Monsters of Rock: Can BHP Nickel West survive Indonickel onslaught?

Pic: C.J. Burton/The Image Bank via Getty Images

- The usual topics reemerged as BHP’s top brass fronted shareholders at its AGM in Adelaide today

- Chair Ken MacKenize and CEO Mike Henry confident sulphide nickel will see demand with sustainability advantage over Indonickel

- Materials sector up strongly while Azure share price surge suggests more corporate action

Fresh off its $9.6 billion acquisition of OZ Minerals, the world’s biggest miner BHP (ASX:BHP) took its annual meeting of shareholders to Adelaide in an event that had all the hallmarks of formality.

There were ongoing criticisms from Brazilian locals on the delivery of reparations for the Samarco dam disaster, where BHP is fighting a lawsuit in the UK court system chasing up to US$50 billion. It’s fighting because its board claims the Pogust Goodhead suit doubles up on Brazilian litigation.

There were complaints from CEO Mike Henry on the Same Job, Same Pay legislation currently running on the table in Canberra – something it claims will hit super fees, dividends and $2 billion of investments in a South Australian copper business that could grow to a potential 500,000tpa.

We’ll see about that.

Complaints from investors about BHP’s stance on supporting the failed Voice to Parliament referendum via a $2 million Yes Campaign donation – including one who recited an entire Paul Kelly column to get to a “that was not a question” response.

Chair Ken Mackenzie said the recommendation came from management and was relayed to the company’s board and that the expectation it would support the Voice came from its own employees and indigenous partners.

BHP’s top brass again reiterated its commitment to high quality met coal after the announcement of the sale of its Daunia and Blackwater mines to Whitehaven Coal (ASX:WHC) for up to US$4.1 billion ($6.4b) last week, saying the steelmaking industry would be essential to urbanisation and electrification as the global population balloons to 10b by 2050.

That will require coking coal using technology BHP says will be in vogue for decades to come, though it still has no growth capex assigned to its long life joint venture with Mitsubishi where it pulled the commitments last year after the Queensland Government imposed a substantially higher royalty scheme.

Facing the future

But BHP did also give a sense of its thinking on some of its future facing commodities, including its growth plans in copper and potash.

The latter will see BHP tip another US$4.9 billion in to build a second stage of the Jansen Potash project in Canada despite a big drop in muriate of potash prices this year, after its board approved the investment on Tuesday.

BHP thinks food security needs for a growing global population will be bullish for the commodity long term. The first stage of the mammoth MoP operation is due to produce in 2026, with construction now 32% complete.

Another area of focus is nickel, where BHP still appears to be on board with plans to develop the 35,000tpa West Musgrave mine in WA’s remote Ngaanyatjarra Lands despite falling prices in 2023.

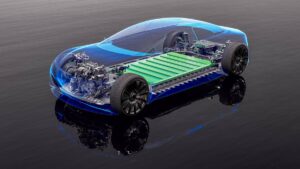

Nickel is now trading in the low US$18,000/t range as ramping supplies from Indonesia have outpaced demand from the electric vehicle sector.

Indonesian President Joko Widodo is currently lobbying for a free trade agreement with the US, which would make the country’s nickel inflation reduction act compliant.

A terrifying prospect for Australian nickel sulphide producers, whose ability to help OEMs access those tax credits is a selling point to investors on why they stay in the volatile battery metal.

Coming a day after Nickel Industries (ASX:NIC) MD Justin Werner said western EV makers were realising they would need Indonesian nickel, Mackenzie and Henry said their Nickel West division would deliver battery nickel with lower carbon intensity than Indonesian nickel laterites.

“Our ambition there is to continue to grow our nickel position,” Mackenzie said.

“Now in the case of Indonesia, it does have significant nickel reserves and we’ve seen a big rise of late in nickel production out of Indonesia, but the Indonesian reserves are typically laterite ore rather than what we have, which is sulphide ore in Western Australia, which is used for batteries.

“So to convert Indonesian ores into battery-grade materials requires significantly more processing and energy, and as a result of that has significantly greater carbon footprint.”

Henry said he believed sulphide nickel would sit at the low end of the cost curve and would be the most sustainable nickel produced for EVs.

“It also is the Tanzanian opportunity that we’re investing in Kabanga, which is perhaps the world’s best undeveloped nickel sulphide resource,” he added.

And on the markets

It was a good day for miners, with a rally from the iron ore price leading the materials sector anchored by its biggest players to a 1.05% gain.

That was supported by hard-running uranium stocks, with both Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) up big.

Also up strongly was Azure Minerals (ASX:AZS), where SQM is finding machinations from large players behind the scenes (including now 18.9% shareholder Gina Rinehart) are bound to complicate its $3.52 a share bid for the miner.

Investors are punting on a higher price, with the firm up almost 5% to $3.65 at the close of trade.

Monstars share prices today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.