Q+A: Nickel Industries’ Justin Werner on building a nickel empire

Nickel Industries managing director Justin Werner.

Indonesia is the world largest nickel producer, with ‘industrial parks’ at Morowali and Weda Bay churning out huge amounts of nickel pig iron (Class 2) for the Chinese stainless-steel industry.

Stainless steel consumes ~70% of the world’s nickel.

And yet shaping up as a massive growth opportunity is battery quality nickel (Class 1), which the world will soon have an acute shortage of.

Here, Indonesia is also looming as the main source of growth.

One of the companies looking to have feet in both camps is Nickel Industries (ASX:NIC).

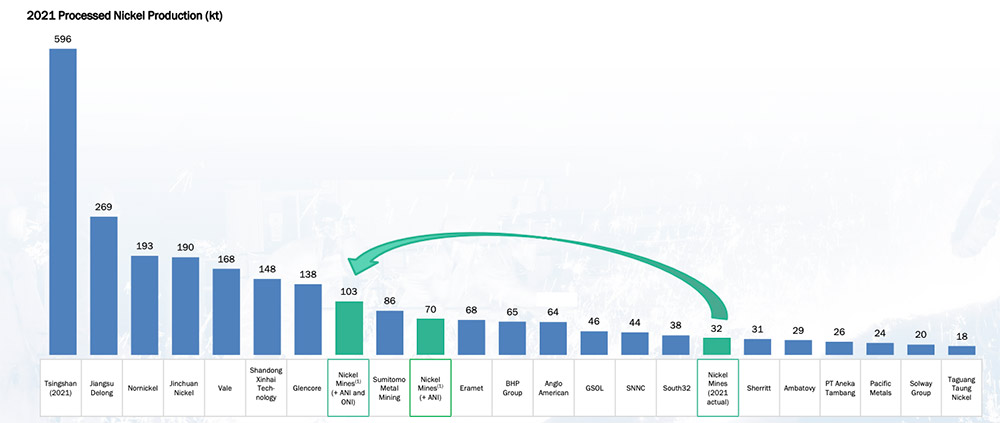

Backed by the world biggest stainless steel co Tsingshan, NIC will jump into the top 10 largest global producers when its Oracle nickel project in Morowali comes online very soon.

Tsingshan, via its subsidiary Shanghai Decent, is NIC’s largest shareholder with a 18.7% stake. It also builds the projects, and is NIC’s sole offtaker.

Oracle, alongside the already ramping up Angel project (80% ownership), is expected to result in a combined nameplate capacity of more than 130,000 tonnes (of nickel in NPI).

And yet the ~$3bn stock is doing poorly, down to $1.01/share from a peak of $1.65/share in March after Tsingshan found itself with its pants down on the wrong side of the trade — i.e. shorting nickel in a rising market.

NIC was hurt by association, despite Tsingshan ostensibly walking away from the debacle unscathed.

In May, analyst John So called the stock “cheap”. Nickel Mines managing director Justin Werner agrees.

Stockhead speaks to Justin about a bunch of things, including NIC’s aggressive but “risk-free as you can get” plans to build a nickel empire.

Give us background on the company and how the relationship with Tsingshan developed.

“Nickel Mines started 2006-07, originally with some projects in the Solomon Islands. Those didn’t pan out, so the focus shifted to Indonesia around 2008, when I first got involved with the company,” Werner says.

“We initially identified a large tonnage, high grade nickel laterite project that was on the coast, and in those days the direct shipping of ore to China was taking off.

“The margins were very good, you know; $40 margins at 2 million tonnes per year off a very low capex base.

“We drilled, permitted, and got the mine into production, shipped a couple of vessels to China and one to Japan.

“Then, in 2014, the Indonesian government enacted a ban on the export of raw ore to encourage in-country processing.

“Serendipitously for us, Tsingshan is the world’s largest stainless-steel producer and they had identified the opportunities of operating in Indonesia. They had already started construction of the Morowali industrial park in 2013.

“That’s the world’s largest stainless-steel park, with capacity to do about 4 million tonnes.

“They were looking for ore supply, which allowed us to restart our mining operations in 2015.

“That would be the start of the relationship. As we got to know each other better, Tsingshan was attracted to the fact that Nickel Mines’ board between them had a lot of capital markets experience.

“We then signed a collaboration agreement to acquire an interest in some of the RKEF’s [rotary kiln-electric furnace] to produce nickel pig iron in the industrial park.

“We went to IPO in 2018.

“We wanted to raise $150m but had a lot of support so upped that to $200m, making us the largest resources IPO of the preceding 10 years.

“Since that point to time we have grown quickly.

“At the end of this year, we will be looking at a production run rate of around 130,000t of nickel. That puts us up amongst the top 10 global nickel producers.

“That’s annualised EBITDA of – depending on the margins — $US700-$US800m.

“We have grown rapidly. We have been in Indonesia for a long time – more than 15 years – and have a very strong relationship with Tsingshan. They are our largest shareholder, and the vice president of Tsingshan sits on the Nickel Industries board.

“We are now looking to diversify some of our production into nickel matte [for the battery sector].”

Why haven’t any other ASX listed nickel companies tried to replicate your success in Indonesia?

“[In country] experience and knowledge. I have been here almost 25 years,” Werner says.

“We also have a very good relationship with our local partners, with our strategic partner Tsingshan – all of those relationships take time to foster and develop.”

How important has Tsingshan been to NIC’s rapid growth?

“The deals we have done with Tsingshan have been very value accretive. The acquisition multiple is a little over three times EBITDA,” Werner says.

“The [deals] come with a capex guarantee and a nameplate guarantee — and they consistently perform 35% above nameplate.

“There’s also a time frame guarantee which is two years, and they have consistently brought them on within 12-18 months; well ahead of schedule.

“You just can’t find those deals anywhere in the market.”

Where’s the next growth opportunity coming from once you hit 130,000tpa?

“I think the focus for us will be more on nickel for the battery market,” Werner says.

“We have converted two of our lines that can produce nickel matte.

“And we have signed an MOU with Tsingshan to look at High Pressure Acid Leach (HPAL) opportunities given the significant amount of limonite resources that exist in Indonesia.

[HPAL is a process used to extract battery quality nickel and cobalt from laterite ore bodies.]

“I like to think we will be a company that continues to have a strong growth profile.

“The benefit of the relationship with Tsingshan is that they build these plants with a capex guarantee, and nameplate guarantee and a timeframe guarantee. It’s about as risk-free as you can get.”

How big could nickel matte production be for you guys?

“It just provides flexibility in our business,” Werner says.

“We will be a swing producer. HPAL is always going to be the lowest cost producer; if you look at the Ramu HPAL plant for example, they report costs of about $US2/lb.

“Nickel matte production via electric furnace is never going to get anywhere near that, but where there are shortages of class 1 nickel we can certainly come in and fill that supply gap, where the economics are favourable.

“At this point in time there is a noticeable margin to be captured in the production of nickel matte.”

When do you plan to turn that production on?

“We haven’t set a firm date yet, but given fundamentals are very strong and that there appears to be a margin advantage it could be possibly very near,” Werner says.

“We would do it on a campaign basis, producing matte for 6-9 months a year.”

2022 has been dramatic for the company. In March, the stock plummeted on speculation regarding a short position in LME nickel held by Tsingshan and the implications this had for you.

Must have been a stressful time.

GROUND BREAKERS: Hard-running iron ore prices could mean big earnings upgrades while Tsingshan-backed Nickel Mines sees its shares tumble amid nickel madness: https://t.co/d1p1w5lIH1 pic.twitter.com/jkQ90Qu4sY

— Stockhead (@StockheadAU) March 9, 2022

“It obviously did impact us, but it actually didn’t impact Tsingshan or their operations in any way — production was unaffected, payments, cashflow were unaffected,” Werner says.

“Tsingshan worked themselves out of the situation fairly quickly, in an orderly manner.

“While at one point the short position looked to be pretty large, $US1bn, you need to put it into the context of Tsingshan’s revenues, which were $US53bn last year.

“For us, we were never concerned, but there was some angst in the market, people trying to work out what it all meant for Tsingshan.”

In one of your recent presentations, you talk about risks — one of them being your heavy reliance on the relationship with Tsingshan. Do you need to diversify your customer base?

“The short to that is no,” Werner says.

“Tsingshan is the largest stainless-steel producer globally. They need all the NPI that we produce, they pay the market price with very good payment terms.

“We do have flexibility to sell elsewhere, but there is really no benefit to that.”

Does your current valuation reflect your status as pending top 10 global producer?

“I believe we are undervalued. We were $1.80 in March, then there was a short squeeze in the LME nickel market; and since then, the market across the board has come off,” Werner says.

“We have now eight RKEF lines operating, and another four lines coming online soon.

“Add to that are our further growth opportunities with Tsingshan.

“There is a lot of value in Nickel Industries as a stock.

“If you look at what is happening amongst other ASX listed nickel companies, it is really growth by expensive acquisition.

“We have the luxury of cheap acquisitions plus all the guarantees that come from our relationship with Tsingshan.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.