Up, Up, Down, Down: Trump ends gold bull run … for now … as metals post light losses in November

Pic: Getty Images

- Lithium and nickel markets settle as market looks for the bottom

- Trump’s election ends gold’s bull run … for now

- Copper, coal, iron ore retreat in absence of bazooka Chinese stimulus

Up, Up, Down, Down is Stockhead’s regular check-up on how metals produced and explored for by ASX miners fared in the past month. All prices correct as at November 29, 2024.

WINNERS

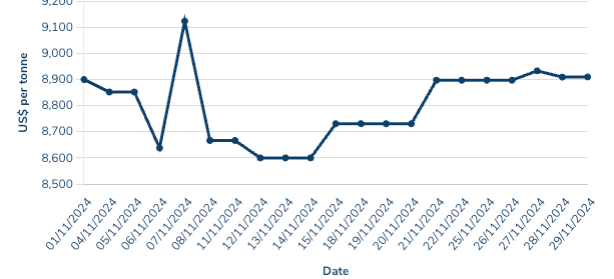

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$9250/t

% Change: +2.21%

Market observers continue to wonder how real the umpteen rebounds we’ve seen in lithium prices this year are.

Spodumene came back on the spot market in November, lifting from US$755/t to US$840/t, though we’ve seen a number of false dawns.

How much of this is down to short-term restocking, as Macquarie warned in a recent note, remains to be seen.

Lithium hydroxide, used more commonly in electric vehicle batteries with nickel-rich cathodes, has been harder hit than carbonate, a chemical in greater demand for cheaper lithium-iron-phosphate batteries.

CIF China, Japan and Korea carbonate prices were set by Fastmarkets at US$10,650/t end November.

UP

- Mine closures including MinRes’ Bald Hill are taking material out of the market, speeding up the return of potential deficits.

- Junior lithium miners like Liontown Resources received a bit of support from the state government in WA via a $150m support package, though much was linked to downstream refining. Royalty relief was not included in the package.

DOWN

- SQM reported big losses, bleeding US$524.5m through the first nine months of 2024.

- The collapse of European battery maker Northvolt has sent shockwaves through the refining industry in Europe, with Portugal’s Galp cancelling a proposed plant after its partner’s descent into bankruptcy.

READ

High Voltage: WA state gov throws lithium miners $150m lifeline. Will it do the job?

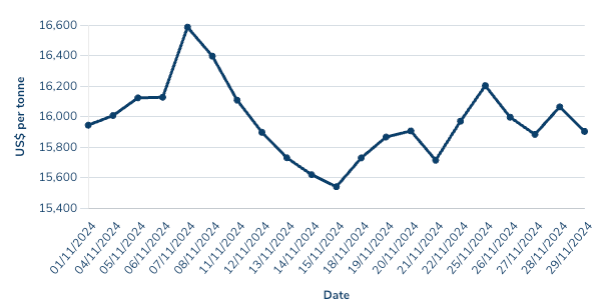

Nickel

Price: US$15,903/t

% Change: +1.18%

Nickel prices ticked up slightly in a November notably lacking in serious volatility.

There have been some positives for the commodity, which has seen its price halve despite a string of mine closures thanks to a flood of supply from Indonesia.

But not all is as rosy in the Southeast Asian nation as it may seem, with environmental compliance checks ramping up as concerns grow for the sustainability of its lateritic nickel production.

Some smelters are reportedly turning to Philippines exporters for ore as they look for new sources of supply.

UP

- Alliance Nickel posted a well-received DFS on its NiWest nickel laterite project in WA, suggesting costs will be in the lowest quartile.

- Indonesia has been curbing supply of nickel ore to ensure small miners remain operational.

DOWN

- Glencore boss Glen Nagle said Murrin Murrin, one of only two WA mines still in operation along with IGO’s Nova, was close to lossmaking territory.

WATCH

Break it Down: Alliance demonstrates definitive nickel numbers

LOSERS

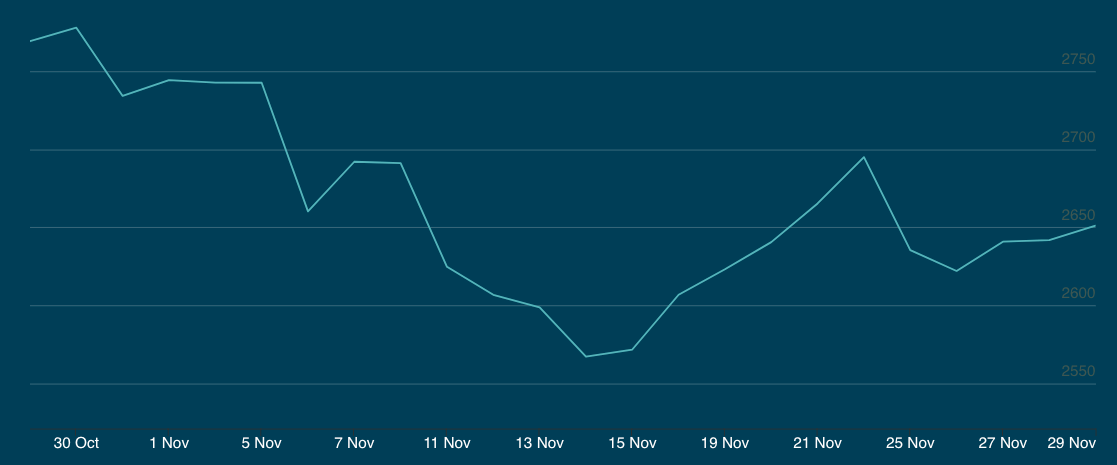

Gold

Price: US$2651.05/oz

% Change: -3.04%

The pre-election bump that propelled gold to all-time highs dissipated in November as the election of Donald Trump prompted an immediate sell down.

Markets are concerned Trump’s key trade policies, including large tariffs on countries like China, Canada and Mexico, are going to prompt inflationary pressure that will halt a newly minted rate cut cycle at the US Fed.

The rising US dollar also played a major role, with gold typically trading inverse to the key global currency, with the uncertainty posed by the election itself another gold catalyst which has now dissipated.

UP

- Northern Star Resources (ASX:NST) and De Grey Mining (ASX:DEG) announced they were tying the knot on a $5 billion all scrip deal that will deliver NST the future 530,000ozpa Hemi gold mine in the Pilbara. All eyes are now on who else may merge as gold prices remain near record highs.

- Reserve banks in the former Eastern Bloc have become among the biggest net buyers of gold bullion, building their reserves to avoid currency and asset instability.

DOWN

- Fitch’s BMI Commodity Insights says it’s “now bearish” on gold and doesn’t see further upside, predicting average prices of US$2500/oz in 2025. Average prices in 2024 so far have come in at US$2352/oz, though much higher levels have been traded in the back half of the year.

- High prices have seen physical gold demand from Chinese consumers slide, with the last premium against the LBMA price on the Shanghai exchange seen on October 21.

READ

Gold Digger: The precious metal’s love affair with Trump returns

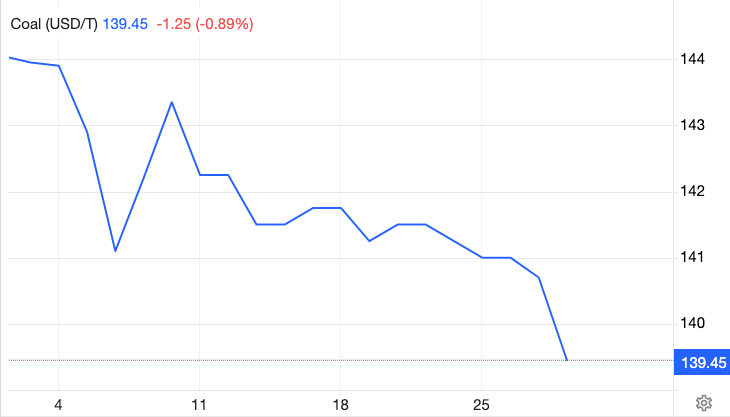

Coal (Newcastle 6000 kcal)

Price: US$137.40/t

% Change: -5.57%

There was no bigger news in the world of coal last month than Anglo American’s sale of its coal division in Queensland to Peabody Energy.

The deal, which will net US$3.8 billion contingent on a number of events including high met coal prices and the restart of the Grosvenor mine, closed in June due to a fire, reinforced the significant draw of met coal for miners in the sector.

Top quality steelmaking coal is trading still for upwards of US$200/t, more than US$60/t above Newcastle grade thermal coal on the spot market.

A number of major thermal producers have now engineered significant shifts into metallurgical coal predicated on the idea dominant steel mill technology will use the product for decades to come, with Glencore buying Teck’s Canadian assets for ~US$9bn with two Asian steelmaking partners, Whitehaven Coal (ASX:WHC) snaring BHP’s Daunia and Blackwater mines in a deal worth up to US$4.1bn and now Peabody securing Anglo’s managed coal operations.

UP

- India continues to emerge as a growth engine for steelmaking raw materials, with consumption up 13.5% in the first half of the current financial year.

- China’s seaborne thermal coal imports were at a record high in November, Reuters says.

DOWN

- Capital Economics predicts thermal coal demand will slide next year with China’s hydropower rebounding and an expansion in renewable and nuclear power in the Middle Kingdom. It tips Newcastle 6000kcal coal will fall to US$110/t by end-2025.

READ

Bulk Buys: Anglo American out of coal. Is it slim enough for BHP?

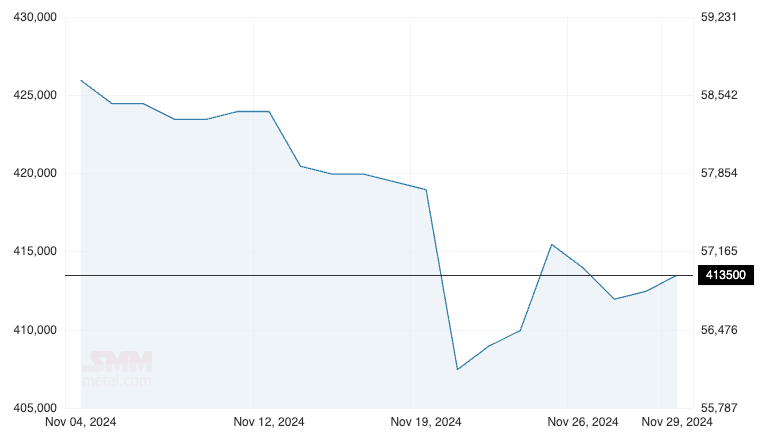

Rare Earths (NdPr Oxide)

Price: US$56.95/kg

% Change: -3.98%

Rare earths continue to tread water despite the incredible long-term demand outlook for the metals, used in electric vehicle motors, wind turbines, defence and more.

Shanghai Metals Market analysts said activity had been weak, but it expects buying to rise with stockpiling season on the way ahead of the new year.

“Leading large producers saw a surge in orders from the new energy and compressor sectors, resulting in busy production. However, small and medium-sized enterprises struggled with weak order growth, difficulty in acquiring new customers, low production enthusiasm, and a cautious outlook on the future market,” SMM reported.

“Industry insiders also pointed out that with December approaching and the stockpile for the Chinese New Year period arriving, domestic downstream demand might gradually strengthen. Based on this, SMM expects rare earth prices to show a gradual upward trend.”

Up

- Australian rare earths giant Lynas (ASX:LYC) finally announced the opening of its new cracking and leaching plant in Kalgoorlie, a key infrastructure piece for Australia’s plan to bring critical minerals processing onshore.

- Kachin rebels who halted rare earths mines in Myanmar continue to hold sway, reportedly taking a border town amid a dispute with the Myanmar military.

DOWN

- Lynas’ CEO Amanda Lacaze and chair John Humphrey said prices would remain volatile until China’s economy strengthens.

- Northern Minerals narrowly avoided the election of a mystery Chinese businessman to its board as the heavy rare earths hopeful faces continued apparent attempts from Chinese interests to expand their control of the company.

READ

Resources Top 5: Runs on the board for rare earths explorer Narryer

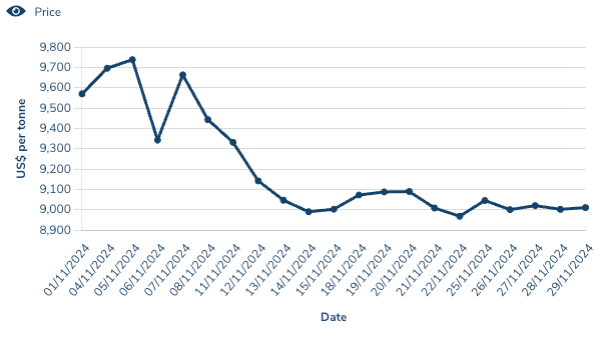

Copper

Price: US$9010.50/t

% Change: -5.21%

A stronger US dollar and concerns about global growth and Chinese stimulus or lack thereof hurt copper prices in November, with fundamentals also showing production was rising faster than usage this year.

The International Copper Study Group thinks there was a 359,000t copper surplus in the first nine months of 2024.

UP

- Supply tightness at the mine gate continues to dog copper refiners. Fastmarkets says the benchmark price could fall from US$80/t to as low as the US$20s/t.

- BHP continues to be bullish on copper, suggesting it could put as much as US$15 billion into a massive program of works to maintain output from its Chilean mines Escondida and Pampa Norte in the 2030s.

DOWN

- A major copper importer in China suggested more stimulus was needed to keep demand strong.

- Citi cut its short term price target for copper by 11% to US$8500/t, based on concerns Trump’s tariffs could hit global growth.

READ

Hillgrove’s Kanmantoo copper mine reborn and ready to grow

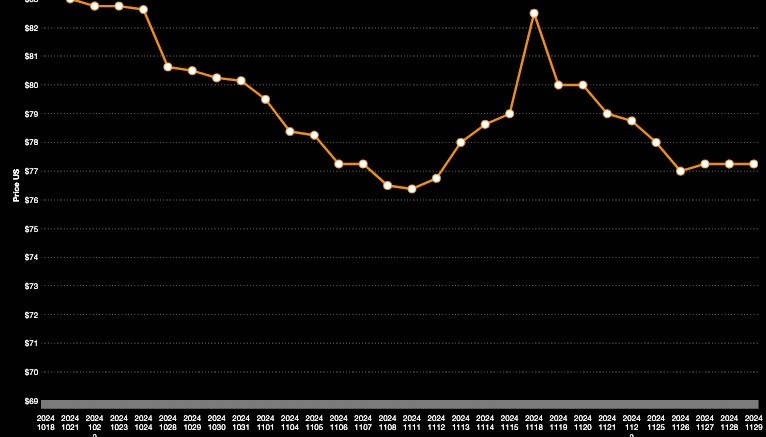

Uranium (Numerco)

Price: US$77.25/lb

% Change: -3.62%

Uranium is another commodity in limbo, with spot prices down 27% on the 17-year high of US$106/lb they saw in January.

If that sounds bad it’s not so awful. Spot prices are near generally accepted incentive price levels and term prices – derived from contracts drawn between utilities and miners and thought to be closer to a true reflection of the market than spot – are hovering around spot and at long term highs.

Canadian producer Cameco reported the term price at US$81.50/lb in October.

UP

- Sprott CEO John Ciampaglia has tipped a uranium comeback next year on the back of supply shortages and a pro-nuclear Trump Presidency.

- Russia has temporarily suspended exports of enriched uranium to the US, giving enrichment stocks and domestic US miners and explorers a boost.

DOWN

- Pilbara Minerals, long the ASX’s most shorted stock, has been displaced by uranium miners Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) at the top of the leaderboard as ramp up issues send shivers down the spines of investors.

- Cameco slightly upped its forecast production for 2024 from 22.4Mlb to 23.1Mlb on an equity basis (37Mlb 100%).

READ

US, Russia uranium tiff sees opportunity knock for Africa

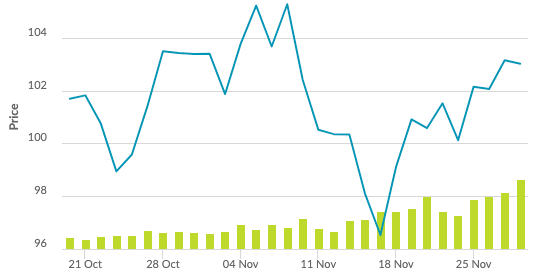

Iron ore (SGX Futures)

Price: US$103.02/t

% Change: -0.84%

Iron ore markets continue to confound bears, holding steady at above US$100/t.

The continued solidity in iron ore pricing comes with Chinese steel production still in and around the 1Btpa mark, and major iron ore producers suggesting cost support will kick in for the market between US$80-100/t with high cost players shutting swing supply.

“Market conditions therefore suggest that iron ore prices of at least $US100/t is reasonable as any sustained fall in China’s steel output beyond ~2%/yr looks unlikely,” Commbank’s Vivek Dhar said in a note.

“Have market conditions though turned positive enough to justify iron ore prices above $US110/t? This outcome would mean modest growth in China’s steel output and is consistent with the 2.9%/yr increase in China’s steel output in October.

“Our reluctance to turn more positive on iron ore comes down to China’s steel demand. The sub‑component of construction in China’s non‑manufacturing PMI moved into contraction territory last month – indicating that property headwinds (~30% of China’s steel demand) are stronger than infrastructure tailwinds.”

Dhar said major stimulus for the Chinese economy was more likely to come at the Two Sessions meeting in March than the Central Economic Work Conference in mid-December, with the impact of Trump’s tariffs to become clearer.

UP

- Stronger Chinese manufacturing data helped iron ore rebound, with the Caixin PMI at 51.5, its highest level since June.

- Junior iron ore companies saw support from the broader market, with Cyclone Metals (ASX:CLE) announcing a JV with Vale and Fenix Resources (ASX:FEX) securing new hedges for 120,000t of iron ore sales to June 2025 at a $152/t (AUD) average.

DOWN

- Some iron ore analysts are getting bearish, with Morgan Stanley tipping prices to fall to US$75/t next year on rising supply from Australia and Brazil.

- Fitch’s BMI Commodity Insights sees prices falling to US$78/t by 2033, citing rising supply with market growth to come to 3.2% a year from 2024 to 2028, against 0.9% for the previous five years.

READ

Rumours of iron ore’s demise have been greatly exaggerated

OTHER METALS

Prices correct as of November 29, 2024.

Silver: US$30.70/oz (-8.6%)

Tin: US$28,913/t (-7.37%)

Zinc: US$3103/t (+2.44%)

Cobalt $US24,300/t (0.00%)

Aluminium: $2594/t (-0.9%)

Lead: US$2072.50/t (+2.62%)

Graphite (Fastmarkets flake): US$459/t (-0.22%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.