Up, Up, Down, Down: War stirs gold rally as uranium hits a new 15-year high

Pic: John M Lund Photography Inc/DigitalVision via Getty Images

- War is in fact good for gold prices, but how long will October’s safe haven bump last?

- Uranium prices hit new 15-year high as the month draws to a close

- Lithium and coal among the worst performers as demand woes bite

In Up, Up, Down, Down we track the commodities that won and lost the market in October.

WINNERS

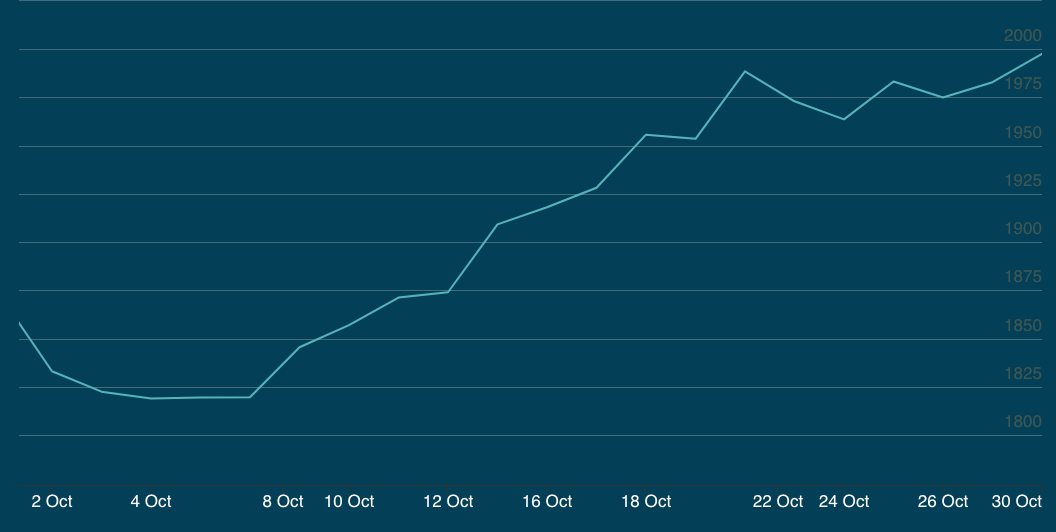

Gold

Price: US$1997.60/oz

% Change: +6.79%

Gold briefly rose above US$2000/oz but can’t seem to break the ceiling that would burst beyond all time highs from the post-Covid days of August 2020 of US$2075/oz.

In Australian dollar terms it’s paying well over $3100/oz ATM, a price that should deliver margins of around $1000/oz or above for unhedged gold miners.

At the same time it’s unclear how long those prices will remain in place. Without a doubt the trigger for gold’s latest price surge is the war in the Middle East, where Hamas’ invasion of Israel has been met with an intensifying barrage of air strikes and now a limited ground invasion from the Israeli Defense Force over the past three weeks.

Safe haven rallies like these don’t always last, as we saw with the run beyond US$2000/oz after last year’s invasion of Ukraine by Russia.

Hovering in the back of investors’ minds still is the US rate hike cycle, which could yet persist longer than expected with inflation remaining a concern for key state banks.

When it comes to actual demand for bullion, the World Gold Council said in its latest demand trends report this week that remains strong.

“Central banks’ gold buying maintained a historic pace but fell short of the Q3’22 record,” the WGC said.

“Jewellery demand softened slightly in the face of high gold prices, while the investment picture was mixed.

“Gold demand (excluding OTC) in Q3 was 8% ahead of its five-year average, but 6% weaker y/y at 1,147t. Inclusive of OTC and stock flows, total demand was up 6% y/y at 1,267t.1

“Net central bank buying of 337t was the third strongest quarter in our data series, although failed to match the exceptional 459t from Q3’22. Yet, demand from central banks YTD is 14% ahead of the same period last year at a record 800t.”

Gold miners have responded to the strong demand and prices by producing 2744t of gold YTD.

“This puts a new annual record within reach for 2023. The YTD supply of recycled gold is also higher at 924t (+9%),” the WGC said.

“Although this element of supply has been supported by elevated gold prices, it has been capped by economic resilience in the US and a strong investment motive in the Middle East.”

Gold miners share prices today:

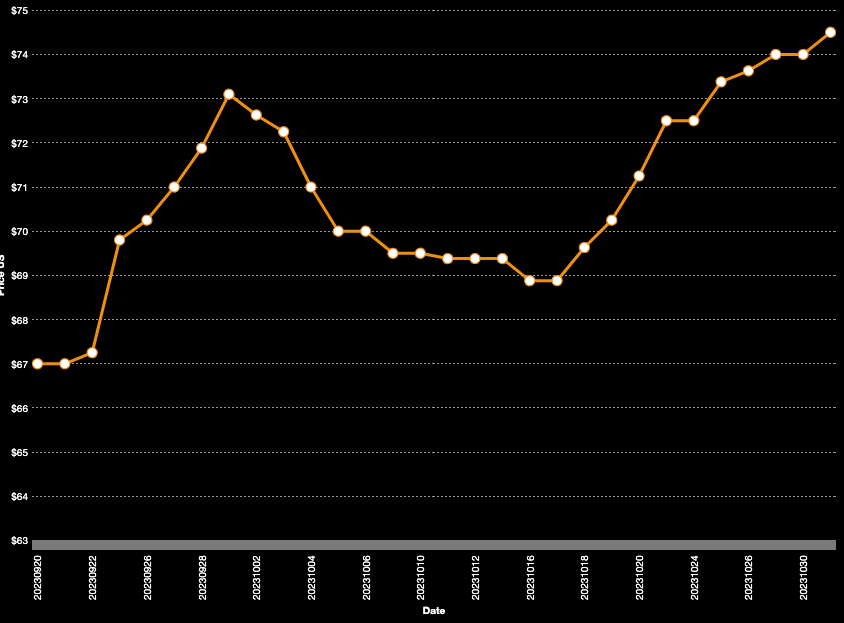

Uranium (Numerco)

Price: US$74.50/lb

% Change: +1.92%

Uranium hit a fresh yearly high on Tuesday of US74.50/lb according to Numerco, as an increasing number of analysts and pro-yellowcake fundies say we could be at the start of a sustained bull market.

Sprott ETF product manager Jacob White said in a note in early October positive sentiment building toward nuclear energy was “likely to persist in the decades to come”.

“With support for the nuclear industry increasing, we expect that market participants will have to shift their psychology to contend with higher demand for uranium supporting higher prices,” he said.

“Utilities may not be able to complacently draw down existing inventories in the hope that uranium prices will come down.

“Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market.”

Uranium price monitor TradeTech said prices crossed their highest level since March 2008 on October 27 for a 50% YTD gain.

“With buyers seeking to secure material over the next several months and stretching beyond the spot market window into Q1 2024, sellers have responded to this new demand by raising offer prices for each successive sales opportunity. As a result, prices for material have risen in recent weeks,” TradeTech president Treva E. Klingbiel said.

“There is a growing demand profile for nuclear power globally as licences are extended for existing nuclear power plants and new build plans continue to emerge in nations seeking clean, reliable, and secure energy supplies. In addition, advanced and small modular reactors are moving swiftly along the development path.”

Paladin Energy (ASX:PDN) plans to complete the US$118 million restart of the Langer Heinrich mine in Namibia early next year.

Up 54.55% YTD in line with uranium prices, the returning yellowcake hopeful rose beyond a $3 billion market cap yesterday.

In a presentation to the Shaw and Partners uranium conference this week it said 48% of production from Langer Heinrich had been contracted to 2030, with 90% of output exposed to market linked pricing.

Uranium share prices today:

LOSERS

Iron ore (SGX Futures)

Price: US$119.25/t

% Change: -1.27%

After a stagnant October, iron ore has taken just one day to move back beyond the critical US$120/t mark, a level that should support marginal iron ore players at home and abroad.

All of a sudden everyone’s positive again. Citi’s Paul McTaggart raised the investment bank’s quarterly forecast for December to US$120/t from US$100/t, with a bull case upside of US$130/t.

Brazil’s Vale, which is ramping up plans to produce higher grade iron ore for use in lower emissions blast furnace steelmaking and DRI plants expanding in the Middle East and USA, says it sees a balanced market that supports “upside risk”.

Executive VP of ferrous minerals Marcello Spinelli told analysts on an earnings call this week the purveyor of top grade iron ore saw reasons to be optimistic on the Chinese steel market, saying the green energy transition was reinventing its manufacturing sector.

That and an infrastructure market being charged up by government stimulus are displacing demand from a weakening property sector.

“They are leading the green industry, turbines, all the equipments to support decarbonisation in the world are being produced in China to support their domestic demand and also the export,” Spinelli said.

“They are in production of double digit for small appliance. EVs, they are flooding the world with their cars, and we see this in Brazil. So there is a new platform of manufacturing that is going on in China. And they need more high-quality steel to support that.”

While a number of iron ore producers have long-term plans to ramp up output, including BHP (ASX:BHP), Mineral Resources (ASX:MIN), Rio Tinto (ASX:RIO) and Vale, Spinelli said they were not seeing a big supply side increase with tonnages in India — the world’s fastest growing steel producer — notably on the decline.

“We just signed a 5 million tonne contract to India to support them in this very high-speed growth,” Spinelli said.

“So we see a tight market, a very balanced market in the supply side and demand side that can support this upside risk that Eduardo just mentioned.”

Iron ore miners share prices today:

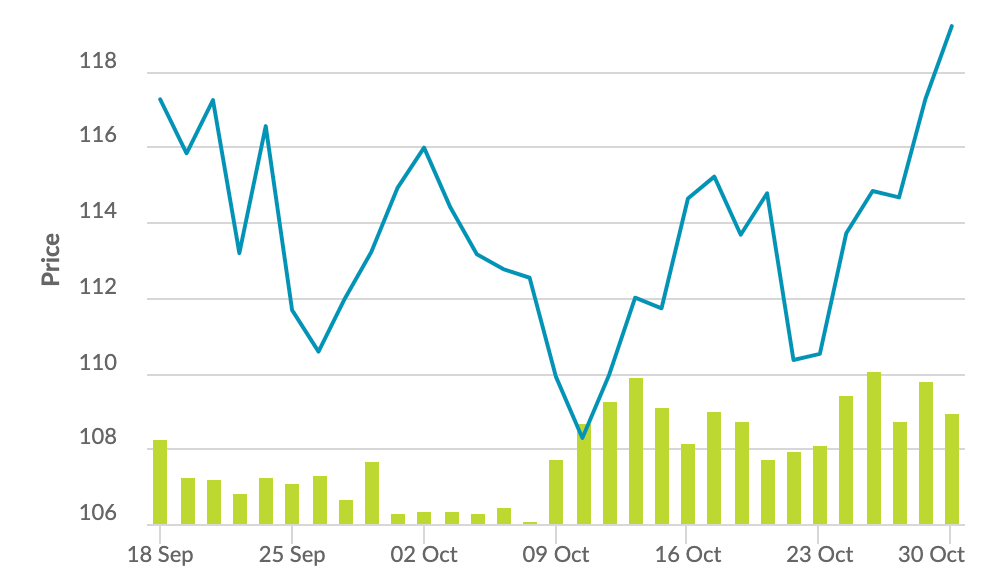

Rare Earths (NdPr Oxide)

Price: US$71.26/kg

% Change: -1.62%

Non-Chinese buyers of rare earths oxides were delivered some relief as Lynas Rare Earths (ASX:LYC) received approval to continue operating a refinery in Malaysia that had threatened a shutdown period at the end of the year.

The update of its licence conditions mean the ASX-listed miner will still be able to ship lanthanide concentrate for at least another two years, allaying concerns it would face a shutdown period amid potential ramp up delays at its new $575 million cracking and leaching plant in Kalgoorlie.

“We are excited to have now commenced the kiln heating cycle at the new Kalgoorlie Facility. This is the first step in production and will be followed by first production, and then ramp up over the next few months. Whilst the trajectory of this ramp up is inherently unpredictable, this is an exciting milestone,” Lynas noted in its September quarter report.

Lynas owns the Mt Weld mine near Laverton, a hard rock deposit known as one of the largest deposits of rare earths for permanent magnets in the world. Products using NdPr and other magnet rare earths are key components of EV motors and wind turbines.

The approval will enable Lynas to ramp output eventually to 10,500tpa of NdPr oxide.

The company has been stockpiling uncontracted material owing to low prices, something that persisted throughout the September quarter as sale receipts fell from $188.9m in the June quarter to $128.5m.

But interest in rare earths deposits and gaining control over them remains strong. Fortescue Metals Group (ASX:FMG) has extended its hunt for non-iron ore resources to rare earths in Brazil.

Meanwhile, Nick Curtis’ Northern Minerals (ASX:NTU) has called in the Foreign Investment Review Board, seeking a three-month delay on its AGM as it suggests a Chinese investor seeking a position on the Browns Range owner’s board has been picking up stock on the sly.

Curious times to be a rare earths explorer indeed.

Rare Earths share prices today:

Nickel

Price: US$18,130/t

% Change: -3.01%

A diplomatic storm is brewing in the nickel market as Indonesia’s dominant producers look to gain access to the US EV industry.

Nickel Industries (ASX:NIC), an Aussie nickel stock which has leveraged connections in Indonesia and China to become the largest pure play nickel producer on the ASX in just five years, reckons Joko Widodo is working hard to get a free trade agreement sorted.

That would make Indonesian metal IRA compliant, a nightmare for Australian nickel sulphide producers given the incredible speed with which Indonesian producers and their Chinese backers can scale up production.

While a supply glut has sent prices falling back to Earth this year after an extraordinary 2022, BHP remains bullish on the long term outlook for nickel.

Its chair Ken MacKenzie and CEO Mike Henry told shareholders at the big miner’s AGM yesterday they were still keen to grow the company’s nickel division, saying its Australian nickel suphide operations were more sustainable and could produce battery nickel at a lower carbon intensity than Indonesia’s laterite converters.

“Our ambition there is to continue to grow our nickel position,” Mackenzie said.

“Now in the case of Indonesia, it does have significant nickel reserves and we’ve seen a big rise of late in nickel production out of Indonesia, but the Indonesian reserves are typically laterite ore rather than what we have, which is sulphide ore in Western Australia, which is used for batteries.

“So to convert Indonesian ores into battery-grade materials requires significantly more processing and energy, and as a result of that has significantly greater carbon footprint.”

Nickel miners share price today:

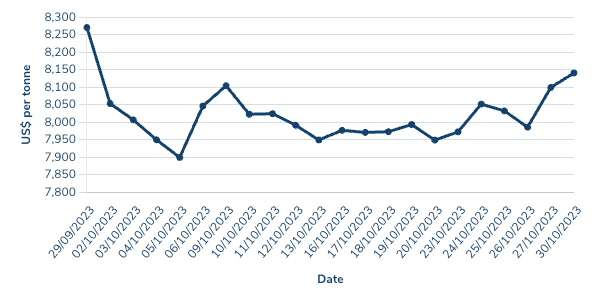

Copper

Price: US$8111/t

% Change: -1.93%

Copper has great long term fundamentals and any doofus could work out it’s nigh on impossible for the primary market today to fill the 50Mtpa demand outlook S&P projects for 2050.

That will need new mines and higher prices to achieve, along with a bit of inventive exploration.

But for the next year or so the market could be a lot tougher.

Much of that is macro and sentiment driven in nature. Once interest rates start coming down, the US dollar softens and China really kicks its economic growth into gear, some of the slack will be picked back up.

But much of it is supply based.

We, currently, have too much of it, which sounds like a funny problem when you think about the future needs of the green transition.

Copper warehouse stocks are well shy still of historical levels, but LME stockpiles were up around 90% between December 2022 and October 22 this year, when they peaked at just short of 192,000t.

The International Copper Study Group last month updated its forecasts as well, projecting a 467,000t surplus in 2024, up from prior estimates of 298,000t.

Chile’s output lifted 4.1% in September (reporting is lagged) after a year of disappointments. Top global producer and serial problem child to the South American country’s government Codelco finally got its s**t together, lifting mined tonnes 2.1% in the September quarter.

But still, we point you to the long term tailwinds.

The world’s largest copper mine, BHP’s US$46 billion Escondida, will need US$8b of investments to keep up a 1.2Mtpa production rate into the next decade.

A brownfields expansion, Goldman Sachs estimates, would need an incentive price there of US$3.60/lb (US$7920/t). And that’s for a mine that’s already been operating since the early 1990s.

Build a new one and you’ll need US$9460/t.

Copper miners share prices today:

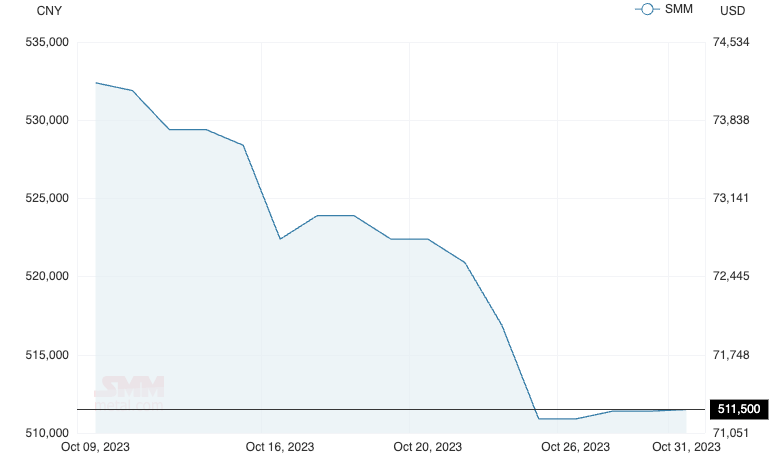

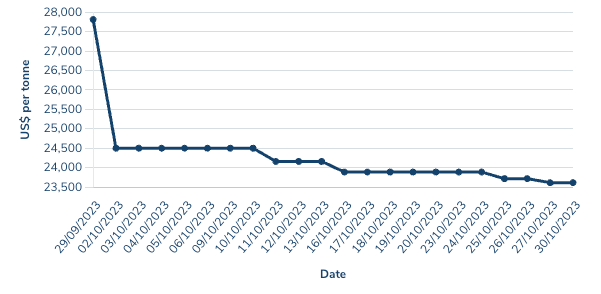

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$23,613/t

% Change: -15.09%

A great cognitive dissonance has consumed the lithium market.

Prices are on the way down, with October’s 15% tumble in lithium hydroxide prices the second major decline in a row.

Remember, lithium chemicals were paying over US$80,000/t late last year. Not overly sustainable, unless you were cool with only ever seeing EVs in the Golden Triangle.

That wasn’t going to work since, eventually, just about everyone will need one. But the current situation isn’t the best for producers.

They’re still making solid profits, but the volatility of the lithium price is creating havoc.

Mineral Resources (ASX:MIN) has seen prices fall 28% in the past quarter to US$1870/dmt. Pilbara Minerals (ASX:PLS) suspended plans for a one-off special dividend after a 31% QoQ drop to US$2240/t.

IGO’s (ASX:IGO) Greenbushes prices were higher, owing to its higher concentrate grade and lagging price mechanism. But that has thrown up issues as well since its partner Tianqi doesn’t want all of its offtake now that margins on lithium chemicals are being squeezed. IGO has flagged a 25% drop in its sales from the world’s largest lithium mine.

MinRes executive James Bruce memorably implied paper trading was manipulating market prices for lithium, though physical evidence of softening demand in China would suggest there are more concrete reasons for chemical and spodumene prices are dropping.

At the same time, billionaires and majors are battling it out for supremacy, offering massive premiums for lithium juniors and explorers.

Gina Rinehart’s buying spree killed hopes of Albemarle completing a $6.6 billion deal to acquire Liontown Resources (ASX:LTR), while she has also been active buying up Azure Minerals (ASX:AZS) shares in a potential blow to the Pilbara explorer’s $1.63 billion sale to SQM.

The $3.52 offer from SQM, a massive 44.3% premium on the Andover owner’s pre-bid closing price, was all the more remarkable since Azure is yet to post a maiden resource.

Another lithium multi-bagger could be a future takeover target as well after Chris Ellison’s MinRes spent over $150 million to acquire a near 20% stake in Tabba Tabba owner Wildcat Resources (ASX:WC8).

Lithium stocks prices today:

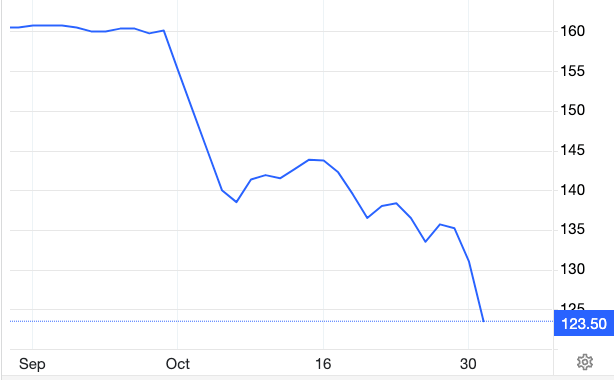

Coal (Newcastle 6000 kcal)

Price: US$123.50/t

% Change: -21.01%

Thermal coal miners spent much of 2022 laughing heartily in the face of greenies who once said they were on death’s door as a rapid uptick of demand from Russia-reliant Europe sent prices surging.

But the gods had another trick in store, delivering a mild winter that left European generators with too much of the stuff. Coal prices are now sitting on a 61% 12-month loss, hitting a year low of US$123.50/t at the end of October.

The impact on stocks has been swift. TerraCom (ASX:TER) this week dumped its quarterly dividend on the back of weakening market conditions for energy coal.

Reading the tea leaves, one of Australia’s largest listed thermal coal producers Whitehaven Coal (ASX:WHC) moved to acquire BHP’s Daunia and Blackwater steelmaking coal mines for a total fee of up to US$4.1 billion ($6.4b).

Adding around 17Mtpa of coking coal capacity to the primarily thermal coal exporter’s production profile, the purchase will see it shift 70% of its revenues to the premium coal product.

Premium hard coking coal was fetching around US$333/t on Tuesday, though intermediate coal grades and PCI steelmaking coal products are trading at growing discounts to the top end product.

Coal miners share prices today:

OTHER METALS

Prices correct as of September 29, 2023.

Silver

Price: US$23.15/oz

%: -0.30%

Tin

Price: US$24,079/t

%: +0.56%

Zinc

Price: US$2429.50/t

%: -8.30%

Cobalt*

Price: US$33,420/t

%: +0.00%

*Cobalt has traded sideways for several months with liquidity virtually at a halt on the LME. Battery cobalt prices are lower.

Aluminium

Price: US$2251.5/t

%: -4.07%

Lead

Price: US$2085/t

%: -3.96%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.