Up, Up, Down, Down: Gold scales new peak while copper and iron ore show mettle in January

Gold is chasing the highs. Pic: Getty Images

- Gold takes first place (again) as precious metal hits new high in January

- Iron ore and copper show stability despite Trump turbulence

- Lithium trends down, but signs point to a bottom for the battery metal

WINNERS

Gold

Price: US$2812.05/oz

% Change: +7.78%

Gold hit a new record to end the month of January after the bullishness over the US economy that followed Donald Trump’s election win and capped bullion gave way to uncertainty as the 47th US President delivered on eccentric policies like hard-line tariffs.

With geopolitical uncertainty driving investors to safe haven commodities, the US economy recorded slower than expected growth in the December quarter as well.

That last one couldn’t be attributed to the new regime, only inaugurated January 20, but the cocktail of volatility has driven renewed enthusiasm in gold’s status as a store of value.

According to figures released yesterday by the World Gold Council, gold demand hit a record 4974t in 2024, with central banks buying over 1000t for the third year in a row and investment demand up 25% to a four-year high of 1180t.

The LBMA record 41 record highs in 2024. How many are we in store for in 2025?

UP

- The ASX’s top listed gold miners, sans Newmont, could soon be pulling in over $1 billion a quarter after analysis from Euroz showed a cohort of 19 miners generated a record $960m cash in the December quarter.

- Swiss gold imports to the USA rose 11x in December to 64.2t – the highest import level since March 2022, the month the biggest US Fed rate hiking cycle in four decades began.

DOWN

- The Federal Reserve declined to cut rates further in January, putting chair Jerome Powell on a collision course with an angry and orange President Trump.

- Upside in gold has become extraordinarily consensus, and if Trump’s tariffs curb rate cuts and drive a stronger USD, it may have overshot. ETF flows will also be important – critics say they deliver a positive feedback loop, exaggerating price movements during both bull and bear runs.

READ

As bullion booms ASX gold miners could soon be raking in $1 billion a quarter

Rare Earths (NdPr Oxide)

Price: US$57/kg

% Change: +4.78%

Rare earth prices rose ahead of Lunar New Year in China as buyers stocked up on the magnet metals, though the Shanghai Metals Market later reported timid post LNY trade.

Lynas (ASX:LYC), the largest western producer, reported stronger prices from its Australian and Malaysian operations in the December quarter, though an ‘optimised product mix’ and weak Aussie dollar were the drivers behind the improvement rather than market forces.

In its quarterly last month, Lynas said demand for rare earth materials inside China – which relies not just on EV and renewables growth but also on consumer electronics linked in part to its ailing property sector and broader economic performance – remains subdued.

Market watchers will be looking out for the first quotas for China’s rare earth sector to assess the direction of prices this year. Some observers think the CCP will look to prevent an oversupply situation that has sent most of its producers into lossmaking territory.

Also potentially hitting supplies is the control of areas with mines in Myanmar by Kachin rebels. Largely unregulated eavy rare earth mines in Kachin and Wa States on the Chinese border are major suppliers.

Up

- Donald Trump has made heavily contested claims to Greenland and tried to barter rare earths out of Ukraine for military support. Does he know what he’s talking about? Does it matter? Who knows.

- Gina Rinehart lit up further speculation about her rare earth ambitions, paying close to $70 million to lift her stake in Lynas Rare Earths from 7.14% to 8.21%.

DOWN

- While EVs, defence and renewables get the most attention in the mainstream media, two-thirds of neodymium-iron-boron magnet demand comes from everyday applications exposed to China’s property, construction and retail sector.

- That makes rare earths incredibly sensitive to China’s domestic economy and stimulus measures.

READ

Trump’s wooing of Greenland shines spotlight on awakening resource giant

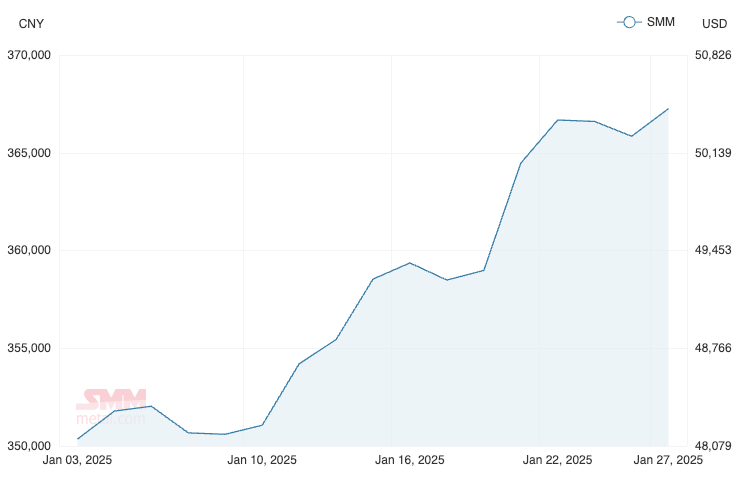

Copper

Price: US$9048/t

% Change: +3.19%

Copper prices ticked up marginally to start 2025 as they ended last year with a whimper, weighed down by a strong US dollar.

The long term outlook continues to be concerning on the supply side (though bullish for prices), with Teck’s head of market research Michael Schwartz predicting demand will lift 105% to 52Mt by 2050 – bearing in mind that’s in a scenario where the world is ambitious on New Zero.

By 2035, Schwartz says miners will be unable to cover market needs, with global output to peak in 2028 and a 2.5Mt cathode shortage possible as soon as 2030.

Majors continue to look for opportunities to grow their market share, notably the staggering news that Rio Tinto (ASX:RIO) and Glencore revisited decade old merger discussions in early stage talks last year.

UP

- Chile, the world’s largest producer, lowered its forecast for 2034 production from 6.43Mt to 5.54Mt, with the ‘more realistic’ adjustment adding to long-term supply concerns.

- Treatment and refining charges have been forecast to hit a bargain US$10.70/t over the course of 2025, with China’s smelters facing a shortage of concentrate from strained mines.

DOWN

- LME copper stocks are sitting at over 250,000t, around 2.5 times levels seen when prices hit all time highs in May last year.

- The market remains in contango, with futures paying more than cash settlement, a sign physical supplies of refined copper are not heavily stressed.

READ

Copper Alert: What does Chile’s production downgrade mean for small caps?

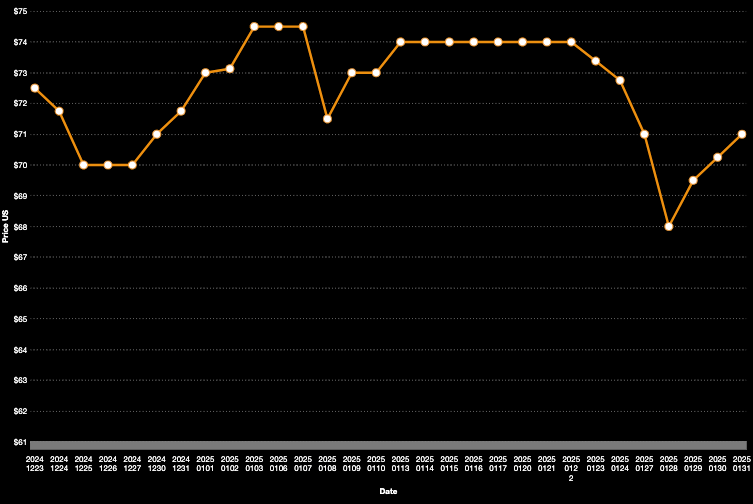

Iron ore (SGX Futures)

Price: US$105.70/t

% Change: +4.68%

Iron ore stocks have been flipping and flopping since the return of Donald Trump to the White House.

Tariffs proposed on Chinese products could limit the export of manufactured goods from the Middle Kingdom which use steel largely made, of course, with Aussie iron ore. High exports of steel products also propped up a despairingly weak Chinese domestic market last year, placing even greater fears for iron ore producers if the US and other countries act to curb Chinese shipments via tariffs and anti-dumping actions.

So far prices have remained relatively stable, with supply increases globally remaining incremental. It’s worth noting the largest Australian iron ore producers are sitting on costs of around US$20/t, so it will take a large drop in iron ore prices before major operations are impacted.

UP

- M&A movements show majors remain keen to shore up their portfolios and deliver an exit for small caps in the large cap dominated iron ore market. Fortescue Metals Group (ASX:FMG) completed the critical first step of its $254m takeover of Red Hawk Mining (ASX:RHK) this week, securing a 78% stake in the neighnouring explorer.

DOWN

- Westpac last month said iron ore could fall to as low as US$70/t by the end of the year, citing the introduction of high grade iron ore from Rio Tinto and Chinese parties’ Simandou mines in Guinea this year. However, no guidance has been set, opening the possibility that only a nominal amount will hit the market this year.

- Vale posted its highest output in 2024 in six years, with Brazilian iron ore shipments finally recovering from the January 2019 Brumadinho dam disaster.

READ

Bulk Buys: As iron ore outlook fades, majors gain more control in the Pilbara

LOSERS

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$10,000/t

% Change: -3.78%

Lithium prices were inconsistent across the quarter, reflecting the complexities of a disjointed and immature market with multiple different players across a fragmented supply chain.

Most pleasingly for Aussie producers, spodumene prices have tip-toed higher from US$760/t at last year’s lows to US$895/t at the end of January. Auctions from major players Albemarle and

At the same time, oversupply of chemical grade products has bit. IGO (ASX:IGO) and Tianqi halted plans to double the capacity of a lithium hydroxide plant in Kwinana, with unwanted product from an underdelivering first train already being stockpiled.

While hydroxide prices ticked up marginally, carbonate has remained rangebound around US$10,000/t.

Researchers for Aussie bank ANZ were bullish on the longer term in a recent note, with commodity strategists Daniel Hynes and Soni Kumari saying: “We see a strong long-term outlook. Supply still needs to increase by a factor of 1.5–3.5 over the next five years, which is a difficult goal.”

UP

- Spodumene prices have moved significantly higher in recent weeks, with miners Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MIN) reporting a slight uptick in December quarter sales prices.

- MinRes will not shut any more operations, insisting it wants to be ready for a price run. CFO Mark Wilson told analysts the miner did not expect to see US$900/t spodumene pricing in five years’ time.

DOWN

- Zijin Mining has announced an investment to develop part of the Manono lithium project, with Chinese investments in African and domestic supply continuing the threaten the market’s return to balance.

- Chilean mining agency Cochilco expects to see the lithium surplus rise from 89,000t LCE in 2024 to 141,000t LCE in 2025.

READ

Monsters of Rock: How close are we to the lithium revival?

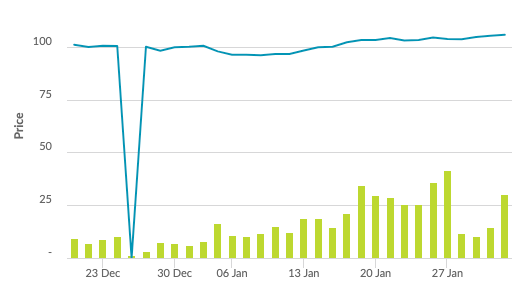

Uranium (Numerco)

Price: US$71/lb

% Change: -1.05%

Uranium prices fell as low as US$68/lb in late January as enthusiasm for yellowcake waned across 2024.

Negative sentiment around the future energy requirements of AI data centres as tech companies engage in war to produce more efficient large language models played a role – a number of US tech firms have looked to nuclear plants as a source of low carbon energy.

The resumption of production at Cameco and Kazatomprom’s Inkai JV in Kazakhstan also played a role in dropping a lid on spot prices, though sulphuric acid shortages could still hurt exports from the Central Asian country – supplier of around 40% of the world’s yellowcake.

UP

- Spot prices may be down this year, but term prices continue to sit at decade long highs of around US$80/lb. These better reflect the prices received by miners under contracts with utilities.

- Incentive prices now sit around US$100/lb, with miners saying prices will need to move higher to prevent large supply shortages in the years to come.

DOWN

- Kazakhstan’s higher than expected production guidance for 2025 spooked the uranium market. It will produce 25,000-26,500t (65-69Mlb) this year, up from the 23,000tU (60Mlb) previously forecast by Canaccord Genuity.

- DeepSeek’s entry to the AI game tanked uranium stocks in late January, with the Chinese interloper’s claimed energy savings over incumbent models like ChatGPT raising prospects future data centres will not need the enormous nuclear power volumes analysts previously forecast.

READ

Miners and analysts think uranium bull market is still in its infancy

Coal (Newcastle 6000 kcal)

Price: US$116.90/t

% Change: -6.66%

You’d be foolish to say the jig is up for thermal coal producers, though lower prices show few signs of turning into the historic run seen after Russia’s invasion of Ukraine three years ago.

Ironically coal demand, despite the impact of policies to stimulate investment globally in renewable energy, hit a record high of 8.77Bt in 2024.

That doesn’t all flow through to international prices though, which have been as choppy as the seas that carry the cargo.

Weak demand, especially from a tepid Chinese and international steel market, has put pressure on met coal prices, while thermal coal appears well supplied in the near term.

Analysts remain generally bullish that coking coal prices will be supported longer term, with Goldman Sachs tipping constrained Canadian and Aussie supplies and robust Chinese and Indian demand will keep premium hard coking coal prices over US$220/t, well above pre-Covid levels.

Currently front month coking coal futures are fetching US$190/t.

UP

- Indian demand for metallurgical coal is expected to expand this year, potentially supporting prices for coking coal early in 2025.

- European thermal coal imports hit their highest levels in the December quarter since Q1 2023 as wind generation dropped and lower than expected temperatures improved energy demand.

DOWN

- The IEA is expecting coal demand to plateau through 2027.

- EMR Capital may have to accept lower prices than previously hoped for its Kestrel mine – lower coking coal prices have raised questions over the Queensland mine’s US$3bn valuation.

READ

Bulk Buys: The top iron ore and coal gainers in 2024

Nickel

Price: US$15,210/t

% Change: -0.77%

Nickel prices threatened a recovery early in the month in a familiar pattern seen as the battery metal and stainless steel ingredient treaded water over the past year.

While the worst is behind most miners, with more price drops seeming unlikely, surpluses remain substantial, thanks to a rapid lift in production from Indonesian miners mostly backed by Chinese capital.

Miners are among those who remain pessimistic on the supply-demand situation. Russia’s Nornickel, the world’s largest single producing company with a production forecast of 204,000-211,000t nickel metal in 2025, sees a 150,000t surplus across 2024 and 2025 having lifted its prediction last month of the class 1 nickel metal glut 50% from 100,000t.

UP

- Mining quotas under approved Indonesian RKAB permits are expected to be cut significantly this year, tightening the market for nickel ore.

- That came alongside comments from Indonesia’s chief mining official Tri Wanarno, director general of mineral and coal in the Ministry of Energy and Mineral Resources, that the country needed to manage its resources to ensure stable prices for domestic and export markets.

DOWN

- Battery chemistries in China have increasingly shifted to cheaper nickel-less LFP products.

- Nickel adjacent cobalt fell significantly as DRC copper miner CMOC doubled output to 114,165t in 2024, larger than the whole market a decade ago.

READ

High Voltage: Indonickel production quotas an ingredient in the cocktail for a price rebound

OTHER METALS

Prices correct as of January 31, 2025.

Silver

Price: US$31.61/oz

%: +7.30%

Tin

Price: US$30,102/t

%: +3.50%

Zinc

Price: US$2742/t

%: -7.94%

Cobalt

Price: $US21,550/t

%:-11.32%

Aluminium

Price: $2594/t

%: +8.81%

Lead

Price: $1949.50/t

%: -0.13%

Graphite

Price: US$435/t

%: -4.19%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.