Up, Up, Down, Down: Rare earths back in the game and gold keeps winning in August

Some gambles (rare earths, gold) were better than others (cough, lithium) in August. Pic: Getty Images

- Gold scores new record in August as rate cut hype hits fever pitch

- Rare earths rebound in rare win for depressed magnet metals market, but lithium fails to fire

- Iron ore looking rough but resilient, with coal, uranium and copper in holding pattern

Up, Up, Down, Down is Stockhead’s regular check-up on how metals produced and explored for by ASX miners fared in the past month. All prices correct as at August 31, 2024.

WINNERS

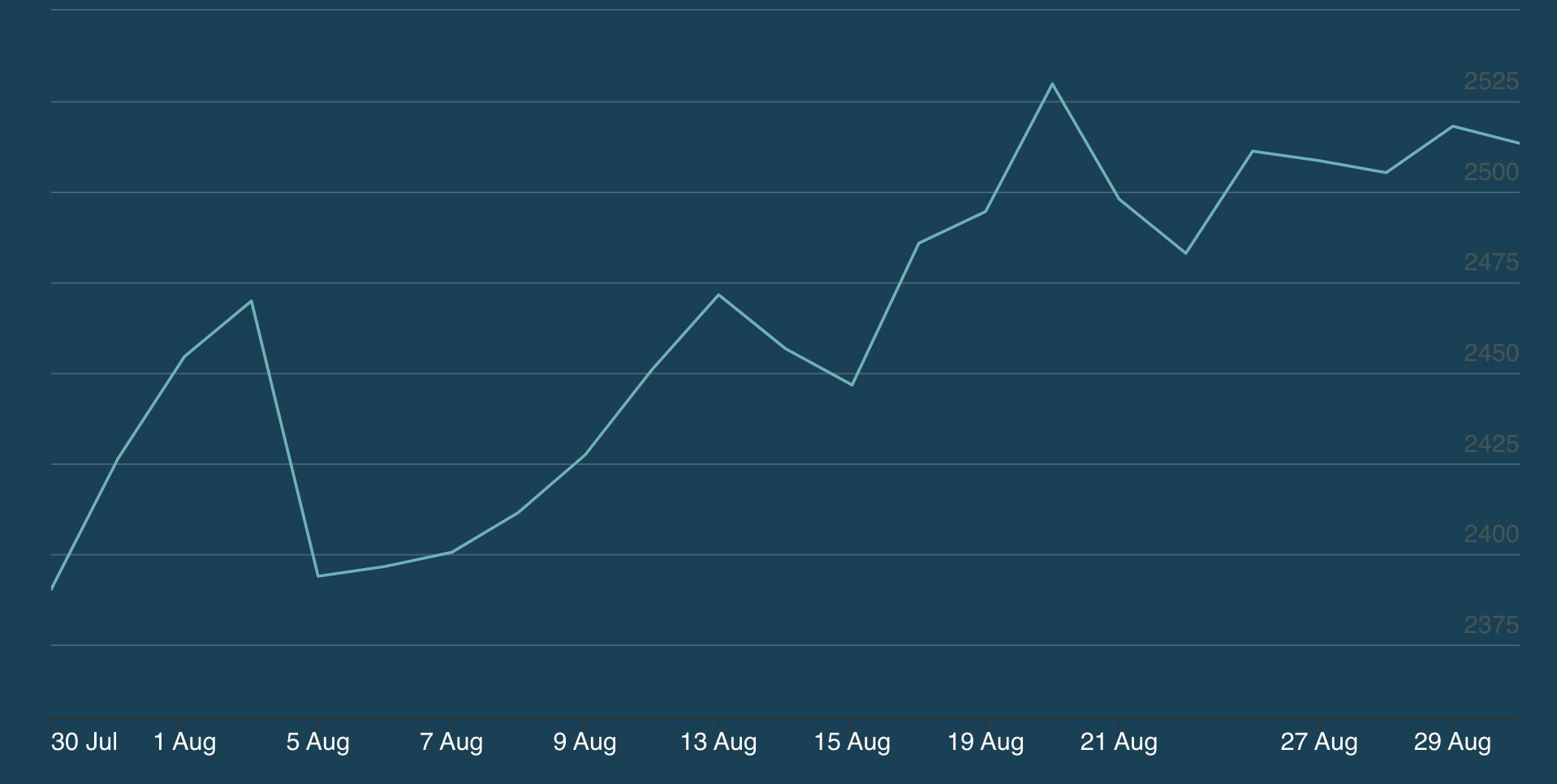

Gold

Price: US$2513.35/oz

% Change: +3.59%

Gold prices crested a new high in August, rising on the LBMA to US$2529.75/oz at the close on August 20. It comes ahead of what is widely expected to be a rate cut from the US Fed in September for the first time since the first of 11 hikes began in March 2022. Whether that’s already priced in for gold miners, who delivered a by and large strong set of financial results in August, remains to be seen.

It would be remiss of us not to mention antimony, often found in concert with gold mines, which has doubled in price to over US$24,000/t this year. The main cause was proposed restrictions on exports of the metal, used in a number of defence applications, from major producer China. Anti-mania, like a riot, like a riot, oh.

UP

- Gold miners are pulling stronger profits, with a grab bag of the top Australian domiciled miners posting collective profits in excess of $2 billion in FY2024. That’s aligning with stronger dividends than normally seen from the traditionally volatile and narrow margined sector.

- There are hopes a September rate cut from the Fed, all but baked in now, will provide another leg up for gold prices after hitting an all time high in August.

DOWN

- Regis Resources (ASX:RRL) was effectively barred from developing its McPhillamys mine in New South Wales after Federal Environment Minister Tanya Plibersek approved an Aboriginal heritage application over the location of its tailings dam. It’s become a flash point for the industry, which is pushing against laws that will duplicate state processes and create a federal environmental regulator. Whether Regis really wanted to throw $1 billion to build the blown-out Blayney mine is another matter.

- Chinese central bank gold buying has dried up, removing a major driver of the bullish price run from the market.

READ

Volatility to rule in gold’s year of miracles

Coal (Newcastle 6000 kcal)

Price: US$143.75/t

% Change: +1.66%

Met coal has found the going tough, with front month premium hard coking coal futures tumbling from over US$230/t to US$201/t by the end of August. Steel mill profitability has been a big factor. Just 3.9% of China’s steel mills were profitable on August 30 according to MySteel, down from almost 45% in early May.

Thermal coal has stood up better than expected, with supply and demand delicately balanced for the energy product.

UP

- M&A activity in the coal market is heating up, with Yancoal Australia’s (ASX:YAL) decision to dump its dividend foreshadowing a major bid in the met coal space.

- Whitehaven Coal’s (ASX:WHC) guidance was a worry for analysts, but its ability to get more than it paid BHP (ASX:BHP) on a % basis for a 30% stake in its Blackwater mine to two Japanese steel mills shows the long-term outlook Asian buyers have for the steelmaking raw material.

DOWN

- Chinese steel mills have been pressing to reduce coke prices, nabbing seven price drops in recent months according to MySteel, hitting pricing for metallurgical coal.

- Goldman Sachs thinks thermal coal is well supplied, tipping prices will slide back to US$120/t.

READ

Bulk Buys: Coal miners continue to seek diversity

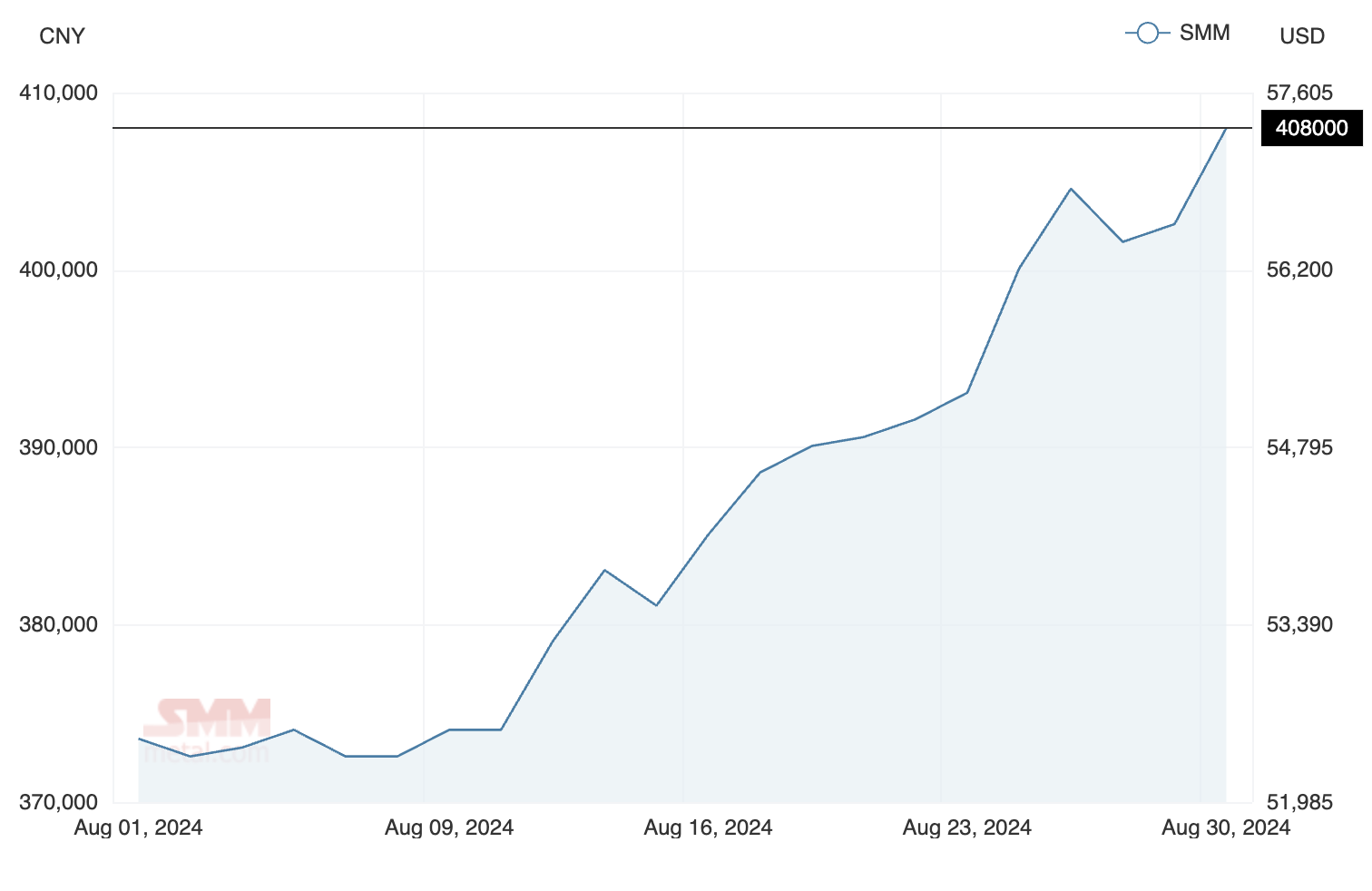

Rare Earths (NdPr Oxide)

Price: US$57.32/kg

% Change: +13.17%

Rare earths pricing finally lifted off its ~US$50/kg floor, prompting Lynas (ASX:LYC) boss Amanda Lacaze to say her and the ASX 200 miner and refiner’s market expert Pol Le Roux would break out the sparkling, but not yet the champagne.

No major quota lifts from China, where producers are also suffering margin pressure, is helping. Ken Brinsden last month promoted the idea of a ‘wheat desk’ that sets prices in the West to ensure magnet metals producers are profitable. How socialist.

Up

- The long-term outlook for rare earths continues to look brighter than the near future, with the promise of supply chain bifurcation and Western government investment in downstream and upstream supply bearing the potential to get large resource holders into production.

- Brazilian rare earths stocks have been able to get support for offtake from Western customers, with Meteoric Resources’ (ASX:MEI) non-binding MoU with TSX-V listed Ucore Rare Metals a case in point.

DOWN

- Australian and US miners and processors may be reliant on government funding to break China’s hold on the market – a major focus at the Diggers and Dealers Mining Forum in Kalgoorlie, with Iluka Resources (ASX:ILU) currently pitching Canberra for more funding to complete a $1.7-1.8bn refinery at Eneabba in WA’s Mid West.

- New listing prices from leading producer China Northern Rare Earths could set the direction for NdPr, with the Shanghai Metals Market saying some customers are baulking at further price increases after an intense period of buying by customers in the magnet and downstream industries. Prices are forecast to remain stronger in the near term with September typically seasonally strong, but with upside limited, according to analysts at the Chinese PRA.

READ

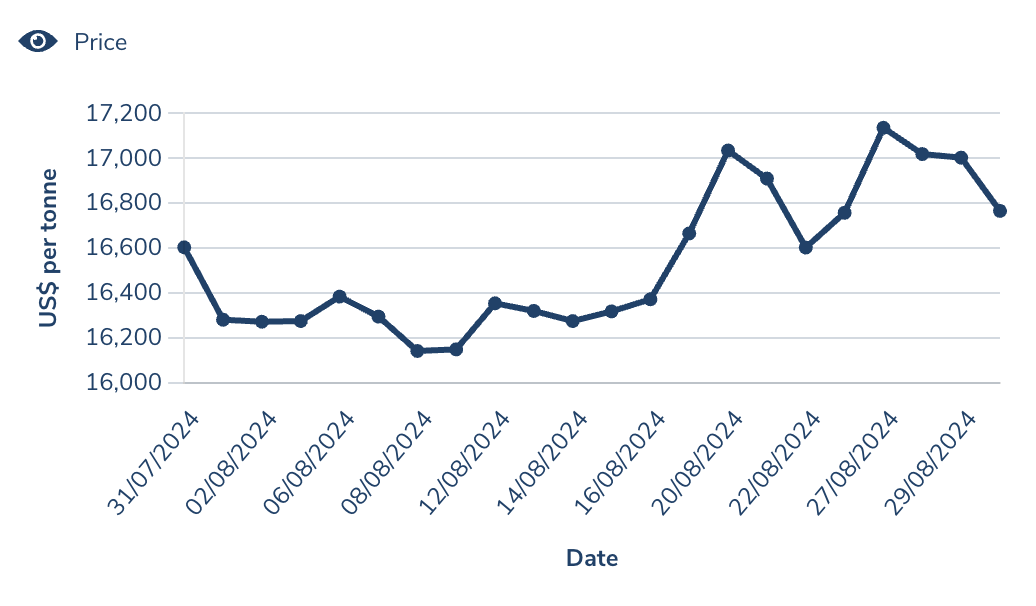

Nickel

Price: US$16,766/t

% Change: +0.98%

Prices in nickel are sitting at levels uneconomic for most current Australian producers, though it is worth noting mines like Glencore’s Murrin Murrin and IGO’s Nova remain cash generating and in nominal terms prices are little different to levels investors were enthusiastic about in 2021.

But Indonesian supply is keeping a lid, with small movements up and down largely coming in line with the broader base metals space.

“The synchronised rise and fall in base metal prices suggest that nickel‑specific factors were a secondary driver to price movements,” Commbank’s Vivek Dhar said in a note last week.

“Synchronised base metal prices moves are typically driven by the US dollar (negative relationship) and Chinese demand hopes (positive relationship).

“Given neither a weaker US dollar nor a meaningful increase in Chinese demand hopes accompanied the rise in base metal prices, we weren’t too surprised to see base metal prices retrace lower to reflect market fundamentals. Nickel prices, alongside other base metals, have lifted through August in line with a fall in the US dollar. Futures are currently sitting just above $US17,000/t.”

UP

- Nickel exploration actually increased in WA in the June quarter, according to ABS stats on drilling released yesterday, up 24.2% to $52.9m, though that’s down on $73m a year earlier and likely to drop as BHP closes its Nickel West business.

- There’s plenty of scuttlebutt around the market that a host of local players could put pressure on the Government and BHP to lease or repurpose the Kambalda nickel concentrator, mothballed earlier this year ahead of the transition to care and maintenance of the wider Nickel West business. Lunnon Metals (ASX:LM8), backed by South African giant Gold Fields and chaired by Perth mover and shaker Liam Twigger, has both investigated building its own concentrator and publicly stated its interest in BHP’s infrastructure.

DOWN

- Nickel will still see a substantial surplus into the decade’s final third, BHP’s economic analysts said in their commodity update, despite mine closures in WA and New Caledonia, as well as LME bans on Russian metal, taking substantial volumes of product out of the market.

- Indonesia has been trying to encourage investment in smelters in which Chinese companies hold less than 25% ownership to access the US and European markets, in a potential blow for Western miners.

READ

Diggers and Dealers: Is Australian nickel dead?

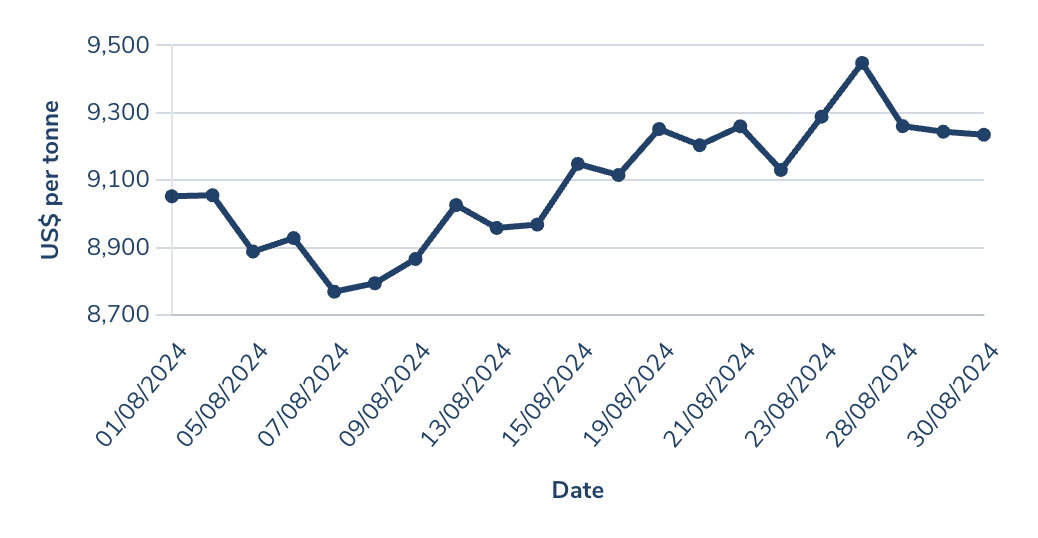

Copper

Price: US$9235/t

% Change: +0.11%

Want to get a sense of how bullish long term copper bets are? Check out BHP’s (ASX:BHP) latest financial results, where plans to double the size of its South Australian copper business by 2035 took centre stage, pushing its higher earning iron ore business in the Pilbara out of the limelight.

In the near term the physical shortage in America that pushed prices to all time highs earlier this year looks to have subsided, with the red metal humming along a touch above US$4/lb.

UP

- Argentine copper explorers and developers are bullish on their potential to put new supply sources into the market after the election of the pro-mining Milei Government.

- Deutsche Bank says copper will need to hit prices of US$10,000/t and above to incentivise new mines, a good omen for existing producers and companies with smaller assets that can enter production quickly.

DOWN

- Despite concerns about the long-term supply picture for copper, the near term is well balanced. The International Copper Study Group in August said refined output had grown 6.2%, while refined usage was up just 3.3% in comparison through the first six months of 2024.

- Mined production, despite the premature closure of Cobre Panama and persistent issues in top producer Chile, was up 3.1%, heavily influenced by an 8.5% lift in the DRC. Chile was up 2.4% YoY but 4.5% below its five-year average.

READ

LOSERS

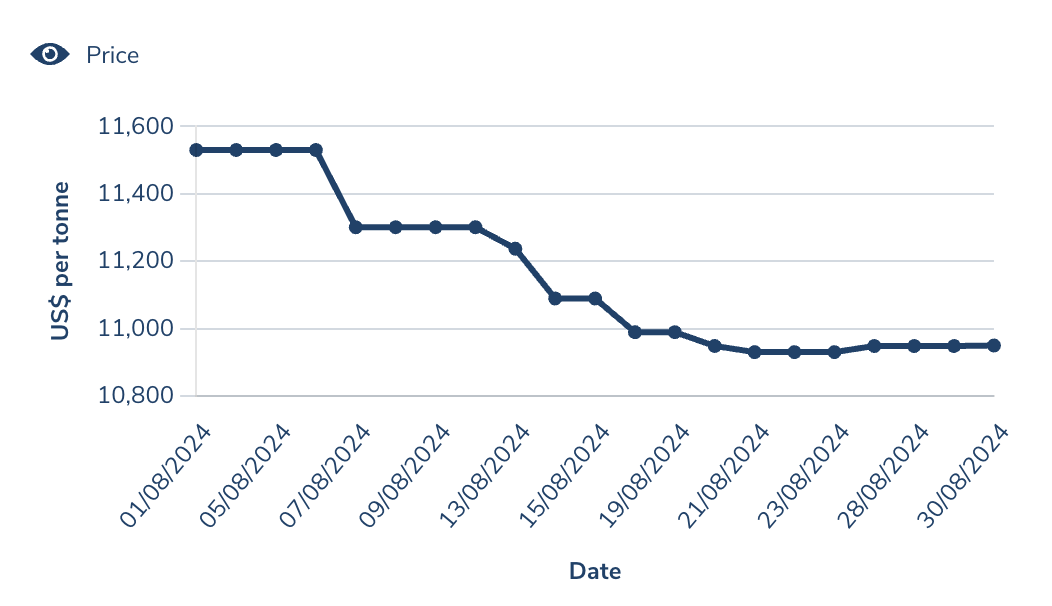

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$10,550/t

% Change: -8.5%

A second big move down in two months for lithium as the market continues to pray for a bottom. M&A chess moves, miners cutting back and spodumene prices flip-flopping above and below US$800/t certainly seem to signal a low. How long it lasts is the question.

UP

- Pilbara Minerals’ (ASX:PLS) move to purchase Latin Resources (ASX:LRS) is a signal bottom of the cycle M&A is beginning in lithium, an opportunity for resource holders with depressed share prices to realise value for their discoveries.

- 6% Li2O Spodumene prices enjoyed an upwards lift back above US$800/t late in August, though they hit resistance and tumbled lower to US$760/t at the close of the month.

DOWN

- SQM suggested there was more gloom to come for lithium markets, expected downward price trends to continue in the second half of 2024 during the Chilean miner’s quarterly results call.

- Mineral Resources (ASX:MIN) showed how tough the lithium market is by dumping its dividend, with boss Chris Ellison saying “no one is making money” in the commodity right now. Pilbara and IGO (ASX:IGO) results were solid, with IGO’s dividend a major beat, though Sayona Mining (ASX:SYA) copped worrying losses at its North American Lithium operation in Quebec, Canada.

READ

‘No one is making money in lithium’, says big dog Ellison as MinRes cuts back

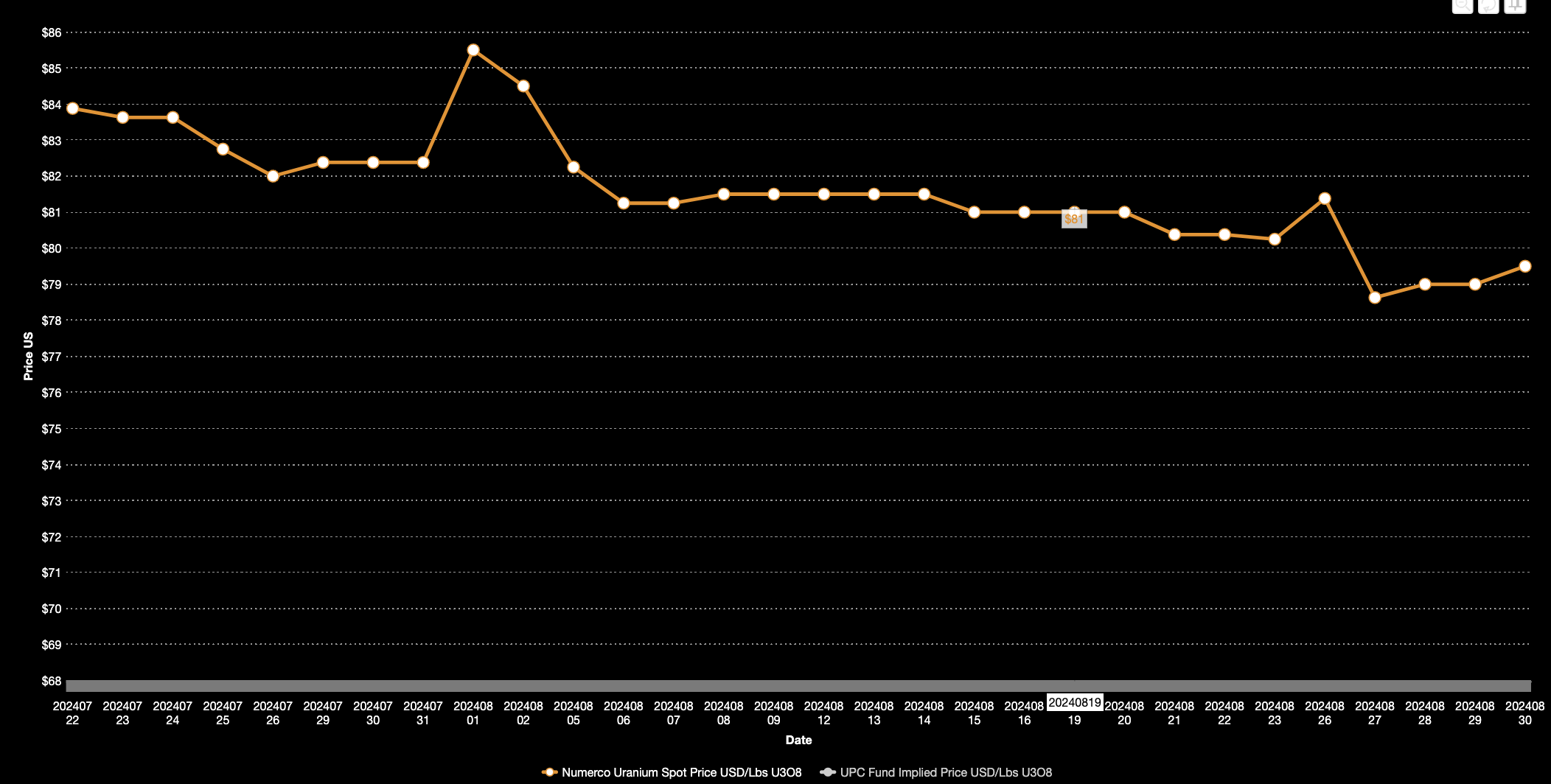

Uranium (Numerco)

Price: US$79.50/lb

% Change: -3.38%

Weak contracting numbers and concerns about Kazakhstan’s Kazatomprom – the world’s biggest producer – lifting output have capped uranium spot prices. But it’s worth a bit of perspective here. Recent malaise has prices around what most developers would still regard as ‘incentive price’ levels, up around 340% from the lowest ebb of the post-Fukushima downturn.

UP

- Kazatomprom’s revelation it would cut 2025 guidance for its mines in Kazakhstan from 30,500-31,500t to 25,000-26,500t proved manna from heaven for yellowcake producers and explorers on the ASX. This is a 12% lift on 2024 guidance.

- Term prices have been reported above uranium spot prices in some instances lately. This is closer aligned to the prices miners actually receive from utilities, with around 85% of uranium sold on contracts.

DOWN

- Regulatory issues get no easier for Aussie uranium hopefuls. Energy Resources of Australia’s (ASX:ERA) ownership of the Jabiluka uranium lease continues to be in limbo after it pursued court action to prevent its non-renewal for now. The NT deposit wouldn’t be developed without the support of traditional owners, with major backer Rio Tinto (ASX:RIO) potentially pushing out minority holders who want to see it developed over time by bankrolling most of a heavily discounted $880m equity raising.

- Contracting was down 71% YoY in the first half, according to Morgan Stanley analysts, a result of both the US ban on Russian uranium and higher prices.

READ

Diggers and Dealers: Boss defends uranium sector amid stale yellowcake sentiment

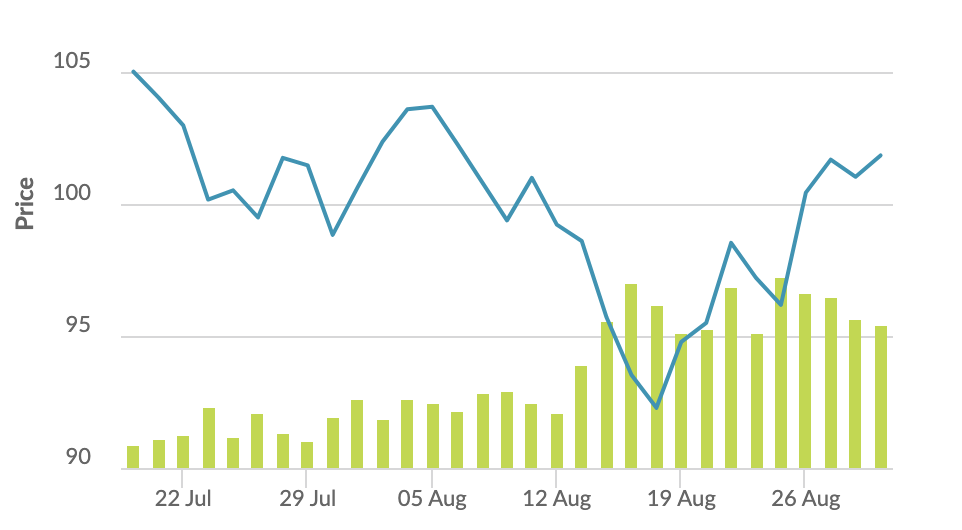

Iron ore (SGX Futures)

Price: US$100.90/t

% Change: -0.02%

Iron ore continued to flirt with a run below US$100/t after some more than bearish commentary from steel giant Baowu, and collapsed below that level again on the first trading day of September, falling over 3% in morning trade in Singapore to US$97.85/t. Chinese real estate was to blame, no surprises there. On the flip side, MySteel said consumer steel demand and pricing was stronger in the last week of August amid hopes for US rate cuts and better pricing.

That could be short-lived. China Iron and Steel Association vice chairman Jiang Wei called for more market discipline from the beleaguered sector, accusing mills of pushing prices lower and cannibalising profits in a bid to claim market share.

UP

- Multiple miners have played down the impact of the Simandou iron ore mine in Guinea – long touted as the ‘Pilbara Killer’ – on the supply side of the market, with Rio Tinto’s (ASX:RIO) Jakob Stausholm, Arrow Minerals’ (ASX:AMD) David Flanagan and MinRes’ Chris Ellison all touting its role as a blending ore for lower grade Pilbara iron.

- Small producers are starting to exit the market, placing cost support which has presented a prolonged run below US$100/t.

DOWN

- China’s steel sector is making little to no money right now, with production likely to fall this year. Leading producer Baowu warned of a long, harsh winter to rival the depression of 2015, which sent iron ore prices to long term lows of US$38/t.

- Real estate numbers are getting bleaker in the Middle Kingdom, with a YoY fall in new home sales expanding from 19.7% in July to 26.8% in June.

READ

Bulk Buys: How the little guys are protecting the iron ore majors

OTHER METALS

Prices correct as of July 31, 2024.

Silver: US$29.47/oz (+3.19%)

Tin: US$32,346/t (+7.62%)

Zinc: US$2897/t (+8.28%)

Cobalt $US24,300/t (-6.99%)

Aluminium: $2447/t (+6.83%)

Lead: US$2053/t (-1.46%)

Graphite (Fastmarkets flake) US$484/t (+0.83%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.