You might be interested in

Mining

Barry FitzGerald: Barton Gold's plan to become South Australia's answer to Capricorn Metals

Mining

Resources Top 5: Tin prices surge as DRC operation closes and Metals X reaps rewards

Mining

Mining

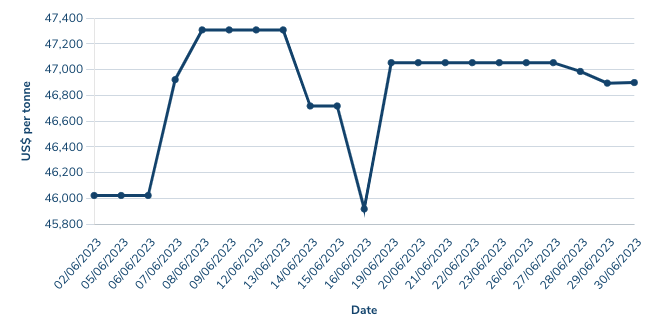

Price: US$46,900/t

% Change: +4.22%

Lithium continued to rally in June, launching off a solid May as prices recovered from the declines seen across the first four months of 2023.

It came after Morgan Stanley and Citi, the former famous for taking an uber bearish stance that correctly predicted the lithium price crash of 2018-2020, both pointed to a turning point for the market after chemical prices more than halved in China earlier this year, falling from 2022 highs in excess of US$80,000/t.

It’s already seen a change in strategy from some quarters. Mineral Resources (ASX:MIN) is switching back from toll treatment to higher margin spodumene sales for concentrate from its 50% share of the soon to be 900,000tpa Mt Marion JV with Ganfeng.

At spot prices of US$3750/t, Australian hard rock lithium producers are still making extraordinary margins.

The long term outlook for the commodity gets no less bright, with a volley of interest at the commercial end of the market, where offtake deals, mergers, takeovers and cornerstone investments continue to demonstrate how hot it is.

Notably, Mark Creasy and SQM backed Azure Minerals (ASX:AZS) surged on massive lithium hits from its Andover project in the Pilbara while Gina Rinehart revealed plans to explore and hopefully supply lithium to India, as David Flanagan’s Delta Lithium (ASX:DLI) picked up almost $50m in an investment from Japanese conglomerate Idemitsu Kosan.

That was before the company’s shares surged on big hits at its Yinnetharra project, where Fortescue (ASX:FMG) was also revealed to be keen to go exploring for lithium of its own.

Figures from the Department of Industry, Science and Resources yesterday showed lithium exports from Australia quardrupled in value to a record $19 billion last financial year.

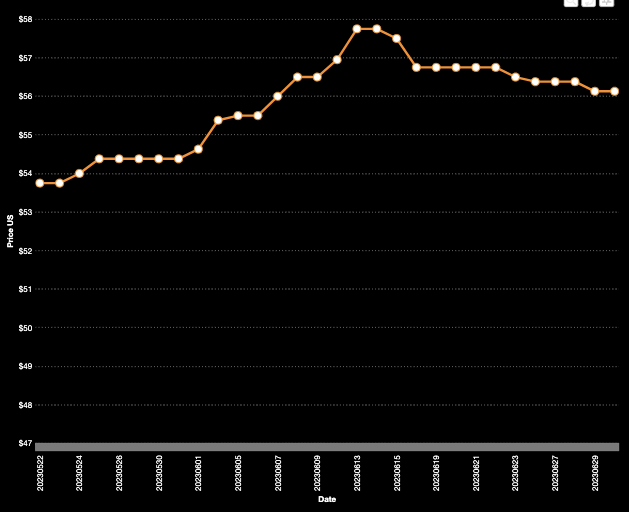

Price: US$56.13/lb

% Change: +3.22%

Uranium spot prices continue to steadily tick up.

That’s being underpinned by strong demand from utilities to lock in new uranium contracts after years holding the whip hand over miners in price negotiations.

Spot prices have been affected by strong demand from physical uranium buyers and holders like the Sprott Physical Uranium Trust.

Longer term a shift away from Russian enriched uranium and Kazakh production which feeds into the Russian supply chain could ratchet up demand for Western sources of uranium.

By the end of 2025, Bank of America’s Michael Widmer sees prices hitting US$75/lb, with a deficit of supply to grow to Kazakhstan’s annual output level of 60Mlb within the decade.

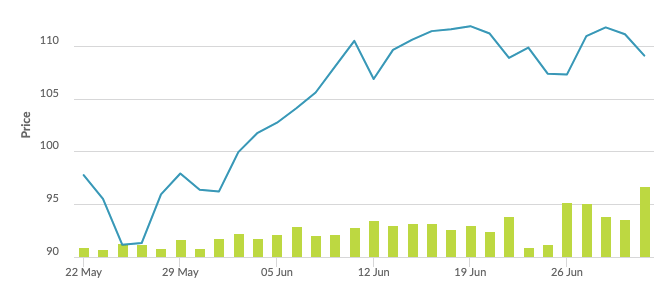

Price: US$109.07/t

% Change: +10.84%

Iron ore is back, baby, we think. Or maybe not.

The signals we’re getting out of China on the health of its property and steel markets, and general economy, are more mixed than the English cricket team’s ethics.

Iron ore had been in the doghouse in late April and May as steel producers fell into loss-making territory and property market indicators started to look very ill indeed (and not in the Beastie Boys sense).

But it came roaring back as China’s Premier Li Qiang told a meeting of the World Economic Forum in Tianjin the Chinese economy was well and truly poised for growth in the second half of 2023.

That puts iron ore in an interesting position. China is keen to see its property sector bounce back off the canvas with new stimulus to help it recover.

But steel output has been strong through the first half of 2023 and that means a production slowdown could be required through the second half of 2023 to keep output below 2022 levels as Chinese authorities claim they want to do.

If it does it could be the catalyst for sliding iron ore prices through the latter part of the year, following a trend seen in 2021 and 2022. To that end the China Iron and Steel Association sees a tough second half for its members.

“Iron ore futures struggled amid concerns of weaker demand. China’s leading steelmakers warned that the industry faces a very challenging second half of the year,” ANZ’s Steven Gregorius said in a note.

“China Iron & Steel Association said, ‘the peak inflection point for steel demand has emerged, while the problems of insufficient end-user demand are particularly prominent’.

“This comes after data showed its steel industry shrunk for the fourth consecutive month in July (sic), with the steel industry Purchasing Managers Index coming in at 49.9.”

Government forecasters in yesterday’s Resources and Energy Quarterly, often conservative, see iron ore prices falling from US$98/t this year to US$74/t by 2025.

That would see Australia’s iron ore export earnings slip from $123b in 2022-23 to $110b next year and $93b in 2024-25.

“China — which accounts for almost 60% of global iron ore demand — is projected to see a modest fall in total steel output over the outlook period to 2025,” DISR’s office of the chief economist says.

“This is expected to soften the rate of growth (1.1% annually) in global iron ore demand in the coming years, driving iron ore prices down.

“China faces a number of key structural drivers that are expected to contribute to this lower growth in iron ore demand. China’s stated aim to reach peak steel output by 2030 — as part of a longer-term shift in its economy away from investment-led (and toward consumption-led) growth — is a key driver.

“A falling population and workforce in China is expected to contribute to more modest rates of economic growth overall, as well as less ‘steel intensive’ growth — through reduced demand for new residential and infrastructure construction.

“And with the real estate sector constituting as much as 25% of the Chinese economy, property sector weakness will continue to suppress near-term steel demand.”

Price: US$149.70/t

% Change: +10.88%

Thermal coal prices finally showed signs of a turnaround from almost six months of declines in the final days of June, having fallen to levels not seen in two years.

The big factor in the price drop had been waning demand out of Europe, which experienced an unusually mild winter and cool start to summer.

That’s meant less electricity demand, boosting gas stores, with the diversion of discounted coal from Europe to Asia helping chill seaborne prices.

The recent run could be short-lived. The main reason for a 15% surge in European gas prices late last week was maintenance at operations in Norway, though heatwaves in Asia could help the commodity rediscover demand.

Demand from China has also disappointed, though it has moved quicker than expected to restart Aussie supply after the end of an official ban on Aussie coal earlier this year.

Surprisingly, thermal coal exports to China have recovered quicker than coking coal despite initial expectations the latter would see the biggest benefit from the reopening of the Chinese-Australian coal trade.

“The rapid recovery in Australia’s thermal coal exports to China, particularly in March, was likely driven by the economics of importing cheaper Australian coal (5500kcal/kg Net As Received (NAR)) over local Chinese coal,” Commbank mining expert Vivek Dhar said in a note yesterday.

This dynamic has moved the opposite way and helps explain why Australia’s thermal coal exports to China haven’t kept up with the typical surge from March to April. China’s import demand for thermal coal will likely trend structurally lower given the push to boost local thermal coal supplies to improve energy security.

“Australia’s coking coal exports to China face additional headwinds as China has substantially increased imports from Mongolia and Russia, particularly in the wake of the Ukraine war.

“We think Australian thermal and coking coal exports will track below levels before China’s unofficial ban came into effect, with Australia’s coking coal exports to China likely to settle at a lower level than thermal coal.”

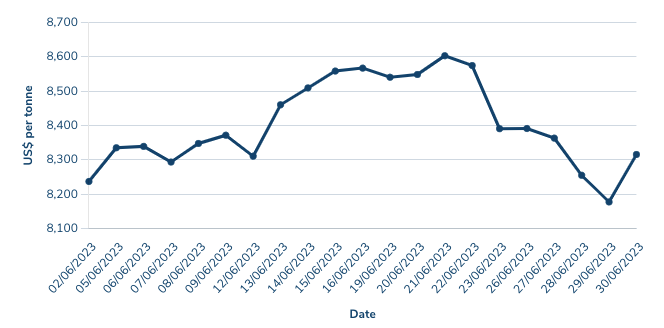

Price: US$8315.50/t

% Change: +2.80%

Copper prices were largely unchanged last month, but we could be seeing a situation emerge where the commodity becomes extremely vulnerable to price shocks.

Backwardation is on the rise, returning to levels not seen since November last year, while stockpiles are back at extremely low levels. That means physical demand for copper is far stronger than a sentiment-affected market is really showing.

Adding to those concerns over copper supply is data out of Chile, the world’s largest producer, that showed its copper output fell 4.7% year on year through the first five months of 2023 to 2.1Mt.

Develop Global’s (ASX:DVP) Bill Beament told Stockhead after the release of a DFS on the company’s Sulphur Springs copper and zinc mine last week that a surge in copper demand for renewables and EVs would likely be a 2024-25 story.

“Analysts are quarter by quarter, they never look out beyond that, the market looks out beyond a certain time but when you’ve got more pressing issues like cost of living, inflation and recession, markets aren’t really interested in copper or zinc or whatever,” Beament said.

“But we all know what’s coming.

“I’ve said this from day one, two years ago when I recapped… the copper and zinc story was more of a ’25 onwards story.

“If you look at all the supply and demand, you look at the commitments people have done on net zero and when they kick in, you look at all the new models and the new production lines of EVs and when they kick in, and the charging stations and the take up of all that, it was always a ’25 story onwards.”

Price: US$62.96/kg

% Change: -9.53%

We’d be lying if we could say we knew exactly why rare earths prices have been so mild in 2023, with another big drop in June.

At ~US$63/kg, neodymium-praseodymium oxide is now down around 40% since the start of the year and 64% from highs in March 2022 of US$175/kg.

While nowhere near the dire price levels seen after the last rare earths boom popped post-2011, it has taken some heat out of the market for the magnet metals.

As Reubs reminds us though, by 2030, demand for magnet rare earths oxides could exceed supply by 40 per cent, with the real shortfall to begin from 2025 onwards.

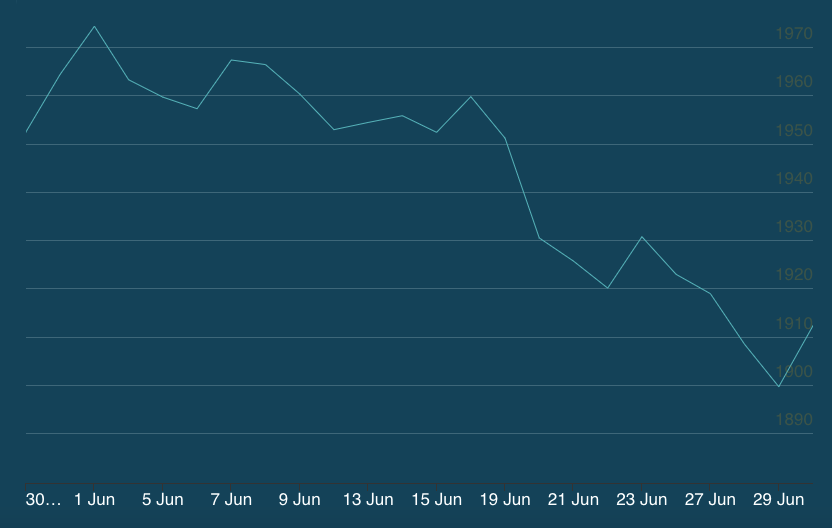

Price: US$1912.95/oz

% Change: -2.64%

Gold continues to struggle to break through to record highs, sliding in June as the spectre of more interest rate rises haunted bullion investors.

It comes with ongoing strength in the tech-heavy US share market and sticky inflation posing a problem for bulls who saw 2023 as their year to shine.

“This was another bad week for gold as risk appetite remained healthy as the big-tech trade won’t go away,” OANDA senior market analyst Ed Moya said.

“The Nasdaq has seen its value increase almost $5 trillion in the first half of the year. Gold had its hands full with both a record first half for the Nasdaq and aggressive central bank tightening globally.

“Some investors are turning cautious stocks as we are approaching what will be a very busy summer vacationing season.

“It appears that gold might be able to hold onto the $1900 level if those odds for a second Fed rate hike by year end continue to come down. Gold’s tentative rebound might face resistance from the $1900 level.”

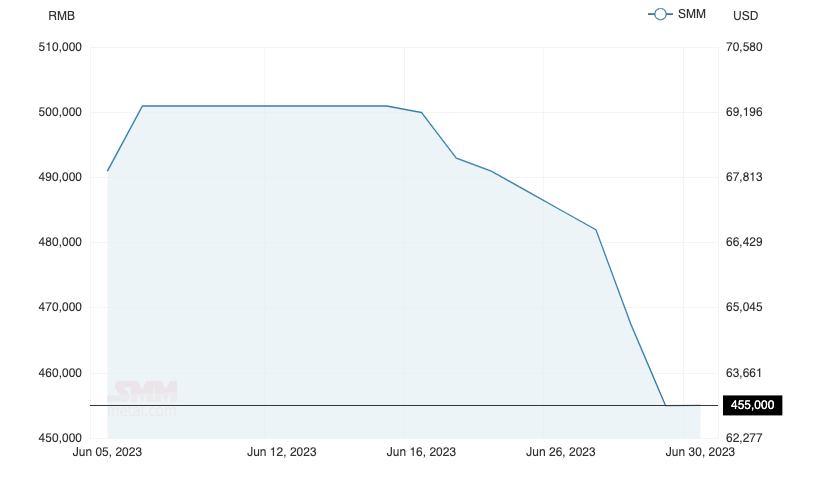

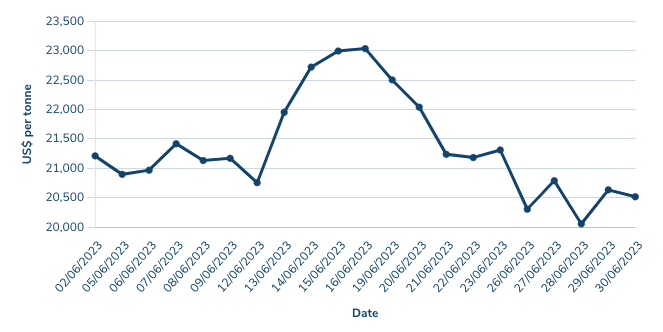

Price: US$20,516/t

% Change: -0.35%

Nickel finished the month in no man’s land, virtually unchanged from the end of May after falling around a third from levels in excess of US$30,000/t at the end of 2022.

At these price points most producers should be making money, though some smaller ones with operational issues like Panoramic Resources (ASX:PAN) are pushing on their margins.

PAN is eyeing a big ramp up in concentrate production through FY24 after process plant issues late in FY23.

In general, Indonesian supplies including of battery grade nickel continue to ramp up.

No more obvious was this seen than in the near $1 billion investment in ASX listed Nickel Industries (ASX:NIC) from PT United Tractors, a subsidiary of Indonesia’s largest conglomerate Astra International.

For context, the project would make NIC’s output as much as double BHP’s (ASX:BHP) Nickel West, a business that has operated since the 1960s nickel boom.

NIC’s output could rise from 83,000t of nickel metal today to 156,000t by 2026 and 196,000tpa at some point beyond that.

Prices correct as of June 30, 2023.

Silver

Price: US$22.47/oz

%: -3.40%

Tin

Price: US$26,787/t

%: +5.24%

Zinc

Price: US$2388/t

%: +6.20%

Cobalt

Price: US$33,420/t

%: +13.19%

Aluminium

Price: US$2151.50/t

%: -4.21%

Lead

Price: US$2099.50/t

%: +4.32%