision is expected later this year.

Boss Keith Bowes has plenty of confidence in the uranium market, telling our esteemed deputy editor Reuben Adams there is plenty of room for upside beyond US$50/lb.

“People are talking about $US100/lb – I think that is possible,” he said.

Uranium share prices today:

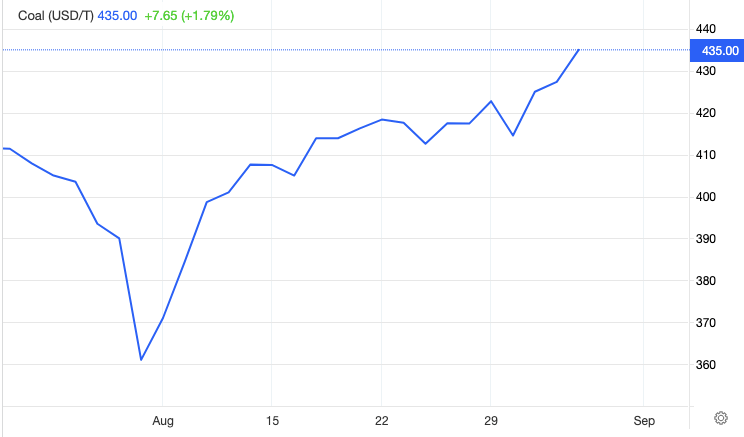

Coal (Newcastle 6000kcal)

Price: US$427.27/t

%: +5.37%

Little more can be said about coal’s miracle run in 2022, although we’ll try.

Prices have edged up further for high energy 6000kcal Newcastle thermal coal since the end of the month, pushing US$435/t.

That has sent producers of the fossil fuel up to highs not seen since, well, ever.

Whitehaven Coal (ASX:WHC), the industry’s bellwether, is breaking records on the daily closing yesterday at a best ever $8.49 a share.

Yancoal (ASX:YAL) also recently hit a record of $6.41, justifying a decision by a committee of independent directors to poo-poo a lowball $5.08 per share offer for Australia’s largest standalone coal miner from its Chinese majority owner Yankuang Energy.

Despite waning steel demand across the world a recent ban on Russian coal has driven the return of high prices for metallurgical coal.

Steelmaking coal continues to trade, unusually, at a discount of over US$100/t to the lower quality thermal coals used in power plants. Indeed, miners like Coronado (ASX:CRN) have shifted sales of semi soft grades of coking coal into energy coal markets to service starved European power plants.

Demand could get even spikier, with Russian gas producer Gazprom announcing the definitely-not-politically-motivated indefinite shutdown for maintenance of the Nord-Stream 1 pipeline into Germany and China facing a larger than expected import bill as drought hammers its hydropower supply.

Coking coal futures were trading for ~US$272/t on Monday.

Coal miners share prices today:

Lithium

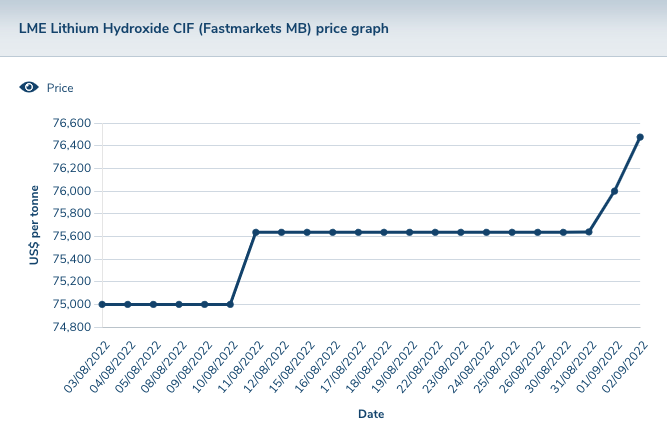

Price (Fastmarkets Lithium Hydroxide): US$75,640/t

%: +0.85%

Keep calm and carry on, the lithium market is yet to show any signs of oversupply and three months on from Goldman Sachs’ bold price crash premonition equities are starting to recover the pep in their once very peppy step.

In fact, having stumbled as low as $2.05 in mid-June, Pilbara Minerals (ASX:PLS) is back near record levels, with the $11 billion producer’s $3.70 share price near its early 2022 record high of $3.86.

Lithium miners are printing fat wads of cash right now. Allkem (ASX:AKE), which mines hard rock spodumene in Australia at the Mt Cattlin lithium mine in Ravensthorpe and brine from the Olaroz project in Argentina, turned a US$337.2m profit in FY22, reversing a US$89.5m loss.

PLS recovered from a $51m to a tasty $561m profit. What a difference a year makes.

While other commodities have been hurt by China’s economic slowdown, EV sales and production around the world continues on an upwards trajectory supporting high prices for lithium.

Fastmarkets reported a slight uptick in lithium hydroxide prices to US$75,640/t in August after months of stability at US$75,000/t.

Lithium carbonate is unchanged at US$73,000/t, with 6% Li2O spodumene at a spot price of US$6750/t according to the pricing agency.

Still heated like a pot of boiling water.

MinRes (ASX:MIN) Chris Ellison thinks power will be on the side of the producer until 2030, telling his JV partner Albemarle he wants to be exposed to spot pricing on sales from the Wodgina lithium mine.

As the firebrand CEO so eloquently put it: “If you don’t own your rock you’re screwed … by us.”

Lithium stocks prices today:

LOSERS

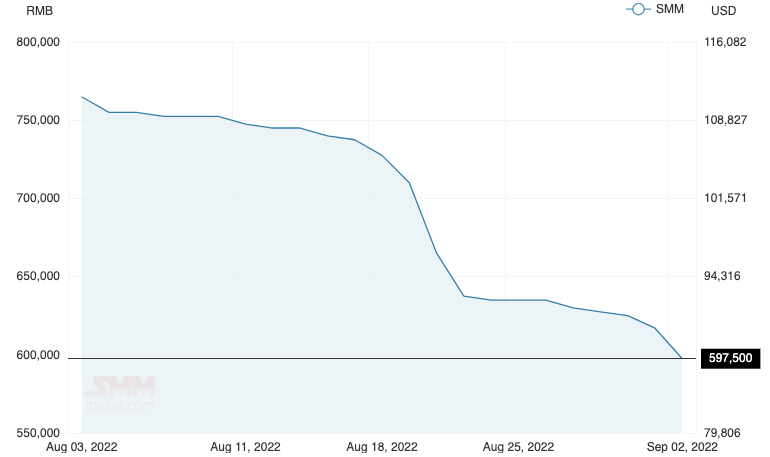

Rare Earths (NdPr Oxide)

Price: US$86.59/kg

%: -27.68%

Prices for the headline rare earths product neodymium-praseodymium oxide flopped in August, as China’s lockdowns and some concerns about high raw materials prices in China weighed down the critical minerals used in wind turbines and EVs.

Analysts at the Shanghai Metals Market expect prices to remain under pressure with buying activity failing to pick up as prices have dropped.

“In addition, after the centralised restocking last week, the rigid demand has been largely fulfilled, and it is difficult to see more purchase behaviour in the short term,” they said yesterday.

“The main downstream areas of rare earth magnetic materials such as new energy vehicles, wind power, and air conditioners have not seen any improvement in their consumption.

“It is expected that the prices of major domestic rare earth products will remain under pressure this week.”

According to the SMM, while downstream demand from magnet customers has dropped China’s quotas, levels up 25% on a year earlier are still being kept to by miners.

Lynas Rare Earths (ASX:LYC), the main rare earths producer outside China, recently announced the $500m expansion of its Mt Weld mine near Laverton in WA to capture strong downstream demand in the coming years from EVs and renewables producers.

Yesterday it announced the support of its Japanese Government backed lenders for the expansion of the Mt Weld mine, with special purpose vehicle JARE providing a US$9m contribution and technical expertise for a new drilling campaign at the operations.

“The relationship between Lynas and the Japanese rare earths industry is significant for the global rare earths industry. We are pleased to have JARE’s continued support, including for our exciting exploration program at Mt Weld,” Lynas boss Amanda Lacaze said.

“The removal of the capital management restrictions in the Loan Facility is an important step in the maturing relationship between Lynas and JARE and will ensure all options can be considered as part of our capital management strategy.”

Rare Earths share prices today:

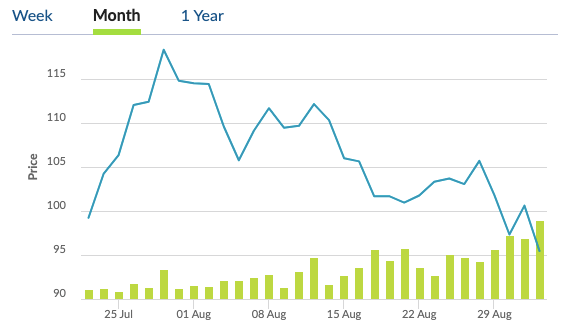

Iron Ore (62% Fe)

Price: US$100.61/t

%: -12.5%

Iron ore prices have hit their lowest point in 10 months after, you guessed it, China’s economic slowdown started to bite.

In particular, negative commentary from steelmakers in China, who say the industry’s negative margins and ongoing restrictions have made it difficult to operate, has brought down sentiment in a market which was at record highs 15 months ago.

Benchmark 62% Fe prices dropped below US$100/t for the first time in five weeks in early September.

It’s a tough environment for juniors like Strike Resources (ASX:SRK), which has had to review its Paulsens East iron ore operations only a few months after starting up.

The big dogs on the other hand are still rolling in it, with their costs still in and around the US$20/t mark.

BHP (ASX:BHP) blew analyst forecasts out of the water with a US$8.9 billion dividend for FY22.

The world’s biggest miner returned a US$30.9 billion net profit and US$23.8b underlying attributable profit after a bumper year buttressed by coal prices after iron ore prices dropped off.

BHP boss Mike Henry remains positive about the Chinese demand story, as do Fortescue Metals Group (ASX:FMG) chairman Andrew Forrest and MinRes’s Ellison, whose company signed off on the development of the $3b 35Mtpa Onslow iron ore project last week.

Meanwhile, high grade junior miner Grange Resources (ASX:GRR), which sells its product at a significant premium to benchmark prices, hopped, skipped and jumped into the ASX 300.

Iron ore share prices today:

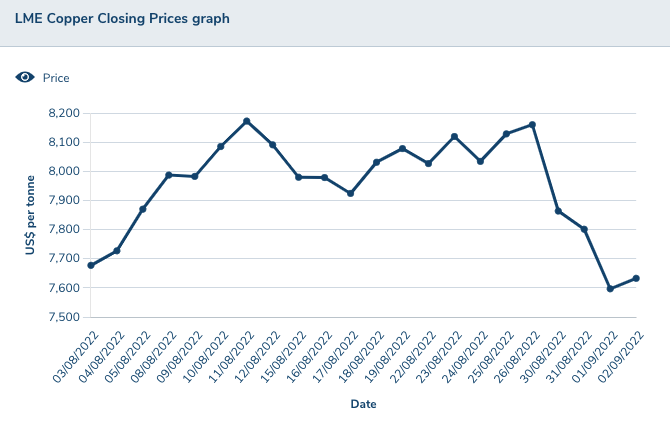

Copper

Price: US$7801.50/t

%: -1.47%

Having spent much of the month above US$8000/t the price of copper, the doc that tells you just how healthy the world’s economy is, the recent dip in line with China’s Covid sitch could just be a momentary blip.

Most of the big players are looking to a future where 20 Escondidas, the world’s largest copper mine, could be needed to fill a future shortage driven by copper’s use in everything needed to assist global decarbonisation.

BHP certainly thinks so, lobbing an unsuccessful $8.4 billion bid for copper, gold and soon to be nickel miner OZ Minerals (ASX:OZL) right before the start of earnings season.

The world’s biggest miner has shown a touch of discipline so far, refusing to up its cash bid despite its outright rejection by OZ’s board, which ain’t even granting due diligence.

The deal would get BHP up to 150,000t of extra copper and up to 230,000oz of gold a year, plus a $1.1b nickel and copper development called West Musgrave the big miner once sold to a junior called Cassini Resources (now part of OZ) for just $250,000.

That sounds silly, but BHP is confident copper (and nickel) has a great outlook. Its chief economist Huw McKay wrote in the miner’s half-yearly commodity outlook as much as US$250 billion would need to be spent on copper capex to meet global climate ambitions by 2030.

There is a clear disconnect. Supply won’t come close to meeting demand at this rate, explaining why BHP and Rio Tinto, which announced a US$3.3b deal to double its stake in the giant Oyu Tolgoi copper-gold mine in Mongolia, are so down with it.

BHP’s offer has a secret motive behind it as well, suggesting an investment in nearby resources at OZ’s Carrapateena and Prominent Hill mines could be less capital intensive than smelter upgrades at its long underperforming Olympic Dam mine in South Australia’s Gawler Craton.

Copper miners share prices today:

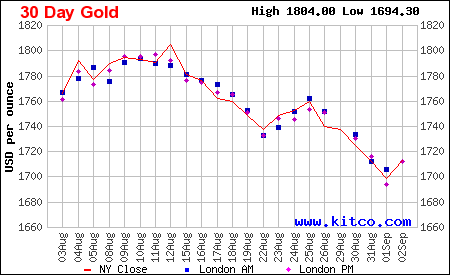

Gold

Price: US$1723.43/oz

%: -1.68%

Gold prices fell below US$1700/oz briefly at the end of the month, breaking a resistance level that has concerned bullion nuts in recent weeks.

Despite high inflation and geopolitical instability (you’ve heard about the war, right? … right?) safe haven demand for gold is doing little to counter fears around interest rate rises, more of which seem to be on the way.

US Fed chair Jerome Powell’s dour notes coming out of the Jackson Hole meeting in Wyoming at the end of the month kicked the sector down when it was already on the ground, with gold equities off around a quarter year to date.

Support could come from Chinese demand coming out of the lockdowns, but like many commodities whether that provides a lighthouse in the storm will be hugely dependent on decisions from China’s Politburo.

Gold miners share prices today:

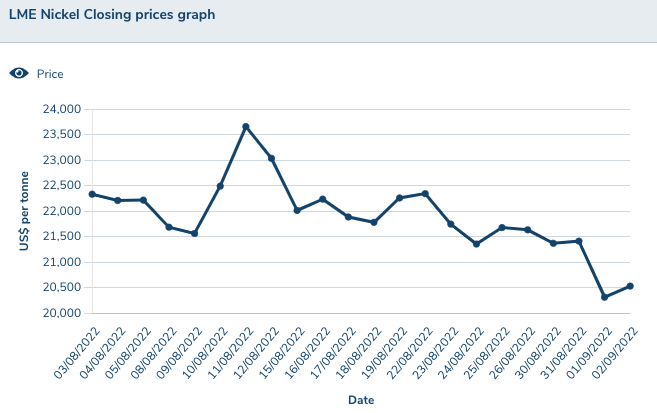

Nickel

Price: US$21,411/t

%: -9.35%

Nickel prices fell at the end of the month after the Chinese city of Chengdu was shut, locking 21 million people in their homes and ending optimism about China’s potential to rebound and hit its economic growth targets through the second half of 2022.

Producers shouldn’t despair. Prices remain well over US$20,000/t, a level that guarantees profitability for all but the highest cost producers (cf. the eternally cursed Ravensthorpe nickel mine).

Nickel Industries (ASX:NIC), which will soon be a global top 10 nickel supplier producing nickel pig iron in Indonesia, has done especially well, making a US$118.4m after tax profit in H1 FY22 and declaring a 2c per share interim dividend.

Its boss Justin Werner says the next leg of growth for the Tsingshan backed miner will be producing nickel matte for supplying the battery industry.

Nickel miners share price today:

Other Metals

Silver

Price: US$18.02/oz

%: -11.5%

Tin

Price: US$22,793/t

%: -9%

Zinc

Price: US$3459.50/t

%: +4.56%

Cobalt

Price: $US51,995/t

%: 2.96%

Aluminium

Price: $2359/t

%: -5.2%

Lead

Price: $1950/t

%: -4.15%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.