Up, Up, Down, Down: It’s gold, gold, gold for… gold

Pic: Justin Setterfield/Getty Images

- Gold runs away with the commodity Olympics for July as the strongest gainer on rate-cut hopes and safe haven demand

- Coal and rare earths both up but prices remain range bound at mild levels

- China’s economic woes play havoc with iron ore and base metals

Up, Up, Down, Down is Stockhead’s regular check-up on how metals produced and explored for by ASX miners fared in the past month. All prices correct as at July 31, 2024.

WINNERS

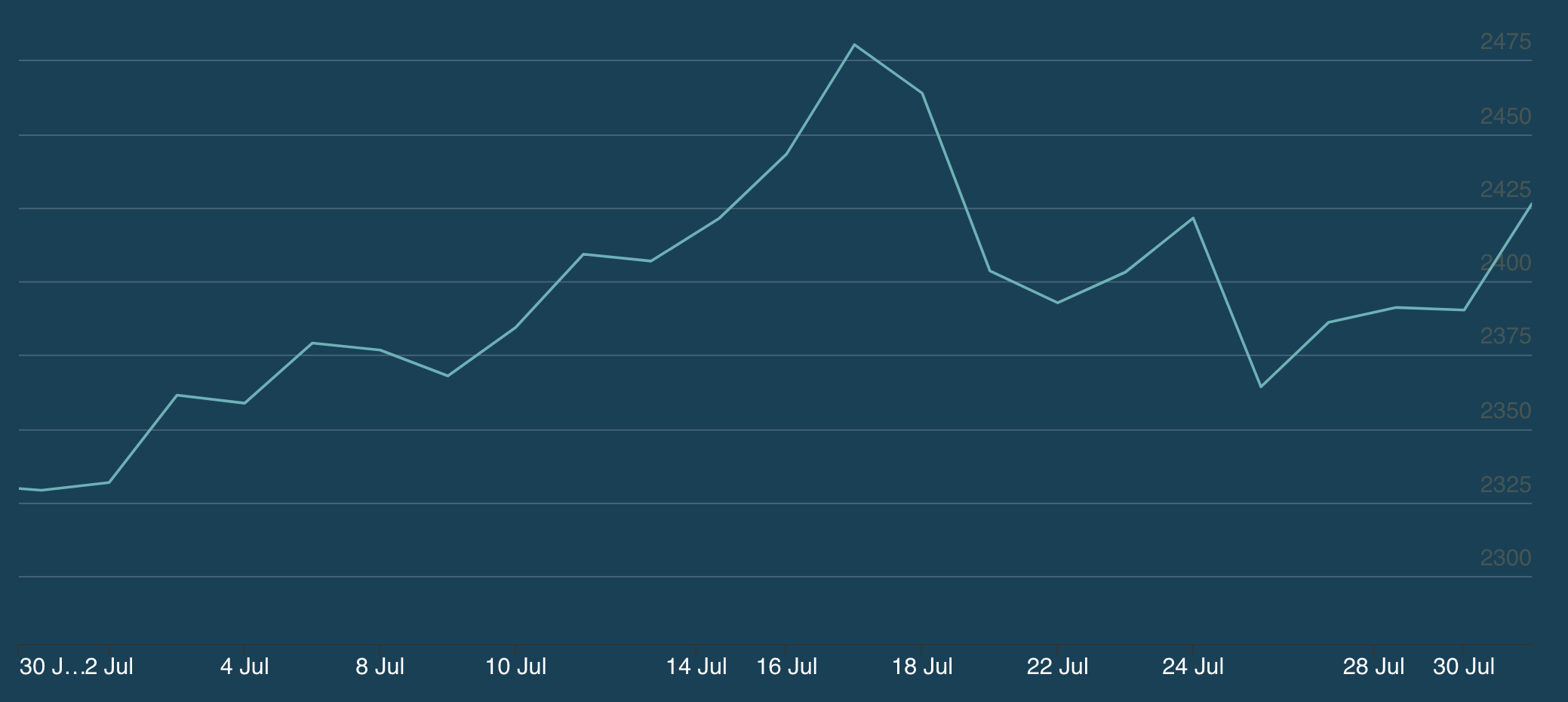

Gold

Price: US$2426.30/oz

% Change: +4.09%

Gold returned to record highs again during the month of July, emerging as one of the few commodities with a bit of backbone in the face of adversity.

The hope of rate cuts spurred the latest run, as well as the precariously timed assassination by Israel of Hamas political leader Ismail Haniyeh on Wednesday, an act which sent safe-haven betting into overdrive.

US Fed chair Jerome Powell finally said yesterday that his board of governors was looking at rate cuts in September. That’s bullish for gold, which doesn’t generate interest and therefore becomes more attractive when cash and bonds are pulling in lower yields.

UP

- Analysts have grown increasingly bullish on gold, with Shaw and Partners memorably lifting its 2025 and 2026 forecasts to US$3000/oz last month.

- Gold M&A is starting to rival copper for excitement. Spartan Resources (ASX:SPR) is being watched by all comers after Ramelius Resources (ASX:RMS) punted $180m on an 18% stake. It’s already in the money after Spartan surged on the release of a resource at its Never Never deposit containing 1.49Moz at 8.07g/t – certainly high-grade.

DOWN

- Gold may be better off but it doesn’t mean all miners and developers are. While some of the quarterly reports delivered big wins – think Catalyst Metals (ASX:CYL), Perseus Mining (ASX:PRU) – others were hideous, with Regis Resources (ASX:RRL) notably smashed for both disappointing guidance and a DFS that put a potentially back-breaking ~$1bn price tag on developing its McPhillamy’s operation in New South Wales.

- And teething issues continue to afflict new producers. Bellevue Gold (ASX:BGL) was smashed on its maiden guidance announcement as it raised $175m at a discount to clear a large portion of its debt and provide flexibility for growth capex and exploration. The end result will be a bigger mine, rising from 165,000-180,000ozpa to 250,000ozpa by 2029.

Pic: LBMA

Coal (Newcastle 6000 kcal)

Price: US$141.40/t

% Change: +6.16%

Thermal coal prices rose slightly in July after a shift to what the IEA said was a rare period of stability set in over the first half of 2024.

“With spot prices approaching levels driven by fundamentals in early 2023, backwardation vanished. Instead, the expectation was for future API2 prices to remain rather flat, slightly over USD 100/t,” it said in its mid-year update.

“This did not change significantly until June 2024, when the forward curve showed a slight increase over the next two years. In summary, following the tumultuous conditions of recent years, the financial market now shows stability similar to the physical market.”

Premium hard coking coal futures spiked immediately after the fire on June 29 at Anglo American’s Grosvenor mine, but reverted due to mild steel demand to US$219/t at the end of the month.

For intermediary products like PCI and semi-soft, miners like Stanmore Coal (ASX:SMR) say relativities against PHCC prices, previously impacted by Russia’s flooding of the latter markets, have improved as sanctions against product of Russian origin have tightened.

UP

- Investor pressure and softening bank attitudes to steelmaking coal could see Glencore keep its coal business rather than demerge next week. It would be a sign of rising acceptance from mainstream parts of the finance sector for coking coal assets.

- Numerous analysts see premium hard coking coal prices returning to strong levels, with Morgan Stanley tipping US$290/t in early July and Goldman Sachs placing its chips on US$300/t.

DOWN

- Fitch’s BMI says thermal coal supply is growing at around 3% a year, lowering expectations of a return to post-Ukraine highs.

- Met coal markets are well supplied, with weaker steel demand in Asia keeping prices subdued despite the Grosvenor mine closure and questions over Anglo American’s proposed sale of its met coal division.

Rare Earths (NdPr Oxide)

Price: US$50.65/kg

% Change: +1.69%

NdPr oxide, the flagship rare earth product linked to permanent magnets used in EV motors, wind turbines and electronics, continues to sit near cyclical lows.

But few producers are making real cash at these prices, with Australia’s Lynas (ASX:LYC) still stockpiling uncontracted material at its Malaysian processing plant in the aim of selling it at higher prices later down the line.

But Lynas’ latest move, announcing a $25m investment in a heavy rare earths circuit at its Kuantan facility shows where the market is heading, with Western companies keen to invest early to supply metals like terbium and dysprosium, previously the near exclusive domain of Chinese miners.

Up

- Global competition for control of rare earths projects is delivering value to sold down juniors in the form of M&A, with Peak Rare Earths (ASX:PEK) inking a $96m deal in the form of a non-binding term sheet to sell a half-stake in its Ngualla project in Tanzania to China’s Shenghe Resources.

- A number of Brazilian rare earths explorers were among the top performers in the ASX resources sector in FY2024, with a number drilling out high-grade clay deposits to rival those found in China.

DOWN

- Even Chinese rare earth miners are struggling at current prices with China Northern Rare Earth Group reporting a 95% fall in profit.

- New regulations to come into effect in China in October could give the State even more control over rare earth supply.

LOSERS

Copper

Price: US$9225/t

% Change: -3.91%

Copper fell in July amid concerns it had previously run ahead of fundamentals and amid a slowdown in Chinese purchasing. It staged a late recovery on the aforementioned rate-cut hopes – base metals tend to do well with a weaker US dollar since they’re typically traded in the greenback.

The drain of some Chinese inventories also reinforced long bets.

“There are some positive signs of narrowing export parity and retreating inventories, which supported prices,” ANZ said yesterday.

“Mine supply issues continued in Chile, with production falling 1.2% y/y to 453kt in June.”

UP

- The copper M&A narrative is alive and well, with BHP (ASX:BHP) and Lundin Mining announcing a joint C$4.1bn takeover of Argentine explorer Filo Corp, owner of the Filo del Sol discovery in the Andean Vicuna mining district. BHP is spending US$2.1bn alone taking on half of Filo and 50% of the nearby Josemaria discovery owned by Lundin, making it one of three major pre-development copper assets in its portfolio alongside the Oak Dam discovery in South Australia and Rio-led Resolution project in Arizona.

- Fitch’s BMI Commodity Insights unit delivered a barely believable prediction that copper would hit record levels of US$17,000/t by 2033. Crazy talk … then again, we wonder.

DOWN

- Some Chinese copper smelters could cut output due to high competition and super low treatment and refining charges.

- Chinese refined copper exports have surged this year due to weak domestic demand.

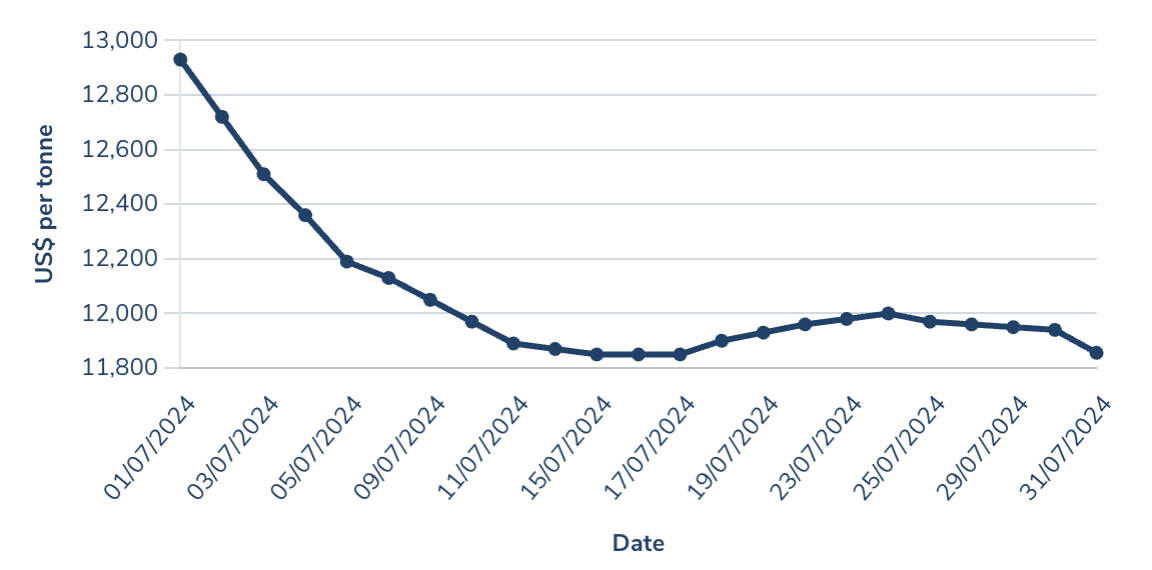

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$11,530/t

% Change: -9.92%

Lithium endured yet more struggles in the month of July, with chemicals off the boil and SC6 spodumene concentrate heading back towards its January lows at US$910/t.

Big players remain confident in the long-term outlook despite concerns some of the lustre is coming off the EV growth story.

“The bottom line is some of the doomsday headlines just don’t reconcile with the broadly strong growth markets that you can see,” Pilbara Minerals (ASX:PLS) MD Dale Henderson said in a quarterly call.

UP

- The pause on construction at Albemarle’s Kemerton plant yesterday is very bearish and a bit of an admission it’s struggling with the technical side of lithium processing in WA as well, but it may be a sign of the breaking point needed to get lithium prices back in gear.

- Miners like Pilbara Minerals and MinRes believe lithium pricing is well into the cost curve, saying current levels will knock out low-grade lepidolite and African producers who cannot match Aussie hard rock miners and South American brine producers on cost.

DOWN

- Some major suppliers of spodumene continue to grow production, notably Pilbara Minerals.

- A number of battery and cathode projects are slowing in the West amid concerns about the costs of competing with the Chinese in electric vehicles.

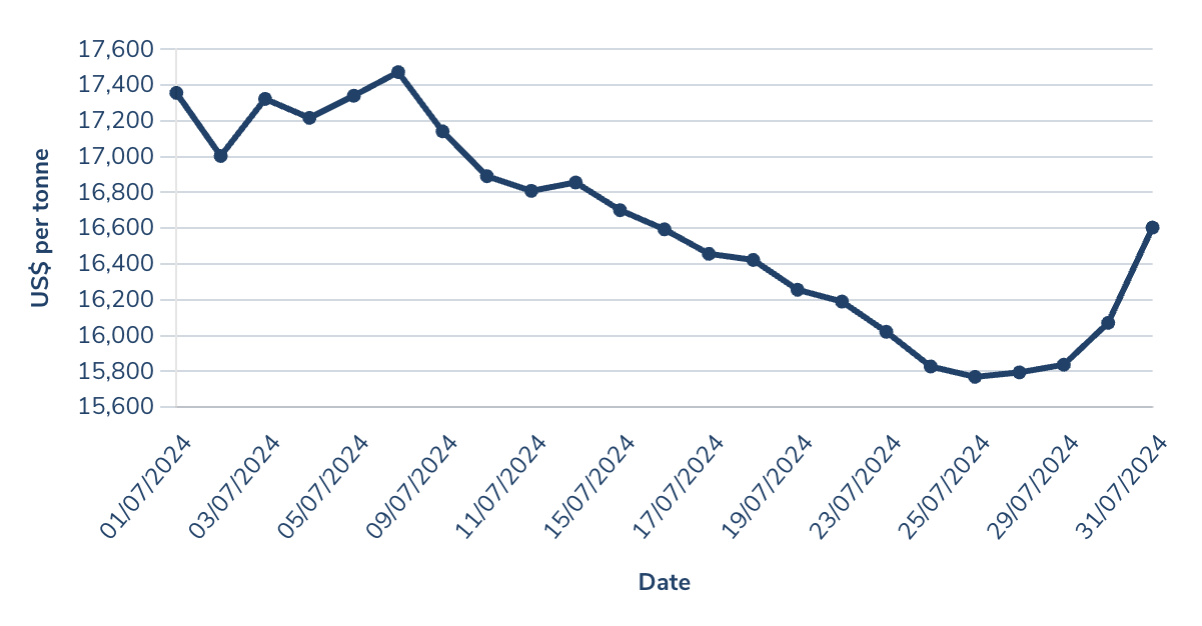

Nickel

Price: US$16,604/t

% Change: -3.97%

Nickel’s short-lived revival crumbled in the June quarter and was compounded by BHP’s decision last month to mothball its Nickel West division later this year.

Oversupply from Indonesia has been one factor, but stainless steel demand in China – which has been hit by unfavourable weather conditions and economic problems – has not helped either.

Hundreds of thousands of tonnes have recently been pulled from the market in the form of announced cuts, raising hopes a supply side response could shore up the currently flimsy nickel market.

UP

- Nickel Industries boss Justin Werner said output growth is slowing in Indonesia amid weak nickel prices, with two of its own nickel pig iron plants slightly lossmaking in the June quarter.

- Interest rate cut hopes brought a surge in buying for nickel at the end of July, with China’s stainless steel prices also going up, suggesting the worst of the demand problems from that segment could be behind us.

DOWN

- BHP’s decision to shut its Nickel West division comes with the uncertainty that it may never rise again. A decision on the long-term future of the 58-year old business, to be mothballed by Christmas, will be made in early 2027.

- Exploration success continues to elude the major Aussie nickel companies, with IGO announcing a near $300m impairment on its exploration assets in July.

Uranium (Numerco)

Price: US$82.28/lb

% Change: -3.39%

Uranium continues to trade in and around the US$80-85/lb range, a limbo it’s been stuck in for most of 2024 after briefly charging early this year to over US$100/lb.

But term contracting levels have hit US$79/lb, the highest in over a decade. Those prices are closer linked to the value of new contracts being inked between utilities and miners which make up a far larger portion of the supply picture than spot sales.

Cameco, the west’s largest uranium producer, increase earnings around 2.5x year on year in June to US$36 million.

CEO Tim Gitzel said the supply picture longer term continues to look poor.

“Today, we’re not seeing investments in significant Greenfield projects that will be needed to satisfy growing demand from reactors being saved and restarted, reactor life extensions and new reactor builds. There are a few idle production centers restarting, but new supply sources take time,” he said.

“The recent cancellation of permits and the negative developments in Niger, the refusal to renew the lease at Jabiluka in Australia, and the unexpected significant tax increase in Kazakhstan contribute even more to the uncertainty.”

Cameco owns a share of the Inkai JV in Kazakhstan, where volumes have been hit by sulphuric acid shortages.

UP

- Unusually, miners are outperforming uranium as an underlying commodity, with equities tracked by Sprott sitting around a 3.5% YTD gain at the end of June against a 6.3% fall in yellowcake prices.

- The global cost curve will move up significantly after world leading producer Kazakhstan’s government moved to lift taxes substantially over 2025 and 2026, Cameco’s Gitzel said on a conference call this week.

DOWN

- Contracting volumes continue to be lower than last year’s decade high.

- While new miners are in production on the ASX, we’re yet to see the true profitability of Boss Energy (ASX:BOE) and Paladin Energy’s (ASX:PDN) Honeymoon and Langer Heinrich mines, with operating costs yet to be reported.

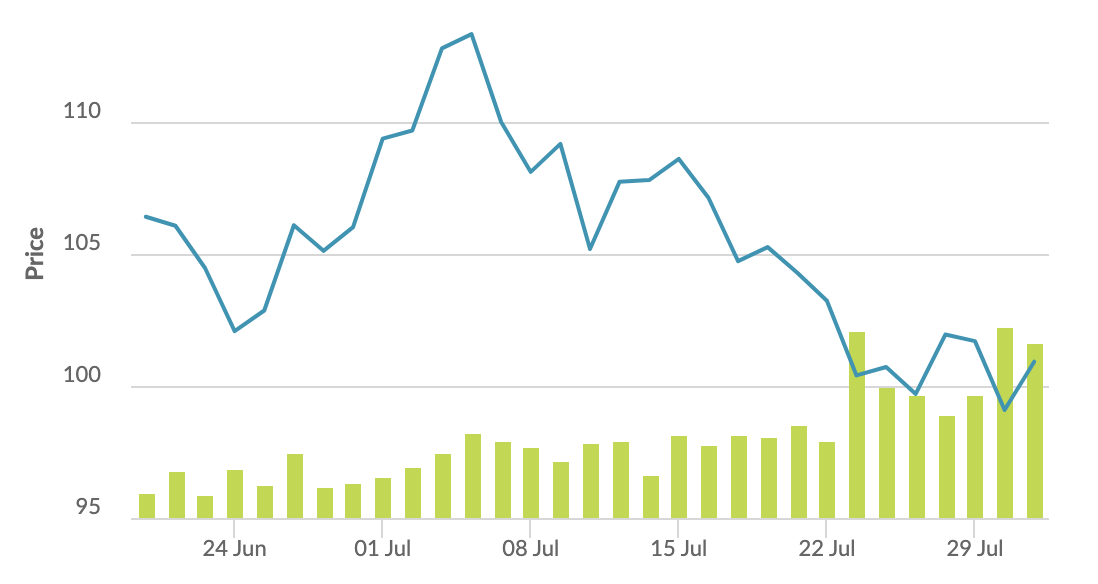

Iron ore (SGX Futures)

Price: US$100.92/t

% Change: -5.11%

Iron ore continued to threaten a plunge below US$100/t only to be pulled back up at each attempt to tear up the floorboards.

Many iron ore miners now think the marginal point in the cost curve is between US$80-100/t, with swing supply to replace Vale’s pre-Brumadinho tonnages having come more from small swing suppliers than the low-cost Pilbara majors.

Steel demand in China remains the big concern, with MySteel reporting rebar prices at more than four year lows last month. East China’s Shagang Group dropped longs prices by US$21/t (150RMB) this week after a 100RMB dip the week before.

UP

- Rio Tinto (ASX:RIO) CEO Jakob Stausholm said despite a weak property market, Chinese steel and commodity demand remained “robust” as he reported a US$5.8bn profit for H1 2024.

- Traders are hopeful additional stimulus could arrive this month after China reduced the down payment required to purchase property in a bid to improve conditions in the downtrodden industry.

DOWN

- 700 job cuts announced by Fortescue (ASX:FMG) last month were linked to its green energy plans, but have raised concerns its view of Chinese commodity demand and iron ore is softening. Metals CEO Dino Otranto said on a conference call last week FMG remains positive on metal demand in China. It later fell 10.2% after a $1.9bn selldown by insto the Capital Group.

- Rio Tinto and its Chinese partners approved the construction of the Simandou mine in Guinea, a network of massive undeveloped high grade deposits known colloquially as the ‘Pilbara Killer’ due to fears up to 120Mtpa of new supply could flood the iron ore market and drive down prices.

OTHER METALS

Prices correct as of July 31, 2024.

Silver: US$28.56/oz (-2.76%)

Tin: US$30,056/t (-8.20%)

Zinc: US$2675.50/t (-8.92%)

Cobalt $US26,125/t (-3.78%)

Aluminium: $2290.50/t (-9.27%)

Lead: US$2083.50/t (-6.32%)

Graphite (Fastmarkets flake) US$480/t (+3.23%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.